Bond yields are rising fast and investors are getting nervous.

So what’s the big deal?

Let’s talk about it.

So what’s the big deal?

Let’s talk about it.

BTW, yields 101:

Yields rise when bond prices fall. So as people buy bonds, yields fall.

Got it? OK, let’s do this thing.

Yields rise when bond prices fall. So as people buy bonds, yields fall.

Got it? OK, let’s do this thing.

Yields are rising like a 🚀

The 10-year yield, Wall Street’s favorite gauge for yields, jumped 11 basis points yesterday. That’s the most in 11 months.

It’s up about 23 basis points in February, poised for the biggest monthly jump in three years.

The 10-year yield, Wall Street’s favorite gauge for yields, jumped 11 basis points yesterday. That’s the most in 11 months.

It’s up about 23 basis points in February, poised for the biggest monthly jump in three years.

The 10-year yield also broke through an important post-COVID level yesterday, which has people all 🤯

https://twitter.com/bullandbaird/status/1361762864940384256

These are big moves, and Wall Street expects yields to move even higher this year as the economy grows and inflation picks up.

(generally, higher growth and inflation = higher 10-year yield)

(generally, higher growth and inflation = higher 10-year yield)

So what does this mean for you, dear stock investor?

Historically, rising yields have been good for stocks because they typically foreshadow a growing economy.

Since 1990, the S&P 500 has risen an average of 1% in months when the 10-year yield has climbed (vs. 0.4% in the months when the 10-year yield has dropped).

Since 1990, the S&P 500 has risen an average of 1% in months when the 10-year yield has climbed (vs. 0.4% in the months when the 10-year yield has dropped).

To be fair, context matters here.

But in this particular situation yields are rising mainly because of economic optimism. So that’s good.

But in this particular situation yields are rising mainly because of economic optimism. So that’s good.

There is such a thing as yields rising too quickly, though.

If that happens, investors freak out because then it looks like the economy’s growing TOO fast and inflation may be getting out of hand.

If that happens, investors freak out because then it looks like the economy’s growing TOO fast and inflation may be getting out of hand.

That’s not good, and it’s a real risk people are worried about these days.

(p.s. a thread on inflation if you want to learn more)

(p.s. a thread on inflation if you want to learn more)

https://twitter.com/callieabost/status/1346828590365761543

Quickly rising yields can also point to major shifts in the market’s mood.

Big changes in other markets make investors nervous, especially with stocks at record highs, because there could be something nefarious stocks aren't picking up on...

Big changes in other markets make investors nervous, especially with stocks at record highs, because there could be something nefarious stocks aren't picking up on...

Here's the deal, though.

