It’s my pleasure to share with you all on this platform. I think this is a good way of knowledge exchange. I have always had a passion for law and administration whilst growing up and I am not one of those born with a silver spoon. I grew up in the ghetto.

I did my A’s and got 11 pts which meant I couldn’t make it to UZ as it was the only main law school at the time. I instead studied Software Engineering at UZ (Ansted School of Technology) which I ended mid-way and moved to UK. The UK has a split legal profession.

Barristers and solicitors. Solicitors have limited rights of audience whereas barristers can appear in any court and they mainly work as self employed whereas the bulk of solicitors tend to work for law firms. Qualifying through any of the two routes is quite difficult.

On average it takes 6 years from study to qualifying provided you move through the three stages needed without taking breaks in between. The most difficult part is getting a traineeship as it is extremely competitive. I am currently working in financial services.

I have a keen interest is financial technologies which takes me to what I think most people are looking forward to discuss- digital assets (a.k.a cryptocurrencies).

Cryptocurrencies like #bitcoin remain unregulated in most jurisdictions so long as they do not reference other instruments such as derivatives. In EU the 5th Anti-Money Laundering Directive brought some level of oversight to cryptos by treating them in same way as money for AML

In the US bitcoin is treated as a commodity and it comes under Oversight of US Commodities and Futures Trading Commission (CFTC) Ethereum is also treated as a commodity but there are other digital assets which the US Securities and Exchanges Commission has classed as securities.

In the UK cryptocurrencies are unregulated and the regulator, Financial Conduct Authority only now provide supervision for AML purposes as required under EU law before Brexit. Globally, (US and EU included) regulators have shown an interest in cryptocurrencies.

In the US and UK, cryptocurrencies are now getting embedded into financial services despite unclear regulation which has worked like a double edged sword in some cases.

The Banking regulator for the US @USOCC through an interpretative letter in 2020, allowed banks to custody crypto in same way as they do money. This has made it easy for institutions to join retail in buying bitcoin and other digital assets. occ.gov/news-issuances…

At the same time, a Cryptocurrency exchange in Wyoming (US) was granted a bank charter approval effectively paving way to convert to a crypto bank in the state of Wyoming 👇🏿 google.co.uk/amp/s/www.nasd…

Following the granting of this charter, institutions have had to come to terms with the fact that cryptocurrencies are now established as a new asset class for the digital age. This is now the phenomenon known as Web 3.0. The banking regulators in US have not stopped here.

A Crypto Fintech was granted a federal bank charter which is wider than the initial one granted in Wyoming as it enables opening branches all over the US. occ.gov/news-issuances…

Bank cards backed by cryptocurrencies are now commonplace with Coinbase UK leading with a VISA card which enables spending bitcoin balance in a coinbase wallet anywhere where visa is accepted. @Visa has recently announced plans to support cryptocurrencies. usa.visa.com/solutions/cryp…

Another big payment provider entering crypto space has been @paypal by announcing support for buying and selling cryptocurrencies for its 346 million users which has so far been lauded as a huge success. google.com/amp/s/www.forb…

What all this shows is a huge change in the banking landscape through a new asset originating from retail rather than institutions as has been the case with most technological innovations. Currently in Zimbabwe banks are banned from handling cryptocurrency transactions.

Retail customers are discouraged but not stopped from using cryptos as this is difficult to stop. This takes me to a discussion about the disruptive effect of cryptocurrencies. Bitcoin is only one of many cryptocurrencies, albeit the first one. There are now over 8000 cryptos

