I think it is important to highlight some underlying issues in the global crude market.

1) the physical market has been weak for months and not the "weeks" being peddled by the narrative shift

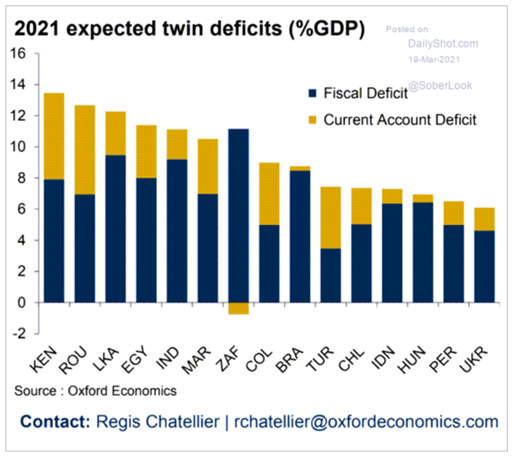

2) the bigger issue now is the rising rates at the EM level and "new" demand headwinds

1) the physical market has been weak for months and not the "weeks" being peddled by the narrative shift

2) the bigger issue now is the rising rates at the EM level and "new" demand headwinds

We have talked about (been bearish) the emerging market world as cracks were already forming before the US 10 Yr took off. Monetary policy is already shifting tighter as Fiscal tries to remain accommodative- but costs are rising and pressuring government balance sheets.

COVID cases are rising again in some key spots limiting travel and the "normalization" of activity throughout Asia/Europe. The reduction of activity will only stress balance sheets further as jobs data/inflation impact underlying wages and spending.

The US normally sees a shift higher in activity during Spring/Easter Break, but the amount of floating product in the world is flowing to our shores given the glut in the market. The overhang in employment/cost of living/wage compression remains the anchor against a full recovery

This is all occurring with 10M barrels of spare capacity offline, physical diffs at 10-11 month lows, Nigeria OSPs for April at lows, WAF not clearing, ESPO/CPC softening again and North Sea pressure- as refiners maintain low run rates while still building product storage.

We are now coming into shoulder season, which will be bigger with China refinery maintenance levels- but the current physical market reflects activity that would happen AFTER those assets ramp back up.

The US oil/refined product market is global and the US is currently 15% of the crude demand market (as measured by refining throughput). The paper market ran well ahead of the physical, which was already reflecting demand issues that have now made headlines.

• • •

Missing some Tweet in this thread? You can try to

force a refresh