What’s all this fuss about #NUE? New Umbrella Entity!

One of India’s feather in the cap is its Digital payments system initiative - NPCI and its various products. It has put #India on a global map!

A thread...! (1/n)

One of India’s feather in the cap is its Digital payments system initiative - NPCI and its various products. It has put #India on a global map!

A thread...! (1/n)

Many developed economies such as the US & UK are trying to emulate India in this field that stands as a testimony for its success.

So, we are the best in Digital payments, right? So why bother?

As the famous quote says, 'Well begun is half done!

(2/n)

So, we are the best in Digital payments, right? So why bother?

As the famous quote says, 'Well begun is half done!

(2/n)

The current NPCI which is an umbrella entity is the sole/monopoly that takes care of the entire range of digital payments.

So, what if it’s a monopoly? Bollywood ka Badshah bhi toh ek hi hai? @iamsrk ;)

(3/n)

So, what if it’s a monopoly? Bollywood ka Badshah bhi toh ek hi hai? @iamsrk ;)

(3/n)

Remember the Outage of the NSE exchange and all the ruckus it created. Recently in Feb, the UPI system alone crossed Rs 4.25 lakh cr Value and 2.3 lakh Cr volume transactions. The NPCI has become a large elephant in itself and has a lot on its plate currently.

(4/n)

(4/n)

#NPCINDIA not only offers all the below services but it is also a ‘NOT FOR PROFIT ENTITY’.

Also, most importantly GOI decided to waive off MDR. This doesn’t make sense to any businesses. Hence, the #RBI decided to float NUE which will be an alternative to NPCI that will create an infrastructure similar to UPI in India and can generate revenues, profits, etc.

(6/n)

(6/n)

While India has witnessed significant growth in payments over the past decade with the introduction of numerous payment systems, the infamous pandemic has acted as a blessing in disguise for digital payments boosting the overall penetration in India. (7/n)

So, why are many players such as Banks, conglomerates such as reliance & tatas, foreign entities such as facebook & google interested in #NUE?

1. The growth story of digital payment penetration is fantabulous, yet largely underpenetrated.

(8/n)

1. The growth story of digital payment penetration is fantabulous, yet largely underpenetrated.

(8/n)

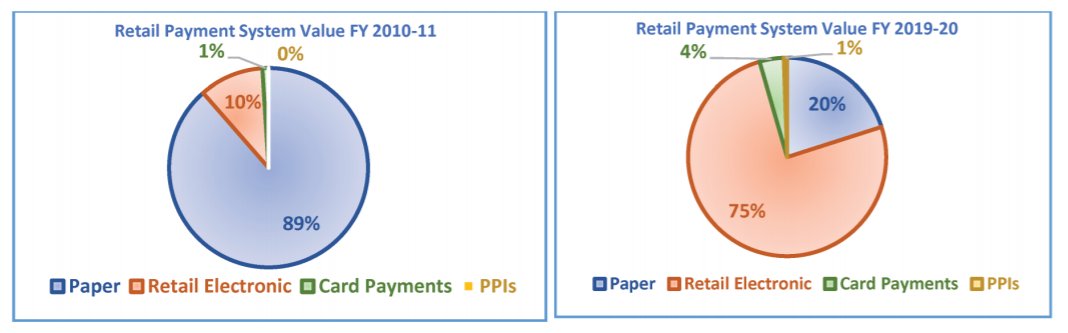

The shift in payment preference in the last 10 years is evidenced by the fact that the volume of paper clearing, which comprised of 60% of total retail payments in the financial year (FY) 2010-11, shrunk to 3% in the FY 2019-20.

(9/n)

(9/n)

Within the digital payments, retail electronic payments comprising credit transfers {NEFT, fast payments (IMPS and UPI)} and direct debits (ECS, NACH) have shown rapid growth over the past ten years at a CAGR of 55% and 43% in terms of volume and value, respectively. (10/n)

Over the past 10 years, during the period between FY 2010-11 and FY 2019-20, the number of debit cards issued increased from 22.78 crore to 82.86 crore. During the same period, the number of credit cards issued also increased from 1.80 crore to 5.77 crore. (11/n)

Other products in digital payments such as ECS, NACH, RTGS, NEFT, IMPS have also shown exponential growth over the last decade. (12/n)

Apart from the growing market! There are many other reasons why people are flocking for NUE licence!

2. Sensible business model as they can generate revenues and make profits

3. Data is the next-gen legalized Bitcoin

4. Cross-sell other financial products (13/n)

2. Sensible business model as they can generate revenues and make profits

3. Data is the next-gen legalized Bitcoin

4. Cross-sell other financial products (13/n)

5. Innovation in products and capture higher market share

- •Bill payments are still at a nascent stage which needs better innovation and products. BBPS - Bharat Bill Payment System (BBPS) is still largely underpenetrated.

(14/n)

- •Bill payments are still at a nascent stage which needs better innovation and products. BBPS - Bharat Bill Payment System (BBPS) is still largely underpenetrated.

(14/n)

- Toll and transit payments - Products such as FASTags which is mandatory now can also be used for other payments such as for parking charges, fuel purchases, etc., in an interoperable environment. Imagine the time saved!

(15/n)

(15/n)

These are good bruh! But Isn’t the market already matured in terms of penetration?

Oh, really?

- Look at other emerging economies such as Brazil, China, and others. We still need to go to the nooks and corners of the country especially, Tier 3 + cities.

(16/n)

Oh, really?

- Look at other emerging economies such as Brazil, China, and others. We still need to go to the nooks and corners of the country especially, Tier 3 + cities.

(16/n)

- In a country of more than 1.4 billion people, Digital payments are still underpenetrated with less than 20% of Indians using digital payments. (17/n)

exponential growth of infra and spread of mobile cellular networks and more than 50 Cr smartphones, there is a big market waiting to be tapped. In the last 10 years, the number of active digital payment users has jumped to 15 percent from 5 percent.

#Okbye :)

May the best man win

#Okbye :)

May the best man win

• • •

Missing some Tweet in this thread? You can try to

force a refresh