Good article on the four general types of Investing edges.

✔️Informational edge

✔️Analytical edge

✔️Behavioral edge

✔️Organizational edge

schroders.com/en/uk/the-valu…

✔️Informational edge

✔️Analytical edge

✔️Behavioral edge

✔️Organizational edge

schroders.com/en/uk/the-valu…

Very important for investors (especially individual investors picking their own stocks) to figure out what your edge is, that will enable you for LT success in the Market.

W/o getting into too much details, below are some methods I recommend to improve chances of success.

W/o getting into too much details, below are some methods I recommend to improve chances of success.

1⃣ Informational edge : Most of the raw information is freely available to everyone, but if you can filter out the noise (media/stock predictions, random opinions), & focus only on the reliable sources (Co produced docs, analysis by investors you respect..) you can have an edge.

2⃣ Analytical edge : This builds up over time with effort. Your circle of competence, previous experience with spotting quality, avoiding traps, evaluating Management, interpretation of Financial statements etc will lead to an edge.

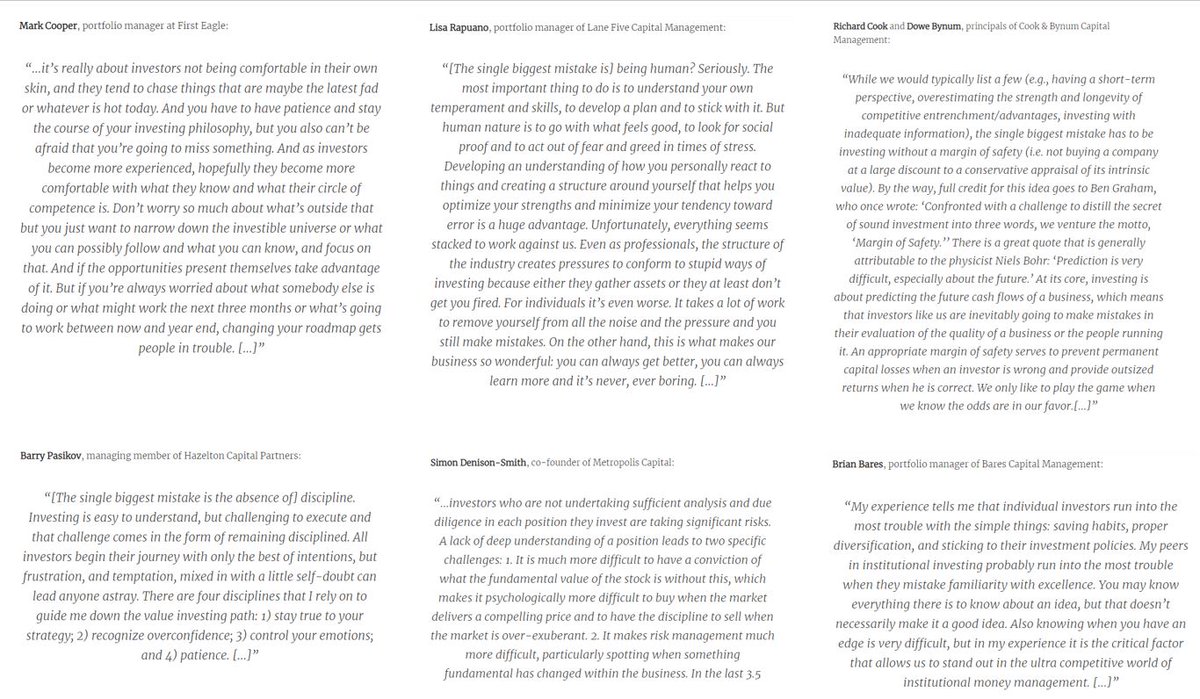

3⃣ Behavioral edge : This is where individual investors (who are not constrained by performance benchmarking, and many other rules) can develop by an edge by thinking and acting long-term...

...accepting Volatility & taking advantage of it, identifying the most impactful behavioral biases (hurting your results) and acting on countering them etc.

4⃣ Organizational edge : This is where working towards a good/reliable process (checklists, looking for and accepting mistakes & improving, maintaining journals, watchlists etc) can be an edge.

/END

/END

• • •

Missing some Tweet in this thread? You can try to

force a refresh