When I was at Lynton-Edwards Stockbrokers, we did a little digging of how the Stock Exchange started in Zimbabwe.

Not a surprise who started the @ZSE back in Rhodesia

Below are the founding members of the Rhodesia Stock Exchange in 1946

Not a surprise who started the @ZSE back in Rhodesia

Below are the founding members of the Rhodesia Stock Exchange in 1946

https://twitter.com/mentorshipzim/status/1364059436629843973

Upon the colonisation of the country in the 1890’s, the first stockbroker set up a broking firm in 1891 to act as an intermediary between settlers & the JSE & LSE. 4 Stock Exchanges were then established in Salisbury, Bulawayo, Gwelo (Gweru) and Umtali (Mutare) from 1894 – 1898.

The first of which was the Salisbury Stock Exchange which was opened on the 20th of June 1894. It had 33 members and 18 listed companies. There was massive interest in British and South African mining companies in the country and they needed to raise capital for development.

The creation of these exchanges were not adequate enough to deal with the amount of development needed in the country, & by 1902, these exchanges had closed as a result of speculation & financial chaos. Between 1903 & 1945.Speculation is the mother of market crashes. Say after me

Finally on the 2nd of January 1946, the Rhodesian Stock Exchange (RSE) was formed as an exclusive exchange in Bulawayo with 22 practicing members. It started with thirteen listed companies, which then grew to 98 companies in 1963. We regressed instead of progressing @BgoniJustin

A second exchange was opened in 1951 in Harare where brokers met for a daily call over and prices were communicated to Bulawayo by telephone. By 1952, the exchange could cater for three different markets: industrial, mining as well as local and central government stock.

The capital for the RSE was raised through the issuance of proprietary rights and each member had to have at least four, but not more than 8 rights. The Committee of the Stock Exchange was then formed from the members to govern the exchange.

The Members Rules are still in effect, but the ZSE Act was replaced, resulting in the formation of the Securities Commission of Zimbabwe (SEC) in 2009. The ZSE still elects some of its members onto the ZSE committee, but it is now governed by a Board and regulated by SEC.

Trading on the ZSE was suspended from November 2008 until February 2009. This was due to the hyper-inflation that was prevalent at the time in the country, and when trading commenced in 2009, it was in the more stable United States Dollar currency.

An example of the prevalent hyper-inflation was the fact that Old Mutual Plc traded at ZWD$520,000,000,000,000,000 on the 17th of September 2008!

The ZSE has a love-hate relationship with Govt. In 2008, Gono closed it and accused traders of using fraudulent cheques. Eleven companies and nine individuals had their accounts frozen on November 20 after the cheques totaling “60 hexillion”Zim dollars had been used to buy shares

My former paymasters at Lynton-Edwards Stockbrokers also had their accounts closed yet the cheque used to buy the shares was cleared by banks. It was just a blame game because brokers only acted on acted on genuine bank cheques

Thats Mr Edwards there 👇 panguva yekuomerwa lol

Thats Mr Edwards there 👇 panguva yekuomerwa lol

When Biti came, he described the ZSE as a "mafia operation". “We are not happy with the board and the committee running the ZSE which is comprised of brokers who are both the referees and the players,” said Minister Biti. “The ZSE has become a “Mafia operation”.

Last year, the love-hate relationship continued last year when the ZSE was once again accused of “sabotaging the economy.” @MthuliNcube had this 👇at the time

Just like other markets across the world, the ZSE also had its own crash on Nov 14, 1997, a day referred to as “Black Friday”, when the Zim dollar lost 71,5% of its value against the United States dollar. The ZSE subsequently crashed, wiping away 46% from the value of shares

