$PLTR Palantir Technologies announced FY results – Stock is🔻12%

Below are $PLTR Full Earnings + Year Review/Takeaways after the Conference call:

+ Why Q4- looked weaker than expected

+ Why I’ll be buying more shares

+ This week's volatility

Review Thread & hope it helps:👇

Below are $PLTR Full Earnings + Year Review/Takeaways after the Conference call:

+ Why Q4- looked weaker than expected

+ Why I’ll be buying more shares

+ This week's volatility

Review Thread & hope it helps:👇

1/ $PLTR - Let’s start with Revenues:

Full-Year 2020: 1.093B vs $743M (2019) - 47% YoY

• Q4-20: Rev Est. vs Actual: $322M vs 2019-$229M - 40% YoY

• Overall, 56% came from Gov't and 44% from Commercial clients

**Slight improvement from 2019 in Revenue mix

We break it down>

Full-Year 2020: 1.093B vs $743M (2019) - 47% YoY

• Q4-20: Rev Est. vs Actual: $322M vs 2019-$229M - 40% YoY

• Overall, 56% came from Gov't and 44% from Commercial clients

**Slight improvement from 2019 in Revenue mix

We break it down>

1i/ $PLTR - Government Revenue:

- It was $610M grew 77% YoY

- QoQ basis: Q3-19: $97M > Q3-20: $163M (68%YoY) > Q4:20 190M (85% YoY)

- 10 National Govt generated most of it.

*The growth was boosted by more Govt clients spending on Covid-19 (FDA & NHS England) and the US Army

- It was $610M grew 77% YoY

- QoQ basis: Q3-19: $97M > Q3-20: $163M (68%YoY) > Q4:20 190M (85% YoY)

- 10 National Govt generated most of it.

*The growth was boosted by more Govt clients spending on Covid-19 (FDA & NHS England) and the US Army

2a/ $PLTR - Commercial Clients

- It was $482M grew 22% YoY

- This experienced slow-down, as we saw only 4% growth YoY in Qtr-4 (Many of the new contracts were not recognized)

- The US Commercial part of the business is growing the fastest as FY 2020 - 107% growth YoY

Cont'd

- It was $482M grew 22% YoY

- This experienced slow-down, as we saw only 4% growth YoY in Qtr-4 (Many of the new contracts were not recognized)

- The US Commercial part of the business is growing the fastest as FY 2020 - 107% growth YoY

Cont'd

2b/ $PLTR Commercial

- They signed lots of new commercial clients that were NOT RECOGNIZED YET - signed almost 21 Contracts (12 were worth 10M+; 9 were 5M+);

- Smaller sizes are growing faster with over 50% growth

- The IBM Partnership with scale this number further in 2021

- They signed lots of new commercial clients that were NOT RECOGNIZED YET - signed almost 21 Contracts (12 were worth 10M+; 9 were 5M+);

- Smaller sizes are growing faster with over 50% growth

- The IBM Partnership with scale this number further in 2021

3a/Let's talk $PLTR Clients:

- Finished the year recognizing Total customers of 125;

- Top 20-customer concentration risk is decreasing by (6%)

Although, they are generating more as

- Avg. Revenue of Top 20 Customers:

- FY 2020: $24M -> $33M (34% Growth)

Contd

- Finished the year recognizing Total customers of 125;

- Top 20-customer concentration risk is decreasing by (6%)

Although, they are generating more as

- Avg. Revenue of Top 20 Customers:

- FY 2020: $24M -> $33M (34% Growth)

Contd

3b/ $PLTR :

- Avg. Rev. Per Customer (ARPU): From: Q3 2019: 4.2M -> Q3-2020: 5.8M (38% G) -> FY 2020: 7.9M (41% G)

- $42M from new customers

- Important, they are upselling and retaining high net-dollar retention as they don't 'always' need to attract new clients to grow Revs

- Avg. Rev. Per Customer (ARPU): From: Q3 2019: 4.2M -> Q3-2020: 5.8M (38% G) -> FY 2020: 7.9M (41% G)

- $42M from new customers

- Important, they are upselling and retaining high net-dollar retention as they don't 'always' need to attract new clients to grow Revs

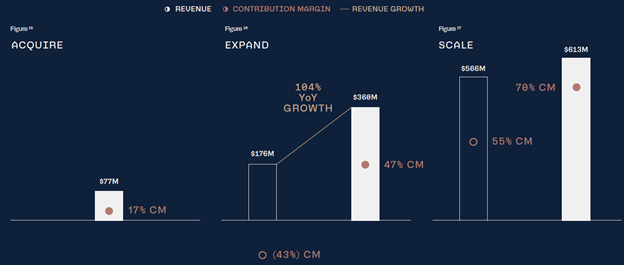

4/ $PLTR Contribution margins - measure of efficiency in selling and delivering software to clients (Revs - cost)

- FY 2020 improved: 21% -> 54%.

