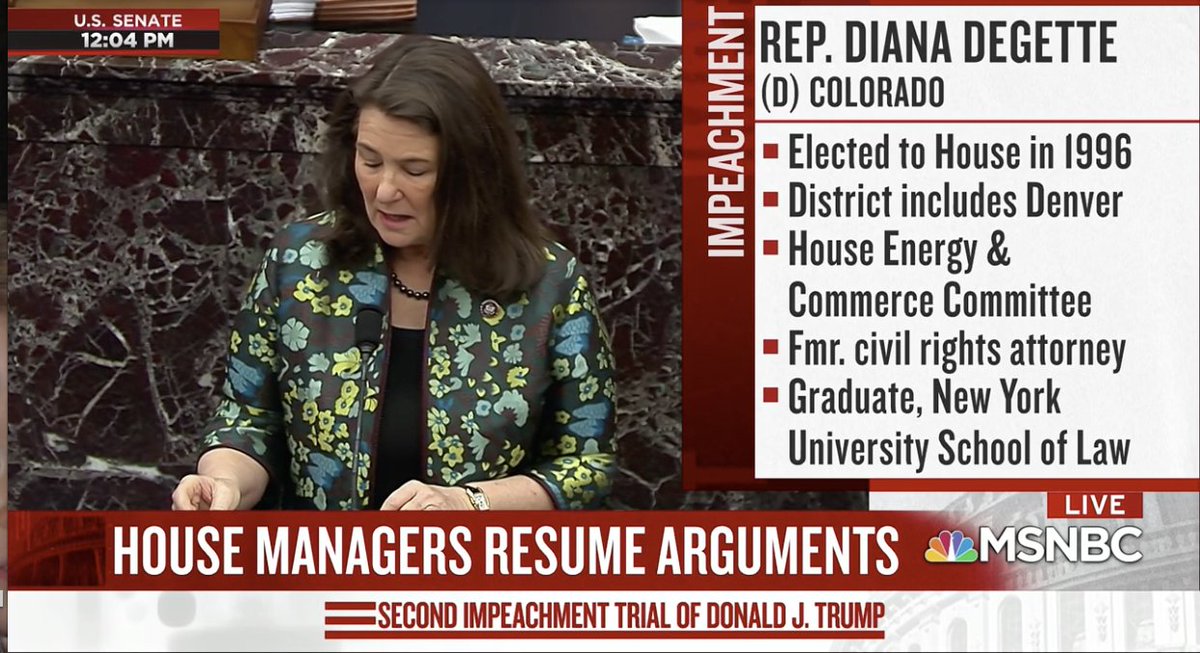

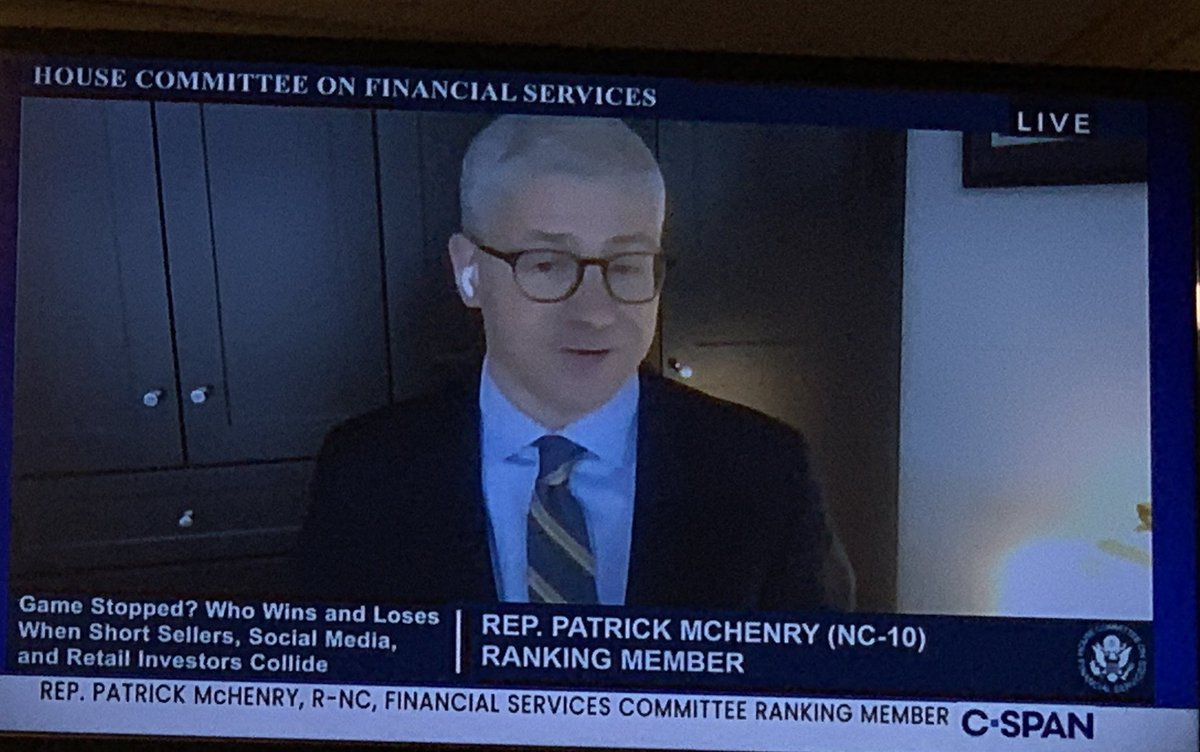

Ranking member McHenry says there is “wisdom to the crowd” and said that general public is more savvy and intelligent and people in Washington think they are. Funny. The Securities laws were created to protect investors. With a “seller beware” motto from FDR

2/

2/

He is complaining about the accredited investor definition designed to protect people who cannot afford to lose money from being fleeced by securities offerings where there is not adequate disclosure.

