Angular Ventures is super excited to release our 2020 Data Deck on Enterprise & Deep Tech VC Investment in Europe & Israel. 73 pages of proprietary data & analysis. (Thank you @poetential for all the hard work here!)

@poetential You can find the full report (downloadable) on medium/docsend here: medium.com/angularventure…

As with everything, this is a massive team effort. Andrew @poetential Posaste did an amazing amount of work on this. Couldn't have done it without. Thank you, Andrew! (Founders who haven't met him yet should reach out...)

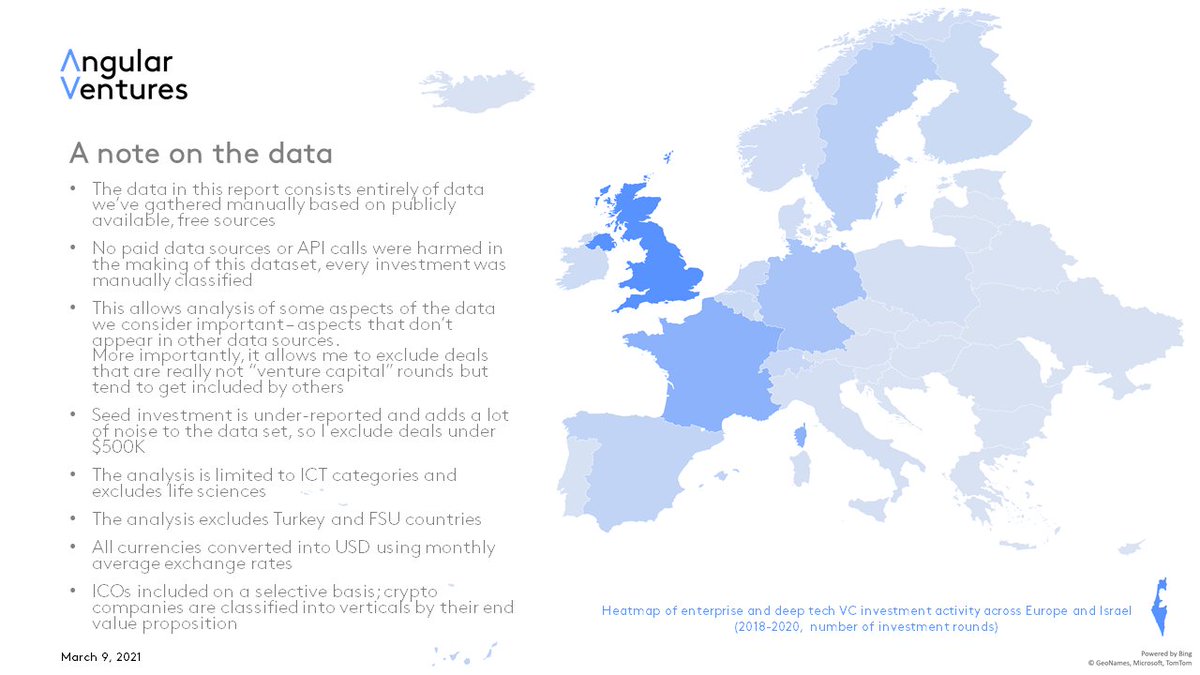

As always, we are hand-curating the data - which is why it takes time and why there are sometimes little errors - but it's also why we think our data is and view on the market is more accurate than anything else out there.

