CFA. CAIA. ETFs. Cryptos. Asset Management. @Bloomberg. @bbgintelligence. Runner. Opinions my own. Likes, RT's & Follows≠endorsements

How to get URL link on X (Twitter) App

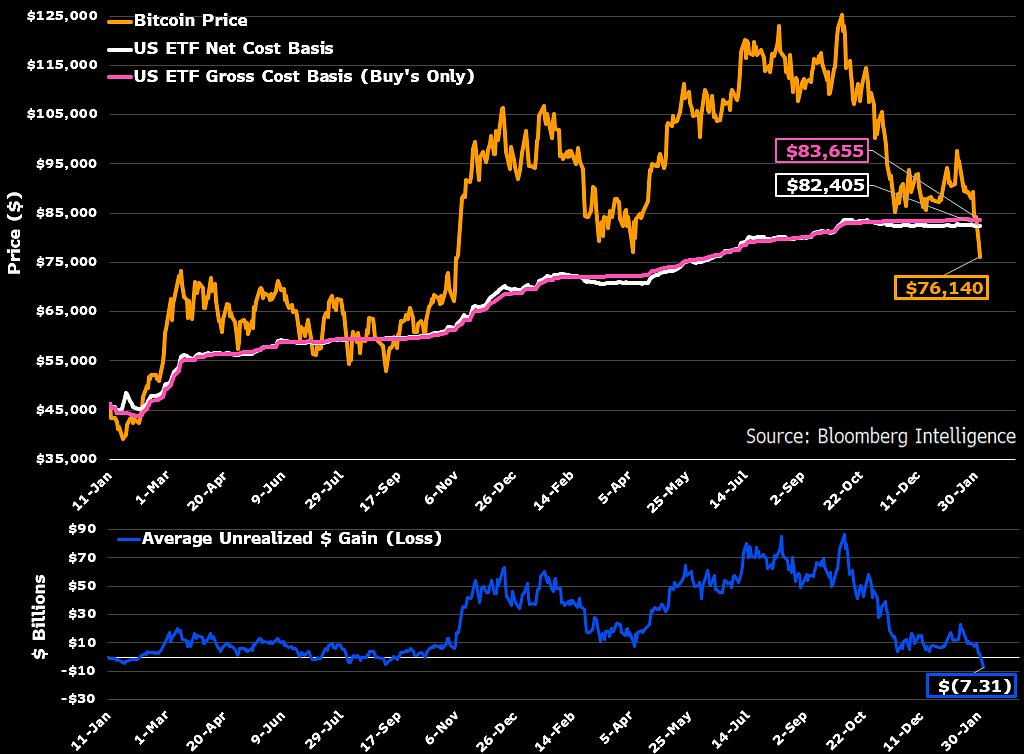

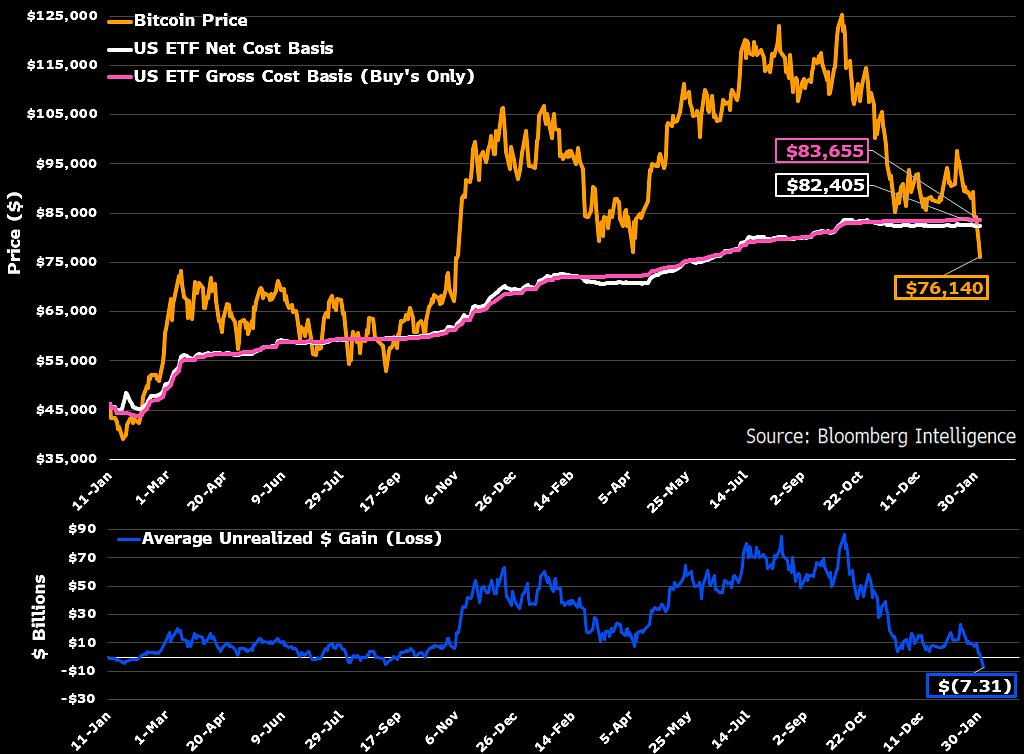

The ETFs are facing the worst Bitcoin pullback in % terms since their launch. Now sitting at a ~42% loss with BTC under $73k.

