"The demography of sub-Saharan Africa is one of the megatrends of the 21st century. Africa is the only world region projected to have strong population growth for the rest of the century. "

adamtooze.substack.com/p/chartbook-ne…

adamtooze.substack.com/p/chartbook-ne…

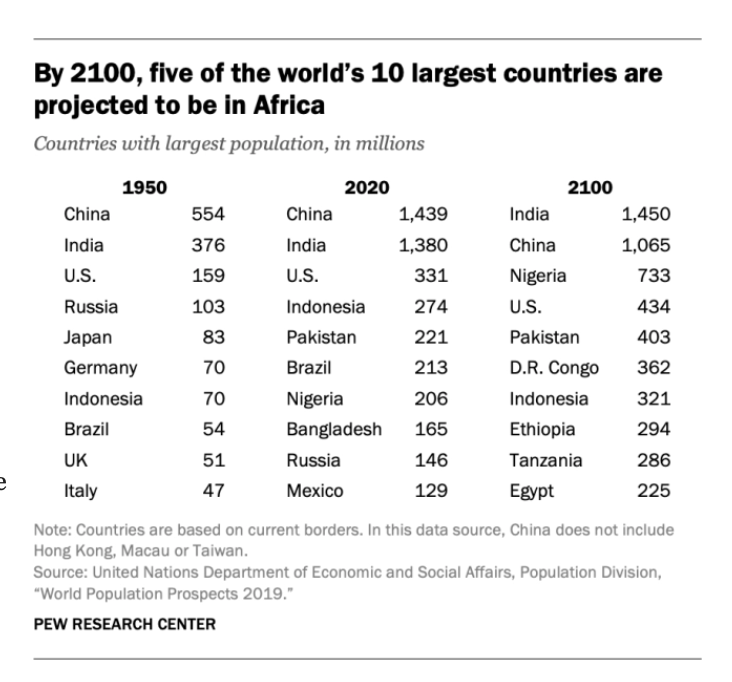

"According to Pew Research, between 2020 and 2100, Africa’s population is expected to increase from 1.3 billion to 4.3 billion. " by @pewglobal

"These gains will come mostly in sub-Saharan Africa, which, even allowing for demographic transition, is expected to more than triple in population by 2100."

"The Democratic Republic of the Congo, Tanzania, Ethiopia and Angola, along with one non-African country (Pakistan) are all major centers of population growth. But Nigeria is by far the most dramatic."

by @pewglobal

by @pewglobal

"On current trends, Nigeria will surpass the U.S. as the third-largest country in the world in 2047.

"

"

"Nigeria is expected to have 864 million births between 2020 and 2100, the most of any African country. The number of births in Nigeria is projected to exceed those in China by 2070."

"Currently, total fertility in Nigeria is running at 5 live birth per woman, compared to the global average of 2.5. "

"Given limited medical facilities and prevalent poverty, Nigeria’s women are in the frontline of a spectacular drama.

Today 20% of all global maternal deaths happen in Nigeria. "

Today 20% of all global maternal deaths happen in Nigeria. "

"600 000 Nigerian women died in childbirth between 2005 and 2015 and there were no less than 900 000 maternal near-miss cases."

"According to WHO a Nigerian woman has a 1 in 22 lifetime risk of dying during pregnancy, childbirth or postpartum/post-abortion; whereas in the most developed countries, the lifetime risk is 1 in 4900."

"“Lagos, the federal capital until government functions shifted to Abuja in 1991, is arguably Africa’s most vibrant, creative and dynamic city. "

"It is a centre not only of commerce and the country’s burgeoning high-tech industry but also of its creative industries, including music, fashion and the Nollywood film industry. ""

"Like India’s Mumbai, that makes it a city of dreams. Each day, thousands of people arrive from poorer parts of the country attracted by an economy bigger than that of Ethiopia, a country of 110m people."

"The city’s expansion has been almost entirely unplanned. In 1960, at Nigeria’s independence, Lagos had just 200,000 people. More than half a century later it has grown 100-fold to around 20m making it one of the top ten most populous cities in the world. "

"By 2040, that could hit 30m."

Needless to say, none of this is a recipe for economic success. The World Bank recently produced this comparison of Nigeria and Indonesia’s economic development over the last half century.

by @WorldBank

by @WorldBank

"In 1970 Nigeria’s gdp per capita was twice that of Indonesia. Today that economic balance is flipped. Indonesia is now a rapidly growing middle-income country. Nigeria is not."

"Nigeria has fallen behind not just relative to Asian competition. It also lags its African competitors too. Ethiopia, in particular, has demonstrated how high investment can drive growth."

"As Reuters reports, currently Nigeria produces huge quantities of crude oil but has no adequate refinery capacity. It has to import petrol and suffers regular fuel shortages. There is a promise that a $12bn refinery will soon open that should produce fuel by 2022."

"That Nigeria's economy functions at all is credit to the endless capacity for improvisation displayed by its population. "

"It is testament to that that Nigeria has amongst highest GDP per GW of grid power in world! In other words the system is grotesquely inefficient, but Nigerians make the most out of whatever stable on-grid electricity supply they can get."

"Given the huge population growth, unemployment is a chronic problem"

"But for all the dynamism and drive, for all the success that many achieve, some 94m people in Nigeria live on less than $1.90 a day, more than in any other country in the world.

By 2030 a quarter of all very poor people on the planet will be Nigerian, predicts"

@worlddatalab

By 2030 a quarter of all very poor people on the planet will be Nigerian, predicts"

@worlddatalab

The deisre of Niegerians to migrate internationally has grown in recent years

The emmigrants are young anhd well educated and urban people

by @WorldBank

The emmigrants are young anhd well educated and urban people

by @WorldBank

"Many migrants cannot find a legal route and resort to paying extortionate fees to people smugglers."

• • •

Missing some Tweet in this thread? You can try to

force a refresh