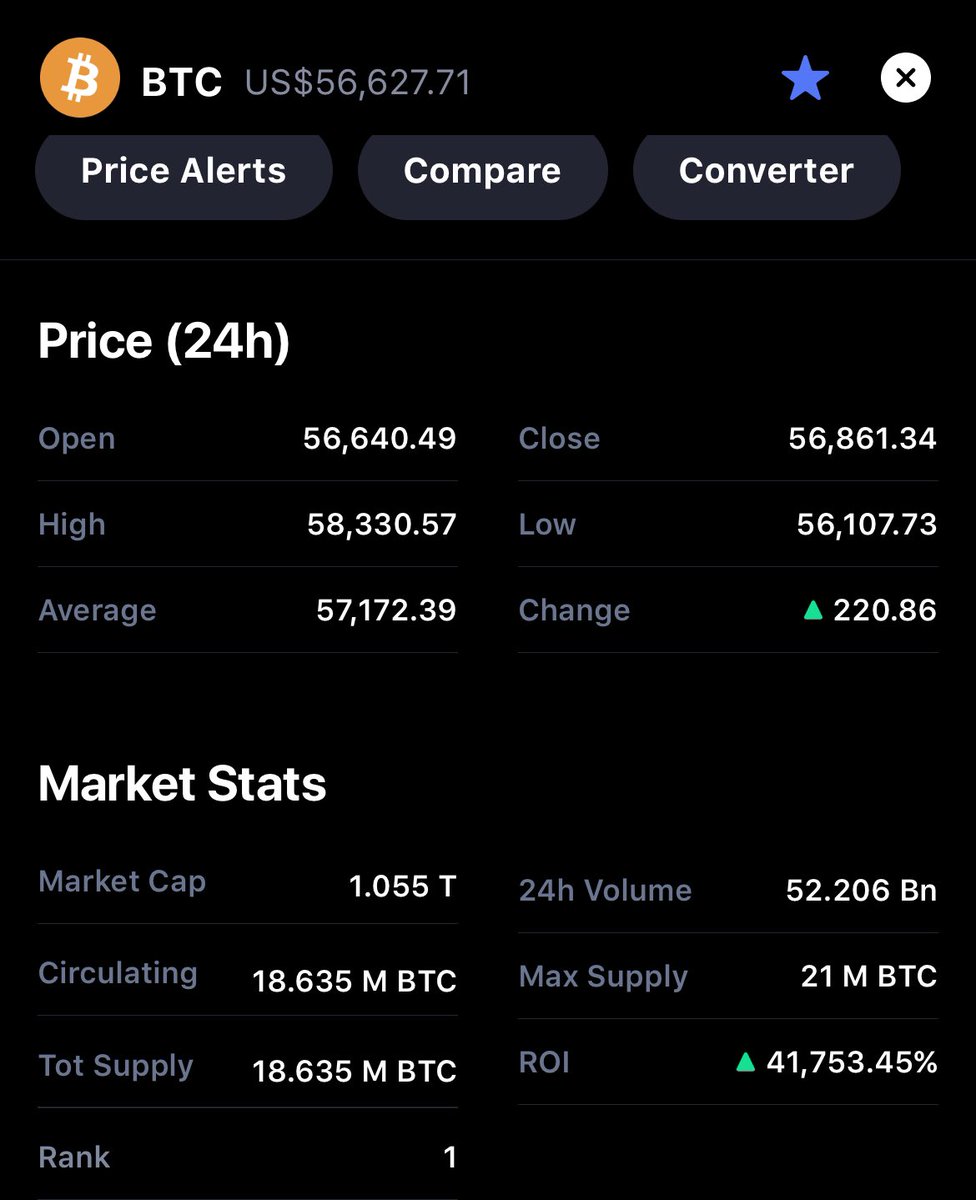

The total market capitalisation (money invested) in the whole crypto sector is now over $1,7 trillion dollars-which makes it an industry in its own right. Bitcoin alone takes the biggest share with over $1 trillion marketcap. Bitcoin has seen the biggest uptake by institutions.

Listed companies in US, UK and recently Canada have seen it attractive to hold bitcoin in company treasuries as a hedge against inflation. @Tesla has been the most recent company to allocate 7.7% of its treasury into the nascent asset to the amount of $1,5bn.