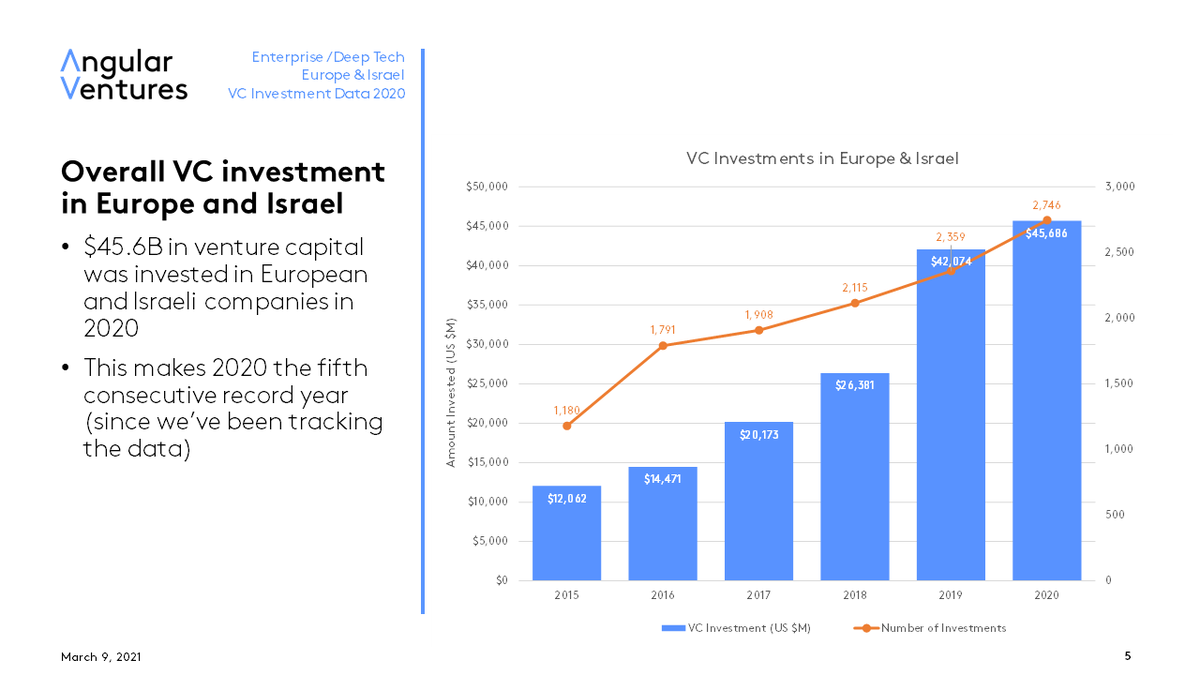

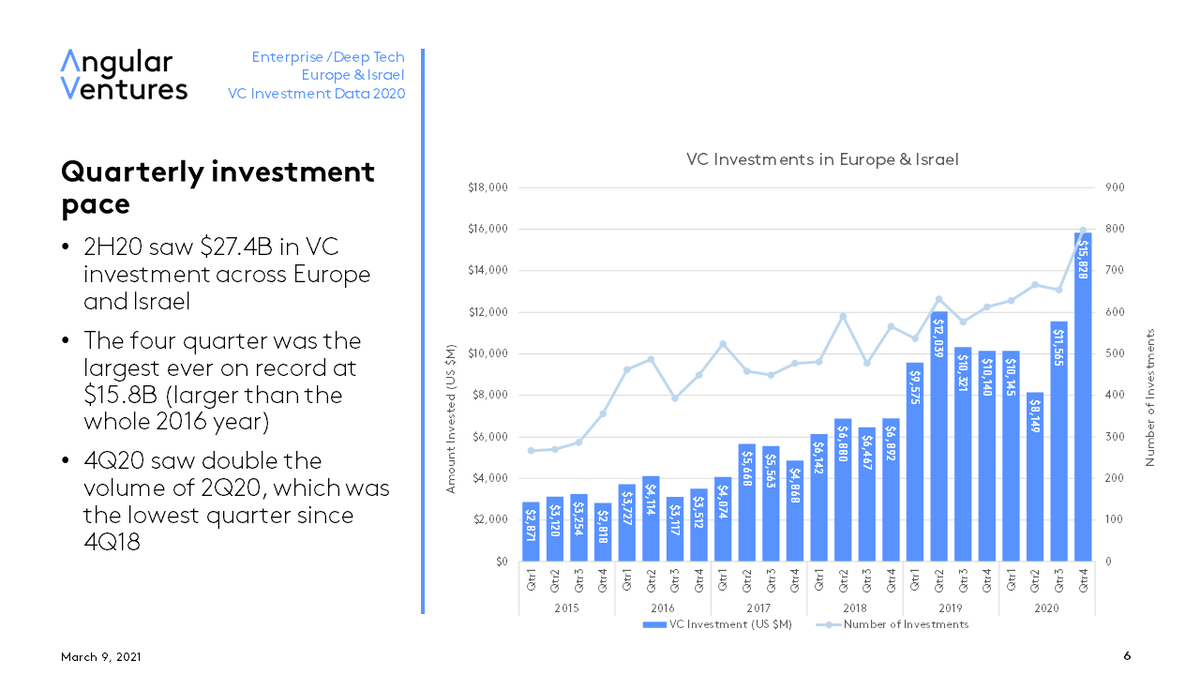

In retrospect, it's clear there was no overall negative impact of Covid on investment pace (contrary to what we and many others expected). 2Q20 was slow, but 3Q and 4Q were very strong - with 4Q an all-time record.