The ETFs are facing the worst Bitcoin pullback in % terms since their launch. Now sitting at a ~42% loss with BTC under $73k.

Those jagged moves up and down in the chart above are due to reconstitutions of the Russell 2k -- aka names are being bid up by active funds and then promoted to the Russell 1k

Those jagged moves up and down in the chart above are due to reconstitutions of the Russell 2k -- aka names are being bid up by active funds and then promoted to the Russell 1k

2/ This should occur on July 23rd for $ETHE & $ETH. For $GBTC & $BTC it should occur on July 31st.

2/ This should occur on July 23rd for $ETHE & $ETH. For $GBTC & $BTC it should occur on July 31st.

Here’s the language around the spinoff. There is no fee disclosed yet orrr what % of $GBTC will spin off but pretty sure this will be a non-taxable event for a chunk of those shares to get into a cheaper and cost competitive product.

Here’s the language around the spinoff. There is no fee disclosed yet orrr what % of $GBTC will spin off but pretty sure this will be a non-taxable event for a chunk of those shares to get into a cheaper and cost competitive product.

@BlackRock This one dropped 65 minutes earlier than BlackRock:

@BlackRock This one dropped 65 minutes earlier than BlackRock: https://x.com/JSeyff/status/1731784498101068137?s=20

Delay orders were issued by the SEC for BlackRock, Bitwise, VanEck, WisdomTree, Invesco, Fidelity & Valkyrie at the same time. If the agency wants to allow all 12 filers to launch -- as we believe -- this is the first available window since Grayscale's court victory was affirmed

Delay orders were issued by the SEC for BlackRock, Bitwise, VanEck, WisdomTree, Invesco, Fidelity & Valkyrie at the same time. If the agency wants to allow all 12 filers to launch -- as we believe -- this is the first available window since Grayscale's court victory was affirmed

https://twitter.com/EricBalchunas/status/1674055780058771463

The key question here is -- "Is Coinbase a market of significant size?" And I have a note out today talking about this... We think it is.

The key question here is -- "Is Coinbase a market of significant size?" And I have a note out today talking about this... We think it is.

Vast majority of that massive jump in shares actually happened in one fell swoop when 3AC (remember those guys?) defaulted on a loan from Genesis bc GBTC was used as collateral. This has caused a lot of speculation that $GBTC will have to liquidate. Below is from a 10Q. 2/X

Vast majority of that massive jump in shares actually happened in one fell swoop when 3AC (remember those guys?) defaulted on a loan from Genesis bc GBTC was used as collateral. This has caused a lot of speculation that $GBTC will have to liquidate. Below is from a 10Q. 2/X

2. $RSX also saw ~$600 mln worth of inflows at the end of Feb as people rushed in to call a bottom (Bad move IMO because I think a majority of the holdings are virtually worthless to U.S. investors). The value of the entire fund is about $30 million now... h/t @EricBalchunas

2. $RSX also saw ~$600 mln worth of inflows at the end of Feb as people rushed in to call a bottom (Bad move IMO because I think a majority of the holdings are virtually worthless to U.S. investors). The value of the entire fund is about $30 million now... h/t @EricBalchunas

https://twitter.com/PeterSchiff/status/1504082706598146058He also spelled 'United States' incorrectly. Which is just a little icing on the cake.