@MicroStrategy was the very first company to enter bitcoin which triggered the institutional race running through the last quarter of 2020. Most people don’t understand why Bitcoin is valuable and I will attempt to address this point which is mainly to do with scarcity

Understanding bitcoin starts from reading the whitepaper which I consider to be rich in intellectual capital. The average person see #btc as a passing craze but the signs are that it is here to stay. Here is a link to the whitepaper bitcoin.org/bitcoin.pdf

The #btc whitepaper shows meticulous calculation and exhibits pure genius. It doesn’t only show competence in cryptography but in-depth knowledge of math, economics, law and a thorough grasp of the global financial system and its inadequacies.

The creators of bitcoin are unknown, however they used the pseudonym of Satoshi Nakamoto. It doesn’t appear to be the work of an individual- most likely it was a group and they had probably spent a lot of time writing the whitepaper and the code because of its sophistication.

Everything about bitcoin was deliberate. It was calculated to the minute detail that every four years the difficulty for mining (process of creating new bitcoins) goes through a reduction of rewards (halving).

Whenever price drops, the difficulty adjusts to keep miners incentivised. The technology underlying bitcoin is called blockchain and it is a distributed ledger. What this means is that you have people spread globally running bitcoin software to secure the network.

Mining bitcoin used to be easy with a normal household computer in the early day. This helped decentralise the network. Each computer running bitcoin software gets rewarded with bitcoin for the computational power committed to the network.

People new to #btc think the gain in value is accidental- but is was all deliberate. An email by Hal Finey, the first person to receive btc from Satoshi after running the software. It shows foresight-he was doing the math of 1 btc at $10m when it was worth nothing at the time

The successful implementation of Bitcoin blockchain solved one key issue- the problem of double spending. Internet money was a live idea since invention of the web but it suffered one key weakness- bills have serial numbers which can help in countering counterfeiting

Internet money couldn’t work-you could pay many people without them knowing you have used the same unit to pay someone else. This is what Satoshi fixed with a distributed ledger. Once a transaction is broadcast- it requires 51% confirmations before it is validated

Every computer on the network stores a piece of information about the transaction which makes is more secure and irreversible (immutable). It solves the byzantine generals problem through executing on consensus.

All transactions occurring in the bitcoin blockchain are broadcast and anyone can see them. To take part one requires a wallet. A wallet is made up of a private key and public key. The public key is the wallet address you give to someone whilst the private key is secret

Whoever has the private key can move the bitcoin in a wallet and if your lose it-you lose your assets in the wallet. It is where people say you are your own bank. One does not need to own a full bitcoin as it is divided into satoshis. You can own a fraction for even $10

Bitcoin wallets are very secure and they are described in the image. To have one all that is needed is a mobile phone and internet connection. The wallet and mining is a different process- a wallet is simply for storage. There are many wallet providers in the market now.

Bitcoin blockchain has been running for a decade and has never been compromised and for that reason it is considered hack proof . What has been getting hacked are the exchanges which are venues for trading. Most crypto exchanges are unregulated.

The fact that supply for bitcoin will stop at 21 million is what makes bitcoins scarce. The world population is was at 7,6 billion in 2019- it means there won’t be enough bitcoin for each person if they were to try to win one.

With single company owning as much as 40k btc, this will cause a big squeeze at supply and forces of demand and supply are expected to keep pushing prices up. The characteristic of censorship resistance is another feature which make bitcoin attractive in restrictive societies

Now that we have discussed bitcoin, we move to other assets. Out of bitcoin was created other bitcoin inspired crypto assets which have more exciting features and technology. Ethereum is one such asset created by Vitalik Butterin who was in his early 20s at the time

Unlike bitcoin, Ethereum is a more cool asset as it has use. Bitcoin is now taken to be digital gold and it resembles gold in the fact that the technology is great but it doesn’t scale. Ethereum is a separate blockchain to bitcoin blockchain.