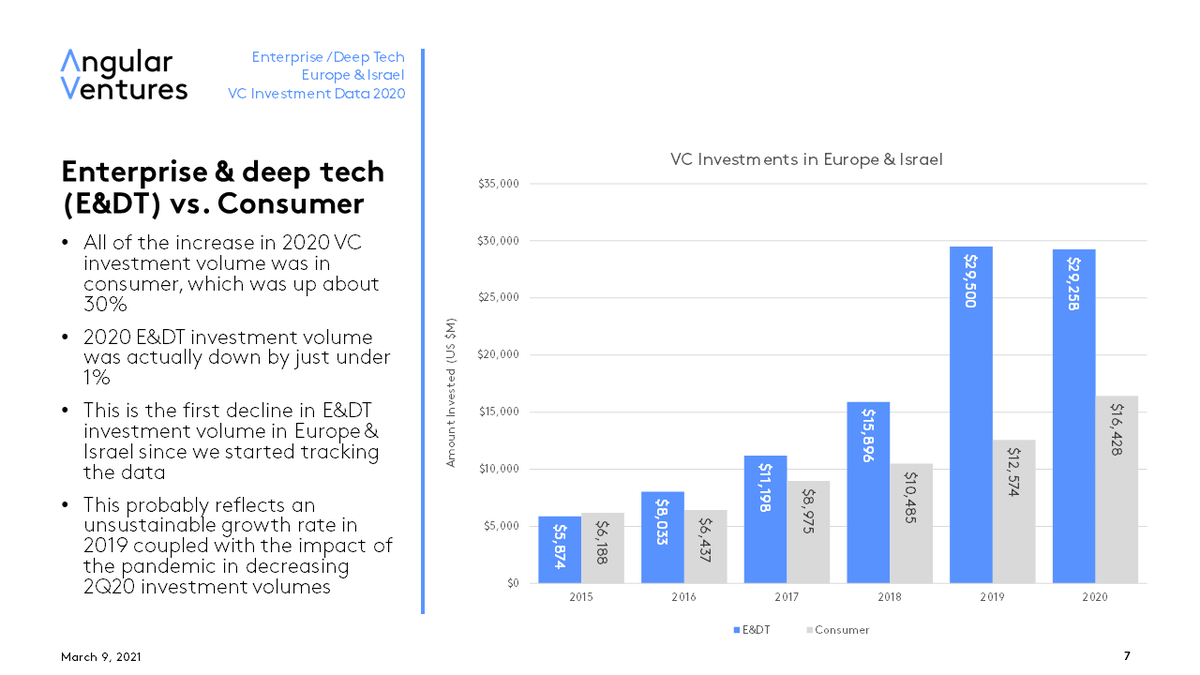

As our work @AngularVentures focuses on Enterprise & Deep Tech (E&DT). In recent years, this has been the majority of the dollars invested in Europe/Israel. We like being contrarian, but are glad that investors are recognizing the incredible potential of EU/IL E&DT founders.

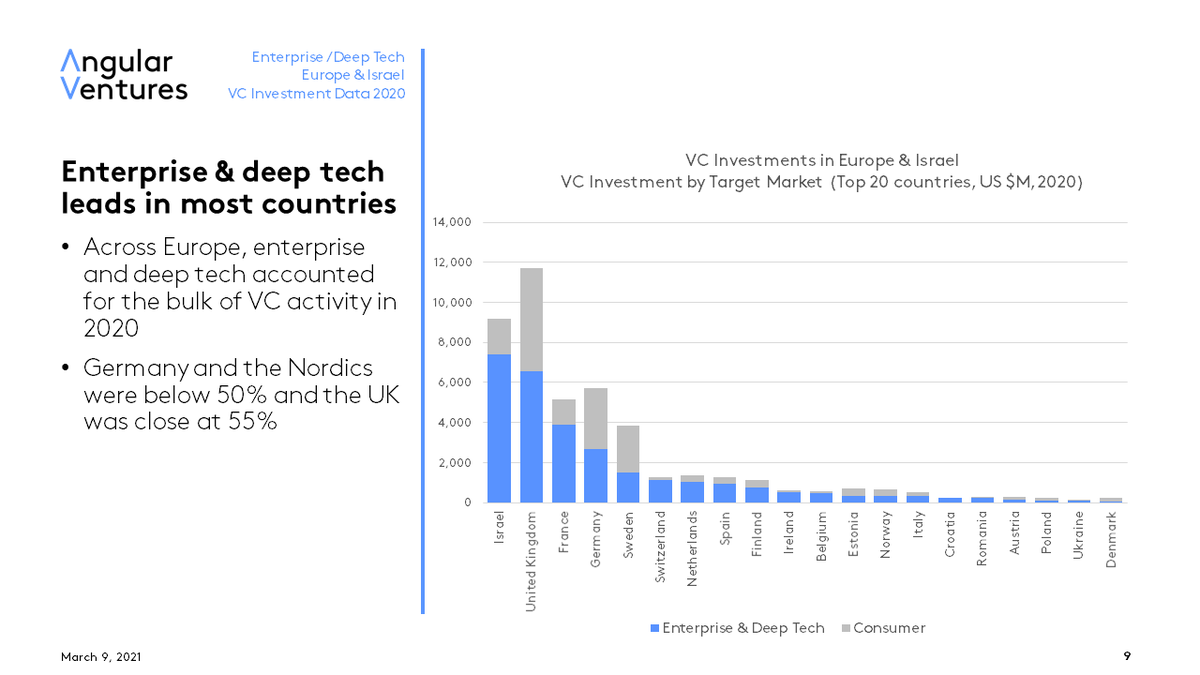

Here's a look at the breakdown by country of E&DT versus consumer. UK, Germany, and Sweden are still seeing a lot of consumer investment E&DT dominates most other markets.

