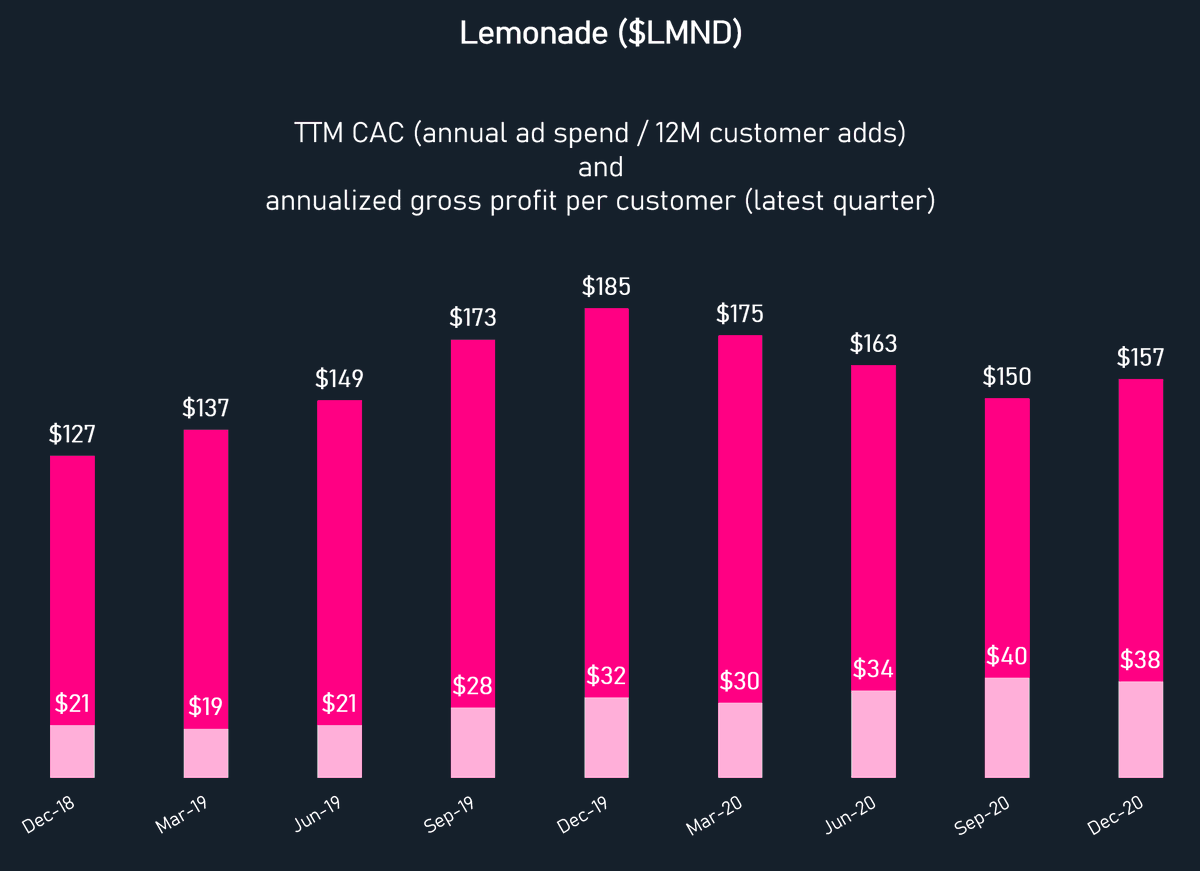

Lemonade $LMND LTV/CAC calculation. First, let's look at TTM LTV and gross profit per customer. Gross profit margin is running ~18-20%. I'm assuming ~70% of S&M spend for advertising:

Also interesting to look at in-force premium growth on a TTM basis, and how many dollars of IFP growth the company got out of every dollar of ad spend ($1.76 in latest quarter):

LTV/CAC calc: assume 20% gross profit margin (IPO video says eventually 35%!), $213 of premium per year, 7.7 year lifetime = $327 of lifetime GP which / $150 of CAC = 2.2x

Company says 2-3x so in the ballpark.

Company says 2-3x so in the ballpark.

With these types of economics and the path to improving over time (cross-sell = $0 CAC) and graduation to higher premium products, the company should be pouring $ into product, team and customer acquisition.

oops on first slide I meant TTM CAC, not LTV!

• • •

Missing some Tweet in this thread? You can try to

force a refresh