Dividends Are Robbing Your Portfolio

Here's How

/THREAD/

Here's How

/THREAD/

One of the biggest myths on Money Twitter is that dividends are free money

"Buy dividend stocks and earn money while you sleep" are all the "gurus" shouting to young beginner investors

But what if I told you that those dividends are actually costing you money while you sleep?

"Buy dividend stocks and earn money while you sleep" are all the "gurus" shouting to young beginner investors

But what if I told you that those dividends are actually costing you money while you sleep?

First, a dividend is a part of the earnings that a company returns to the shareholders

It usually happens every quarter, with some companies (mostly REITs) paying them monthly

But while it's nice to see money coming to your account, you wouldn't be happy if you did the math

It usually happens every quarter, with some companies (mostly REITs) paying them monthly

But while it's nice to see money coming to your account, you wouldn't be happy if you did the math

Let's have two young investors, Mr. DRIP and Mr. Compounder

Mr. DRIP invests in 1 share of the company "Shower Inc."

"Shower Inc." pays a 2% yearly dividend, which Mr. DRIP automatically reinvests by buying more shares at the current price

Mr. DRIP invests in 1 share of the company "Shower Inc."

"Shower Inc." pays a 2% yearly dividend, which Mr. DRIP automatically reinvests by buying more shares at the current price

Mr. Compounder invests in 1 share of the company "Grower Inc."

"Grower Inc." does not pay a dividend and reinvests all the earnings back in the company

"Grower Inc." does not pay a dividend and reinvests all the earnings back in the company

Both companies are stalwarts in their industry and

• Are growing at 8% annually

• Have a P/E of 15

• Have a stock price of $100

In general, the stock price follows the growth of the business

• Are growing at 8% annually

• Have a P/E of 15

• Have a stock price of $100

In general, the stock price follows the growth of the business

In Year 1:

Mr. Drip received a $2 dividend and has to pay taxes

Dividend taxes range from 10% to 37% depending on your tax bracket

Let's assume a 20% tax, which leaves him with $1.6

Mr. Drip received a $2 dividend and has to pay taxes

Dividend taxes range from 10% to 37% depending on your tax bracket

Let's assume a 20% tax, which leaves him with $1.6

He reinvests the $1.6 by buying 0.016 shares in "Shower Inc." at $100/share

He now has 1.016 shares worth $101.6

He now has 1.016 shares worth $101.6

Mr. Compounder does not receive dividends

"Grower Inc." reinvested the $2 back in the company

Mr. Compounder now owns 1 share worth $102

"Grower Inc." reinvested the $2 back in the company

Mr. Compounder now owns 1 share worth $102

Next Year both companies grew by 8%

"Shower Inc." shares are worth now $108

Mr. DRIP receives another 2% dividend of $2.16

He pays $0.43 in taxes and reinvests the rest

He buys 0.016 additional shares at $108/share

He now has 1.032 shares worth $111.46

"Shower Inc." shares are worth now $108

Mr. DRIP receives another 2% dividend of $2.16

He pays $0.43 in taxes and reinvests the rest

He buys 0.016 additional shares at $108/share

He now has 1.032 shares worth $111.46

"Grower Inc." shares are now worth $110.16, after an 8% growth

The 2% dividend of $2.2/share is not distributed to shareholders and is reinvested in the company

The stock is now worth $112.36

Mr. Compounder now has 1 share worth $112.36

The 2% dividend of $2.2/share is not distributed to shareholders and is reinvested in the company

The stock is now worth $112.36

Mr. Compounder now has 1 share worth $112.36

Do you see where this going?

Mr. Compounder has still 1 share

Mr. DRIP got 0.032 extra shares "for free"

But Mr. Compounder has $112.36, while Mr. DRIP has $111.46

Mr. Compounder has still 1 share

Mr. DRIP got 0.032 extra shares "for free"