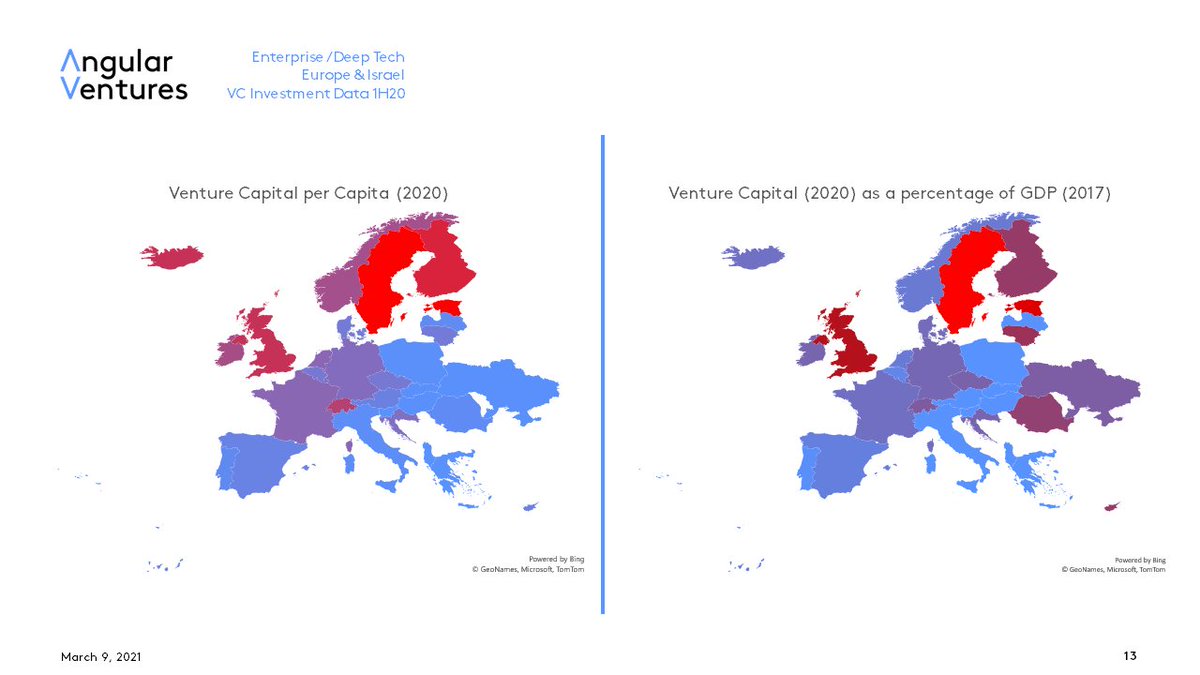

Israel and Estonia have higher VC $ per capita than the US. Sweden is nearly at the US level. The UK is still less than half the US on a per capita basis.

The number of ANNOUNCED early-stage rounds continues to increase, but far slower than the total dollars would suggest. We believe there is a shift to later-stage rounds, but we also believe that early stage rounds are increasingly not being announced.

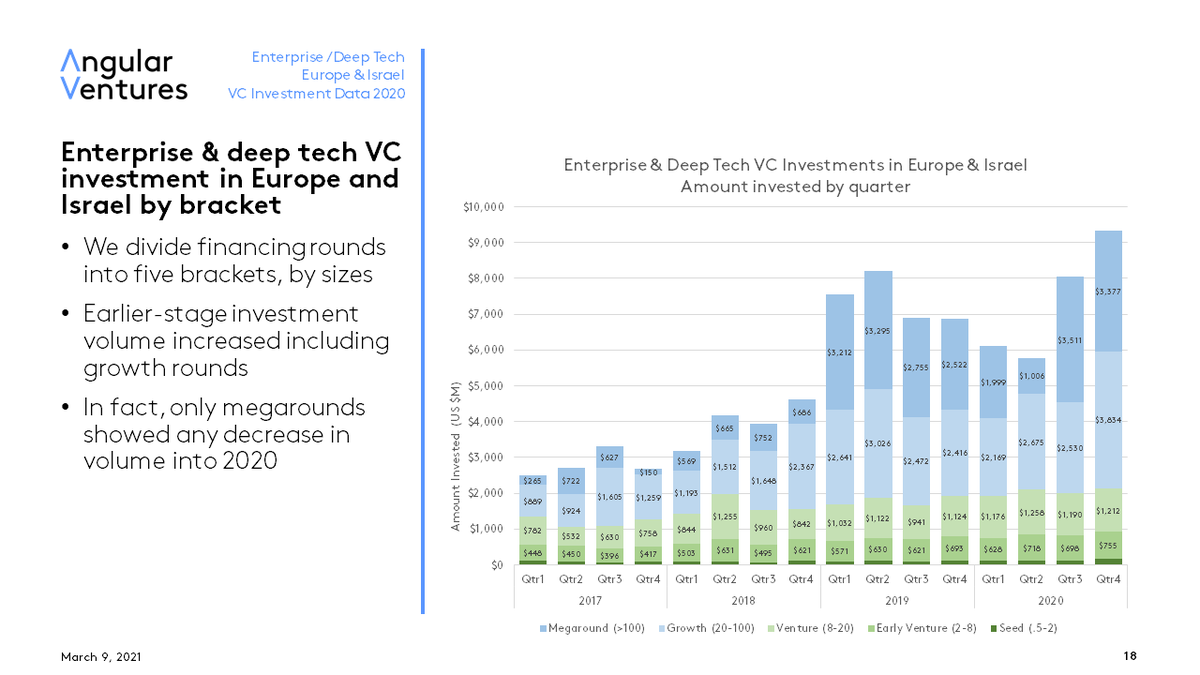

Looked at strictly through the E&DT lens, 2020 was actually slightly weaker than 2019 - but this is due to less megaround activity in total. Early round activity increased somewhat.