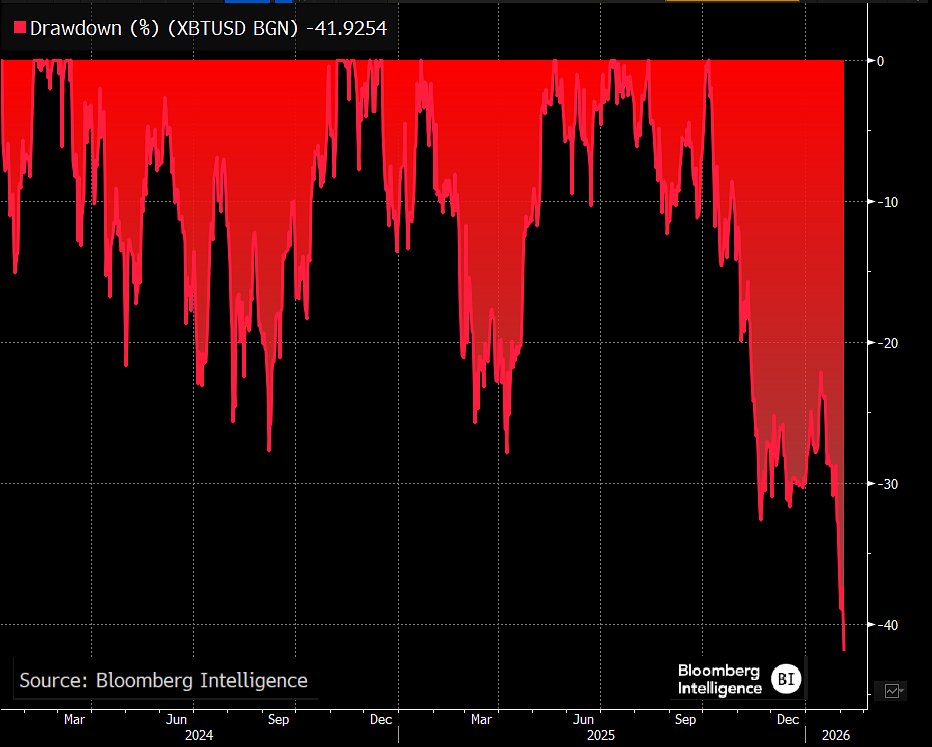

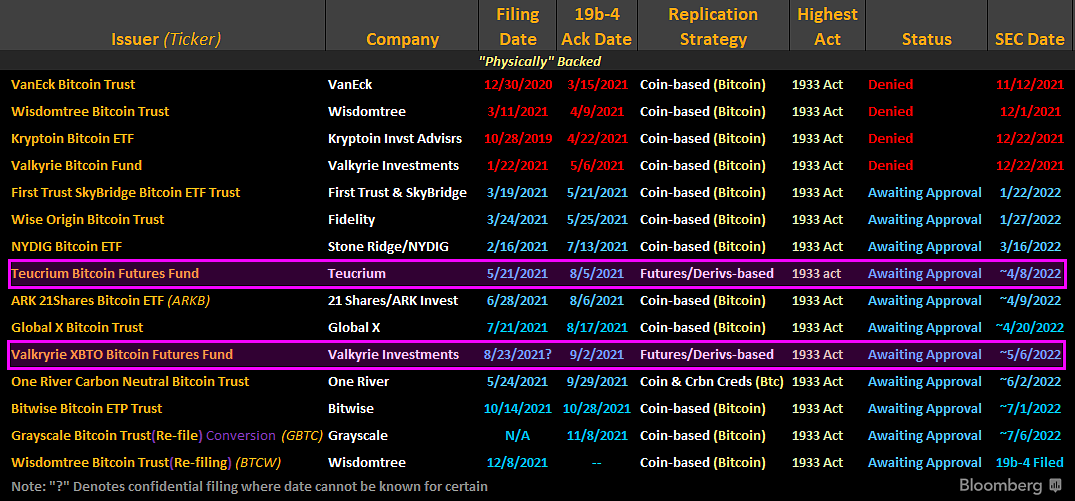

2/x @TeucriumETFs' decision is due on about April 8. Unlike $BITO (which was approved without a 19b-4 process) this one is 1933 act and follows the same process as spot ETFs. Since Vaneck's denial i've said the SEC reasoning suggests a futures ETF would likely be denied too.

2/x @TeucriumETFs' decision is due on about April 8. Unlike $BITO (which was approved without a 19b-4 process) this one is 1933 act and follows the same process as spot ETFs. Since Vaneck's denial i've said the SEC reasoning suggests a futures ETF would likely be denied too.

Originally we had ProShares way out in front but as @DaveNadig pointed out in a note. And @tpsarofagis pointed out in the table below-- Valkyrie is the only product that's been filed without reference to Canadian Bitcoin ETFs or other Bitcoin related instruments for exposure 2/x

Originally we had ProShares way out in front but as @DaveNadig pointed out in a note. And @tpsarofagis pointed out in the table below-- Valkyrie is the only product that's been filed without reference to Canadian Bitcoin ETFs or other Bitcoin related instruments for exposure 2/x

If $GBTC is ever able to convert to an ETF and BTC price trend is positive during that time, it may act as a leverage play again as the discount closes. Who knows when/if that happens though. Still hasn't stopped $GBTC's trading dominance though. No other fund is remotely close.

If $GBTC is ever able to convert to an ETF and BTC price trend is positive during that time, it may act as a leverage play again as the discount closes. Who knows when/if that happens though. Still hasn't stopped $GBTC's trading dominance though. No other fund is remotely close.

Difference in inflation statistics. 2/5

Difference in inflation statistics. 2/5

Regression analysis showed nothing in most basic metrics like beta, market cap, liquidity, etc. But taking the firm's stakes in the underlying stocks and their liquidity relative to the size of its position showed a definitive pattern. Heres avg return by quintile in each metric.

Regression analysis showed nothing in most basic metrics like beta, market cap, liquidity, etc. But taking the firm's stakes in the underlying stocks and their liquidity relative to the size of its position showed a definitive pattern. Heres avg return by quintile in each metric.