My name is Bond, Safe Bond. And I have a license to yield

A quick lesson in bonds for beginner investors

/THREAD/

A quick lesson in bonds for beginner investors

/THREAD/

In the age of low interest rates and high-growth stocks, few seem to care about investing in bonds

But what are they and what do you need to know about them?

But what are they and what do you need to know about them?

A bond is a debt investment in which an investor loans money to a corporate entity or government

The investor receives an interest at specified intervals and at the end he is paid back the money he loaned

The investor receives an interest at specified intervals and at the end he is paid back the money he loaned

Each bond has four main factors:

1. Face Value: The amount loaned

2. Coupon Rate: The interest rate paid to the investor at specified intervals, usually yearly

1. Face Value: The amount loaned

2. Coupon Rate: The interest rate paid to the investor at specified intervals, usually yearly

3. Maturity: After how many years the principal will be paid back to the investor

4. Credit rating: A rating given by a rating agency regarding the bond issuer’s financial status and trustworthiness.

The higher the score, the safer your investment is considered.

4. Credit rating: A rating given by a rating agency regarding the bond issuer’s financial status and trustworthiness.

The higher the score, the safer your investment is considered.

The face value should not be confused with the price

The price can fluctuate depending on the change in government interest rates, or the financial status of the company/government that issued the bond

The price can fluctuate depending on the change in government interest rates, or the financial status of the company/government that issued the bond

You might want to sell the bond at a lower value (at discount) if:

• Bond issuer's financial status deteriorates

• Government has raised interest rates

• Bond issuer's financial status deteriorates

• Government has raised interest rates

You might be able to sell the bond for a higher price in the bond market (at premium) if:

• Bond issuer's financial status improves

• Government has lowered interest rates

• Bond issuer's financial status improves

• Government has lowered interest rates

The interest rates (i.e. coupon rates) are different for different types of bonds and issuers

A good company will have a lower interest rate than one that is considered risky

Also, the longer the maturity period the higher the interest rate will be

Let's see some examples

A good company will have a lower interest rate than one that is considered risky

Also, the longer the maturity period the higher the interest rate will be

Let's see some examples

Good Company Inc. wants to raise money to build a new factory and expand its business and decides to issue corporate bonds

Since this company has a good reputation and financial standing, the interest rate will be 3.5% for a 5-year maturity

John Bond buys a bond for $1,000

Since this company has a good reputation and financial standing, the interest rate will be 3.5% for a 5-year maturity

John Bond buys a bond for $1,000

This means for the next 5 years he will receive:

• $35 each year in interest

• $1,000 after the five years have ended and the bond matures

• $35 each year in interest

• $1,000 after the five years have ended and the bond matures

In the meantime, Good Company Inc. performed better than expected in terms of revenues and earnings

John decides to check the bond market and finds a buyer who wants to buy the bond for $1,050 (at premium)

John decides to check the bond market and finds a buyer who wants to buy the bond for $1,050 (at premium)

John has two choices:

• Sell it and earn $50 plus the interest he has received so far

• Keep it until it matures and keep receiving the $35 yearly interest

• Sell it and earn $50 plus the interest he has received so far

• Keep it until it matures and keep receiving the $35 yearly interest

On the other side, company Fraud Inc. also wants to expand its business

But due to its financial standing, investors are not so keen on loaning them money

Thus, Fraud Inc. issues bonds with 12% interest rates

But due to its financial standing, investors are not so keen on loaning them money

Thus, Fraud Inc. issues bonds with 12% interest rates

John now has the option to buy this bond for $1,000 and earn $120 yearly

However, this will be a riskier investment for him

After 2 years, Fraud Inc hasn't managed to expand its operations successfully and its financial status has worsened

However, this will be a riskier investment for him

After 2 years, Fraud Inc hasn't managed to expand its operations successfully and its financial status has worsened

John now has the option to sell the bond on the market for $900 (at discount)

He has already received $240 in interest and a $100 loss on the bond value will net him a $140 profit

He has already received $240 in interest and a $100 loss on the bond value will net him a $140 profit

This comes down to a 14% return (or yield) on his $1,000 investment in two years

However, if he keeps holding the bond he risks getting paid much less, if at all, if Fraud Inc. keeps getting worse

However, if he keeps holding the bond he risks getting paid much less, if at all, if Fraud Inc. keeps getting worse