Round sizes continue to trend up strongly - something that may be artificially depressing the number of early rounds. Many companies are just skipped a phase and moving right to the big round.

In 2020, more E&DT VC capital flowed into Israel than any other market in Europe, with over $7.4B invested. UK was next at $6.5B. France ($3.8B) and Germany ($2.6B) were distant 3rd and 4th.

The UK led Europe in the number of VC rounds announced. This raises some uncomfortable questions: Are too many companies in the UK getting formed? Are too few seed rounds taking place in Israel?

In terms of E&DT volume, Southern Europe, Iberia, and BeNeLux are growing the fastest. Eastern Europe seems to be in retreat.

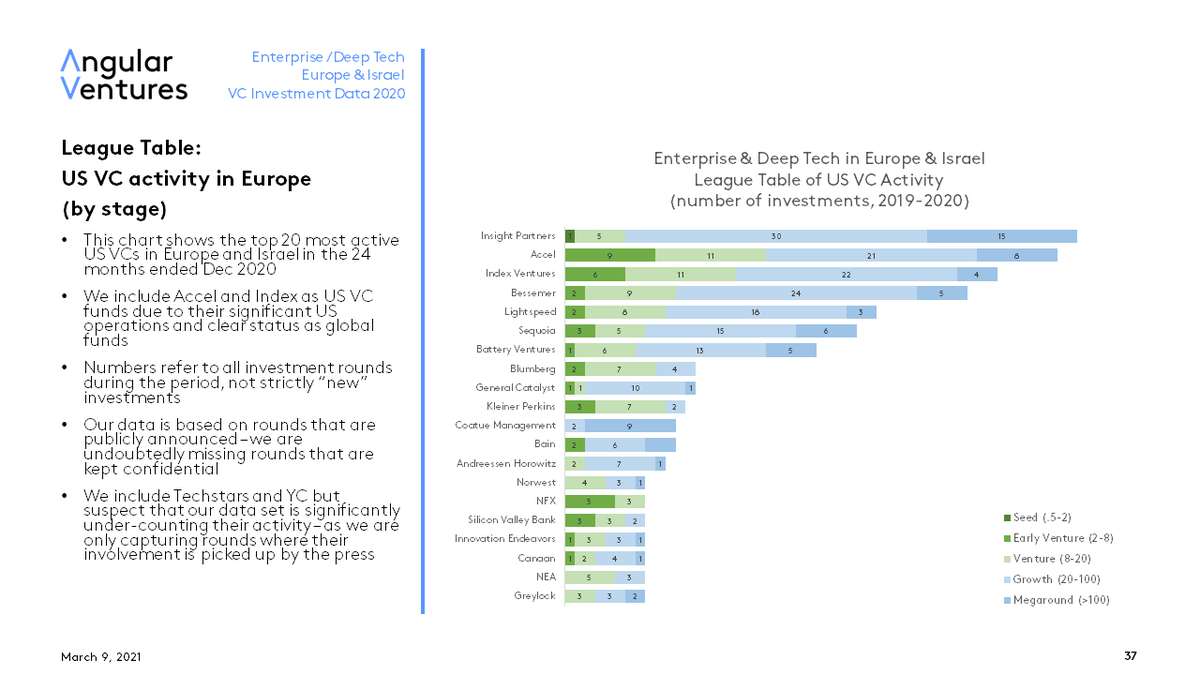

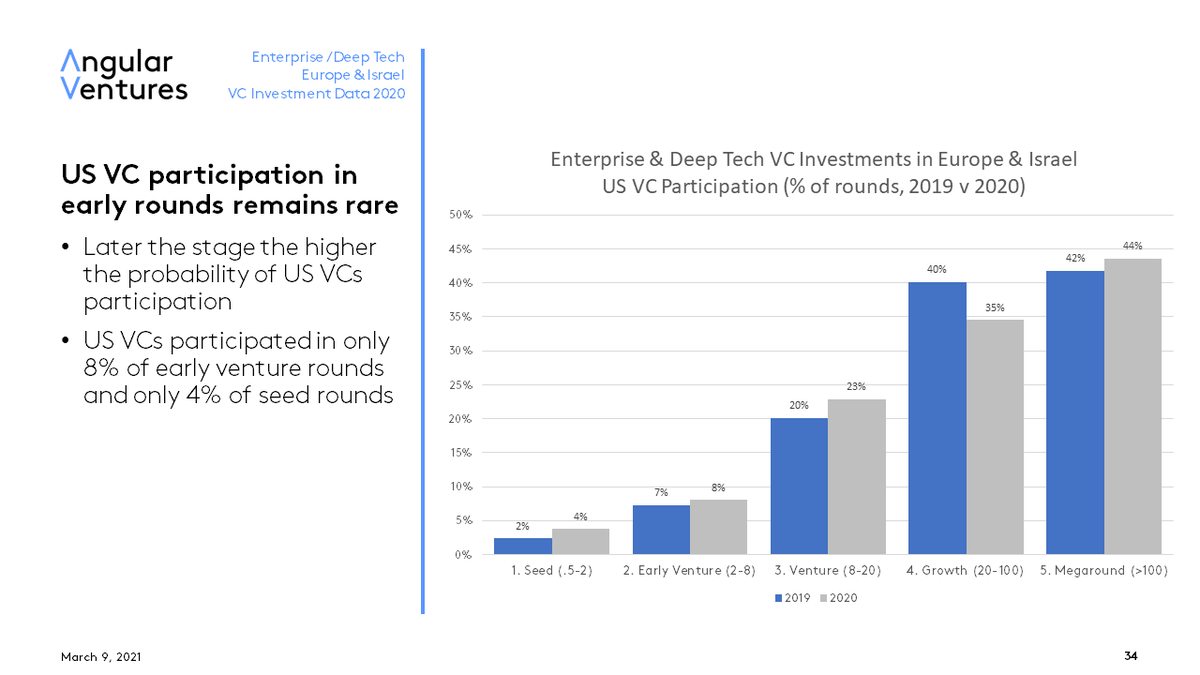

US VC participation in early-stage rounds in Europe/Israel remains very rare. At the later stages, this is far more common.

We think this is pretty cool. Here's a league table of US VCs active in Europe, broken down by region.

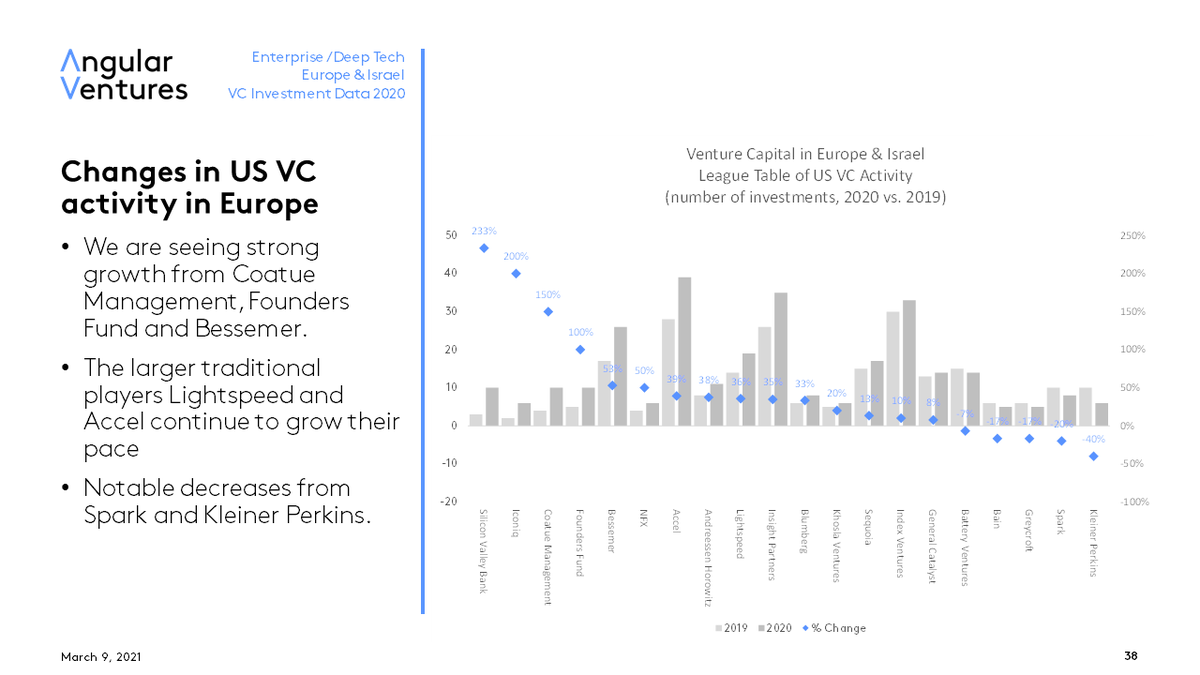

And here (thank you @poetential!) is a very cool chart showing which US VCs are becoming more or less active in Europe/Israel.

