VOLKSWAGEN FOLLOWS TESLA'S PLAYBOOK

"It’s a mirror image to what Tesla has done, and it’s working"

“It’s a carbon copy strategy, and the whole reason is to try and get investors to pay for the electric transition"

- Matthias Schmidt

politico.eu/article/volksw…

"It’s a mirror image to what Tesla has done, and it’s working"

“It’s a carbon copy strategy, and the whole reason is to try and get investors to pay for the electric transition"

- Matthias Schmidt

politico.eu/article/volksw…

VW's share price is up more than +17% over the last week and nearing heights that were only last seen before the 2015 Dieselgate emissions scandal

"Our goal is to secure a pole position,” VW’s CEO Herbert Diess said of his electromobility plan during Monday's Power Day — an event marketed and produced to ape a Tesla or Apple product launch

Volkswagen this week announced a massive expansion of its electric car plans with multibillion-euro moves on battery cell production and software development aimed at cutting off Tesla by copying its strategy

But unlike Elon Musk’s "TechnoKing" persona, Diess struck a more reserved figure, handing the broadcast off to executives from the Porsche and Audi brands to outline why battery technology is so critical to the company's future

Despite the dry Teutonic delivery, Diess’ message is just as gung-ho as a California keynote

The Power Day was pulled together in just two weeks to head off unease from investors about a lack of clear direction from Wolfsburg on its battery strategy after Tesla held its latest Battery Day event late last year, said a VW official who asked not to be named

Under the plan, VW will aim to have an interest in six battery plants in Europe by 2030 at a cost of around $29 billion, according to estimates by BloombergNEF

Meanwhile, Diess said 60% of the company's vehicle sales should be electric by the end of the decade

Meanwhile, Diess said 60% of the company's vehicle sales should be electric by the end of the decade

There will also be a shift of internal resources to software development for autonomous vehicles

Just like its rival, that means moving fast and investing big

Just like its rival, that means moving fast and investing big

"It’s a mirror image to what Tesla has done, and it’s working,” said Matthias Schmidt, a Berlin-based auto analyst, citing the boom in VW's share price — up more than +17% over the last week and nearing heights last seen before the 2015 Dieselgate emissions scandal

"It’s a carbon copy strategy, and the whole reason is to try and get investors to pay for the electric transition"

Since taking VW's top job in 2018, Diess has been trying to clean up the mess of litigation and brand damage caused by Dieselgate while pushing for electrification

Since taking VW's top job in 2018, Diess has been trying to clean up the mess of litigation and brand damage caused by Dieselgate while pushing for electrification

Diess is very much aware of his target: The two CEOs regularly exchange emails

They shared a stage in Berlin when Musk announced plans for a German gigafactory in late 2019

They shared a stage in Berlin when Musk announced plans for a German gigafactory in late 2019

And a big PR coup came last September when Diess made a splash with a video of himself driving Musk along an airstrip not far from Volkswagen's headquarters to a spy film soundtrack

"I think for a non-sporty car it's pretty good," Musk told Diess of the electric VW ID.3 that has become a flagship e-model for the company

For VW management, Tesla's success has been a driver for the company's own transition despite opposition from some executives uncertain about a costly and disruptive move away from fossil fuels

“We always see Tesla as an accelerator for our revolution,” said the VW official

“We always see Tesla as an accelerator for our revolution,” said the VW official

The battle between upstart Tesla and Diess's 83-year-old German giant is centered just outside Berlin, where Tesla is building a car plant capable of producing 500,000 electric vehicles a year

Musk has also claimed the site will have the largest battery factory in the world

Musk has also claimed the site will have the largest battery factory in the world

