Deregulation of the downstream oil & gas sector in Nigeria is one topic that has been on for so long, you will be forgiven for thinking it's a yearly ritual in the country.

#FixOurOil

#FixOurOil

Over the years, successive attempts by various government administrations have failed in delivering a fully deregulated downstream market that should be based on the basic economic principle of DEMAND and SUPPLY.

#FixOurOil

#FixOurOil

In March 2020, downstream oil & gas sector regulators announced the implementation of the deregulated system of the sector. This meant that prices of petroleum products will be determined by the international price & the demand & supply

#FixOurOil

#FixOurOil

Pump price dropped from N145/liter to range between 123.5/liter & 125/liter. Everyone thought the oil sector was finally getting closer to the promised land. This was not the case, sadly 😔

#FixOurOil

#FixOurOil

Gradual rises in the months that followed saw pump price of Premium Motor Spirit (PMS) rise to as high as N168/liter even though the international market prices dropped

#FuxOurOil

#FuxOurOil

This disagreement between pump price & international price caused people to wonder if deregulation of the oil & gas sector was the right thing. There were even suggestions that industry players were taking advantage to enrich themselves

#FixOurOil

#FixOurOil

Truth is, a FULLY DEREGULATED downstream oil and gas sector would create investment avenues, hence increase wealth creation, expand revenue generation avenues for the govt through direct & indirect taxation.

#FixOurOil

#FixOurOil

For a successful deregulation of the downstream sector, there needs to be a market condition that guarantees supply of products at commercial prices to customers. This market condition is only possible through the creation of a competitive market environment

#FixOurOil

#FixOurOil

Full deregulation of the downstream oil and gas sector should not be limited to the removal of government subsidies alone. The concept of deregulation as regards the downstream sector should be all encompassing & not just about removal of subsidies

#FixOurOil

#FixOurOil

A strong regulator should be brought (not to fix product prices) in to monitor & enable transparent & fair competition amongst players

&

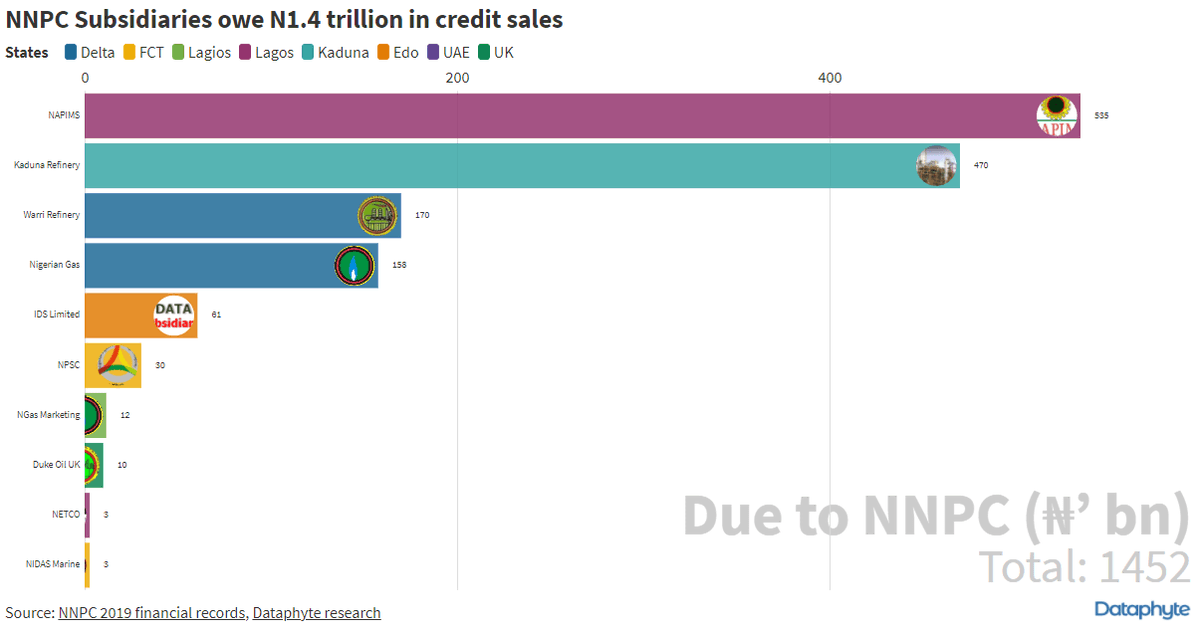

The Nigerian Government shouldn't be charged with the responsibility of importing PMS into the country through the NNPC

#FixOurOil

&

The Nigerian Government shouldn't be charged with the responsibility of importing PMS into the country through the NNPC

#FixOurOil

• • •

Missing some Tweet in this thread? You can try to

force a refresh