3/

3/

I agree with @BradSherman, the GameStop saga would make a great exam question. Especially questions about payment for order flow. Even if perfectly legal, is this a problem for the stability of our financial markets?

5/

5/

Now Rep. Al Green mentions at Citadel has paid $100 million in penalties. Asks how the punishments impact the reward that has been received.

6/

6/

Water swears in the witnesses. If you would like to be their written statements which have been added to the record, see

financialservices.house.gov/calendar/event…

7/

financialservices.house.gov/calendar/event…

7/

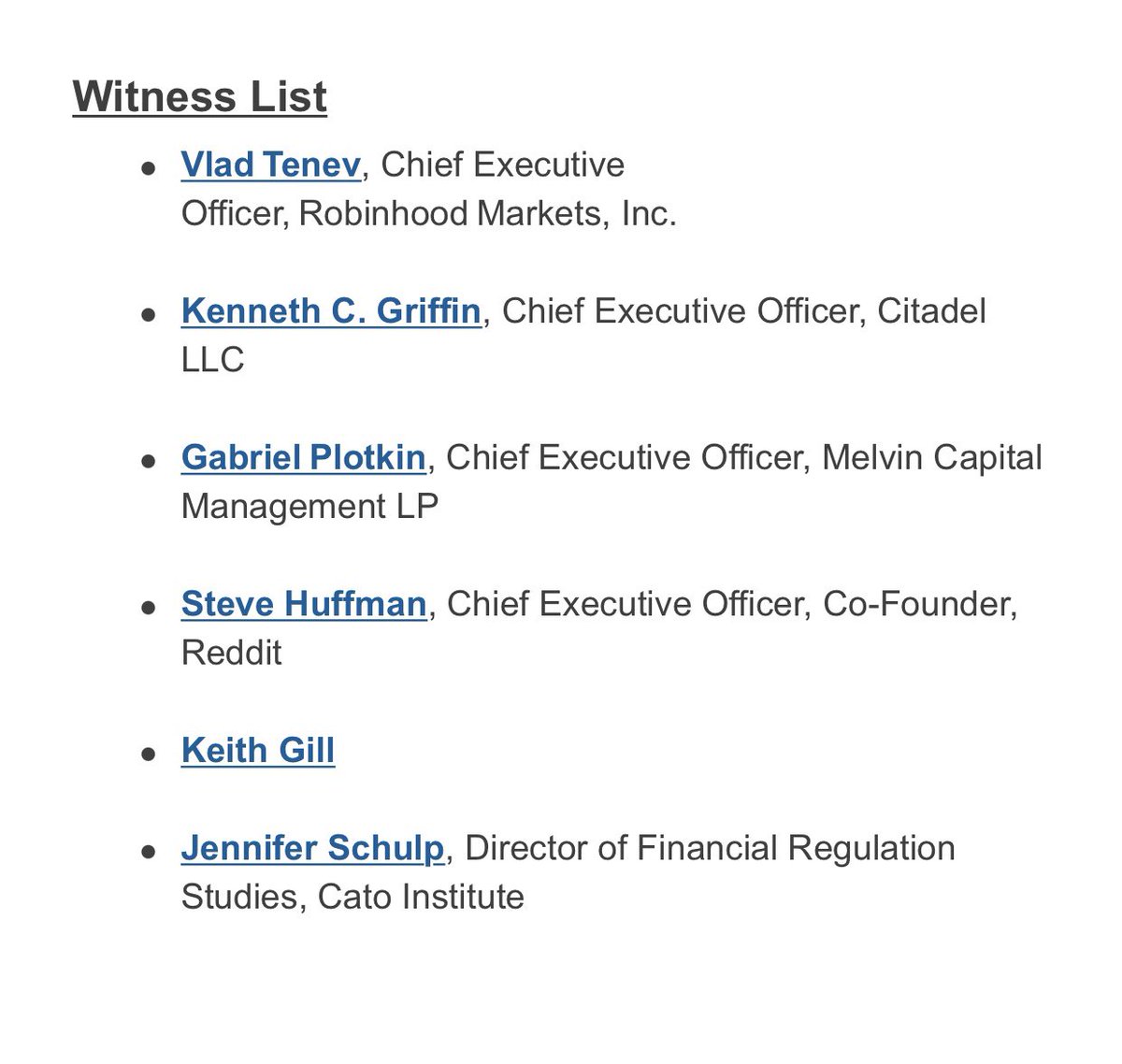

The CEO and cofounder of Robin Hood, Vlad Tenev, is the first witness. he is reading a brief summary of this written statement.

financialservices.house.gov/uploadedfiles/…

8/

financialservices.house.gov/uploadedfiles/…

8/

Waters interrupted him to ask him to focus on what happened with a meltdown instead of this big background statement. Says his platform Robinhood allows people of all background to invest.

9/

9/

He said the value of the brokerage accounts on the platform are worth $35 million in excess of what the investors “deposited“ with them. He says that is indication indication of the success. (But that could just be an indication of how much they borrowed?)

