1/ Once in a while, you happen upon a really interesting story...

Here's one of my favorites.

It's about a brilliantly executed transformation of one of this country's biggest companies that virtually no one noticed...

Here's one of my favorites.

It's about a brilliantly executed transformation of one of this country's biggest companies that virtually no one noticed...

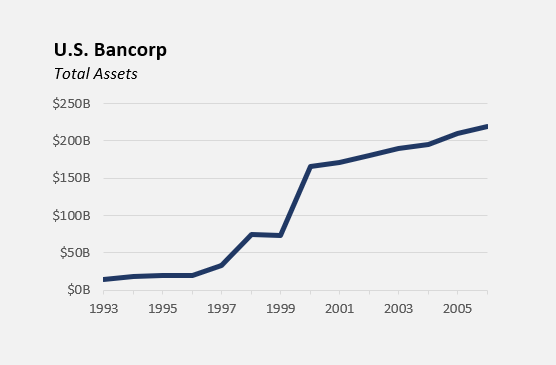

2/ On paper, U.S. Bancorp was one of the top-performing banks in the country in 2006.

It was built through acquisitions over the previous 14 years by a guy named Jerry Grundhofer.

(There aren't a lot of photos of Jerry. So here he is getting out of a van.)

It was built through acquisitions over the previous 14 years by a guy named Jerry Grundhofer.

(There aren't a lot of photos of Jerry. So here he is getting out of a van.)

4/ By combining the banks, Jerry had parlayed the second biggest bank in Cincinnati into the sixth biggest bank in the country — the U.S. Bancorp we know today.

It’s one of the marquee success stories in modern American banking.

But there's more to the story...

It’s one of the marquee success stories in modern American banking.

But there's more to the story...

5/ The secret to the Grundhofers’ success was that they were brutal cost cutters.

Depending on who you ask, Jack was known as either Chainsaw Jack or Jack the Ripper.

“I’ll do whatever I have to do, however Draconian,” he told the WSJ in 1993.

wsj.com/articles/banke…

Depending on who you ask, Jack was known as either Chainsaw Jack or Jack the Ripper.

“I’ll do whatever I have to do, however Draconian,” he told the WSJ in 1993.

wsj.com/articles/banke…

6/ After acquiring a bank, the Grundhofers would strip out as many employees of the acquired institution as possible.

It didn’t matter if the employees worked on the frontlines with customers or in the back office processing paperwork.

That’s how they made the deal math work.

It didn’t matter if the employees worked on the frontlines with customers or in the back office processing paperwork.

That’s how they made the deal math work.

7/ But it also led to acute customer attrition.

It wasn’t uncommon for 40% of an acquired institution’s customers to leave after the deal closed.

Now, one can argue whether this was the right approach.

But there’s no question that it worked.

It wasn’t uncommon for 40% of an acquired institution’s customers to leave after the deal closed.

Now, one can argue whether this was the right approach.

But there’s no question that it worked.

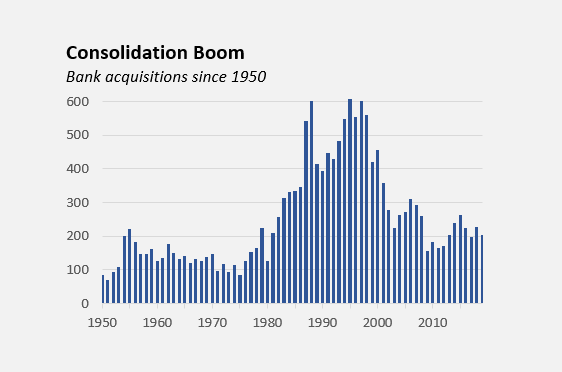

8/ Also, the context is important.

The Grundhofers were building U.S. Bancorp in an era of frantic consolidation.

Starting in the mid-1980s, the barriers to branch and interstate banking were progressively dismantled, igniting a fury of acquisitions.

The Grundhofers were building U.S. Bancorp in an era of frantic consolidation.

Starting in the mid-1980s, the barriers to branch and interstate banking were progressively dismantled, igniting a fury of acquisitions.

9/ The most storied acquirer of the day, NationsBank-cum-Bank of America’s Hugh McColl, a former U.S. Marine, gave crystal hand grenades to employees as awards.

wcnc.com/article/news/l…

wcnc.com/article/news/l…

10/ The consensus in banking at the time was that you could either eat or be eaten.

And the Grundhofers, who cut their teeth early in their careers at a trio of California banking giants that were ultimately eaten, chose to eat.

And the Grundhofers, who cut their teeth early in their careers at a trio of California banking giants that were ultimately eaten, chose to eat.

11/ Until 2006, that is...

That was the year that Jerry Grundhofer passed the reins of U.S. Bancorp to Richard Davis, who would lead the bank as chairman and CEO for the next decade.

That was the year that Jerry Grundhofer passed the reins of U.S. Bancorp to Richard Davis, who would lead the bank as chairman and CEO for the next decade.

