Pat Dorsey’s “The Five Rules for Successful Stock Investing" is one of the best books out there for long-term investors in individual stocks. Excellent summary of that book. 👏

knowledgecapitalist.wordpress.com/2009/12/17/boo…

knowledgecapitalist.wordpress.com/2009/12/17/boo…

Content in the article ⬇️

✔️Economic Moats

✔️Methods to create a sustainable competitive advantage

✔️Conducting Financial analysis

✔️Analyzing an investment & its overall economic prospects

✔️Spotting & avoiding financial accounting tricks

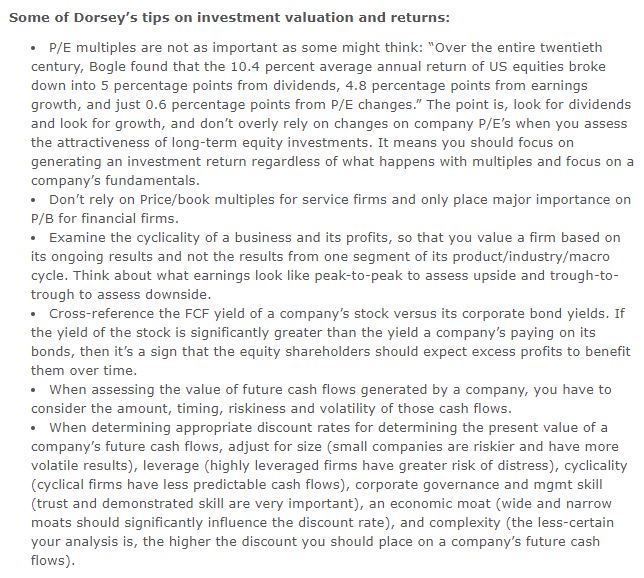

✔️Investment valuation & returns

✔️Economic Moats

✔️Methods to create a sustainable competitive advantage

✔️Conducting Financial analysis

✔️Analyzing an investment & its overall economic prospects

✔️Spotting & avoiding financial accounting tricks

✔️Investment valuation & returns

• • •

Missing some Tweet in this thread? You can try to

force a refresh