Interaction with the Untied Spirits CEO notes (Motilal Oswal): 🧵

Market cap: 38,980 crores

Revenues: 28,823 crores

P/B: 10.78

P/S: 1.34

@dmuthuk

Market cap: 38,980 crores

Revenues: 28,823 crores

P/B: 10.78

P/S: 1.34

@dmuthuk

Consumer sentiment continues to improve month on month. After 49% YoY volume decline in 1QFY21, volumes had already recovered to flattish levels YoY by 3QFY21. Thus, further sequential improvement is encouraging.

Innovation & renovation activity is also likely to pick up further

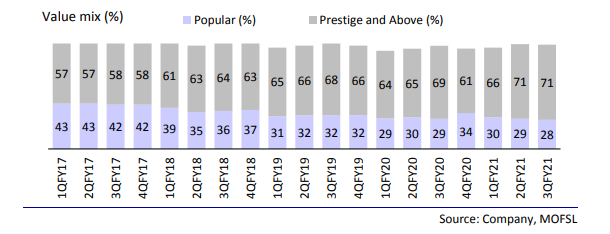

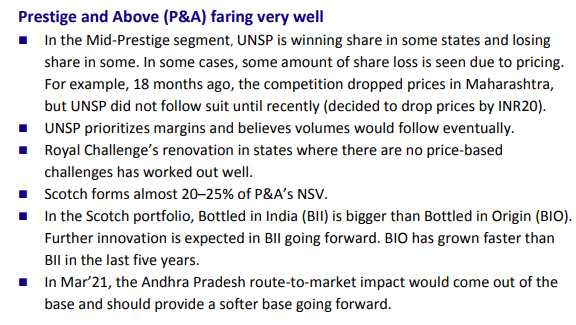

Mr Kripalu believes the ongoing Prestige & Above (P&A) trend would only accelerate as high involvement categories such as alcohol would move toward premium products as they get more affordable for the population

Mr Kripalu believes the ongoing Prestige & Above (P&A) trend would only accelerate as high involvement categories such as alcohol would move toward premium products as they get more affordable for the population

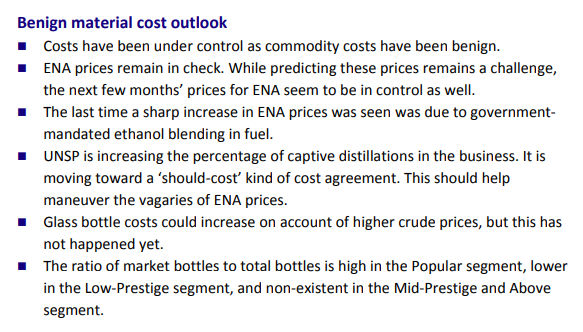

State budgets thus far in February and March have not seen any material increase in excise and VAT, which augurs well – after steep increases in the state budgets last year. The material cost outlook also appears benign.

3/17

3/17

Regulatory Environment:

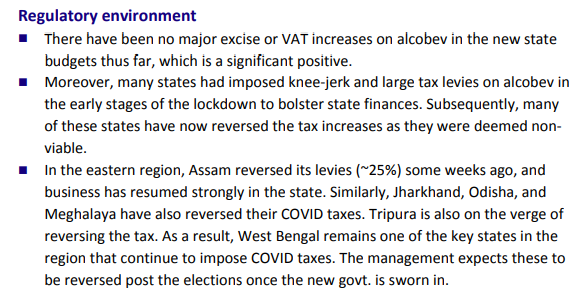

There have been no major excise or VAT increases on alcobev in the new state budgets thus far, which is a significant positive.

Most states are withdrawing Covid related taxes.

4/17

There have been no major excise or VAT increases on alcobev in the new state budgets thus far, which is a significant positive.

Most states are withdrawing Covid related taxes.

4/17

States that had imposed a tax of 25% and above in the wake of COVID are likely to end up with lower tax revenue from liquor sales and also collect less tax per bottle due to consumer downtrading, the Confederation of Indian Alcoholic Beverage Companies (CIABC) stated.

5/17

5/17

The Delhi government has decided to withdraw the special COVID fee levied at 70% on MRP, which it had placed on the sale of all types of liquor in the state.