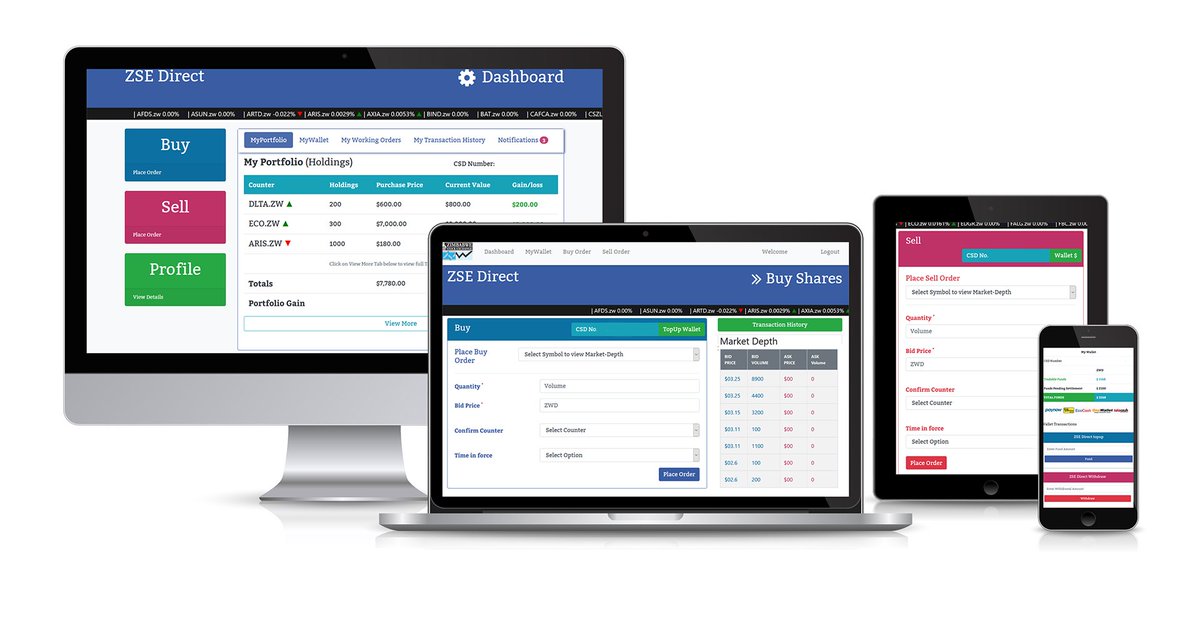

The ZSE, albeit with fewer listed companies, has since developed. Trading is now being done electronically including trading apps. Shares are no longer in physical form but now kept in a Central Securities Depository. Unlike a mafia operation, it now has a regulator @SECZIM.

Thats much about the history of the ZSE. Next is my career path and how I came to know about the stock market, the highs, and the lows. The last thread will be about how you can also participate or start your investment journey.

Now let's move on to the boring stuff. My career path 😂

Now first things first – a disclaimer. Looking at my career path I call myself a Jack of TWO trades & a master of none. I see myself as a communicator, sharing knowledge & having some bit of knowledge in the investment world, it becomes the defacto favourite topic.

So, in short, I have experience in both the communication & investment world & have qualifications in both. Growing up I always wanted to be on radio & was told the passport to that is a journalism course.

I had little exposure to a lot of things & spent most of my time reading novels. My world was the novels. On radio, I would only listen to music. We did not have TV till secondary xul. I first went to Harare CBD to get my passport. That delayed my path to journalism.

I simply did not know where to get the info. I thought that was the end of my career wish & enrolled for an Accounting diploma with the Institute of Administration and Commerce in 2000. Before I finished it, I discovered that COSSA offered journalism & I enrolled.

I started doing IAC over the weekends & Journalism in the evening. By end of 2003 I had both qualifications. While at COSSA my knowledge of accounts came in handy when we were doing Business Reporting. I was clearly the most knowledgeable one in class due to the IAC exposure.

The then Lecturer who later became mentor & benefactor Jono Waters would ask me to take over some of his classes when he had to go globetrotting. I was later told he ran a Financial Intelligence & Business Reporting & Analysis outfit (ZFN). I invited myself for a job & got it.

There I met a few other guys & a then skinny @happ_zenge . Jono was not only a boss but a mentor. He was tough on us, but we learnt a lot. ZFN covered listed stocks mostly & other major economic events. ZFN, which still exists, was a powerful outfit then.

When it commented on company results, the market would react. At first it was mostly Jono but we soon also learnt the ropes that even when he was away very few would notice. Our independence allowed us to say things stockbrokers would not say for fear of losing clients.

Major highlight is when we criticised the deal between Mascom & Econet. We wrote that Strive was short-changing minority shareholders because he was sort of selling his Mascom shares to Econet.Lawyer Tawanda Nyambirai sent a letter threatening to sue for millions

Jono was headstrong & said bring it on. Econet would continue threatening but we did not budge. They later asked to be put on ZFN’s mailing list. First Jono refused, but we later decided to charge them more than others. Yes, for their troubles.

If ZFN did not cover a results briefing or put out a report afterwards, CEOs would call. Jono’s Sandawana Column critiqued companies and even Gvt. At some point Kasukuwere would warn Jono kuti Mamvura (Waters) you are now playing with fire, but panga pasina kudzora tsvimbo.

By the way, that ZSE electronic board you see on pictures- see below, I operated it for maybe 90% of its lifetime. When trading on the ZSE happened, I was there to input data. Lots of noise but I had to capture the prices & the volumes of more than 14 dealers shouting at once.

Just imagine capturing the price of Old Mutual at ZWD$520,000,000,000,000,000. It was funny! In 2007/8 Prices will double or triple between the 2 trading sessions then. You could buy in the morning & sell in the afternoon & make a 300% gain. @mthimz was one of the brokers then.

The price rally was exciting at first. Quick thinkers sold shares and bought houses. By the time it was all blown out, we realised that whilst our shares were worth trillions, in real terms they were worth a few dollars.

I remember some Willdale shares I had. I had used billions to buy them, but when we dollarized, they were worth less than US$5. But in 2007 a lot of pple had not taken calculators to see what was happening & as I said quick thinkers bought houses with share proceeds.

At Zfn that’s when I started my investment journey. Jono gave us Z$20 each for us to buy shares. I bought Delta. I think it was in 2004. From then we would buy every month.

The shares were to come in handy in 2007 when I decided to get married. I sold the shares, paid for everything except mombe 1 yehumayi which had no option to pay in cash.

My wedding was in May 2008, at the height of hyper-inflation, but I just sold shares & paid for everything except stuff that the inlaws said they would cover. No borrowings!

While at ZFN, Jono also paid for my undergrad degree in Financial Management specialising Investments. I also acquired other postgrad qualifications at UZ. In 2010 I joined Lynton-Edwards Stockbrokers as research analyst. I started the research department from scratch.

Major highlight was doing the valuation for the Redan/Puma deal although I think it was just to sanitise the deal for regulatory purposes after the RBZ asked for an independent valuation. I was also part of the team for the listing of GetBucks where we were sponsoring brokers.

Some other major deals were involved include the demerger of Dawn Properties from African Sun. Most of the deals done by Brainworks on the ZSE. The acquisition of Zimplow from Tetrad. Also the acquisition of Masimba by Canada Malunga and Zhanda.

At Lynton the bulk of the clientele base were foreign investors. This meant our analysis had to be thorough. Half-baked reports would not cut it. I think what then carried me through the years was the mix in my qualifications & experience in communicating & reporting.

While I did not end up doing CFA, the modules/textbooks that they use became my daily bread. I had to be able to answer any query & produce any research report requested by the bosses or clients, some of them from big fund management firms like Alan Grey.

For those who want to get into this industry, most analysts and stockbrokers (except the older generation) did MSc in Finance and Investment at NUST. Others did Economics, others Banking and Finance. Any commercial subject should do to get into the stockbroking industry.

Postgrad most did or are doing the Chartered Financial Analyst (CFA) qualification. While without CFA one can be an analyst, the qualification equips you with the skills to forecast & make company valuations. The UZ also offers courses in investments & portfolio management.

To become a Stockbroker, you have to work in the stockbroking industry for a year. You then write the South African Institute of Financial Market's exams. The ZSE will then give you an oral test for you to become a dealer. Then after 1 or 2 years you apply to be a Stockbroker

The passion to communicate & share information stayed with me & in 2012 @happi_zenge asked me to start a radio programme to analyse the ZSE & listed companies. The first such program on radio. I produced & co-presented that program on @ZiFMstereo from 2012 till August 2017.

Remember my first love was to be on radio. January 2016 I started a similar programme which aired every weekday on @capitalkfm. I was there till end of 2019 talking about markets and analyse economic events.

In 2017 I joined Business Weekly, with idea that we could bring what analysts do to the mainstream media. It has not gone as planned as I have assumed other duties that take away my time from doing companies & stock market analysis except once in a while.

That about it my career path. Next we will look at what it takes to work in the Stockbroking fraternity. Then close off with what you need to do to embark on your investment journey.

So you want to work in the industry?

Stockbroking is more about getting deals done. Brokers spend most of their time networking and making phone calls. You have to be well connected to know who has the shares and who is looking for the shares. And when you get the order you have to execute at best price.

To become a Stockbroker, you have to work in the stockbroking industry for a year. You then write the South African Institute of Financial Markets exams. The ZSE will then give you an oral test for you to become a dealer. Then after 1 or 2 years you apply to be a Stockbroker

Stockbrokers can also be engaged as sponsoring brokers, that is when companies want to list or want to conduct Material price-sensitive transactions. The broker facilitates all correspondence between the issuer/company & the ZSE.

For those who want to get into this industry, most analysts and stockbrokers (except the older generation) did MSc in Finance and Investment at NUST. Others did Economics, others Banking and Finance. Any commercial subject should do to get into the stockbroking industry.

Postgrad most did or are doing the Chartered Financial Analyst (CFA) qualification. While without CFA one can be an analyst, the qualification equips you with the skills to forecast & make company valuations. The UZ also offers courses in investments & portfolio management.

The day job of analysts is to research and analyze the economic environment in general and targeted companies. They also forecast how companies are likely to perform. They make valuations on how much companies are worth and put target prices.

Analysts also conduct company visits and management meetings where they meet up with listed company executives. Listed companies also hold analysts' briefings when announcing results giving analysts a chance to ask questions. From there they write research reports & opinions.

Analysts also make recommendations on what to BUY, HOLD or Sell. The economic environment has however reduced the number of analysts. At most you get 3 at a stockbroking firm.

Apart from stockbrokers and analysts, there are also other opportunities that you can find at any other company such as accountants, compliance officers, HR etc.

Apart from going direct to stockbrokers, investors can also use asset management companies. You can get their list on seczim.co.zw. The asset manager can help you with your investment decision and a fee. Asset managers are also regulated and licenced by @SECzim

The industry also has transfer secretaries who make sure when you buy shares they are registered in your name. They also facilitate correspondence between the company & yourself on issues like AGMs & dividends.

Thats about it for those looking for a career!

Thats about it for those looking for a career!

Now this is second from Last.

I often get asked whether it's wise to be investing on the ZSE given the current economic environment. Given a choice, I would look for better assets than ZSE. The risk profile or premium of local investments is too high both at macro & micro level

I often get asked whether it's wise to be investing on the ZSE given the current economic environment. Given a choice, I would look for better assets than ZSE. The risk profile or premium of local investments is too high both at macro & micro level

The biggest investors on the ZSE, pension funds are of the same view & have been knocking on Government's door to be allowed to invest offshore. The same applies to individuals. Inflation & an uncertain environment is a threat to savings & investments.

ebusinessweekly.co.zw/funds-set-for-…

ebusinessweekly.co.zw/funds-set-for-…

But then again, to invest offshore is an option many don't have from a regulatory point of view & frm a currency point of view (we earn Z$). Some would buy USD, but that's probably for value preservation. Those who invested on ZSE last year, despite the risks, got a 130% return

A similar return might not happen, so always be on the lookout for investment opportunities with better returns. Maybe before we even look at that, the question could be why invest in the first place?

I think first question we need to address is why invest and whether that is a good decision in this environment? Here we are talking about any investment which is not starting your own business. My answer to that is it's all about financial goals.

I don't think we can achieve our financial goals by just saving part of our income, that won't be enough. The reason why you want interest on your bank deposit is the same reason why you might want to invest. The old cliche says your money must work for you.

In our case, we don't have any retirement plans that make sense, so what we do for ourselves is much more important than any retirement policy we can acquire. Our pension funds worth US$10 billion in 2018/19 are now worth just above US$1 bln.

You would want money that you are putting aside/saving for lobola, for your children or for retirement years to be able to earn some interest, in the case of stocks some capital gains and or some dividends.

There are many investment options. In the Zimbabwean context you could invest in money market instruments, your unit trusts, you could invest in bonds or into real estate and of course the stock market.

But for those starting an investment journey, getting into real estate might be a tough ask. Our financial resources for most of us are not adequate. So as you save up for that initial property deposit, stocks might be your best option.

Stocks despite the risks involved are quite simply one of the best ways to make your investment dollars work the hardest.

Is it worthwhile to invest in this environment?

Firstly, the environment is not set in stone, so it is always advisable to be diversified in terms of sources of income and stores of value.

Firstly, the environment is not set in stone, so it is always advisable to be diversified in terms of sources of income and stores of value.

Secondly, the upside is significantly higher than the overall risks. On the ZSE for example, any progress on the political and economic end would result in significantly impressive returns even in US$ terms. We saw what it could do in 2013 and even now, the returns are great.

Yes, some stocks might not have done well and the initial US$100 might be US$90 or less. That's the risk. But there is risk in everything, even iri pasi pe pillow inogona kubiwa naBae. You just need to do your homework and not be reckless in how you invest.

Why invest on the stock market?

Zim has gone through tough economic challenges and companies listed on the stock market are operating below their capacity & potential. At the moment Zimbabwe is largely an importer of what it consumes.This means there is scope for local production

Zim has gone through tough economic challenges and companies listed on the stock market are operating below their capacity & potential. At the moment Zimbabwe is largely an importer of what it consumes.This means there is scope for local production

There is nothing that beats investing in a company that has room for growth. Companies like Delta are probably operating at half their capacity, but we know they have strong brands that can compete even globally. What is only needed is for the economy to turn positive

Who can invest?

The stock market is for everyone rich of poor. Just like in business we have tuckshop owners and supermarket owners, the stock market allows everyone to invest at their level.

The stock market is for everyone rich of poor. Just like in business we have tuckshop owners and supermarket owners, the stock market allows everyone to invest at their level.

Let's say as a rule one invests 5% of income every month, the one who earns $100 will invest $5 while the one who earns $200 will invest $10. So basically, anyone can invest on the stock exchange. If the market gains by 10% everyone will enjoy 10% of their investment.

The stock market is in a way a form of saving with potential to earn capital gains of dividends. It is also a way of preserving value. While there are risks involved, when prices come off or the gains are eroded by inflation, it's better to take a risk in something with potential

So for those youth who don't know what their next income will come from I would say put something aside that you can then sell if income does not come at a particular time. Like I said earlier there is no little investor, everyone can invest at their level.

• • •

Missing some Tweet in this thread? You can try to

force a refresh