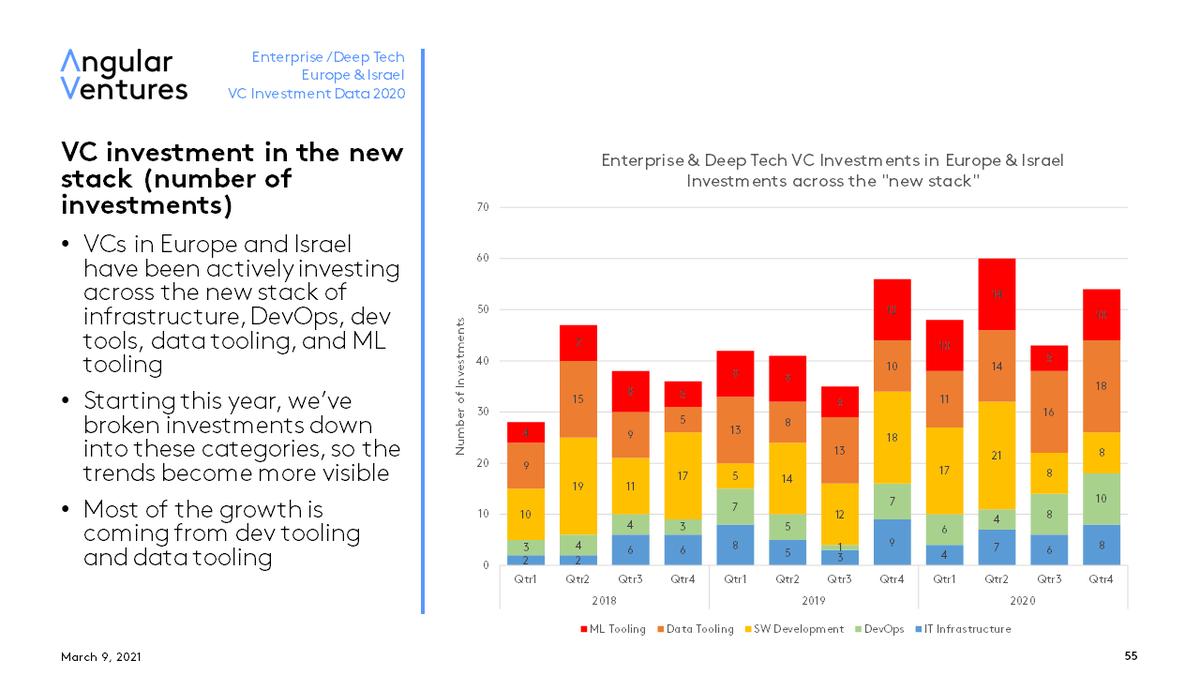

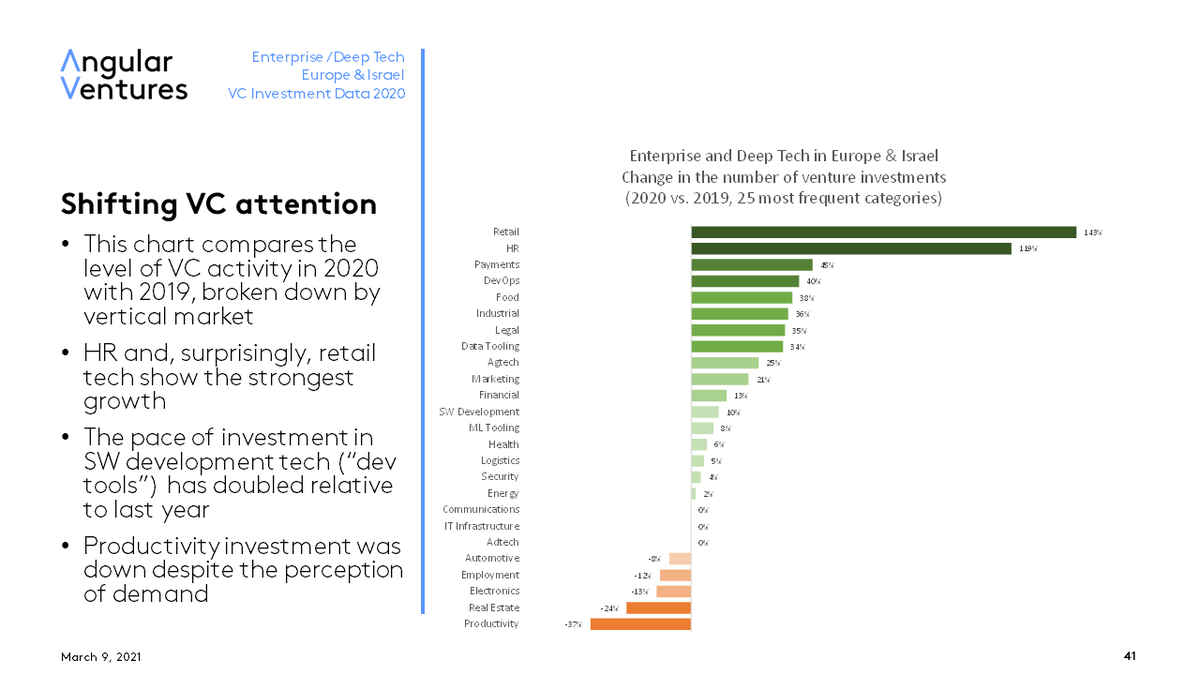

My favorite part of the analysis is the breakdown by vertical. We've added a few new verticals (data tooling, dev tooling, and ML tooling).

Here's a breakdown of which verticals within E&DT are seeing more or less investment across Europe & Israel. Retail and HR are booming.

