Today's thread is on cap table 101 for new founders.

What is a cap table? Why it's impt? What investors typically ask for? Where founders often go wrong w/ re: to cap tables?

Read on >>

What is a cap table? Why it's impt? What investors typically ask for? Where founders often go wrong w/ re: to cap tables?

Read on >>

1) Let's talk about company ownership:

When you have a company, in the beginning it's owned by you and maybe a co-founder or so. If you think of your company like a pie, in the beginning, the co-founders own the whole pie. And then you start allocating pieces to others

When you have a company, in the beginning it's owned by you and maybe a co-founder or so. If you think of your company like a pie, in the beginning, the co-founders own the whole pie. And then you start allocating pieces to others

2) What is a cap table?

A cap table is a spreadsheet that has a list of all the ppl and entities that own pieces of your pie (your company). In the beginning, there may just be 2 line items or so for you and your co-founder.

It will list your name and how many shares you own.

A cap table is a spreadsheet that has a list of all the ppl and entities that own pieces of your pie (your company). In the beginning, there may just be 2 line items or so for you and your co-founder.

It will list your name and how many shares you own.

3) The shares in themselves are meaningless. But they are meaningful as a % of the whole pie.

E.g. if you own 50% of the pie & you have 5000 shares, there are 10k overall representing the whole pie. Or if you have 5M shares, there are 10M shares representing the whole pie.

E.g. if you own 50% of the pie & you have 5000 shares, there are 10k overall representing the whole pie. Or if you have 5M shares, there are 10M shares representing the whole pie.

4) Eventually you start to bring in employees and investors and maybe advisors who will also be granted shares. And they will start to get a % of the pie.

Your cap table will grow in its list size with the respective % numbers next to each of these ppl or entities.

Your cap table will grow in its list size with the respective % numbers next to each of these ppl or entities.

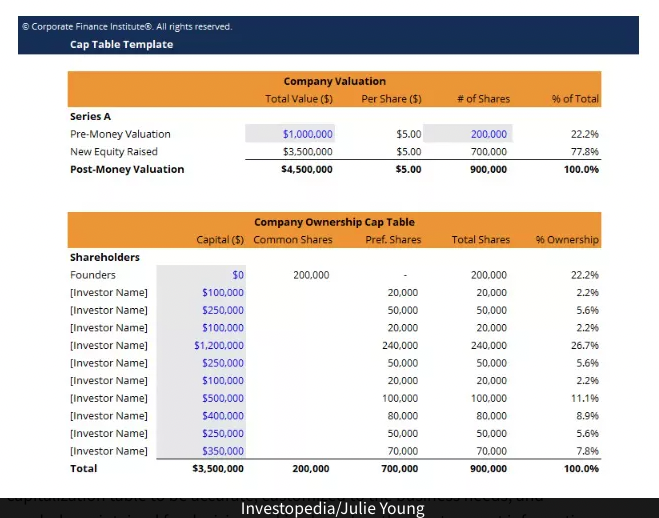

5) This is what a captable looks like:

(From: investopedia.com/terms/c/capita…)

Each line item here has # of shares listed for each entity.

Here the founders have 200k shares allocated towards them, and there are 900k in total representing this co. 200k/900k = 22% of the co.

(From: investopedia.com/terms/c/capita…)

Each line item here has # of shares listed for each entity.

Here the founders have 200k shares allocated towards them, and there are 900k in total representing this co. 200k/900k = 22% of the co.

6) There are common shares & preferred shares. Common shares having voting rights. Preferred shares get preference on liquidity $$ (in IPOs/exits and dividends).

Founders get common shares.

Investors in the US want to invest in preferred shares (outside the US it's different).

Founders get common shares.

Investors in the US want to invest in preferred shares (outside the US it's different).

7) Founder and employee shares typically vest across 4 years. Meaning they do not get all the shares upfront. They have to work at the company for 4 years to get all of them. Investors will ask that you have vesting in place.

Advisor shares typically vest over 1-2 years.

Advisor shares typically vest over 1-2 years.

8) So if an employee is supposed to get 1% of the company after 4 yrs of working at your co but quits after yr 1, he/she will only get 0.25% of the pie.

9) A "fully diluted cap table" means the cap table is written under the assumption that everyone who is allocated shares gets all their shares -- meaning under the assumption everyone fully vests and doesn't leave before then.

10) Now let's say you go and raise money from investors. Everyone already on the cap table will be diluted down. That means that in order to make room for the new ppl getting slices of pie, everyone else will get a smaller % of the pie. This will happen in subsequent rounds.

11) A caveat: if investors are investing on a convertible note or a SAFE, they technically do not own shares at that pt. So they will NOT be added to the cap table until their SAFEs/notes convert into actual shares.

12) This is why with SAFEs / notes, founders often don't realize how much of the pie everyone owns -- because there are investors literally not on the cap table since they hold SAFEs/notes instead of equity.

13) Plug for @HustleFundVC portfolio co @pulley who makes cap tables super easy so you can understand -- even if an investor invests on a note/SAFE and is not on your cap table yet -- how much of the pie everyone will own.

14) Employee stock option pool (ESOP) - when you raise money from investors, they will often ask you to create an employee stock option pool.

This means to set aside some shares for your employees to incentivize them to do great work.

This means to set aside some shares for your employees to incentivize them to do great work.

15) These days, an ESOP is typically 10%. But 10 yrs ago, it was closer to 20%. This is something to potentially negotiate when you raise money from investors, because the ESOP will also further dilute the cap table (mostly the founders).

16) I.e. if you are being diluted down by 20% by the next round of investment AND you have to create a 10% option pool in the same transaction, you are actually diluting down by 30%. This is more dilution than most founders think about when they go to raise money.

17) The last area to be cautious of is the pre-money vs post-money SAFE. Because SAFE holders are not listed on a cap table until they convert, founders are often more diluted than they think.

The pre-money SAFE != post-money SAFE.

The pre-money SAFE != post-money SAFE.

18) The post-money SAFE is easy to convert. If I invest $25k at a $2.5M post-money cap on a SAFE, I'm buying 25k/2.5M = 1% of the pie.

If another investor comes along and invests $475k at $2.5m post on a SAFE, they are buying 475k/2.5M = 19%

Total investor % = 1% + 19%.

If another investor comes along and invests $475k at $2.5m post on a SAFE, they are buying 475k/2.5M = 19%

Total investor % = 1% + 19%.

19) The pre-money SAFE converts taking into account ALL the other investors INCLUDING the terms of the next priced round.

20) Cap tables have traditionally been really messy w spreadsheets, esp when you have many SAFEs & many shareholders.

It's horrifying to say that I've rarely seen cap table math done correctly at each round.

It's horrifying to say that I've rarely seen cap table math done correctly at each round.

21) But, in this day and age, I think it's impt to use a cap table management tool so that you can compute different scenarios quickly and easily.

• • •

Missing some Tweet in this thread? You can try to

force a refresh