10/

10/

Tanev of Robinhood is trying to explain why they put trading restrictions in place. He said this was to meet regulatory requirements, and “we do not answer to hedge funds”. Says they’ve raise $3 billion more in capital.

11/

11/

He apologized to his customers and also is now complaining about the T + 2 settlement of trades. He wants to move to real-time settlement.

12/

12/

The next witness is Citadel CEO and founder Kenneth Griffin. Here’s a copy of his written statement. His oral statement is just five minutes as are the others

financialservices.house.gov/uploadedfiles/…

13/

financialservices.house.gov/uploadedfiles/…

13/

Griffin said “we had no role in Robinhood‘s decision to limit trading in game stop” or other stocks. He said he only learned about that after they were announced.

14/

14/

He said that always, and in particular the week of January 24, he said Citadel was able to provide liquidity. Said they were able to execute 7 billion shares on behalf of retail investors One day mid week. I didn’t remember what day he said

15/

15/

The founder and CEO of Melvin Capital’s statement. He said he closed out all the positions in GameStop before the trading limits were put in place by Robinhood. He claims Melvin was not bailed out but instead that Citadel reached out to invest

financialservices.house.gov/uploadedfiles/…

16/

financialservices.house.gov/uploadedfiles/…

16/

He said he learned from the events and looks forward to answering questions

17/

17/

The CEO and co-founder of REDDIT, Steve Huffman is delivering his opening statement. Like Plotkin, it looks like he is reading it. Now he is talking about content moderation

Here's the written statement which is more detailed

financialservices.house.gov/uploadedfiles/…

18/

Here's the written statement which is more detailed

financialservices.house.gov/uploadedfiles/…

18/

He explained how moderators at the community ("subreddit") level vote up and down. Though there is some centralized content moderation as well by employees of Reddit called the anti-evil team.

19/

19/

Huffman talks about the community WallStreetBets. In the written statement he said "This particular

community specializes in higher-risk, higher-reward investments than what you might find in other, more

conservative, financial communities on Reddit"

20/

community specializes in higher-risk, higher-reward investments than what you might find in other, more

conservative, financial communities on Reddit"

20/

Huffman said they checked the activity in WallStreetBets and said they did not see bot or foreign activities and that it has behaved in the bounds of the Reddit guidelines.

Said it may seem "sophomoric and chaotic" from the outside, but they have raised important issues

21/

Said it may seem "sophomoric and chaotic" from the outside, but they have raised important issues

21/

Keith "Roaring Kitty" Gill said the trading shows he was "right about the company." Talks about his working class upbringing in Brockton, Massachusetts.

He works for MassMutual, but says he had no clients and provided no investment advice.

financialservices.house.gov/uploadedfiles/…

22/

He works for MassMutual, but says he had no clients and provided no investment advice.

financialservices.house.gov/uploadedfiles/…

22/

He said he independently decided GameStop was undervalued and could find knew revenue streams by embracing the digital economy.

He wrote about Game Stop and said doing that on Reddit is "no different from people in a bar or on a golf course" talking about a stock.

23/

He wrote about Game Stop and said doing that on Reddit is "no different from people in a bar or on a golf course" talking about a stock.

23/

Said his posts didn't cause movement of Game Stop price. Didn't post to get unwitting investors to lose money

When price hit $20 knew his investment was success.

"I am thankful that this committee is investigating what happened." Wants retail investors to be free to invest

24/

When price hit $20 knew his investment was success.

"I am thankful that this committee is investigating what happened." Wants retail investors to be free to invest

24/

Next witness is Jennifer Schulp, director of financial regulation studies at the Cato Institute.

Welcomes "new opportunities for individuals to grow their wealth, not restricted."

financialservices.house.gov/uploadedfiles/…

25/

Welcomes "new opportunities for individuals to grow their wealth, not restricted."

financialservices.house.gov/uploadedfiles/…

25/

She said that "temporary volatility" did not present a systemic risk and that "only a small" part of the market was affected.

Not a reason for concern Game Stop trades out of his valuation/fundamentals. Bubbles happen. Maybe due for a correction or maybe research is wrong.

26/

Not a reason for concern Game Stop trades out of his valuation/fundamentals. Bubbles happen. Maybe due for a correction or maybe research is wrong.

26/

Said the SEC is investigating and has the tools to address any misconduct if it occurred.

"There may be areas identify for improvement" but should not restrict retail investors access to the market.

27/

"There may be areas identify for improvement" but should not restrict retail investors access to the market.