But Mr. Compounder has $112.36, while Mr. DRIP has $111.46

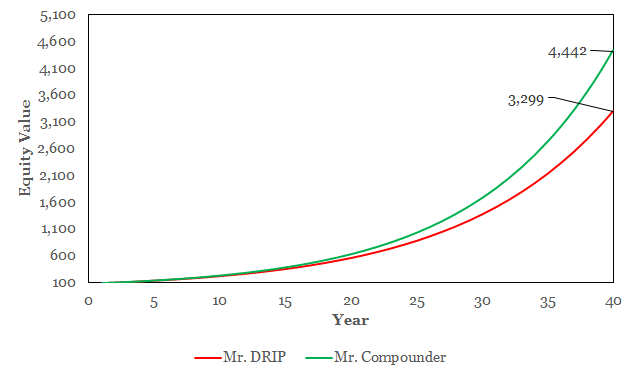

If the same continues for 40 years the difference is staggering

Mr. DRIP has 1.64 shares of "Shower Inc." at $2011.53 price/share

In total, his shares are worth $3298.91

He got 0.64 shares, more than half a share, "for free"

Mr. DRIP has 1.64 shares of "Shower Inc." at $2011.53 price/share

In total, his shares are worth $3298.91

He got 0.64 shares, more than half a share, "for free"

Mr. Compounder has still 1 share after 40 years

That 1 share is now worth $4441.54

His equity is now worth 35% more compared to Mr. DRIP

That 1 share is now worth $4441.54

His equity is now worth 35% more compared to Mr. DRIP

After 40 years, "Grower Inc." decides to start paying dividends of 2% per year as well

Mr. DRIP and Mr. Compounder both decide to retire

Mr. DRIP receives a $65.98 yearly dividend

Mr. Compounder receives an $88.83 yearly dividend

Mr. DRIP and Mr. Compounder both decide to retire

Mr. DRIP receives a $65.98 yearly dividend

Mr. Compounder receives an $88.83 yearly dividend

How is it possible that Mr. DRIP has more shares but his portfolio has lower equity and receives lower dividends?

The answer? Share dilution

Every time a company pays a dividend its shares decrease in value

The answer? Share dilution

Every time a company pays a dividend its shares decrease in value

The dilution and the income taxes on the dividend cost Mr. DRIP 1/3 of his equity

And now that he has retired and wants to use that dividend income to live he gets 30% less compared to Mr. Compounder who was not a "dividend investor"

And now that he has retired and wants to use that dividend income to live he gets 30% less compared to Mr. Compounder who was not a "dividend investor"

Want me to add some salt to your dividend wounds?

Do you know all those "dividend kings" and "dividend aristocrats" that they tell you to invest in to get a "secured income"?

After all, these are blue-chip companies that have been paying dividends for decades

Well, not so fast

Do you know all those "dividend kings" and "dividend aristocrats" that they tell you to invest in to get a "secured income"?

After all, these are blue-chip companies that have been paying dividends for decades

Well, not so fast

The reason? Survivorship bias

The current list does not include all the companies that went out of business and vanished

Let's say you jumped into a time machine back to 1990 and tried to invest in all the dividend "aristocrats" and "kings"

The current list does not include all the companies that went out of business and vanished

Let's say you jumped into a time machine back to 1990 and tried to invest in all the dividend "aristocrats" and "kings"

You would have some trouble getting your dividends today

Why?

24 of the 49 dividend "aristocrats" of that time are no longer trading as the same company

Why?

24 of the 49 dividend "aristocrats" of that time are no longer trading as the same company

That's right. 50% of those solid and safe dividend companies have been acquired or merged at much lower valuations, or even vanished

Being a dividend "king" or "aristocrat" does not guarantee staying one 30-40 years from now

That's when you need these cashflows to retire

Being a dividend "king" or "aristocrat" does not guarantee staying one 30-40 years from now

That's when you need these cashflows to retire

Especially in this day and age of rapid innovation, companies that remain stagnant are doomed to become extinct

So if you are a beginner investor in your 20s, do you still want to be a "dividend investor"?

/END/

So if you are a beginner investor in your 20s, do you still want to be a "dividend investor"?

/END/

If you liked this thread click below and retweet the first tweet, and follow me to stay updated

https://twitter.com/itsKostasOnFIRE/status/1375502229839482882?s=20

You can also subscribe for FREE to my newsletter to stay updated on topics of

-Finance

-Investing

-Stock market history

itskostasonfire.substack.com

-Finance

-Investing

-Stock market history

itskostasonfire.substack.com

For more educational threads on financial independence and investing for beginners see below for a collection of threads

https://twitter.com/itsKostasOnFIRE/status/1345790210441928708?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh