My grandmother always told me to focus on relationships. She was the first female stock broker in Kansas City. Perhaps this is what she meant:

Berkshire closed at $398,840, a new high. $BRK bought back stock at $13.63 in the spring of 1965, just before Mr. Buffett took over. 1/

Berkshire closed at $398,840, a new high. $BRK bought back stock at $13.63 in the spring of 1965, just before Mr. Buffett took over. 1/

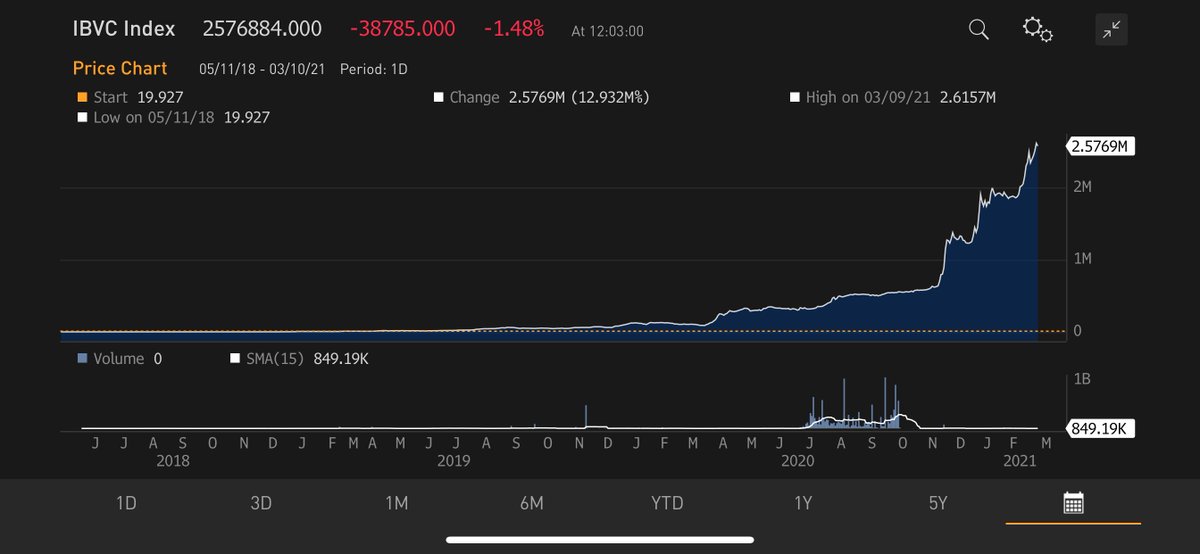

Berkshire's gain is 2,926,100% or 20.2% per year, 2x the annual gain of the S&P 500. Meanwhile, the Caracas Exchange Index was the same 13.63 bolívares in May 2018. It's now 2,576,884 bolívares, an annual gain of 7,190%, 6.5x the gain in $BRK in less than 3 years vs. 56 years. 2/

Now, the dollar lost 88% of its purchasing power since 1965. Bitcoin wasn't a thing so if you wanted to hedge you could buy gold, which was $35/oz for more than 30 years beginning in 1934. Remarkably, gold compounded at 7.2% for the past 56 years. Stocks were a better hedge. 3/

Since 2008 the bolívar has had several iterations. It had 3 lives at the Bolívar fuerte & 4 (so far) as the Bolívar soberano, with changes occurring at least annually since 2016. Against the dollar the bolívar declined from 16.9 to 1,873,297, a loss (so far) of 99.9991%. 4/

As in Weimar Germany, stocks (some) in Venezuela retained some purchasing power. Friends that left Venezuela prior to 2003's capital controls did not leave the country to get rich compared to the suckers that stayed. They left for personal safety and to preserve some wealth. 5/

Presuming Venezuela can move beyond marxist socialism and solve their leadership crisis, will those that go back once the ultimate currency stabilizes be so rich to be able to purchase all of the assets in the state? The answer goes back to relationships. 6/

I'm proud of my grandmother here in Women's History Month & miss her every day. She battled the inflationary 70s for her clients. I wonder what she'd say about relationships today? Cash, bonds, stocks, Berkshire, gold, Bitcoin? Not sure that's what she meant but maybe it was! 7/7

• • •

Missing some Tweet in this thread? You can try to

force a refresh