- They are improving the way they set up new clients

- Led Gross margins up 81%

- This has always been important for scale & for $PLTR

- FY 2020 improved: 21% -> 54%.

- They are improving the way they set up new clients

- Led Gross margins up 81%

- This has always been important for scale & for $PLTR

5/ $PLTR - Contract Value - Why Q4 looks weaker:

- RPO (Remaining performance obligations) it represents the non-cancelable contracted revs that has not yet been recognized.

- Overall RPO was Up 114% YoY – I suspect this will be recognized in Q1-2021 across 2021 and years out

- RPO (Remaining performance obligations) it represents the non-cancelable contracted revs that has not yet been recognized.

- Overall RPO was Up 114% YoY – I suspect this will be recognized in Q1-2021 across 2021 and years out

5a) $PLTR Contract value are increasing & big

- $2.8B CV as of Dec. 31, 2020, up 24% YoY and the length are extending out - this is both good for long-T shareholders, but bad for ST.

- Overall 49% Growth YoY

- Also in 2020 meaning more people are testing out PLTR’s products

- $2.8B CV as of Dec. 31, 2020, up 24% YoY and the length are extending out - this is both good for long-T shareholders, but bad for ST.

- Overall 49% Growth YoY

- Also in 2020 meaning more people are testing out PLTR’s products

6/ $PLTR My personal takes & future expectations:

• $PLTR Guides for $4B in 2025 revenue and 30% growth in 2021 is just being conservative

• In 2020, $PLTR was primarily focused on helping with Covid clients as Covid was a surprise.

• Best kept secret ->

• $PLTR Guides for $4B in 2025 revenue and 30% growth in 2021 is just being conservative

• In 2020, $PLTR was primarily focused on helping with Covid clients as Covid was a surprise.

• Best kept secret ->

7/ My thoughts:

- In 2020, $PLTR could not focus much on the commercial side + businesses were not spending aggressively until yet they got clarity

- Lots of revenue will be recognized in 2021- this Qtr is deceptive, but expect growth in 21 as they've guided for Q1- 47% Growth

- In 2020, $PLTR could not focus much on the commercial side + businesses were not spending aggressively until yet they got clarity

- Lots of revenue will be recognized in 2021- this Qtr is deceptive, but expect growth in 21 as they've guided for Q1- 47% Growth

8/ $PLTR

- The best part is that we will see more from the commercial since they are less than <5% penetrated - only at 8/100 Fortune and 36/300 Global corporations

- Expect more from the Launched partnership with IBM - they will benefit from the scale of IBM’s 2,500 Sales team

- The best part is that we will see more from the commercial since they are less than <5% penetrated - only at 8/100 Fortune and 36/300 Global corporations

- Expect more from the Launched partnership with IBM - they will benefit from the scale of IBM’s 2,500 Sales team

9/ $PLTR Stock Performance:

- Expiry lock-up happens this week where 4/5th of shares will be sold including those of Peter Thiel & execs

- This presents a buying opportunity b'cos from Feb 25, the stock will heal

- Expect to hear more partnerships as Foundry 21 is launched

- Expiry lock-up happens this week where 4/5th of shares will be sold including those of Peter Thiel & execs

- This presents a buying opportunity b'cos from Feb 25, the stock will heal

- Expect to hear more partnerships as Foundry 21 is launched

10/ The future of big data and analytics to drive significant business performance is huge! We are still in the early innings!

Thanks for reading!

Kindly help to share! What did I miss? Any Q? Open to feedback $ long $PLTR!

Thanks for reading!

Kindly help to share! What did I miss? Any Q? Open to feedback $ long $PLTR!

Happy to hear your thoughts after looking at the report?

Did I miss the reason for the weaker quarter than expected @investing_city @saxena_puru @cameroniadeluca @cperruna

Did I miss the reason for the weaker quarter than expected @investing_city @saxena_puru @cameroniadeluca @cperruna

• • •

Missing some Tweet in this thread? You can try to

force a refresh