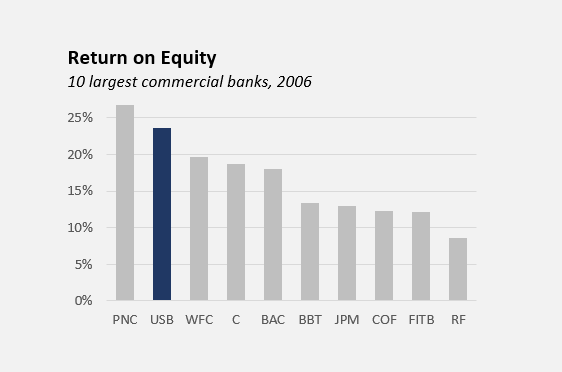

12/ From the outside, it looked like a plum assignment.

U.S. Bancorp was the sixth-biggest commercial bank in the country by then.

And it ranked second in terms of profitability, earning a 2.2% return on assets and a 23.6% return on common equity. (Those were the days!)

U.S. Bancorp was the sixth-biggest commercial bank in the country by then.

And it ranked second in terms of profitability, earning a 2.2% return on assets and a 23.6% return on common equity. (Those were the days!)

13/ But it had done so by cutting costs to the bone.

As late as 2006, new employees wouldn’t get laptops until they had been at U.S. Bancorp for six months.

The gas tank was empty.

And Jerry Grundhofer knew it.

As late as 2006, new employees wouldn’t get laptops until they had been at U.S. Bancorp for six months.

The gas tank was empty.

And Jerry Grundhofer knew it.

14/ So on his way out the door, Jerry decided to do two interrelated things...

First, raise the dividend by 21%.

Second, sell U.S. Bancorp to Citigroup.

The deal was never disclosed publicly, but it's an open secret among well-connected industry insiders.

First, raise the dividend by 21%.

Second, sell U.S. Bancorp to Citigroup.

The deal was never disclosed publicly, but it's an open secret among well-connected industry insiders.

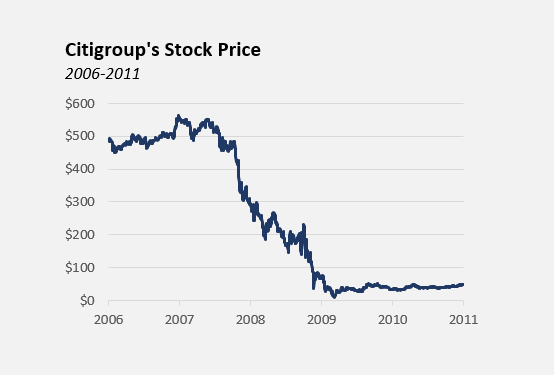

15/ This was just months before Citi's CEO Chuck Prince uttered the infamous words:

“When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you've got to get up and dance."

ft.com/content/80e298…

“When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you've got to get up and dance."

ft.com/content/80e298…

16/ For reasons no one will discuss on the record, the deal fell through.

And it’s a good thing for U.S. Bancorp’s shareholders that it did.

Citigroup’s stock lost 98% of its value over the next two years after diluting shareholders to cover subprime mortgage-related losses.

And it’s a good thing for U.S. Bancorp’s shareholders that it did.

Citigroup’s stock lost 98% of its value over the next two years after diluting shareholders to cover subprime mortgage-related losses.

17/ For U.S. Bancorp, meanwhile, the financial crisis was a blessing in disguise.

When the market bottomed in 2009, Davis noticed that its stock was faring better than every other major bank.

When bank stocks fell, it fell the least. When they climbed, it climbed the most.

When the market bottomed in 2009, Davis noticed that its stock was faring better than every other major bank.

When bank stocks fell, it fell the least. When they climbed, it climbed the most.

18/ Investors had become so enamored with U.S. Bancorp’s safety and soundness, Davis realized, that its efficiency ratio, which had previously driven the valuation of its stock, became a tertiary concern.

So he leaned into this...

So he leaned into this...

19/ The cover of its 2009 annual report depicts a paper airplane gliding peacefully through clear skies.

“U.S. Bancorp’s stability and soundness created a manifest flight to quality that began two years ago and continues today,” Davis wrote in his letter.

“U.S. Bancorp’s stability and soundness created a manifest flight to quality that began two years ago and continues today,” Davis wrote in his letter.

20/ To Davis, it meant that he could drive up the bank’s efficiency ratio by spending more on people and technology without being punished in the market.

It was a seminal moment in U.S. Bancorp’s history.

It was a seminal moment in U.S. Bancorp’s history.

21/ It helps explain not only why U.S. Bancorp emerged from the crisis with the highest credit rating in the banking industry, but also how it would soon become one of the country's most technologically sophisticated banks in the country under his predecessor Andy Cecere.

22/ It was a masterstroke of leadership.

A turnaround that no one noticed.

/END

A turnaround that no one noticed.

/END

A postscript...

Two years after retiring from U.S. Bancorp, Richard Davis was named CEO of Make-A-Wish America.

americanbanker.com/news/former-us…

Two years after retiring from U.S. Bancorp, Richard Davis was named CEO of Make-A-Wish America.

americanbanker.com/news/former-us…

• • •

Missing some Tweet in this thread? You can try to

force a refresh