Fed released the scenarios for 2021 CCAR. Here's the assumptions used for the Severely Adverse Scenario, which is the disaster porn.

Morgan Stanley summarizes the differences between the 2nd test done in late 2020. Modestly less severe economic assumptions in most cases, some harsher capital markets assumptions, net net slightly less punitive.

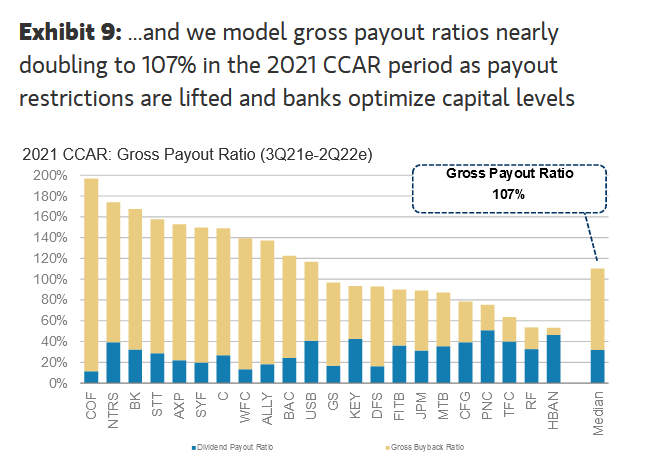

Bank Boards are set to have a level of discretion over capital returns not seen since before the GFC

• • •

Missing some Tweet in this thread? You can try to

force a refresh