Olympus DAO is an attempt to create a stable currency (OHM) through managing a treasury of assets.

Initially this treasury will consist solely of DAI and OHM-DAI Sushi LP shares.

Over time Olympus DAO will add new collateral types and ultimately stabilize versus a basket.

1/

Initially this treasury will consist solely of DAI and OHM-DAI Sushi LP shares.

Over time Olympus DAO will add new collateral types and ultimately stabilize versus a basket.

1/

At a high level Olympus DAO features a single token, OHM, which is both the system’s stable asset and its governance token.

OHM can be staked in return for sOHM which allows OHM holders to accrue protocol profits as well as participate in Olympus DAO governance.

OHM can be staked in return for sOHM which allows OHM holders to accrue protocol profits as well as participate in Olympus DAO governance.

The core building blocks of Olympus DAO are protocol controlled value (PCV), market operations, and bonding.

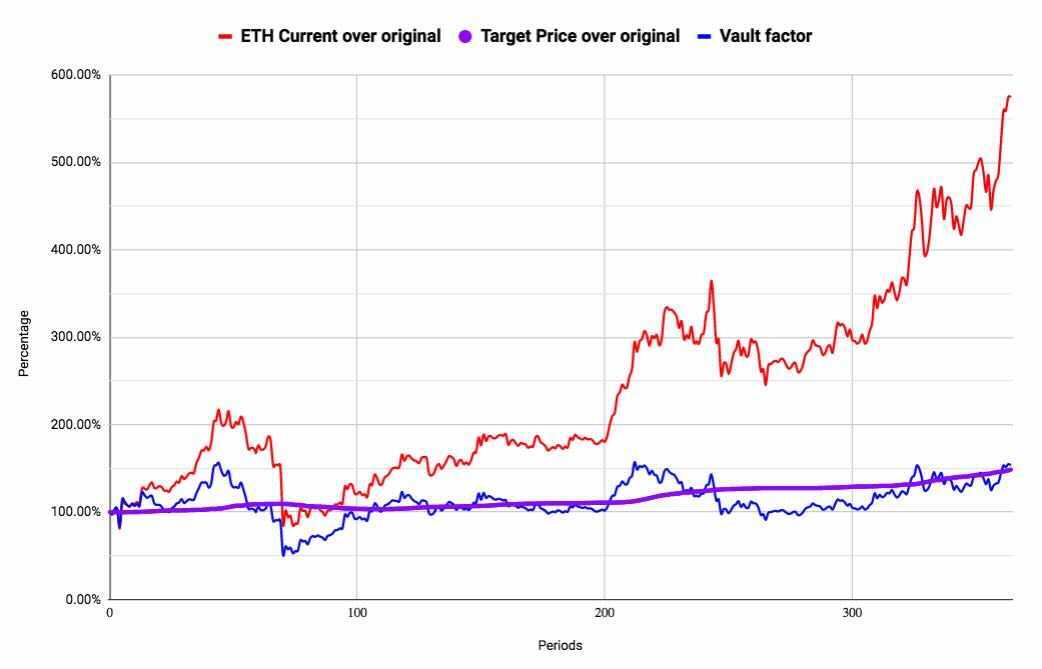

Olympus DAO maintains a treasury (PCV) that ultimately provides a price floor on OHM.

It is built up through sales of OHM and through yield generating opportunities using its existing treasury assets (e.g depositing its treasury DAI into Compound to generate yield).

It is built up through sales of OHM and through yield generating opportunities using its existing treasury assets (e.g depositing its treasury DAI into Compound to generate yield).

When OHM trades above 1 DAI, the protocol mints and sells new OHM.

When OHM trades below 1 DAI, the protocol buys back and burns OHM.

When OHM trades below 1 DAI, the protocol buys back and burns OHM.

In each case the protocol makes a profit.

Olympus DAO distributes these profits 90% to OHM stakers pro rata and 10% to a DAO.

Olympus DAO distributes these profits 90% to OHM stakers pro rata and 10% to a DAO.

Olympus DAO also features Bonds which are a secondary policy tool.

It enables Olympus DAO to both incentivize and accumulate OHM liquidity pool shares (this value also accrues to OHM stakers).

It enables Olympus DAO to both incentivize and accumulate OHM liquidity pool shares (this value also accrues to OHM stakers).

Essentially a Bond provides a user the option to trade their OHM/DAI LP share with the protocol for OHM at a discount at a later date.

The purpose of this operation is to both incentivize and lock liquidity by offering yield.

The purpose of this operation is to both incentivize and lock liquidity by offering yield.

For more on Olympus DAO check out our latest report on non pegged stablecoins. messari.io/article/the-ar…

• • •

Missing some Tweet in this thread? You can try to

force a refresh