27/

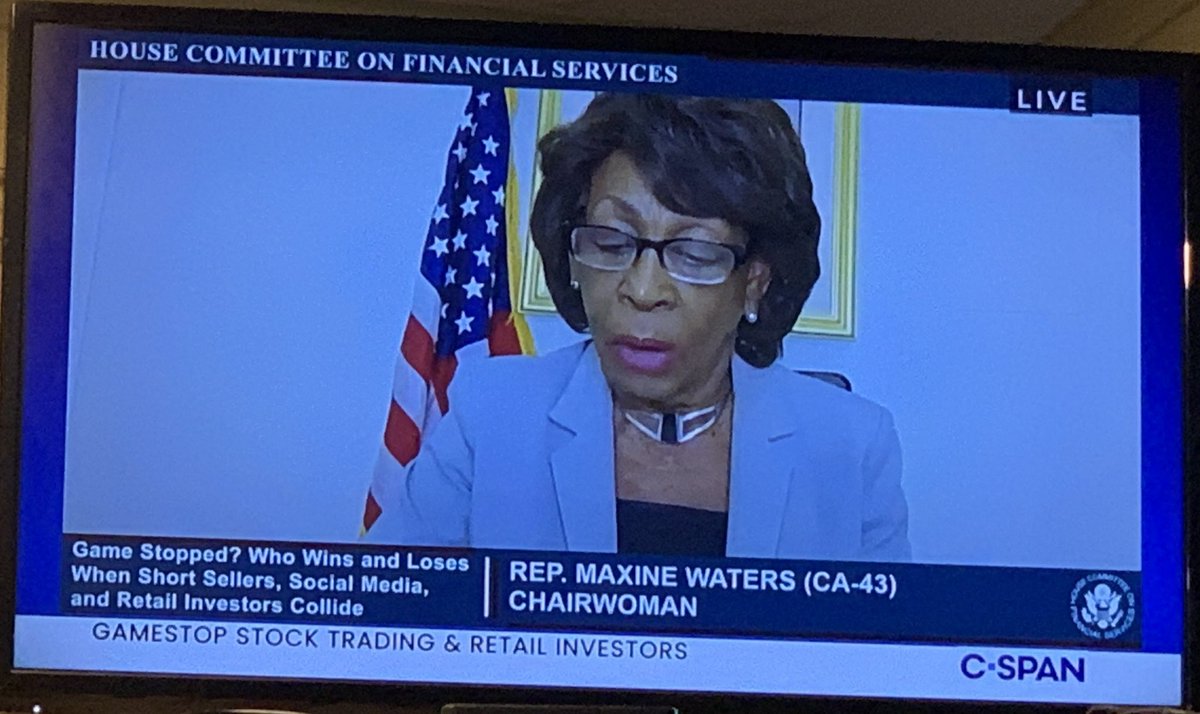

Chair @RepMaxineWaters directs her first question to Tenev. Asked him if he had a liquidity problem. Tenev said he did not, but that Robinhood raised capital he said for other reasons? Seems odd.

28/

28/

Waters Robinhood misled customers regarding its funding including payment by Citadel for order flow. Paid SEC $65 million to settle charges that it was not giving customers best execution

He would not respond to Water's question whether that was fair to customers

29

He would not respond to Water's question whether that was fair to customers

29

Fifty percent of all trades were in dark pools or over-the-counter, she said.

Does Citadel handle around 47% of the retail volume of trading in the US markets.

Griffin said around 40% of all retail volume.

30/

Does Citadel handle around 47% of the retail volume of trading in the US markets.

Griffin said around 40% of all retail volume.

30/

McHenry wants to know from Tenev what happened during the week of January 24th. You decided to halt customers ability to buy Game Stop stock after a convo with accountant.

Why restrict buying and not selling side?

31/

Why restrict buying and not selling side?

31/

Tenev said that preventing buying "was driven by deposit and collateral requirements imposed by our clearinghouses." Said forbidding selling is painful for customers.

32/

32/

McHenry asked if payment for order flow is legal. Tenev said yes and that it is how commission-free trading for customers is feasible.

Tenev said payment for order flow is disclosed.

He said there was "zero pressure" from anyone on panel to halt buying of Game Stop.

33/

Tenev said payment for order flow is disclosed.

He said there was "zero pressure" from anyone on panel to halt buying of Game Stop.

33/

McHenry asked can Robinhood the customer invest in Robinhood the company.

Tenev said no.

McHenry said the customers who make you a successful platform "don't get the same access to equity shares as a Robinhood employee or your institutional investors."

34/

Tenev said no.

McHenry said the customers who make you a successful platform "don't get the same access to equity shares as a Robinhood employee or your institutional investors."

34/

Schulp is now taking about how the accredited investor definition makes it impossible for most Americans to directly invest in private companies. (Income of $200,000 and/or net worth of $1 million -- not including home)

35/

35/

Now @CarolynBMaloney. "It's not all fun and games because people can lose their life savings and hard-earned cash."

Actions of Robinhood and other trading platforms that week caused confusion and anger and undermined confidence in fairness of our markets.

36/

Actions of Robinhood and other trading platforms that week caused confusion and anger and undermined confidence in fairness of our markets.

36/

Many retail investors woke up on January 28th woke up and found out they were being treated differently and could not buy and sell certain stocks.

Maloney said blog post was deceptive. Did not mention clearinghouse requirements, just said stopped buying due to volatility

37/

Maloney said blog post was deceptive. Did not mention clearinghouse requirements, just said stopped buying due to volatility

37/

Maloney said Robinhood website is vague, not transparent. Asked Tenev whether his lack of candor with customers led to wild speculation and confusion after trading restrictions.

38/

38/

"I'm not going to say that Robinhood did everything perfect" hoping to "learn from this and improve."

Is it just me, or does Tenev look like Keanu Reeves meets the monkees?

39/

Is it just me, or does Tenev look like Keanu Reeves meets the monkees?

39/

Rep. Wagner said retail market investor participation has recently doubled. "I believe in the wisdom of the retail investors," attributable to platforms like Robinhood allowing lower account minimums, allowing fractional share trading, and no commissions.

She applauds

40/

She applauds

40/

She objects to "new federal regulatory burdens" to what she says is highly regulated industry.

