Mid-month portfolio update -

$ACTC $ADYEY $AFTPY $CCIV $CRWD $CURI $DKNG $DOCU $EH $FSRV $GHVI $IPOE $LOTZ* $MELI $OPEN $OZON $PINS $PLTR $PSAC* $ROKU $RTP $SE $SFTW $SKLZ $SNOW $TWLO #NQ_F

*beaten down rentals

Levered long, no hedges in place

$ACTC $ADYEY $AFTPY $CCIV $CRWD $CURI $DKNG $DOCU $EH $FSRV $GHVI $IPOE $LOTZ* $MELI $OPEN $OZON $PINS $PLTR $PSAC* $ROKU $RTP $SE $SFTW $SKLZ $SNOW $TWLO #NQ_F

*beaten down rentals

Levered long, no hedges in place

Thoughts -

Sold $SQ due to weak growth estimates/bitcoin exposure

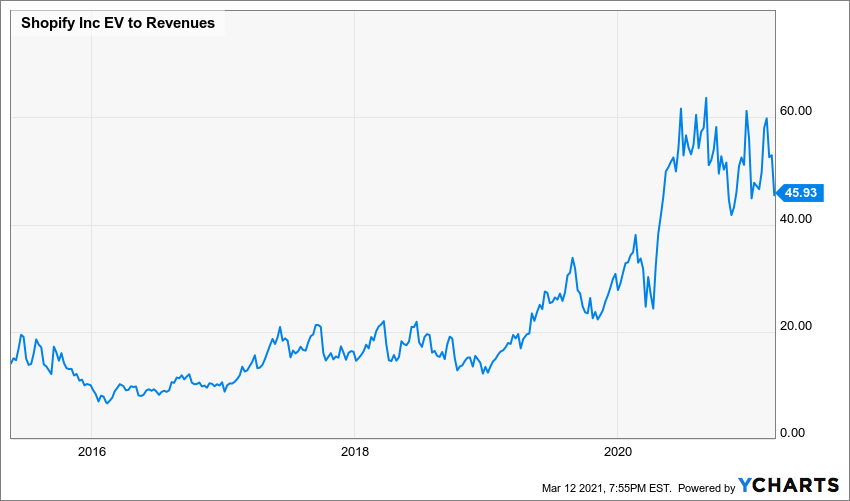

Sold $SHOP due to 45X multiple, pre-COVID was 15-20X

Sold $STNE to add more to severely beaten down names

Sold $VRM after 8 months as tough biz/execution issues

Sold $ACIC and $AACQ to invest in $CCIV $EH $RTP

Sold $SQ due to weak growth estimates/bitcoin exposure

Sold $SHOP due to 45X multiple, pre-COVID was 15-20X

Sold $STNE to add more to severely beaten down names

Sold $VRM after 8 months as tough biz/execution issues

Sold $ACIC and $AACQ to invest in $CCIV $EH $RTP

I'd bought shares of $SHOP in spring '20 during COVID crash and over past year, the stock has quadrupled!

Its multiple is super-stretched now (pre-COVID was between 10-22X). Still love the business, after multiple has normalised, will probably re-invest.

Chart from @ycharts

Its multiple is super-stretched now (pre-COVID was between 10-22X). Still love the business, after multiple has normalised, will probably re-invest.

Chart from @ycharts

• • •

Missing some Tweet in this thread? You can try to

force a refresh