Today, I bought a bag of $SPDR and in addition to that, I will be helping the team with their marketing efforts.

What is SpiderDAO? Thread below 👇

What is SpiderDAO? Thread below 👇

🔹The Concept

SpiderDAO proposes a set of tools to bring online privacy to the end user (VPN).

SpiderDAO is unique compared to other DAO's, because it bundles together hardware and software tools with on-chain elements, providing a “whale-resistant” governance solution. 🐳

SpiderDAO proposes a set of tools to bring online privacy to the end user (VPN).

SpiderDAO is unique compared to other DAO's, because it bundles together hardware and software tools with on-chain elements, providing a “whale-resistant” governance solution. 🐳

🔹The Team

The @SpiderDAO team is fully KYC'd which is always a big plus for me.

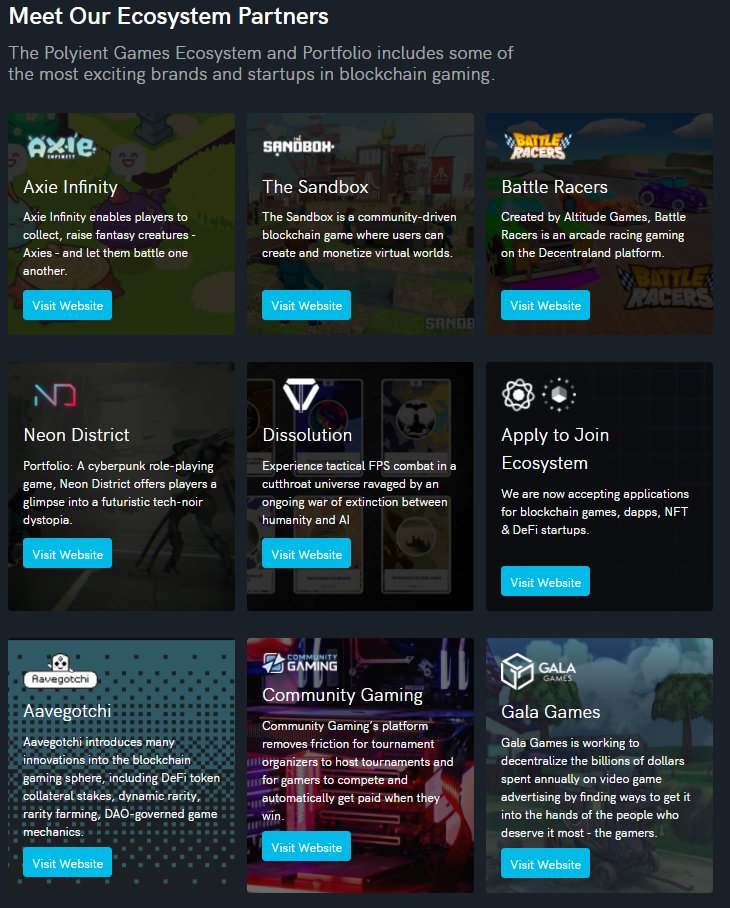

Besides that, they got a solid list of Partners and Supporters mentioned on their website.

The @SpiderDAO team is fully KYC'd which is always a big plus for me.

Besides that, they got a solid list of Partners and Supporters mentioned on their website.

🔹The Token

There is almost $1.8M in liquidity on Uniswap so that's always good to have.

It's possible to provide liquidity into this pool for up to a 360% APY currently.

There is almost $1.8M in liquidity on Uniswap so that's always good to have.

It's possible to provide liquidity into this pool for up to a 360% APY currently.

🔹Staking

There is different staking methods if you don't want to provide LP to the Uniswap pool.

Staking your tokens in these pools give you free access to the VPN service @SpiderDAO provides.

There is different staking methods if you don't want to provide LP to the Uniswap pool.

Staking your tokens in these pools give you free access to the VPN service @SpiderDAO provides.

🔹The Chart

$SPDR was able to break above the $0.047 resistance and looks to be going for a retest of the level currently. If it can hold $0.047-0.051 I think we're at the start of a nice run. Still a new coin so not much holding it back.

$SPDR was able to break above the $0.047 resistance and looks to be going for a retest of the level currently. If it can hold $0.047-0.051 I think we're at the start of a nice run. Still a new coin so not much holding it back.

That's everything for now. I will keep you guys updated on further developments and price action updates.

Always do your own research and if you have any further questions don't hesitate to ask.

The SpiderDAO Telegram is active as well.

t.me/SpiderDAO

Always do your own research and if you have any further questions don't hesitate to ask.

The SpiderDAO Telegram is active as well.

t.me/SpiderDAO

• • •

Missing some Tweet in this thread? You can try to

force a refresh