Asked Tenev: "It appears your company did not have enough money to meet collateral requirements." Were requirements by DTCC too high, or was your company undercapitalized?

41/

Asked Tenev: "It appears your company did not have enough money to meet collateral requirements." Were requirements by DTCC too high, or was your company undercapitalized?

41/

Tenev says it was a black swan event or what he deemed a five-sigma event.

@RepAnnWagner also was glad to see a woman on the panel (Jennifer Schulp from Cato) as it's good to see women in finance.

42/

@RepAnnWagner also was glad to see a woman on the panel (Jennifer Schulp from Cato) as it's good to see women in finance.

42/

He addresses Griffin of Citadel about payment for order flow. He asked the difference between best execution and enhanced pricing. He wants to know whether a Robinhood customer gets as good of a price as Fidelity.

44/

44/

Assuming same size of order. Does the Fidelity customer get enhanced fast execution whereas Robinhood just plain best execution?

Sherman is raising his voice because Griffin is not answering

45/

Sherman is raising his voice because Griffin is not answering

45/

According to a Republican Congressman (Who I did not see because I was just listening) 20% of market volume in stocks is from retail investors up from 10% just if you years ago I think he said.

He asked Tenev of Robinhood how that helps customers

46/

He asked Tenev of Robinhood how that helps customers

46/

That was Rep Lucas. He is now asking Griffin of Citadel about payment for order flow.

47/

47/

Great question from Rep. @RepGregoryMeeks. Reminds us of the 2008 financial crisis brought about when the goal was to open up the mortgage market to more, but the innovation did not also include enough disclosure.

48/

48/

Said information to retail investors must be accessible

Buying stocks on margin which Robinhood allows is risky. How to disclose?

Tenev said only 2 percent of customers buy on margin now.

49/

Buying stocks on margin which Robinhood allows is risky. How to disclose?

Tenev said only 2 percent of customers buy on margin now.

49/

Also small percentage now of Robinhood customers are engaged in options trading. I think he said 14 percent?

But, again, this is now. . . .

50/

But, again, this is now. . . .

50/

Meeks said either you had a liquidity problem or you anticipated that you were going to have one.

But Tenev said he only raise capital to prepare for a future black swan event.

51/

But Tenev said he only raise capital to prepare for a future black swan event.

51/

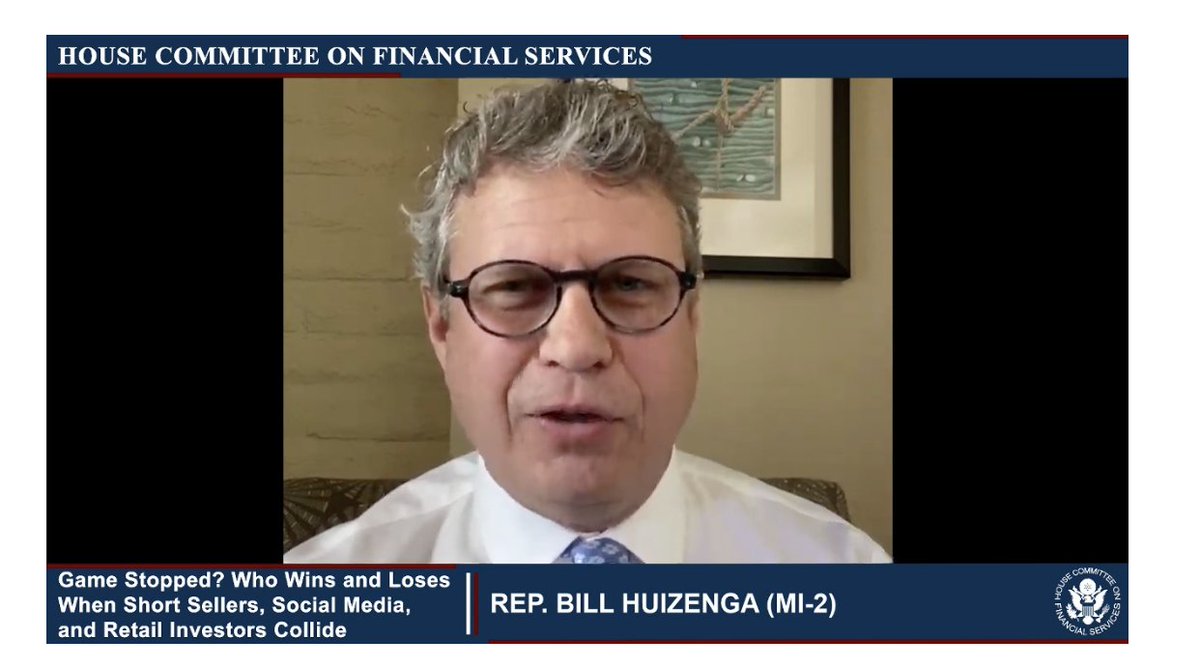

Congressman Huzenga asked Griffin of Citadel about best execution and payment for order flow.

"We just play by the rules of the road." Griffin said it is "an important source of innovation in the industry."

Robinhood drove industry to zero-dollar commissions

52/

"We just play by the rules of the road." Griffin said it is "an important source of innovation in the industry."

Robinhood drove industry to zero-dollar commissions

52/

Schulp of Cato when asked said payment for oder flow has been good for customers but also said disclosure is important.

53/

53/

Now he asked whether the retail investing is gambling. It is a softball question of course nobody is going to say that it is gambling.