It has the capability for someone to issue other tokens on the blockchain and most of the tokens which were created in the early days were issued on Ethereum blockchain. To move these tokens you have to pay gas fees. These are paid in the native currency of the blockchain(Ethers)

Apart from issuing tokens, developers can build apps on top of the Ethereum blockchain. Smartcontracts are tipped to revolutionise financial and legal services. They are self executing code and they do what parties want then to do when conditions are met. It is automation.

Most people see these tokens in the market and they thing it is all speculation, however this is not the only use of tokens. Like Ethereum which requires Ethers in order to transact, most have utility. Our of this tokens mania in past decade has emerged Decentralised Finance

Basically, anything you can do in the legacy financial system, it has been replicated on the web. Ranging from savings, borrowing, lending and trading using what are called decentralised protocols. link.medium.com/HsuDHOGD4db

Someone in Zimbabwe can leverage decentralised finance tools to create wealth only using a mobile phone without leaving the country let alone the house. It is a huge promise which technology is already delivering on and I say this as an active user of these protocols and tech.

There are a few exchanges where Zimbabweans can register and trade and one of them is @krakenfx which has a bank charter in Wyoming. Another tool is an app @CoinMarketCap which has all the data for cryptocurrencies prices and markets where they can be traded.

@CoinBene is another app which Zimbabweans can use to trade. @uhuruwallet is another local solution which enables buying through ecocash and withdrawals to banks including paying bills using cryptocurrencies.

Generally, African regulators have been slow to react to the fast moving cryptocurrencies space and this has resulted in slow uptake and adoption of digital assets. It has also meant that African economies have missed out on investment and knowledge.

One interesting development in crypto has been the writing a whole new dictionary of crypto terms. When you hear people saying they are going to the moon it is not in the literal sense or a call of nature for women- it means price going up

Here is the crypto glossary coinmarketcap.com/alexandria/glo…

Now I will move on to researching tokens before you buy. Most people have put forward the argument that there are no fundamentals in cryptocurrencies but it’s most probably it’s because they don’t even know what they are looking for. One easiest way is to look at project owners

I will give an example (not financial or investment advice). @hedera is a platform working with various companies in various sectors. They have a token called HBAR. Knowing who stakeholders can help in working out longevity and viability of the platform

In the image are the owners and the size of the companies involved such as LG, Google, Boeing and IBM makes it unlikely that they will fail and it makes the project credible. Reading the whitepaper gives more detail sand a roadmap of when the project can start delivering

You also want to check total supply of tokens as this can slow down appreciation in value. This needs to be viewed in light of what solutions they are building. You then have to have appreciation of use of the token in the finished product.

If you are asking someone to invest on your behalf you are almost certainly setting up to get scammed. A lot of Zimbabweans have been scammed through this way and the rule of thumb is you have to do it for yourself. Crypto is about disintermediation ( taking out the middleman)

One question which most people ask is how much to start with in crypto and the answer is that there is no minimum. It is wiser though not to put in funds you require immediately as the markets are extremely volatile. You tend to get better returns over a long period

The safer way of buying volatile assets is Dollar Cost Averaging which is also used in stock markets. If you were to buy 1 bitcoin now and price drops by $10k it means you lose a lot at once. The idea is to buy small amounts spread over a longer period of time. Could be weekly.

DCA is proven to be profitable over longer periods. The easier strategy for picking assets to buy is to go by market capitalisation. One key feature of the crypto markets has been stablecoins google.com/amp/s/www.coin…

Stablecoins are cryptocurrencies but they are stabilised by being pegged to other assets like gold or fiat currencies. USDT is the biggest stablecoin by market capitalisation. During market volatility, traders sell volatile assets into stablecoins.

Stablecoins have grown in popularity and they are another are which regulators have become interested in especially after announcement by @Facebook that they wanted to issue a global stablecoin. This was not received well by legislators in Washington.

Lastly on cryptocurrencies before we go to Central Bank Digital Currencies. This article which I wrote in early 2020 gives a perspective on where this sector is headed and it has been mostly validated by subsequent developments link.medium.com/xynU2jT94db

• • •

Missing some Tweet in this thread? You can try to

force a refresh