Over the next decade or so, Transense #TRT will receive royalties on 6000+ of $GE's military helicopter engines and on many Bridgestone mining tires

Simple order of magnitude numbers suggest that the current cap of £12M may be undervaluing these cashflows quite substantially

Simple order of magnitude numbers suggest that the current cap of £12M may be undervaluing these cashflows quite substantially

It's not a complicated co but there are four parts to this. To help keep track, I'll deal with them in the following order:

1. Bridgestone (discounted 0.5x-1.5x+ cap)

2. Helis (anywhere from undiscounted 1x-10x cap)

3. Free optionalities

4. Tire probes (modest percentage of cap)

1. Bridgestone (discounted 0.5x-1.5x+ cap)

2. Helis (anywhere from undiscounted 1x-10x cap)

3. Free optionalities

4. Tire probes (modest percentage of cap)

TRT makes advanced sensors.

On the Bridgestone side of things, the sensors monitor all aspects of super-large mining trucks' tire condition and provide geofencing and advanced capabilities for. Beyond likely cashflows the optionality here is to expand within the B'Stone range.

On the Bridgestone side of things, the sensors monitor all aspects of super-large mining trucks' tire condition and provide geofencing and advanced capabilities for. Beyond likely cashflows the optionality here is to expand within the B'Stone range.

For the helicopter programme, TRT content is torque / vibration engine monitoring. The cashflows are only my rough estimation but large. Optionality here is from further GE program content and from the nature of the tech (zero-power) as applicable to IOT, EV, wind turbines etc

1. Bridgestone

In mid-2020 TRT essentially sold off this side of things to Bridgestone for £1M. For the next 10 years TRT will receive royalties on the incorporation of their technology, called iTrack, into Bridgestone's mining tires.

bridgestone.com/corporate/news…

In mid-2020 TRT essentially sold off this side of things to Bridgestone for £1M. For the next 10 years TRT will receive royalties on the incorporation of their technology, called iTrack, into Bridgestone's mining tires.

bridgestone.com/corporate/news…

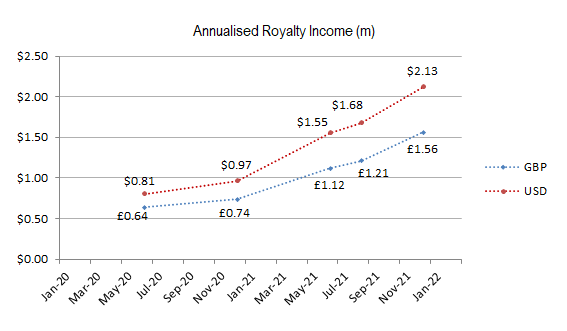

6 months into the start of the 10 years (End Dec 20, report Feb 21) royalties had already grown in two quarters by 15%.

15% is good but it's deceptive; in the circumstances this number is an extremely impressive start

15% is good but it's deceptive; in the circumstances this number is an extremely impressive start

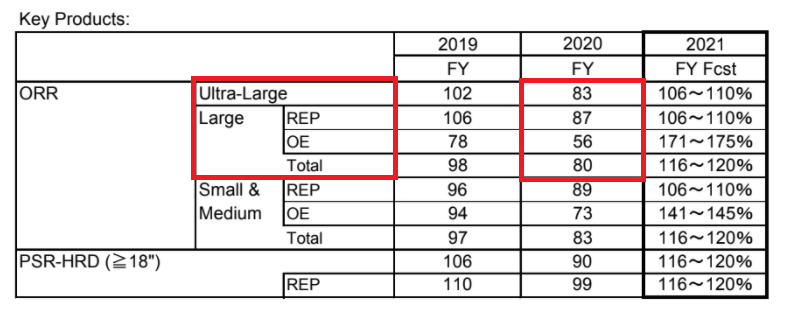

Here's the relevant section of Bridgestone's 2020 and whichever way you read it, this was not a great year for the divison. ORR is Off-road radial, and ultra-large / large are the mining tires that go on the big iron - TRT achieved 15% in that environment.

Note the forecasts

Note the forecasts

Here's are some simple NPVs: 15% annual growth rate and 25% with a pair of discount rates for an idea of scale. I strongly suspect £20M undiscounted will prove to be on the low side but for conservatism's sake, I'll underwrite this as being in the order of the market cap.

I believe the content may in fact have only been on a single range which launched mid 2020 called Mastercore, this was available in only 1 size. If correct, that early 15% is more impressive still.

moderntiredealer.com/articles/30813…

moderntiredealer.com/articles/30813…

2. Helicopters

5 years back, GE and TRT signed a licence agreement for TRT's content for "specific torque applications" with a perpetual sales royalty for each unit using the technology.

5 years back, GE and TRT signed a licence agreement for TRT's content for "specific torque applications" with a perpetual sales royalty for each unit using the technology.

The programme it has ended up in is called ITEP or Improved Turbine Engine Program. In English, this means GE are going to put TRT's content in 6000 new engines for the Apache and the Black Hawk. First engine test will be Q4 this year.

en.wikipedia.org/wiki/Improved_…

en.wikipedia.org/wiki/Improved_…

What's the content worth per aircraft? I don't know; the numbers aren't out there but we can try to triangulate and because the numbers get very silly very quickly, this is only useful (if at all) as an exercise in very vague estimation.

As you may have noticed above, the helicopter tech is called SAW, surface wave acoustic. This division currently generates a small amount of revenue for TRT - around £200K per year and it's mainly from motorsport.

More specifically it seems to be drive input shafts supplied to the NTT IndyCar series by McLaren.

I don't know whether McLaren supply all the drive input shafts for the IndyCar series and I know nothing about Indycar.

I don't know whether McLaren supply all the drive input shafts for the IndyCar series and I know nothing about Indycar.

Google tells me there are 24 cars in a standard Indycar race, so as somewhere to start from I'll multiply that by x2 for backup cars, call it 50 units and assume McClaren in each one. Knock a quarter off the £200K for non-grant revenue and each car has £3000 of content.

For a Formula 1 tech that wouldn't strike me as too outlandish so I'll go with that. From my own background, I know that if you put a 10p screw in a jet aircraft, it immediately costs £15 so if you double that £3K across 6000 helicopters you're at £36M undiscounted.

Triple it, quadruple it and it's £54M or £100M. Again, I'm not claiming any of this as anything close to fact but it seems to me likely at least, that there's something here that's potentially significant beyond those Bridgestone cashflows and not in the price at £12M cap.

3. Optionalities.

First $GE; TRT is involved in a flagship programme with obvious potential application in their other military or commercial programmes - as a foot in the door it's not a bad start; you're not paying for the chance they win content in the next thing GE do

First $GE; TRT is involved in a flagship programme with obvious potential application in their other military or commercial programmes - as a foot in the door it's not a bad start; you're not paying for the chance they win content in the next thing GE do

Second is the tech itself. SAW is zero-power: very simply, you fire a wave at a SAW unit and wave itself powers the unit's ability to give you a reading - this the kind of thing that's clearly suited for IOT applications, periodic monitoring of EV systems etc. Again, free at £12M

4. Tire probe testing.

TRT makes Translogik tire probes, they're apparently state of the art and cost up to around £1000 each

TRT makes Translogik tire probes, they're apparently state of the art and cost up to around £1000 each

In the last half year this grew 71% to £0.4M with nearly a 50% contribution margin.

Unlikely to be the start of something; the best year for this division seems to have been 2018 and £0.8M revenues. At a guess worth some low to mid single digit million on top of all the rest?

Unlikely to be the start of something; the best year for this division seems to have been 2018 and £0.8M revenues. At a guess worth some low to mid single digit million on top of all the rest?

Tiny company, doing something well enough to have caught the eye of B'stone & GE. Probably on the cheap side, potentially on the very cheap side. Fair amount of cheap to free optionality. Would imagine this rerates over time as the tire / heli numbers shake out and become clearer