They say it is investing and building wealth

55/

They say it is investing and building wealth

55/

He is now seeming to seek recommendations from Gill asked him if he is still investing in GameStop

56/

56/

"Investing is not a game and carries significant risk." How does Robinhood balance disclosures to customers of risk of downside loss with ease of trading

"Giving people what they want in a responsible way. We don't consider that gameification."

47/

"Giving people what they want in a responsible way. We don't consider that gameification."

47/

Here’s a correction from me. I think he said only 3% of the Robinhood customers trade on margin.

He said that he it is a self-directed brokerage as they do not provide investment advice. Customers have earned more than $35 billion

48/

He said that he it is a self-directed brokerage as they do not provide investment advice. Customers have earned more than $35 billion

48/

BILLION. Sorry

She said many amateur investors have lost hundreds of thousands of dollars. Her time expired.

49/

49/

Waters said this is not political theater and reminded members not to impugn the motives of fellow members

50/

50/

Sorry. That should have been 60

Rep. Luetkeymer asked if legislation is needed and whether market corrected itself.

61/

Rep. Luetkeymer asked if legislation is needed and whether market corrected itself.

61/

Luetkeymer told Telev that Robinhood was "allowing the poor to compete with the rich".

I think Telev said transparency would be helpful.

62/

I think Telev said transparency would be helpful.

62/

He asked about Melvin Capital's short-selling. Also noted that the overall short interest in Game Stop was 150 percent.

63/

63/

Griffin of Citadel explained that naked shorting is no longer permitted (shorts most borrow shares) and thus I think he implied shorting is more stable now

However if the short interest was 150% that means some shares were borrowed twice. . .

Extraordinary situation

64/

However if the short interest was 150% that means some shares were borrowed twice. . .

Extraordinary situation

64/

Rep. Scott said "something has gone terribly wrong." Asked Tenev, does Robinhood have any policies in place to ensure that investors are making trades based on legitimate material financial information and not the influence of social media or other superfluous information?

65/

65/

Tenev says he provides investor education information on website.

But Scott said "you are at the center of it." How do we protect "our wonderful, precious financial system."

He turns to Huffman at Reddit to address this

66/

But Scott said "you are at the center of it." How do we protect "our wonderful, precious financial system."

He turns to Huffman at Reddit to address this

66/

Huffman says he did not see "any signs of manipulation."

Scott says "when tweets, social media posts do more to move the market than material, legitimate information."

Excellent questioning from Scott

67/

Scott says "when tweets, social media posts do more to move the market than material, legitimate information."

Excellent questioning from Scott

67/

Rep. Stivers is a whiner. There will be other hearings, but he's complaining it's only industry people and not regulators speaking. He wants to talk about T plus 2 settlement.

68/

68/

By the way @repdavidscott is a Wharton grad.

69/

69/

Plotkin of Melvin Capital when asked by Stevens says he has been short Tesla when he was asked.

70/

70/

Waters said that the reason the SEC was not at the hearing today is because there is an acting chair and they are waiting for the person Biden nominated to be approved and appointed.

71/

71/

Rep. Green ask the Schulp from Cato out why market makers benefit from trading ahead of a customer order (even though it is illegal).

72/

72/

Greene points out that Citadel was doing just that and was fined for it. In 2014 it paid penalties. Also in 2017. In 2018 and 2020. Nearly 100,000,000 paid in penalties in 2020 alone.

But meanwhile and $13.2 billion over some period of time. Not sure what years he means

73/

But meanwhile and $13.2 billion over some period of time. Not sure what years he means

73/

Green said that the punishment is so small compared to the revenue generated at the same period of time. Just a cost of doing business, no disincentive. Or rather no deterrence, no incentive to follow the law.

74/

74/

Green points on the inequities in our justice system where people end up going to jail for less serious offenses.

Schulp said she was a former FINRA regulator and does not want this to be just a cost of doing business

75/

Schulp said she was a former FINRA regulator and does not want this to be just a cost of doing business

75/

Rep. Andy Barr said the SEC has approved payment for order flow.

76/

76/

Barr asked whether the margin requirements charged by your clearinghouse approved by federal regulators?

Tenev said yes. But not sure who approved the calculation.

"I'm not trying to throw anyone under the bus. . .Robinhood securities played this by the books."

77/

Tenev said yes. But not sure who approved the calculation.

"I'm not trying to throw anyone under the bus. . .Robinhood securities played this by the books."

77/

"Did your short positions exceed float"? Barr asked Plotkin of Melvin Capital.

He said no

78/

He said no

78/

Now @repcleaver asked Tenev how they came up with the name Robinhood.

Tenev said it stands for lowering barrier to entry and make opportunities for people regardless of net worth to be able to get access to markets

79/

Tenev said it stands for lowering barrier to entry and make opportunities for people regardless of net worth to be able to get access to markets

79/

Cleaver asks what about someone with no training who could get a huge amount of leverage.

Record of a young man getting $1 million of leverage who was twenty years old.

80/

Record of a young man getting $1 million of leverage who was twenty years old.

80/

Tenev said "Mr. Kearns". "I am sorry to the family of Mr. Kearns for your loss."

Not he says "mister" making him seem older than a twenty-year-old

Said "it was a tragedy and we went into immediate action."

He was margin trading

81/

Not he says "mister" making him seem older than a twenty-year-old

Said "it was a tragedy and we went into immediate action."

He was margin trading

81/

Cleaver asks Tenev what were the improvements?

Unfortunately his explanation at hearing was very complex. Did not seem clear for an untrained investor

82/

Unfortunately his explanation at hearing was very complex. Did not seem clear for an untrained investor

82/

Missed the last part and now they are in recess

83/

83/

We are back. Keith Gill, when asked tells Rep. Ed Purlmutter that back when he was investing in Game Stop when it was trading in signal digits he thought it was possible that it could go as high as $480

84/

84/

Plotkin of Melvin took a short position in Game Stop in 2014 nearly at the inception of the fund. Unlike Gill, he thought it was overpriced (confirms Purlmutter's assessment).

Thought it had fundamental challenges. Plotkin says the fund was not in a naked short position

85/

Thought it had fundamental challenges. Plotkin says the fund was not in a naked short position

85/

Rep. Lee Zeldin said "our capital markets are the envy of the world with their liquidity and innovations." He sounds like he is reading.

86/

86/

.@RepLeeZeldin refers to Gill as "Roaring Kitty." Says Gill is a "success story" as he was able to turn $53,000 into nearly $50 million.

87/

87/

Zeldin is focused on broker-dealers providing customer information with firms owned or controlled by Chinese nationals.

88/

88/

His question is directed at Schulp from Cato.

She said his question sounded like a national security concern and "this is a bit outside of my area of expertise."

89/

She said his question sounded like a national security concern and "this is a bit outside of my area of expertise."

89/

But she added privacy rules should apply offshore as well.

90/

90/

🔥Excellent questions from @jahimes. Asks Tenev to break down his $35 billion gain he claims his customers have. Asks him to convert that into rate of return.

"$35 billion is a meaningless number so I can compare it to treasuries or to the S&P 500."

91/

"$35 billion is a meaningless number so I can compare it to treasuries or to the S&P 500."

91/

💥Rep Himes is not having Tenev acting naive and evasive.

"What if your clients had simply invested in long-run S&P index fund?"

Tenev refuses that comparison.

Says the comparison should be having spent the money.

This guy is shady

92/

"What if your clients had simply invested in long-run S&P index fund?"

Tenev refuses that comparison.

Says the comparison should be having spent the money.

This guy is shady

92/

Huh. Loundermilk is trying to imply Himes' questioning is unreasonable and Tenev's evasion as being "the truth".

Very disappointing. Either stupid or cynical.

93/

Very disappointing. Either stupid or cynical.

93/

Loudermilk is very insincere. I really cannot listen to his nonsense.

94/

94/

By the way, settlement used to be T+5. When I worked in finance it was T+3. Now it's down to T+2.

94/

94/

Tenev claims he wants more transparency. He says he publishes 606's disclosing his payment for order flow

96/

96/

Rep. Mooney is now complaining about the Financial Transaction Tax proposed legislation. "Wall Street Tax Act of 2001."

97/

97/

Mooney wants to know if the federal government leveled a 0.1 percent tax on sale of securities, how would protect his platform. (That means 10 basis points).

Tenev says it would "eat into our customers."

98/

Tenev says it would "eat into our customers."

98/

But Tenev says it would have to be weighed against the benefits and knows it's a complex issue

99/

99/

Citadel paid $700 billion for order flow during 2020 (or did she say part of 2020), Congresswoman Joyce Beatty asked Rep. Griffin

But, Citadel at one time asked SEC to ban payment for order flow in the context of some options trading

99/

But, Citadel at one time asked SEC to ban payment for order flow in the context of some options trading

99/

Beatty asked Tenev of Robinhood why Citadel pays more money to Robinhood user order flow than other firms.

He gets paid based on the bid-asked spread (instead of the dollar amount of the trade).

Interesting

100/

He gets paid based on the bid-asked spread (instead of the dollar amount of the trade).

Interesting

100/

.@RepJuanVargas said he apologizes that members of the public made anti-Semitic attacks against Plotkin.

He said the rate of return is very important. This is not political theater.

"This is the story of Robinhood turned on its head."

101/

He said the rate of return is very important. This is not political theater.

"This is the story of Robinhood turned on its head."

101/

The public thinks there was collusion when Robinhood stopped little guys from trading

Asked Griffin, "how many people are in the room with you."

Griffin says 5 people including himself.

"My colleagues [in Congress] don't need to help the CEOs. They have plenty of help."

102/

Asked Griffin, "how many people are in the room with you."

Griffin says 5 people including himself.

"My colleagues [in Congress] don't need to help the CEOs. They have plenty of help."

102/

Vargas asked if Citadel talked to Robinhood about restricting trading in Game Stop.

Griffin: "Absolutely not." No one at Citadel spoke to Robinhood.

103/

Griffin: "Absolutely not." No one at Citadel spoke to Robinhood.

103/

Wowza. @RepJuanVargas just said to Tenev that his saying his customers made $35 billion but refuses to say how much others lost, and refuses to say what that was a percentage of, that's like "taking the fifth."

104/

104/

Huffman says "users should be masters of their own identity." This is his response to the question from a Congressman who asked how do you know users are real people.

And he says a site like Wall Street Bets wouldn't work to have retail investors use their real names

105/

And he says a site like Wall Street Bets wouldn't work to have retail investors use their real names

105/

Question from Gonzales. Said Citadel violated Reg SHO and now asked about conflicts of interest given Citadel's equity investment into Robinhood.