6/17

6/17

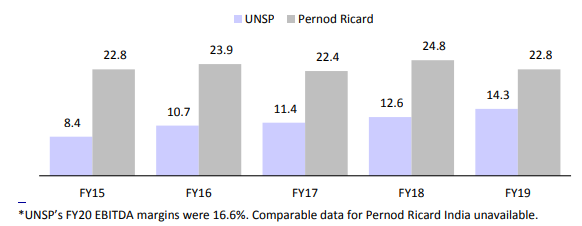

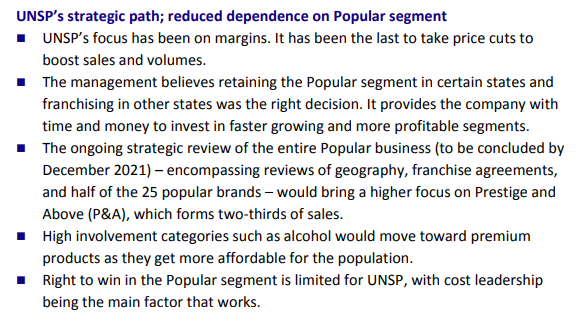

Management focus on more profitable segment. Moving in the right direction. Also check our detailed presentation on United Spirits here: bit.ly/3cXm0XW

7/17

7/17

Material cost:

Under the new excise policy of West Bengal, the rate of excise duty and additional excise duty would depend on the ex-distillery price (EDP) of the liquor – instead of excise duty and sales tax being levied on MRP.

9/17

Under the new excise policy of West Bengal, the rate of excise duty and additional excise duty would depend on the ex-distillery price (EDP) of the liquor – instead of excise duty and sales tax being levied on MRP.

9/17

Home Delivery (Could this boost sales?)

UNSP does not undertake home deliveries. Deliveries, if any, are done by retailers.

West Bengal is the only state wherein the home delivery channel has been successfully implemented, albeit on a small scale.

10/17

UNSP does not undertake home deliveries. Deliveries, if any, are done by retailers.

West Bengal is the only state wherein the home delivery channel has been successfully implemented, albeit on a small scale.

10/17

Home delivery is now permitted in Mumbai; many top-end stores do 30–40% of their sales via home deliveries. Some retailers are even creating apps for such markets.

11/17

11/17

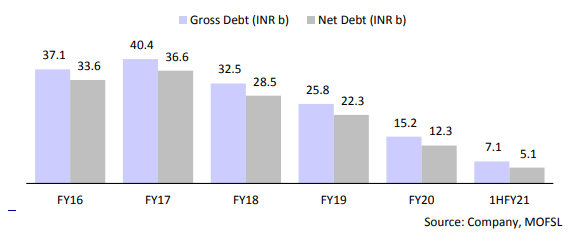

Balance sheet Working capital:

At present, the company is seeing its best cash flow performance. Debt is down to below INR10b. Receivable days are at their best thus far.

Payments from states have been timely or faster than before. The overall WC cycle has been strong.

12/17

At present, the company is seeing its best cash flow performance. Debt is down to below INR10b. Receivable days are at their best thus far.

Payments from states have been timely or faster than before. The overall WC cycle has been strong.

12/17

Asset/Value unlocking – The company sold some flats in Mumbai last month. The overall cleanup of properties has been satisfactory.

13/17

13/17

Spirit Categories and trends:

The White Spirits category has failed to take off in India. Gin is now taking off to some extent (Stranger and Sons, Jaisalmer, and so on). UNSP is also focusing on its own brands.

14/17

The White Spirits category has failed to take off in India. Gin is now taking off to some extent (Stranger and Sons, Jaisalmer, and so on). UNSP is also focusing on its own brands.

14/17

Globally, resurgence is seen in white spirits (apart from vodka) – tequila is gaining popularity in the US, Mexico, and South America and gin in Europe (at just 30–40 calories per serving, it may appeal as a healthier option to the health conscious European population).

15/17

15/17

The consumption of whites is preferred (over browns) on occasions that favor beer or lighter spirits. For example, gin could be consumed as a refreshing early

evening drink.

16/17

evening drink.

16/17

Diageo has acquired a seltzer brand in the US. These can be less sweet and much lighter, with low alcohol content. The Seltzer category holds great potential and is one that UNSP may explore in India in the future.

17/17

End of Thread 🧵

17/17

End of Thread 🧵

• • •

Missing some Tweet in this thread? You can try to

force a refresh