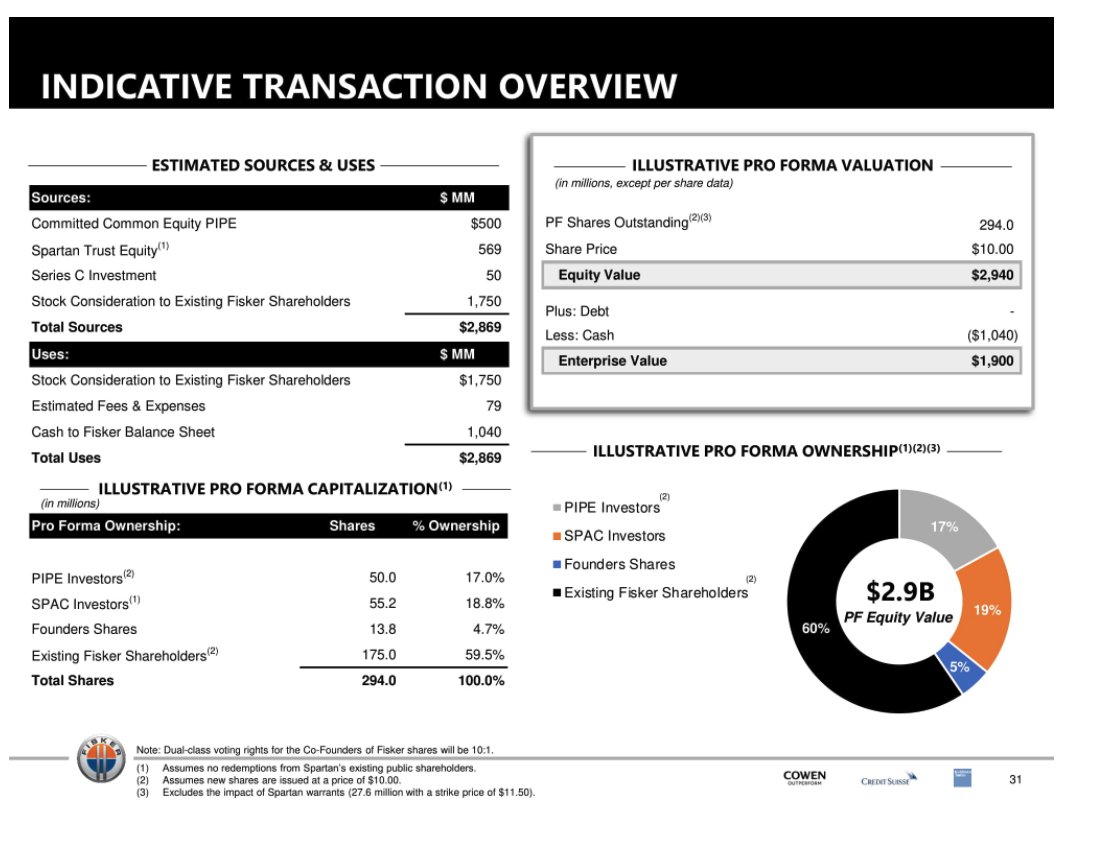

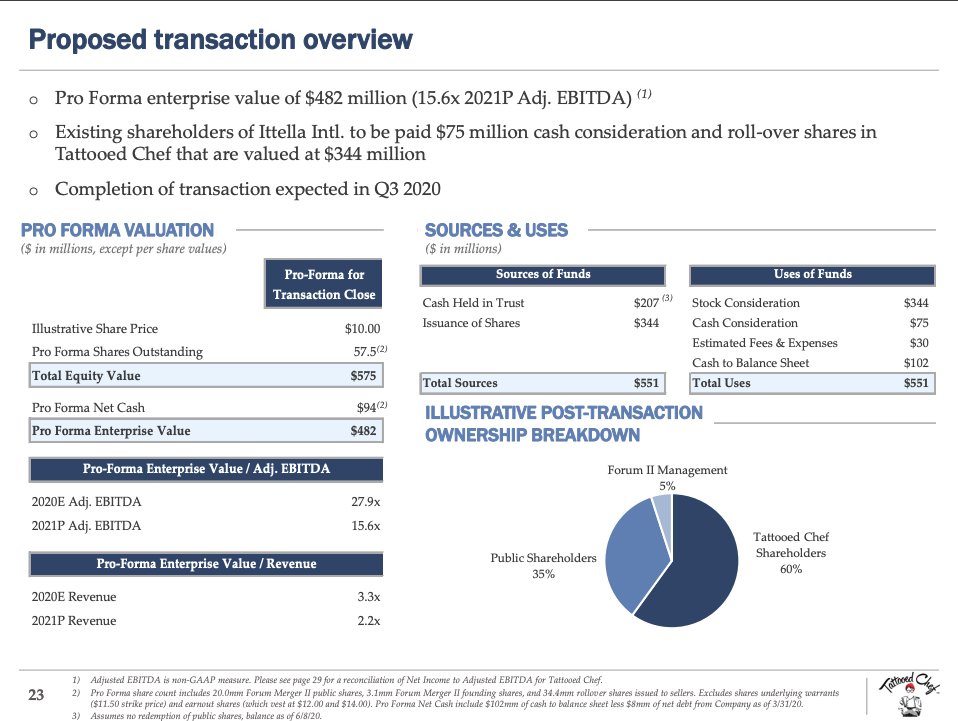

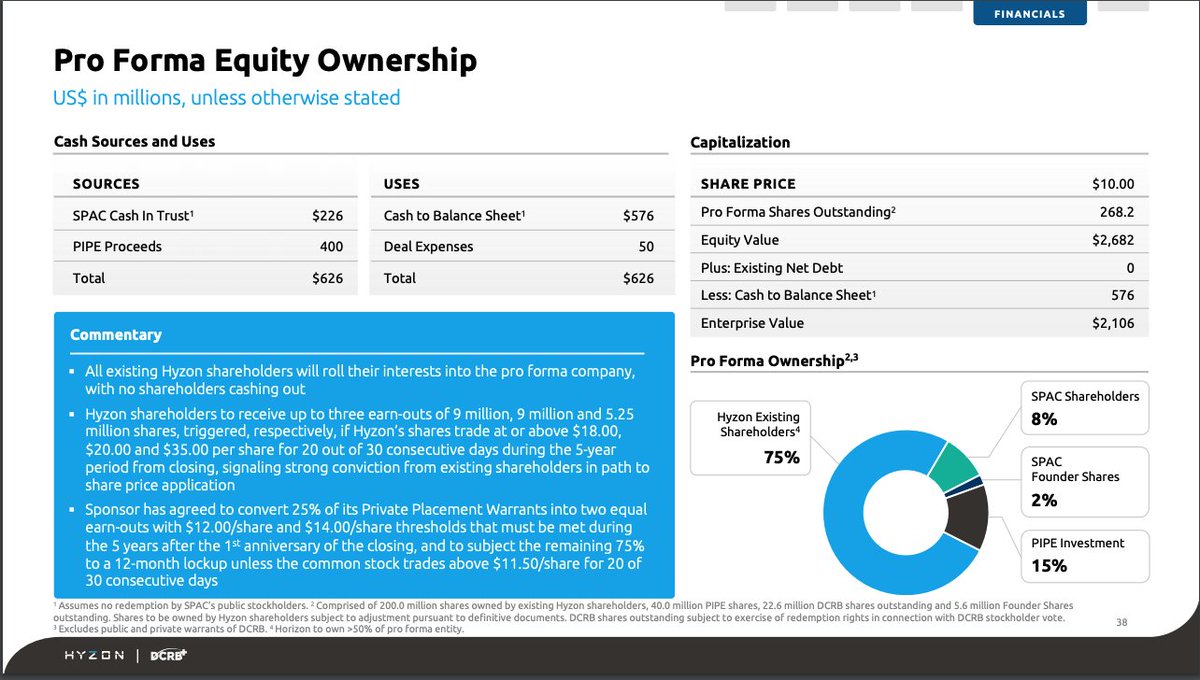

Top-level research on select SPACS for correlations between trust size, PIPE size, ownership %, rolled over equity, and valuation.

Some Findings:

- PIPE can be up 2x trust size

- SPACs got between 4-20% ownership

- Valuations more attractive in 2020 (+upside)

Thread 🧵⬇️

Some Findings:

- PIPE can be up 2x trust size

- SPACs got between 4-20% ownership

- Valuations more attractive in 2020 (+upside)

Thread 🧵⬇️

• • •

Missing some Tweet in this thread? You can try to

force a refresh