1) This thread will analyse one of my biggest holdings, Kambi Group. Kambi is a B2B sportsbetting provider. The company is listed on First North at Nasdaq Stockholm, ticker: Kambi

2) Kambi’s services include services such as front-end user interface, customer intelligence, risk management, and odds compiling services built on an in-house developed software platform. The majority of their income comes from Europe and the US

3) Kambi was originally spun off from Swedish operator Kindred in 2014. This was an important move to attract new customers as the company gained full independence and integrity over their operations and would no longer have any conflict of interest

4) Unlike other providers, Kambi has chosen to avoid unregulated markets. Kambi’s CCO: “[..] our unwavering commitment to integrity and corporate probity [..] since our inception we have been careful to avoid markets where gambling is prohibited. ½

5) “This was a conscious and long-term decision, [..] we realized it was likely to be looked favorably on by regulators when moving into new territories in the future – particularly in the U.S. which has always been a key part of our long-term business strategy.”

6) This approach has provided earnings visibility. As a shareholder, I prefer growth in regulated markets compared to unregulated ones as they provide more stability and less disruption. In the US, the legislature protects licensed operators

7) The US market is the highly interesting component of this company. Following 2020 and heavy budget deficits, US states are under increasing pressure to regulate sportsbetting to capture extra income. Kambi is now live in 13 US states

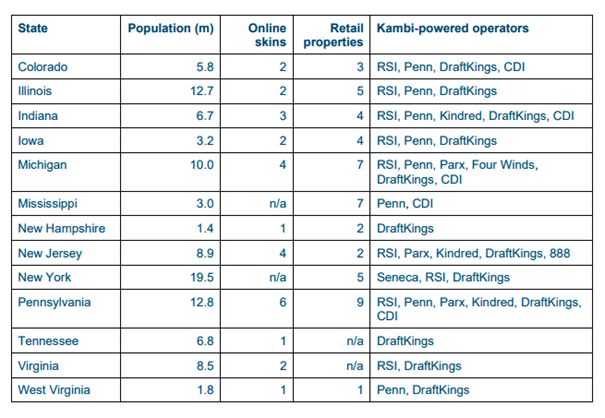

8) The US market is growing double digits q/q as you can see in the table below, credit to @venturaFPC More numbers and interesting info about the US market can be found here: bit.ly/3rJEK3q

9) Although their US partner DraftKings (DK) is posed to leave the agreement in September after acquiring SBTech, Kambi has an impressive line-up of partners seen below. There might also be technical complications delaying the DraftKings migration

10) Additionally, Kambi will be an attractive partner for those afraid of sharing valuable and sensitive data with SBTech following the DraftKing acquisition. This was the case for Kambi while Kindred still owned them

11) Without spending too much time on US state opportunities, the Mohegan Sun won the sole rights to operating in Connecticut. Kambi has an agreement with the Mohegan Sun and basically gets monopoly on a state with a 3.7m population

12) Working in Kambi’s favor is their overview of risk lines vs single state actors. They can easily see where the money is moving on a national level, whereas single state actors are left in the dark. It simply makes no sense to take on the risk management inhouse

13) Additionally, the Wire Act legislation prevents the movement of funds between states, making it tricky for big actors in one state expand to neighbouring ones without taking huge precautionary measures moving funds out of their original state

14) Besides a solid European and US coverage, Kambi has expanded its footprint in Latin America through Argentinian Casino Magic. A deal has also been signed with Racing and Wagering Western Australia

15) Financials: The company finished 2020 on a very high note (in spite of sports being severely impacted for 4 months). Q4 revenue up 76% y/y, operating profit 260% increase y/y. Cash flow increased from €4.4m to €20.5. FY 2020 operating profit up 119% y/y

16) Kambi’s platform is built for scalability. Operating went from 23.1% Q4 19 (FY 16%) to 47.3% Q4 2020 (FY 27.4%). This is a pattern EVO started showing early on, and I think Kambi's business model can copy a similar trajectory (save for EVO’s 56% margin)

17) Shareholders: Chairman (nomination comittee) Anders Ström founded Kindred in 1997 and Kambi in 2010. He owns 5.4m shares, 17.5% of the company. Although he has sold portions throughout the last few years, he thankfully remains heavily involved

18) I remain confident in Kambi’s ability to scale up in the US, and other regulated markets across the world. Their focus on growth in regulated markets have served them well thus far, and the scalability of their platform is increasingly fuelling bottom-line figures

19) Little cherry on top: $Kambi is now live in the 14th US state today through @OaklawnRacing through @ChurchillDowns, #Arkansas. #sports #sportsbetting #kambi

• • •

Missing some Tweet in this thread? You can try to

force a refresh