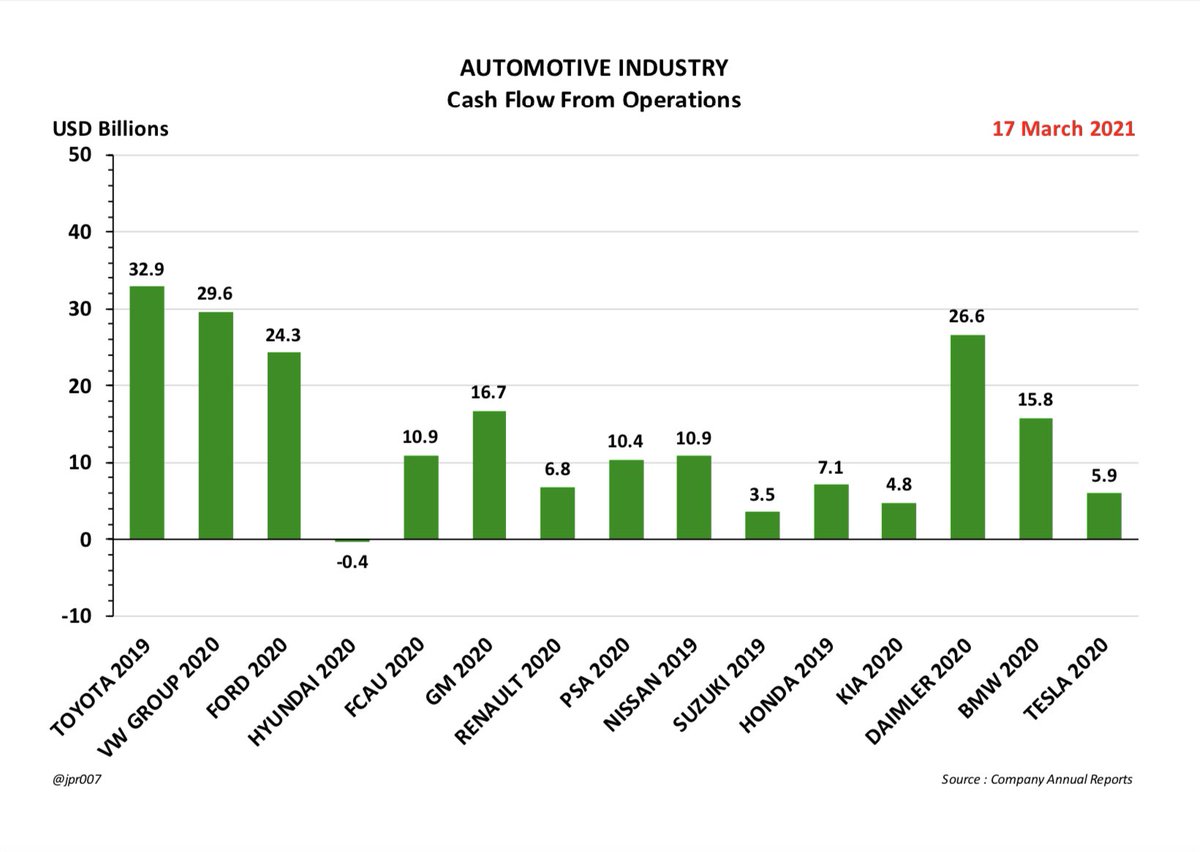

Tesla is by far the world's most valuable car company, with a market valuation of $676 billion compared to VW's $120 billion, but it is a niche player in terms of global auto sales

Their Enterprise Values are more comparable due to VW's huge Debts

Their Enterprise Values are more comparable due to VW's huge Debts

But Tesla is growing fast

Its new Berlin facility, along with a factory in China, ramps up the challenge to VW

Musk also wants Tesla to develop a cheaper model targeted at the German market

Its new Berlin facility, along with a factory in China, ramps up the challenge to VW

Musk also wants Tesla to develop a cheaper model targeted at the German market

Diess also wants to use part of the EU's pandemic recovery fund to help cover the €2.4 billion cost of building a battery plant in Spain and transitioning a factory run by its Seat unit to churn out electric cars

"Tesla might receive lots of euros for their battery facility near Berlin," Diess said on Tuesday

"We need the same conditions that our competitors enjoy"

While recognizing of course the huge Debt support that VW already receives from the ECB

"We need the same conditions that our competitors enjoy"

While recognizing of course the huge Debt support that VW already receives from the ECB

Ben Kallo, an analyst with financial advisory Baird, reckons the result could see at least two electric vehicle ecosystems — one dominated by Tesla with most of its technology in-house, akin to Apple's iPhone — and a rival similar to Samsung which uses Android

Tesla's case is built on advanced batteries and cutting-edge autonomous driving technology — both areas where VW is aiming to challenge

"There is only one complex software domain where Europe still has a chance to play a leading role: the next generation of automotive software,” Diess said Tuesday

If the company can secure a revenue stream from in-vehicle software, it can use that profit to cut the cost of its electric cars, making e-mobility more affordable

"They are basically trying to use their scale to lower their costs, and the gap they need to build is on software,” said Schmidt

"Software is really key in getting the price of electric cars down, and it could change the whole model of the industry"

"Software is really key in getting the price of electric cars down, and it could change the whole model of the industry"

On batteries, as in overall strategy, the two companies are now in parallel lanes

Last year Tesla outlined plans to reduce the cost of battery cells by 56% through an efficiency drive and series of technical upgrades

Last year Tesla outlined plans to reduce the cost of battery cells by 56% through an efficiency drive and series of technical upgrades

Volkswagen said Monday it can slash its cell costs by 50% by developing a one-size-fits-all format for most use cases

"[They] have both selected one cell format that they want to mass produce to help push down costs," said James Frith, head of energy storage at BloombergNEF

"[They] have both selected one cell format that they want to mass produce to help push down costs," said James Frith, head of energy storage at BloombergNEF

"It's hard to say if one is being more aggressive than the other"

A key event for either side could be a breakthrough in solid-state batteries, which are supposed to have a higher energy density than the lithium-ion technology used today

A key event for either side could be a breakthrough in solid-state batteries, which are supposed to have a higher energy density than the lithium-ion technology used today

VW has an investment in QuantumScape — an American company working on improvements in cell technology

The benefits of such batteries could be profound

The benefits of such batteries could be profound

For example, charging times could be less than half compared to today's best batteries, and lighter materials could boost vehicle range by 30%, VW says

Sometime after 2025, the German carmaker said it's aiming to cut ultra-fast charging time in its batteries for a trip of 450 kilometers down to 12 minutes using the technology, which is less than half today's maximum charge time

This is the distance between Munich and Leipzig, or Las Vegas and Los Angeles

The problem is getting the prototypes to commercial development

"It's not true we can say now at what time point solid state batteries will be rolled out," Diess said

The problem is getting the prototypes to commercial development

"It's not true we can say now at what time point solid state batteries will be rolled out," Diess said

"In lab testing they work well, but we are lacking a concept and an industrialized solution"

That sentiment echoes what Musk told German politicians late last year during an event on battery technology organized by the country's economy ministry

That sentiment echoes what Musk told German politicians late last year during an event on battery technology organized by the country's economy ministry

“There’s quite a bit more work in building the machine that builds the machine,” Musk said of the problems rolling out battery breakthroughs on an industrial scale

“The very difficult part is then scaling up that production"

“The very difficult part is then scaling up that production"

That makes predicting a champion in the race to dominate the electric car field difficult to call

"It's likely that the winner will be decided based on its cathode material producers and manufacturing costs," said Frith

"It's likely that the winner will be decided based on its cathode material producers and manufacturing costs," said Frith

• • •

Missing some Tweet in this thread? You can try to

force a refresh