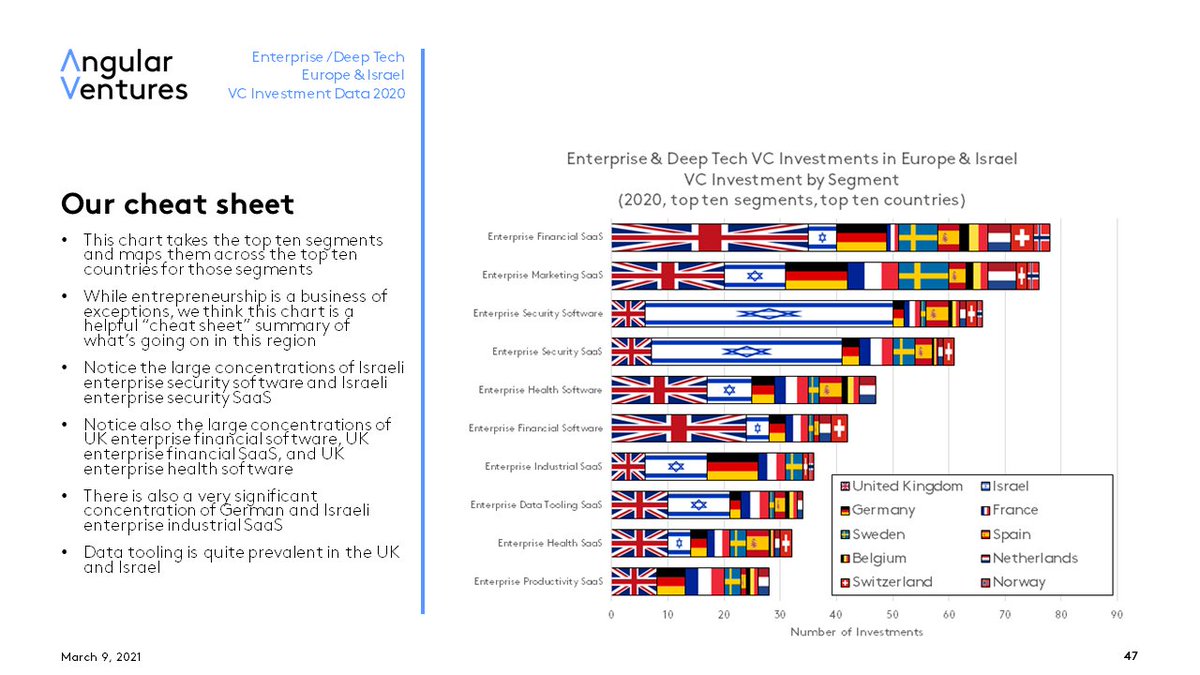

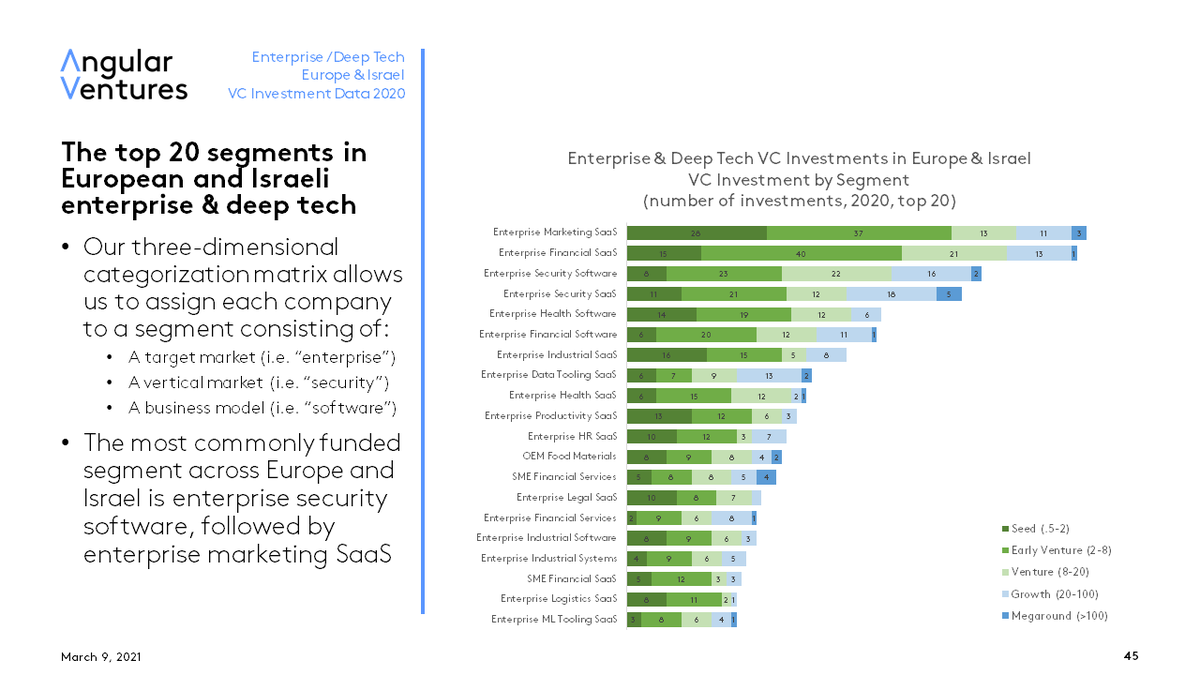

And here are the top segments. "Enterprise Marketing SaaS," "Enterprise Financial SaaS," and "Enterprise Security Software" were the top three.

In the actual report, we have a breakdown of 12 different countries by stage and vertical.

Hope you enjoyed this quick tour through the report. Please share with your friends and contacts - and download the whole report here. medium.com/angularventure…

• • •

Missing some Tweet in this thread? You can try to

force a refresh