1. Biggest Tax Myth EVER:

Thinking you'll be in a lower tax bracket when you retire.

This will likely NOT be the case because of the #1 retirement killer:

Inflation.

You will consistently need to receive more money each year JUST to maintain your standard of living

Thinking you'll be in a lower tax bracket when you retire.

This will likely NOT be the case because of the #1 retirement killer:

Inflation.

You will consistently need to receive more money each year JUST to maintain your standard of living

2. At 3% inflation, you will NEED to double your income every 24 years just to keep up.

And, here is something that will blow your mind:

In 1913, the first year income taxes started, the threshold of the lowest bracket was 1% of income up to $20,000

And, here is something that will blow your mind:

In 1913, the first year income taxes started, the threshold of the lowest bracket was 1% of income up to $20,000

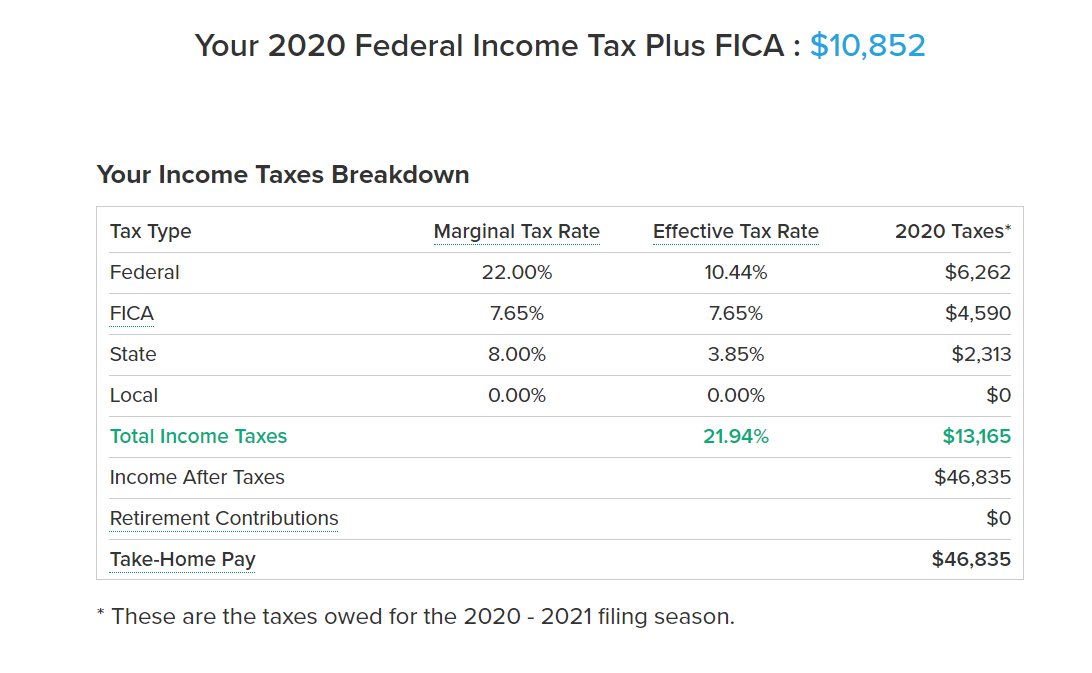

3. Today, in 2020, it is 10% on your first $19,750 of taxable income.

So, the tax is higher and the threshold is LOWER than it was over 100 years ago.

So tax thresholds have NOT kept up with inflation.

Oh, and if you make good money?

So, the tax is higher and the threshold is LOWER than it was over 100 years ago.

So tax thresholds have NOT kept up with inflation.

Oh, and if you make good money?

4. In 1913, you paid 7% on any money over $500,000.

Today, the top threshold is being moved to $400,000, so it too is lower than 100 years ago.

Oh, and the top rate is going to be 39.6% PLUS another 6.4% on income.over 400k, so really, it's 46%.

Today, the top threshold is being moved to $400,000, so it too is lower than 100 years ago.

Oh, and the top rate is going to be 39.6% PLUS another 6.4% on income.over 400k, so really, it's 46%.

5. BTW, if it DID keep up with inflation, the top threshold would start at 11 million.

So, again, for those of you in the cheap seats:

Be VERY careful about postponing paying taxes on your retirement accounts.

You're postponing paying the tax AND the calculation OF the tax.

So, again, for those of you in the cheap seats:

Be VERY careful about postponing paying taxes on your retirement accounts.

You're postponing paying the tax AND the calculation OF the tax.

6. End of rant for the moment.

• • •

Missing some Tweet in this thread? You can try to

force a refresh