Several #FX trades hit targets for private group. Before/after charts in this thread to show you what we traded, how we managed the risk and what we made. Lots of lessons to be learned, but the key takeaway point is this: trade with the trend. First one: #CADJPY

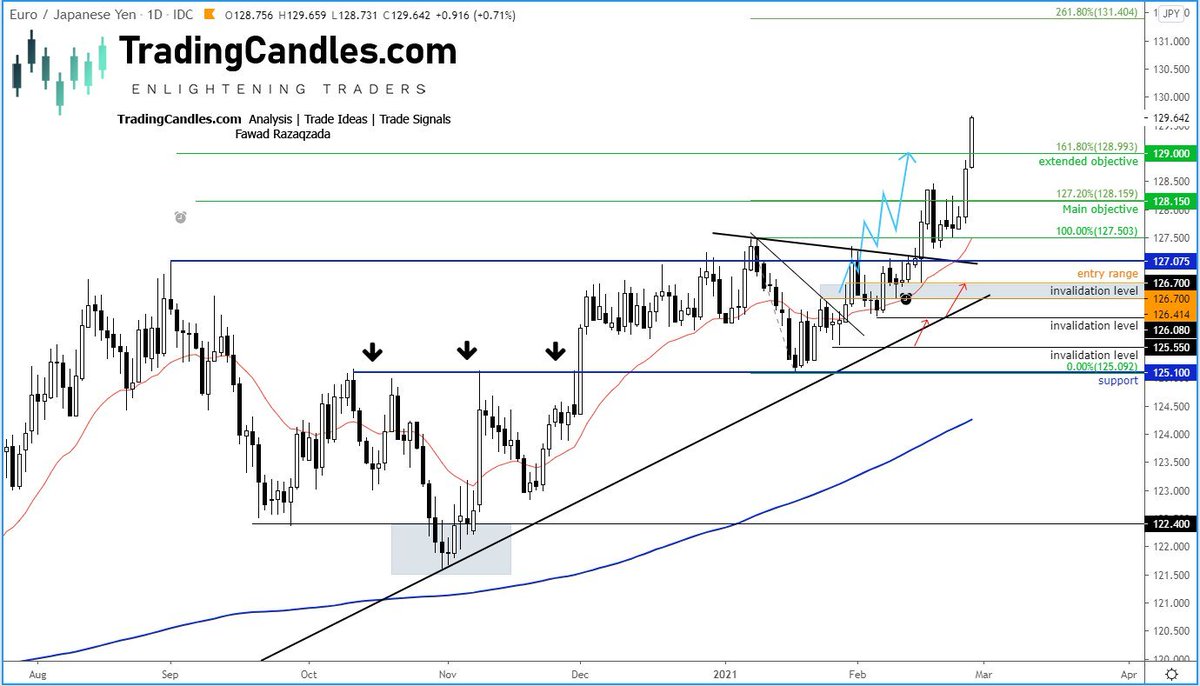

#EURJPY took its sweet time but eventually rose to our extended objective for +230 to +259 pips. We raised the stop as price action evolved over time

#USDCAD short was a strong conviction trade for because of the big rally for crude oil at the time and rising stock prices. CAD being a commodity dollar and risk-sensitive currency had one way to go: up. On this, the private group made a cool +245 to +255 pips

#CADJPY 2 - this was another, separate, long trade. It followed the magic purple line straight to the target with very little deviation - the reason it went up like that is because there was a pool of liquidity from trapped bears resting above the pre-lockdown high of 84.75

#EURJPY long 2 as we called it (as at the time we had another long trade open on this pair - see above). This also hit its main objective for at least +142 pips. Buying the dip at support in a rising trend (without confirmation) is my bread and butter strategy.

Another #USDCAD short but this one wasted little time in dropping to our target for a cool +90 to +110 pips in the process.

If you want to learn how I look for such setups, I have made several guides and videos in this page on my website: bit.ly/35HI0nh

For info on how to join the private group: bit.ly/3ntL8cH

For info on how to join the private group: bit.ly/3ntL8cH

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh