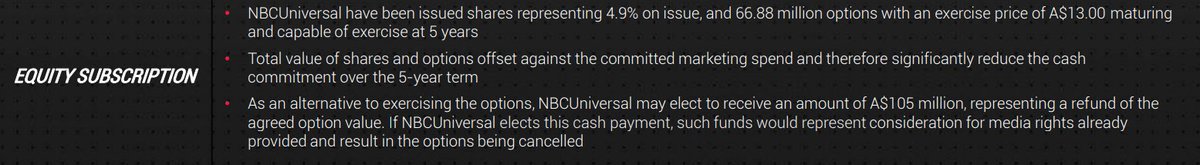

Wtf kind of option deal is this (part of PBH AU's advertising deal with NBC)! NBC has been granted 66.88m options at A$13.00, but also has the option to cancel the option deal for cash consideration of A$105m reflecting "fair value of the options" at the time they were granted!

NBC has managed to negotiate an option on their own options. Definitely got the upper hand in these negotiations & perhaps demonstrates where the real market power/value lies in this relationship.

Context on deal. PBH committed to spend US$400m on marketing with NBC including granting significant equity & options to NBC, as well as the aforementioned "option on their options".

PBH's S&M costs rose faster than revenue & gross profit, with EBITDA margins at circa -100%. But hey they're growing right? Why not pay 20x revenue.

• • •

Missing some Tweet in this thread? You can try to

force a refresh