Just sent out my most recent Substack writeup to the free subscribers.

The company I profiled this week was $APPH aka @AppHarvest

You can read it here: jonahlupton.substack.com/p/apph-appharv…

The company I profiled this week was $APPH aka @AppHarvest

You can read it here: jonahlupton.substack.com/p/apph-appharv…

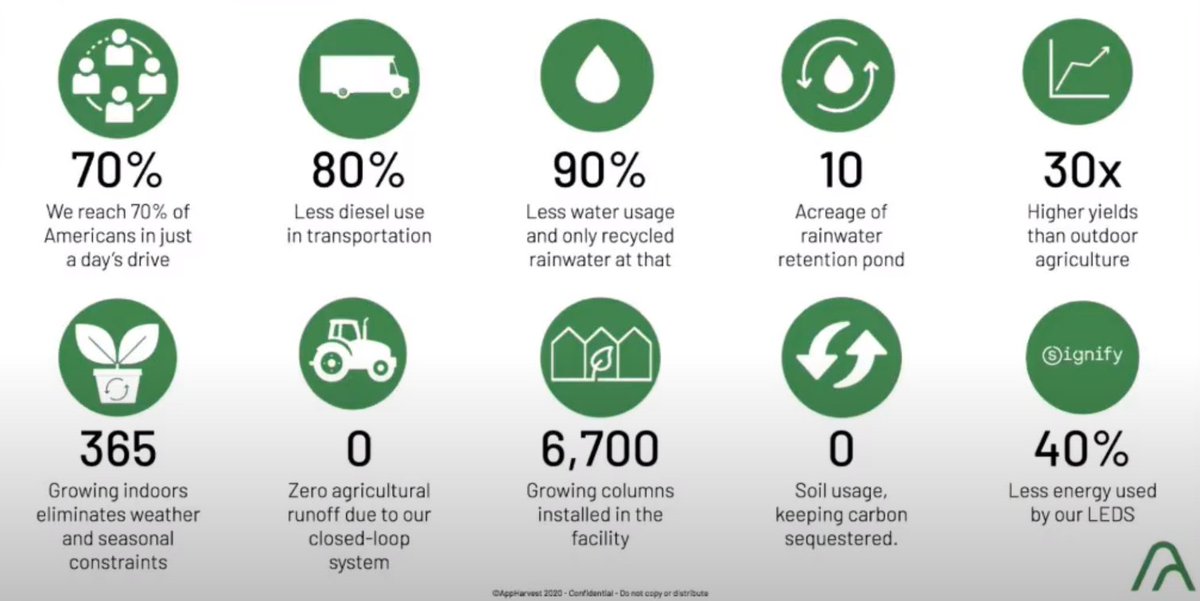

$APPH is building indoor vertical farms which I believe is the future of farming and our food supply.

There are dozens of benefits to indoor farming including water efficiency and no pesticides but the number that blew my mind was 30x crop yield per acre versus outdoor farming.

There are dozens of benefits to indoor farming including water efficiency and no pesticides but the number that blew my mind was 30x crop yield per acre versus outdoor farming.

$APPH is operating their first facility in Morehead, KY which is 2.8 million sq feet.

They're already started building their next two facilities in KY and once those are done they'll start building in NY

These facilities will grow tomatoes, peppers, cucumbers and leafy greens.

They're already started building their next two facilities in KY and once those are done they'll start building in NY

These facilities will grow tomatoes, peppers, cucumbers and leafy greens.

The company has stated they want 12 facilities up and running by 2025.

I can easily envision a future where $APPH has 50+ facilities all around the country which would cut down on transportation costs and ensure our fruits and veggies are even fresher.

I can easily envision a future where $APPH has 50+ facilities all around the country which would cut down on transportation costs and ensure our fruits and veggies are even fresher.

$APPH stock has pulled back nearly 50% over the past two weeks which provides a very attractive entry price in my opinion.

$APPH is one of the only publicly traded certified-B corps which means they are committed to doing good for people & the planet, not just making profits.

$APPH is one of the only publicly traded certified-B corps which means they are committed to doing good for people & the planet, not just making profits.

I believe that $APPH will quickly become a favorite for ESG investors as they learn more about this company and want to support their mission.

Right now the US is importing close to 50% of our fruits and vegetables from other countries which is unacceptable.

Right now the US is importing close to 50% of our fruits and vegetables from other countries which is unacceptable.

We need to be growing our foods here, pesticide and GMO free, close to the customer and at affordable costs.

$APPH is basically building high-tech greenhouses, packed with sensors and robotics to ensure maximum productivity and efficiency.

$APPH is basically building high-tech greenhouses, packed with sensors and robotics to ensure maximum productivity and efficiency.

$APPH even collects all the rainwater in their 10-acre retention ponds then filters it because circulating it through the closed-loop irrigation system so no water is ever wasted.

I'm also interviewing the Founder & CEO next Thursday.

I'm also interviewing the Founder & CEO next Thursday.

• • •

Missing some Tweet in this thread? You can try to

force a refresh