1/ In retrospect, it was inevitable.

Why was Tesla the perfect next company to adopt Bitcoin?

How does it pave the way for Apple and others?

And how soon?

Why was Tesla the perfect next company to adopt Bitcoin?

How does it pave the way for Apple and others?

And how soon?

2/ Tesla’s announcement of a $1.5B purchase of Bitcoin sent shockwaves across the Bitcoin community & mainstream media. Bitcoiners see a kickoff to a major new company trend. Mainstream media sees a one-off event, which won’t be repeated by Tesla or any other company.

3/ MicroStrategy took a huge leap in making Bitcoin their main treasury reserve asset, but they also had stable, predictable cash flows and no leverage. There were no persistent liquidity concerns. As an automaker, Tesla has much higher operating liquidity concerns.

4/ The auto industry can have one of the most difficult finances to balance needs for bc it is so ruthlessly cyclical. When times are good, they’re very good. But when there is a (usually unpredictable) cycle downturn, auto makers are stuck with unsold inventory and high costs.

5/ To combat this, auto companies keep huge amounts of cash and massive credit lines. I.e. when the pandemic hit in Q2, Ford/Fiat/GM collectively drew $45B in credit in addition to their cash. Tesla is not a traditional automaker, but it does share these similar industry concerns

6/ As a company that needs to be hyper aware of liquidity, adopting Bitcoin as a reserve asset is a powerful signal to others. Tesla is a manufacturer w/ complex financial needs. It expands the scope of only pure tech companies taking on Bitcoin. If they can do it, why can’t we?

7/ Moreover it's unlikely that this is a one-off event for Tesla. Tesla has $19.4B cash, growing $4.9B in the quarter, driven by $1.9B in FCF and $5B capital raise.

8/ This cash balance is expected to only increase in coming years, reaching $26B in 2023, as operating cash flow strengthens. It's likely that Tesla will further follow in MicroStrategy’s footsteps by using excess cash flow to continuously acquire more Bitcoin.

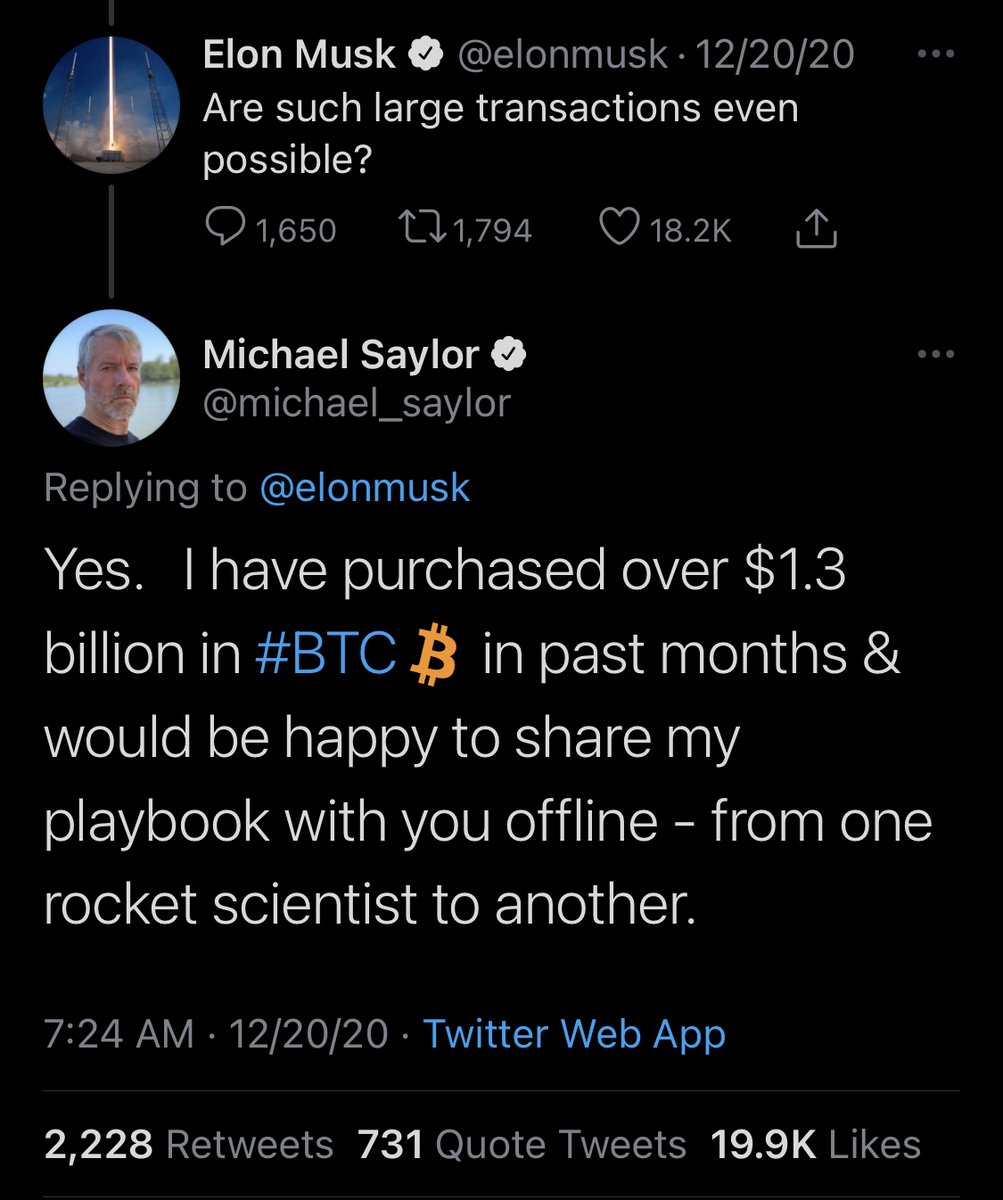

9/ Another company in Silicon Valley w/ a manufacturing component and $38B cash? Apple. RBC theorized that Apple could enable Bitcoin via the Iphone’s preloaded Apple Wallets and would acquire BTC to fund these wallets. But there are other, more compelling reasons.

10/ Apple has been infamous for keeping a long standing cash stockpile, which has drawn heavy criticism from investors as a wasted resource that could be put towards investments in generating more future cash flow.

11/ Apple, like a growing number of other companies, has bucked this idea. They’ve kept cash out of a) uncertainty for the future and b) tax repatriation. When they bring overseas $$$ back to a US entity, then it is subject to US taxes.

12/ Apple could diversify their cash portfolio, hedging against uncertainty and inflation concerns. Even more, they can consider their settlements w/foreign companies. If USD is beginning to no longer be the global reserve currency, BTC could be another way to settle funds

13/ Apple is one of many companies next in line to acquire Bitcoin, given the ~7,000 companies that attended Michael Saylor’s Bitcoin for Corporations Conference last week. MicroStrategy previously shocked with how quickly they were able to adopt Bitcoin - 6 months

14/ But now that MicroStrategy has shared their “playbook” of how to do this, it has shortened the adoption timeline even further. At the end of December, Saylor and Musk connected (if it wasn’t just for show).

15/ In their 10K, Tesla lists their investment policy being updated for Bitcoin in January. And Tesla announced their Bitcoin investment in February. That's ~8 weeks for Bitcoin to be adopted. The beginning of April could prove very interesting...

16/ TL;DR: As an auto manufacturer, Tesla widened the scope of potential companies to adopt Bitcoin more than any other. There are many companies that will view adding Bitcoin as de-risked and will be racing to acquire Bitcoin within the next couple months.

• • •

Missing some Tweet in this thread? You can try to

force a refresh