1/ Bitcoin critics continue to assert that mining is wasteful and disproportionately damaging to the environment.

Contrary to consensus thinking, we believe the impact of bitcoin mining is a net positive for the environment.

Here's why:

Contrary to consensus thinking, we believe the impact of bitcoin mining is a net positive for the environment.

Here's why:

2/ First, proof-of-work mining is critical to Bitcoin. In the Bitcoin network, trustworthiness is protected by computation, and mining is what gives Bitcoin its ability to coordinate trust and facilitate the transfer of value without relying on a centralized authority.

3/ The costliness to produce bitcoin is fundamental to its value.

Unlike the US dollar, Bitcoin cannot be printed with the stroke of a keyboard.

Instead, it converts the output from cheap stranded energy sources into something with monetary value.

lynalden.com/misconceptions…

Unlike the US dollar, Bitcoin cannot be printed with the stroke of a keyboard.

Instead, it converts the output from cheap stranded energy sources into something with monetary value.

lynalden.com/misconceptions…

4/ Even so, Bitcoin’s energy consumption is trivial compared to legacy financial systems. As measured by electricity costs alone, Bitcoin is much more efficient than traditional banking and gold mining on a global scale.

5/ Traditional banking consumes 2.34 B GJ/yr and gold mining 500 M GJ/yr, while Bitcoin consumes 184 M GJ/yr.

Additionally, Bitcoin mining’s estimated $ cost / GJ expended is 40x more efficient than that of traditional banking and 10x more efficient than that of gold mining.

Additionally, Bitcoin mining’s estimated $ cost / GJ expended is 40x more efficient than that of traditional banking and 10x more efficient than that of gold mining.

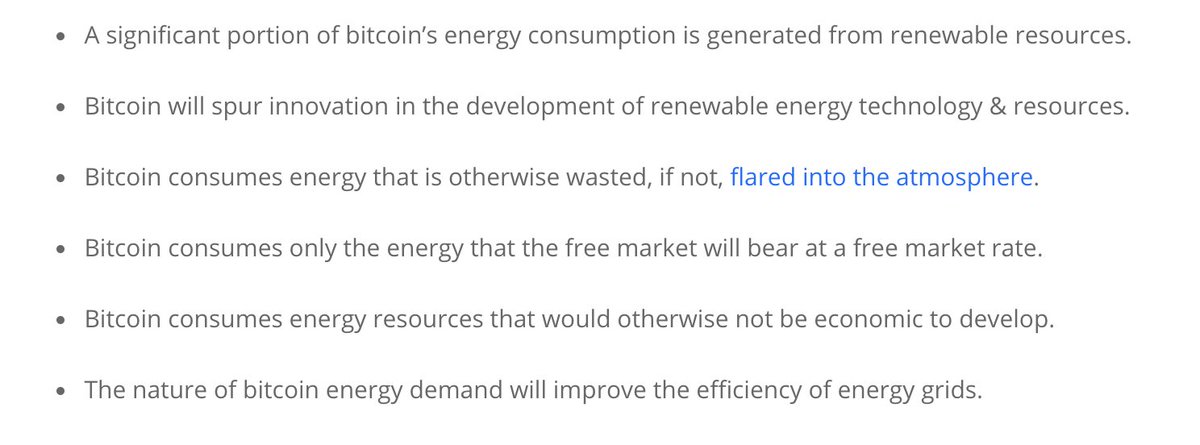

6/ Another common mistake energy detractors make is to naively extrapolate Bitcoin’s energy consumption to the equivalent CO2 emissions. What matters is the type of energy source being used to generate electricity.

7/ In reality, renewables account for the largest percentage of bitcoin’s energy mix. In the search for the cheapest form of electricity, miners flock to regions offering a glut of renewable electricity, unlocking stranded energy assets.

coindesk.com/the-last-word-…

coindesk.com/the-last-word-…

8/ In some instances, Bitcoin mining is even helping to reduce greenhouse gas emissions by consuming methane that would have been leaked into the atmosphere via flaring.

9/ "That energy would have been wasted, as is evidenced by the existence of flare stacks. That gas is flared because it can't be brought to market. Bitcoin miners are incentivized to show up and consume that wasted energy."

- @martybent

- @martybent

10/ "If Bitcoin ends up being worth substantially more in the future Bitcoin’s energy expenditure may end up looking rather cheap in the final analysis." - @nic__carter

11/ Coins only need to be issued once. And it’s better for the planet that they be issued when the coin price was low, and the electricity expended to extract them was commensurately low.

12/ In summary, Bitcoin does not waste energy.

It is clear that because Bitcoin’s footprint is so easy to quantify, it is singled out for special treatment.

unchained-capital.com/blog/bitcoin-d…

It is clear that because Bitcoin’s footprint is so easy to quantify, it is singled out for special treatment.

unchained-capital.com/blog/bitcoin-d…

• • •

Missing some Tweet in this thread? You can try to

force a refresh