#Suvenpharma

My analysis after Concall

-ANDAs contribution to PAT was zero in FY20. It will be biggest growth driver for company with 5 already launched and 6-7 getting launched next year. Company working on one 505 b(2) opportunity which can materialize after Mar 22..

My analysis after Concall

-ANDAs contribution to PAT was zero in FY20. It will be biggest growth driver for company with 5 already launched and 6-7 getting launched next year. Company working on one 505 b(2) opportunity which can materialize after Mar 22..

this can be large opportunity..Overall I estimate ANDAs to contribute 200-250 crs PAT in next 3 years..

-Rising pharma contribution was 46 crs in FY20. With company out of bankruptcy and 100+ ANDAs pipeline, PAT contribution will keep rising..

-Rising pharma contribution was 46 crs in FY20. With company out of bankruptcy and 100+ ANDAs pipeline, PAT contribution will keep rising..

-CDMO pharma will have growth drivers in the form of 1-2 commercial molecules in next 18-24 months and moving from intermediates to API and formulation. Management said they are talking to 2 large customers on these lines

-CDMO non pharma has 2 molecules currently, 2 more will

-CDMO non pharma has 2 molecules currently, 2 more will

be launched in next 18 months. 3 more are in development stage…

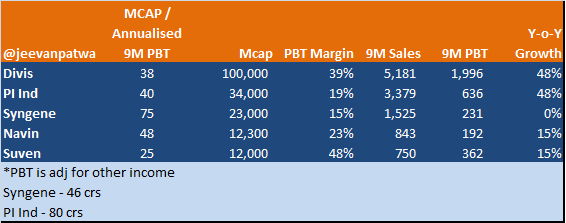

I feel Suven pharma will post 30% plus EPS CAGR for next 3 years..currently available at lowest valuation among peers…

I feel Suven pharma will post 30% plus EPS CAGR for next 3 years..currently available at lowest valuation among peers…

• • •

Missing some Tweet in this thread? You can try to

force a refresh