Governments also issue bonds

For example, the US government issues various types of US treasury bonds

The most important are:

1. Treasury bills: Mature in up to 52 weeks. Since they're so short-term, these are zero-coupon bonds sold at a discount to par

For example, the US government issues various types of US treasury bonds

The most important are:

1. Treasury bills: Mature in up to 52 weeks. Since they're so short-term, these are zero-coupon bonds sold at a discount to par

2. Treasury notes: Have maturities of 2, 3, 5, 7 and 10 years. They pay interest every 6 months

3. Treasury bonds: Typically mature in 30 years with interest paid every 6 months

3. Treasury bonds: Typically mature in 30 years with interest paid every 6 months

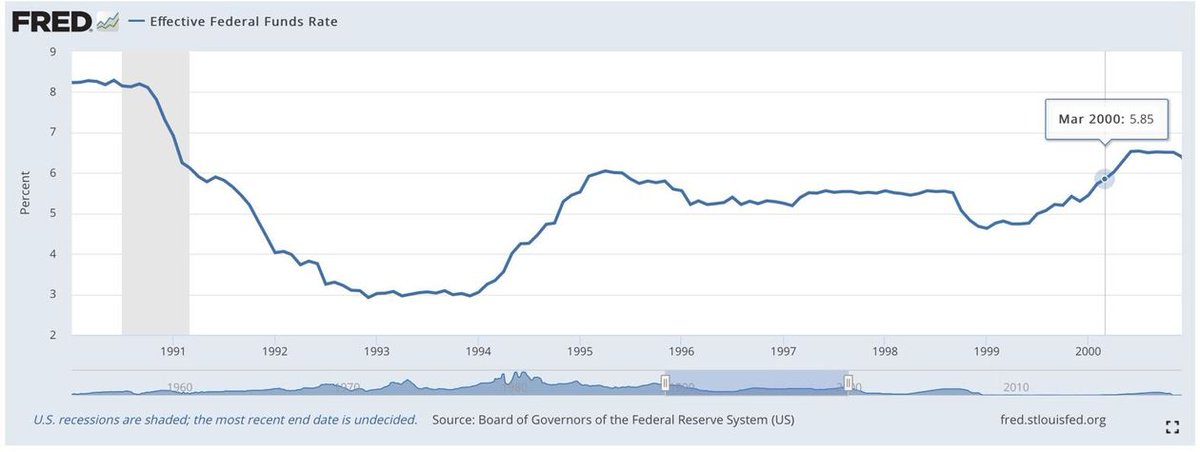

The yields, i.e. the returns on a bond investment, of government bonds determine the basis for other bonds and investments

When government bonds have lower yields, this usually lowers demand leading investors into stocks and other investments chasing higher yields

When government bonds have lower yields, this usually lowers demand leading investors into stocks and other investments chasing higher yields

This is what happened the last years with government bonds having practically zero (or even negative) yields

Investors have swarmed into stocks and cryptocurrencies

Investors have swarmed into stocks and cryptocurrencies

On the other side, when the government raises interest rates, thus creating greater demand, investors tend to rotate from stocks into bonds

The dot-com bubble burst in 2000 after the US government raised rates six times between June 1999 and May 2000 up to almost 6%

The dot-com bubble burst in 2000 after the US government raised rates six times between June 1999 and May 2000 up to almost 6%

Bonds are preferred because they guarantee a standard income

But this is also a disadvantage when interest rates or inflation increase

Bonds are also taxed differently than capital gains, something you should also take into account

But this is also a disadvantage when interest rates or inflation increase

Bonds are also taxed differently than capital gains, something you should also take into account

You should understand that bonds are not risk-free and not an easy investment as many are led to believe

As with individual stocks, you should start with bond funds, similar to index funds and ETFs

/END/

As with individual stocks, you should start with bond funds, similar to index funds and ETFs

/END/

https://twitter.com/itsKostasOnFIRE/status/1374775920595251200?s=20

If you liked this thread click below and retweet the first tweet, and follow me to stay updated

For more educational threads on financial independence and investing for beginners see below for a collection of threads

https://twitter.com/itsKostasOnFIRE/status/1345790210441928708?s=20

You can also subscribe for FREE to my newsletter to stay updated on topics of

-Finance

-Investing

-Stock market history

itskostasonfire.substack.com

-Finance

-Investing

-Stock market history

itskostasonfire.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh