Thread on IEX 🧵

Market cap: 10,790

Revenues: 257 crores

P/E: 56

P/B: 22.71

ROCE: 59.93

ROE: 47.32

Detailed presentation,

bit.ly/3raXeso

Here we go 👇

1/25

Market cap: 10,790

Revenues: 257 crores

P/E: 56

P/B: 22.71

ROCE: 59.93

ROE: 47.32

Detailed presentation,

bit.ly/3raXeso

Here we go 👇

1/25

Potential over the longer term for the exchanges/short term remains huge;

A look into Europe reveals the 2 largest European power exchanges account for ~40% of the EU's electricity consumption (v/s ~4% in India).

Power exchanges have gained significant share:

2/25

A look into Europe reveals the 2 largest European power exchanges account for ~40% of the EU's electricity consumption (v/s ~4% in India).

Power exchanges have gained significant share:

2/25

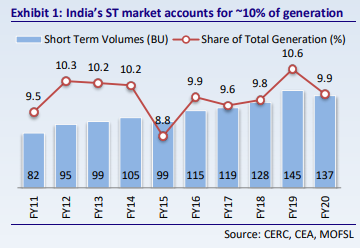

-(>4% in FY20 v/s <2% in FY11) over the past decade, despite the overall share of the short-term market remaining flat at ~10% of the total electricity generation.

IEX- Dominant position with a well-evolved platform:

IEX enjoys early-mover advantage and-

3/25

IEX- Dominant position with a well-evolved platform:

IEX enjoys early-mover advantage and-

3/25

strong brand recognition among the Energy market participants;

Technology innovation, active market participation, & transparent operations have helped the company maintain its market share;

~97% of the traded volumes of electricity contracts in the day-ahead market (DAM)

4/25

Technology innovation, active market participation, & transparent operations have helped the company maintain its market share;

~97% of the traded volumes of electricity contracts in the day-ahead market (DAM)

4/25

-and term-ahead market (TAM) are collectively conducted over IEX;

The subsequent liquidity is a deterrent to competition, and we expect IEX to maintain its competitive advantage.

New product launches to aid market share gains:

IEX's share within ST to increase to 51%-

5/25

The subsequent liquidity is a deterrent to competition, and we expect IEX to maintain its competitive advantage.

New product launches to aid market share gains:

IEX's share within ST to increase to 51%-

5/25

-in FY23 from an est. 44% in FY21, leading to a 20% CAGR in volumes over FY21-23.

Lowe operating cost structure aids profitability:

Transaction fee (~90% of IEX's revenue) is the key revenue driver for IEX;

The company earns INR 0.04/kWh each from buyer and seller;

6/25

Lowe operating cost structure aids profitability:

Transaction fee (~90% of IEX's revenue) is the key revenue driver for IEX;

The company earns INR 0.04/kWh each from buyer and seller;

6/25

~10% of IEX's revenue is primarily based on admission and membership fees;

The cost structure is lean, with an EBITDA margin of ~80% ;

With an insignificant CAPEX requirement and negative working capital, FCF generation would remain high and-

7/25

The cost structure is lean, with an EBITDA margin of ~80% ;

With an insignificant CAPEX requirement and negative working capital, FCF generation would remain high and-

7/25

-broadly mimic growth in profitability.

Key risk includes:

A cut in transaction fees, increased competition intensity, stagnant share of the short-term market, and a change in market design;

Growth in the gas exchange platform could provide an upside.

8/25

Key risk includes:

A cut in transaction fees, increased competition intensity, stagnant share of the short-term market, and a change in market design;

Growth in the gas exchange platform could provide an upside.

8/25

India's short-term power market accounts for 10-11% of the total electricity generation;;

Its share has remained stagnant over the past decade;

Within, ST, exchanges have doubled their market share to ~40% from <20% during the period;

9/25

Its share has remained stagnant over the past decade;

Within, ST, exchanges have doubled their market share to ~40% from <20% during the period;

9/25

Other forms of trade available in ST are: Bilateral contracts through traders, banking transactions, Deviation Settlement Mechanisms (DSM);

Bilateral trader contracts are generally longer duration contracts, typically >1 month.

10/25

Bilateral trader contracts are generally longer duration contracts, typically >1 month.

10/25

Banking on new product launches:

Currently, the buy-side is slightly concentrated with the top 5 buyers accounting for 58% of Real-Time Market volumes;

In terms of Cross border transactions, the company is in talks with the National Load Dispatch Centre;

11/25

Currently, the buy-side is slightly concentrated with the top 5 buyers accounting for 58% of Real-Time Market volumes;

In terms of Cross border transactions, the company is in talks with the National Load Dispatch Centre;

11/25

Cross-border transactions can help add 3-4BUs in the 1st year of launch.

Market coupling unlikely in the near future:

Coupling coming only in tandem with Market-Based Economic Dispatch.

12/25

Market coupling unlikely in the near future:

Coupling coming only in tandem with Market-Based Economic Dispatch.