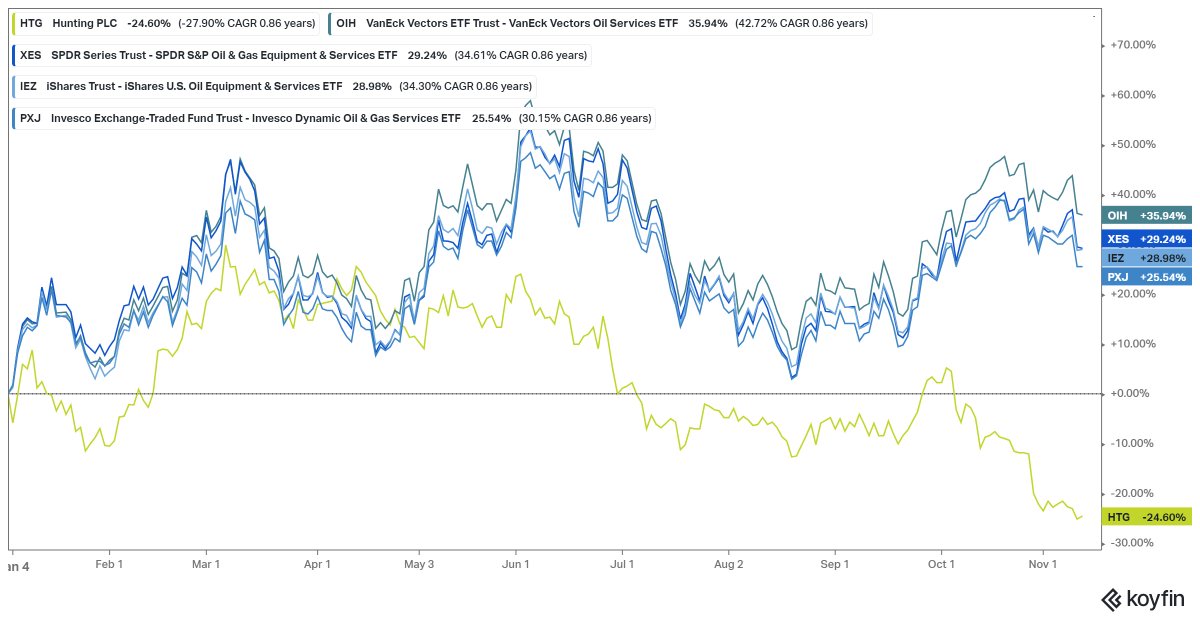

With the caveats that these numbers may in any case not be too useful as a comparable and could be skewed by some particularly large orders, Epiroc yesterday reported equipment orders up 40%, into a strengthened SEK

Bridgestone commentary on mining: "market is recovering compared to 2H of the previous year with mineral demand increasing but it is still weak"

At best the YoY rates suggest the worst is behind for ultra-large and that it's broadly (charitable) back somewhere near prev baseline

At best the YoY rates suggest the worst is behind for ultra-large and that it's broadly (charitable) back somewhere near prev baseline

More +ve are mgmt comments on the call. Evident this is a core focus from the company from the prominence in their presentations: latest vs Aug 20 deck now has possible rise to 48 from 43 MC mines with target of 83. New seems to be that 41 mines now signed into solutions contract

#TRT update looks good - especially considering Bridgestone mining tires still comping -ve. Can't back out the exact figures but given a baseline of £600k, HY1 already at £374k and a run-rate here of £1,080k it's clearly positive. Probe revs up 50% and ITEP programme yet to hit..

This article mentions the US Army is looking to procure "advanced rotorcraft that can fly twice as fast and twice as far as its workhorse choppers, all with an eye on the vast expanses of the Pacific region"

bloomberg.com/news/articles/…

bloomberg.com/news/articles/…

A few mins back, one of them appeared in my feed. The rotorcraft from the Bloomberg piece are a new class of aircraft - the programme is called Future Attack Reconnaissance Aircraft (FARA), it's in addition to Future Vertical Lift (FVL) which covers the upgrades on BH and Apache

The two remaining contenders in the competition to be chosen are the Bell aircraft above and the Sikorsky Raider X. #TRT shareholders may not mind which wins

Respectable performance from #TRT: annualised Itrack royalties up 100% in 14 months, Translogik probes ~5% shy of record year and clearly going higher, SAW revenues up x2 off McClaren alone.

Bridgestone’s FY21 mid-long term business strategy presentation materials released here are the first revisit relevant to #TRT since Q1/21, showing mastercore mine numbers up +25% and those with iTrack +50%

• • •

Missing some Tweet in this thread? You can try to

force a refresh