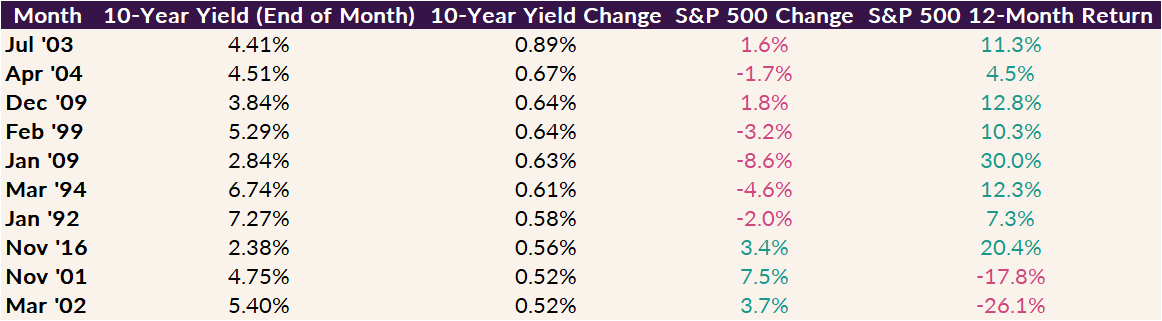

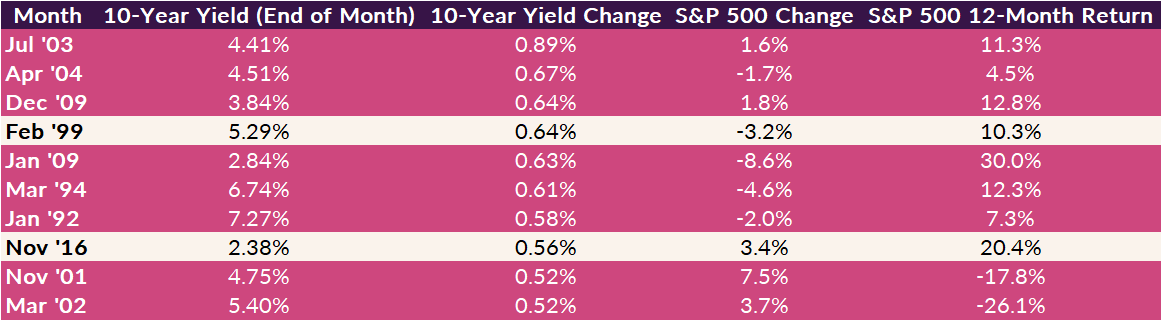

Quick jumps in the 10-year yield tend to freak out stocks, BUT stocks tend to do well in the 12 months after.

Here’s a table of months since 1990 when the 10-year yield has risen the most.

Quick jumps in the 10-year yield tend to freak out stocks, BUT stocks tend to do well in the 12 months after.

Here’s a table of months since 1990 when the 10-year yield has risen the most.

Why?

Because big jumps in yield often happen at the tail end of recessions or early on in economic recoveries.

Every month highlighted in pink below fits that description (tail end of recession or first half of economic expansion).

Because big jumps in yield often happen at the tail end of recessions or early on in economic recoveries.

Every month highlighted in pink below fits that description (tail end of recession or first half of economic expansion).

Where are we now? Early on in an economic recovery. And that’s what yields are trying to tell us.

Right now, higher yields = a very good sign.

Nothing nefarious from what I can see.

Right now, higher yields = a very good sign.

Nothing nefarious from what I can see.

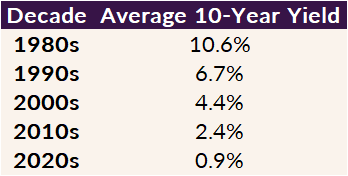

If you’re still freaked out by the 10-year yield, then take a deep breath...

...and remember that yields are historically low.

...and remember that yields are historically low.

In fact, here’s a table of the average 10-year yield by decade.

We’re sitting at 1.3% right now. Can you believe the 10-year got up to 15% in the 1980s?*

*that wasn't good. in the early 1980s, high yields and high inflation led to an economic recession.

We’re sitting at 1.3% right now. Can you believe the 10-year got up to 15% in the 1980s?*

*that wasn't good. in the early 1980s, high yields and high inflation led to an economic recession.

Side note: high yields are why boomers were able to buy houses for $50K in the 80s.

Because their mortgage rates were like 18%.

Because their mortgage rates were like 18%.

Low yields are like catnip to stocks.

Theoretically, they entice people and businesses to take out more debt and take on more risk.

Low yields also entice people out of bonds and into stocks (because low yields = low bond coupon).

Theoretically, they entice people and businesses to take out more debt and take on more risk.

Low yields also entice people out of bonds and into stocks (because low yields = low bond coupon).

So, to wrap it all up.

Yields are telling a good story right now. And the level of yields should make you feel even better about the stock market.

Yields are telling a good story right now. And the level of yields should make you feel even better about the stock market.

Rising yields could be enough to topple stocks from record highs and fuel a quick little selloff (because of change and nerves).

But the economy is recovering, and as long as we can keep growth in check, higher yields could be a good story for stocks long-term.

But the economy is recovering, and as long as we can keep growth in check, higher yields could be a good story for stocks long-term.

• • •

Missing some Tweet in this thread? You can try to

force a refresh