12/25

Market share gains continue:

The launch of new products has provided a fillip with TAM+RTM now contributing 20% of IEX's volumes (v/s less than 10% in FY20);

Volume momentum in the first 2 months of 4QFY21 has been strong at IEX, with over 45% Y-o-Y growth;

13/25

The launch of new products has provided a fillip with TAM+RTM now contributing 20% of IEX's volumes (v/s less than 10% in FY20);

Volume momentum in the first 2 months of 4QFY21 has been strong at IEX, with over 45% Y-o-Y growth;

13/25

Over the past decade (FY11-20), volume on IEX has jumped >4x;

Huge growth potential:

As long term power purchase agreement slowly get utilized and market reforms pan out, the power market could evolve and shift toward the short-term;

14/25

Huge growth potential:

As long term power purchase agreement slowly get utilized and market reforms pan out, the power market could evolve and shift toward the short-term;

14/25

While an oversupplied market keeps exchange prices in check:

Low prices in the exchange market have additionally continued to drive demand from DISCOMs.

ST market- an inherent dependence remains:

A look into some of the major states' tariff orders suggests-

15/25

Low prices in the exchange market have additionally continued to drive demand from DISCOMs.

ST market- an inherent dependence remains:

A look into some of the major states' tariff orders suggests-

15/25

there are sufficient long term power purchase agreements in place to meet the requisitioned demand;

However, factors such as: disruption in/ the unavailability of supply, an unanticipated surge in demand have driven DISCOM's dependence on ST volumes,-

16/25

However, factors such as: disruption in/ the unavailability of supply, an unanticipated surge in demand have driven DISCOM's dependence on ST volumes,-

16/25

to a large extent, in recent years.

IEX's entry into the real-time market (RTM)-

would help the company cater to this variability and provide the means for market participants to better manage their scheduling instead of relying on DSM;

17/25

IEX's entry into the real-time market (RTM)-

would help the company cater to this variability and provide the means for market participants to better manage their scheduling instead of relying on DSM;

17/25

Over the past decade, a transparent and efficient price discovery mechanism reduced transmission constraints, and an oversupplied market have helped IEX nearly double its market share within the ST market;

The launch of longer duration contracts (LDC) would help the company -

The launch of longer duration contracts (LDC) would help the company -

gain a footing in some share of the bilateral contracts placed. Going forward: its entry into RTM, facilitated by increasing renewable penetration & peaking power management, the launch of longer duration contracts, and continued opportunities for OA consumers (by an oversupplied

market and liquidity) would help drive the market share gains.

The European Energy Exchange (EEX), which operates the largest spot power exchange have almost doubled over the past 5 years, even as overall power consumption within the Eurozone has remained largely flat;

20/25

The European Energy Exchange (EEX), which operates the largest spot power exchange have almost doubled over the past 5 years, even as overall power consumption within the Eurozone has remained largely flat;

20/25

Open Access (OA)- price arbitrage play, a sharp rise in CSS/SA may not recur:

While prices on exchanges are a key factor in determining the viability of OA, the imposition of state-demanded surcharge in the form of Cross-Subsidy Surcharge (CSS) and Additional Surcharge (AS)-

While prices on exchanges are a key factor in determining the viability of OA, the imposition of state-demanded surcharge in the form of Cross-Subsidy Surcharge (CSS) and Additional Surcharge (AS)-

Increased the landed cost for OA;

Increasingly, there appears to be a trend to- provide some support to OA consumers (e.g. Karnataka, in its latest tariff order, approved an AS at 50% of calculated levels, keeping in mind the interest of OA consumers),

22/25

Increasingly, there appears to be a trend to- provide some support to OA consumers (e.g. Karnataka, in its latest tariff order, approved an AS at 50% of calculated levels, keeping in mind the interest of OA consumers),

22/25

IEX collects a transaction fee on every unit of trade (buy+sell) of INR 0.04/kWh and also receives annual fees from its members;

The revenues primarily comprise:

a) A transaction fee, for executing a transactions on the exchange.

23/25

The revenues primarily comprise:

a) A transaction fee, for executing a transactions on the exchange.

23/25

b) An annual subscription fee, for trading on the platform,

c) An admission fee, a one-time fee on admission.

Employee wages were the largest cost component at ~60% of operating cost in FY20;

The EBITDA margin has increased from ~70% in FY17 due to savings in technology cost;

c) An admission fee, a one-time fee on admission.

Employee wages were the largest cost component at ~60% of operating cost in FY20;

The EBITDA margin has increased from ~70% in FY17 due to savings in technology cost;

Lower capital expenditure and negative working capital- High FCF generation:

IEX can leverage its existing technology platform to significantly add volumes;

The CAPEX requirement is insignificant, Except for the acquisition of the trading platform.

End of Thread 🧵

25/25

IEX can leverage its existing technology platform to significantly add volumes;

The CAPEX requirement is insignificant, Except for the acquisition of the trading platform.

End of Thread 🧵

25/25

• • •

Missing some Tweet in this thread? You can try to

force a refresh