Griffin made clear he does not own or control DTCC. Not a party to discussions between Robinhood and DTCC.

106/

Griffin made clear he does not own or control DTCC. Not a party to discussions between Robinhood and DTCC.

106/

Congressman Gonzales asked Gill whether he had seen the sort of trading limits placed by Robinhood before. Gill said he had not.

107/

107/

We now have Rep. Hollingsworth. Asked Griffin about the driver of more trades being done off exchange. Is it regulator arbitrage.

Griffin said he doesn't like that expression.

107/

Griffin said he doesn't like that expression.

107/

"It's not that we want to prohibit dark pools. . .we want to enable and empower exchanges to be" better competitors.

108/

108/

Griffin said on-exchange trading is better for price discovery. His concerns that dark pools undermine public confidence in the markets.

He wants SEC to create a new rule like NMS to make exchanges more competitive.

109/

He wants SEC to create a new rule like NMS to make exchanges more competitive.

109/

Rep. Lawson said when his constituents got their stimulus money they tried to pay their rent and other bills. (In response perhaps to something I missed earlier about this topic).

110/

110/

Boom. Rep. Anthony Gonzalez from Ohio just caught Tenev in what seems to have been a lie he has told repeatedly. He has claimed at this hearing that he did not have a liquidity problem.

111/

111/

However Gonzalez just got Tenev to admit that when DTCC called around 5 am to say there was $3 billion needed, he didn't.

Only when agreed to stop buying 13 securities. If they did not do that said it would have been a catastrophe to Robinhood and 13 million customers.

112/

Only when agreed to stop buying 13 securities. If they did not do that said it would have been a catastrophe to Robinhood and 13 million customers.

112/

Rep. San Nicolas of Guam congratulated the small investors who orchestrated the short squeeze and "Robinhood made that possible."

113/

113/

Now he asked where the capital came from.

Tenev said he got $3 billion from venture capitalists they relied on before. San Nicolas asked did that dilute your position. Yes.

You materially benefit from this, he said.

114/

Tenev said he got $3 billion from venture capitalists they relied on before. San Nicolas asked did that dilute your position. Yes.

You materially benefit from this, he said.

114/

Said "you took from the shareholders" to minimize the capital you had to raise.

"We need to ensure that companies are not taking advantage of customers in this way."

115/

"We need to ensure that companies are not taking advantage of customers in this way."

115/

Excellent question from Casten. While democratizing finance is a noble goal, he asked whether this was just a way essentially of feeding fish to the sharks

Asked when did you start offer options trading?

Tenev: In 2018

Casten said revenue model grew due to options

116/

Asked when did you start offer options trading?

Tenev: In 2018

Casten said revenue model grew due to options

116/

Casten called order hotline, but not sure what the recording said.

117/

117/

Unbelievable. Timmons blames the Dodd-Frank Act for the meltdown at Robinhood.

But NO, Robinhood did not need to stop the trading. They needed $3 billion. They decided to stop purchases of those 13 stocks. Could have made other choices

118/

But NO, Robinhood did not need to stop the trading. They needed $3 billion. They decided to stop purchases of those 13 stocks. Could have made other choices

118/

Congressman @RitchieTorres asked how much of income comes from order flow. Tenev said more than 50 percent, but who knows what that means.

120/

120/

Torres is afraid Robinhood is democratization of finance addiction.

"You are encouraging your customers to tap on an app one thousand times a day?"

121/

"You are encouraging your customers to tap on an app one thousand times a day?"

121/

"Addictive trading may be bad for your customers, but it's good for Robinhood. . .there's a sense that Robinhood monetizes addiction" –– @RitchieTorres

122/

122/

Rep. Taylor asked Tenev how they negotiated the margin call down?

Taylor said if you could have come up with $3 billion would customers have been able to trade?

Tenev evades the answer

123/

Taylor said if you could have come up with $3 billion would customers have been able to trade?

Tenev evades the answer

123/

"Isn't it fair to say your firm was undercapitalized"?

Tenev: "In this case certainly" But he called it a "systemic problem."

Whoops. I don't think that's what he meant to say.

124/

Tenev: "In this case certainly" But he called it a "systemic problem."

Whoops. I don't think that's what he meant to say.

124/

Congressman Tom Emmer asked Gill how many people were in the room with him. Gill said zero.

Compare that to the head of Citadel, Griffin who said there were a total of five people (including himself) in the room.

125/

Compare that to the head of Citadel, Griffin who said there were a total of five people (including himself) in the room.

125/

Folks, I'll need to stop watching shortly as I'm joining @benjaminwittes and @Klonick at 5 pm for their podcast the @inlieuoffunshow

126/

126/

Rep. Lynch said he accepts initial analysis that at $5 it was fact-based that it was undervalued and hoped it would go to $20. But at some point, the stock takes off. Ends up almost $500 a share.

"But we're still in a midst of a pandemic" and no one's going to the malls.

126/

"But we're still in a midst of a pandemic" and no one's going to the malls.

126/

Lynch asks is there a point where a stock price gets so dislocate from reality, should SEC or someone else have put a note of caustion.

Asks Gill how this should have worked.

Gill said his thesis changes. Thinks it could keep growing

127/

Asks Gill how this should have worked.

Gill said his thesis changes. Thinks it could keep growing

127/

Okay. Stopping now at 4:53. (I'll watch online later, but the thread is done).

128/128

128/128

• • •

Missing some Tweet in this thread? You can try to

force a refresh