RAI is a governance minimized non pegged stablecoin.

It is an attempt to create a more trust-minimized version Dai not pegged to the dollar.

It is solely backed by ETH and stabilized autonomously using a PID controller.

1/

It is an attempt to create a more trust-minimized version Dai not pegged to the dollar.

It is solely backed by ETH and stabilized autonomously using a PID controller.

1/

At a high level RAI is similar to Single Collateral DAI (SCD).

It is an overcollateralized debt position for users that demand ETH leverage.

It is an overcollateralized debt position for users that demand ETH leverage.

Users can open this position by depositing ETH into a SAFE (similar to Maker’s vaults) and minting RAI against it.

Users can redeem their collateral by paying back their RAI plus a borrow fee.

RAI’s token FLX is used to govern and backstop the system.

Users can redeem their collateral by paying back their RAI plus a borrow fee.

RAI’s token FLX is used to govern and backstop the system.

However, RAI introduces a number of changes to the SCD model.

First and foremost, RAI is not pegged to the dollar and instead pegged to itself.

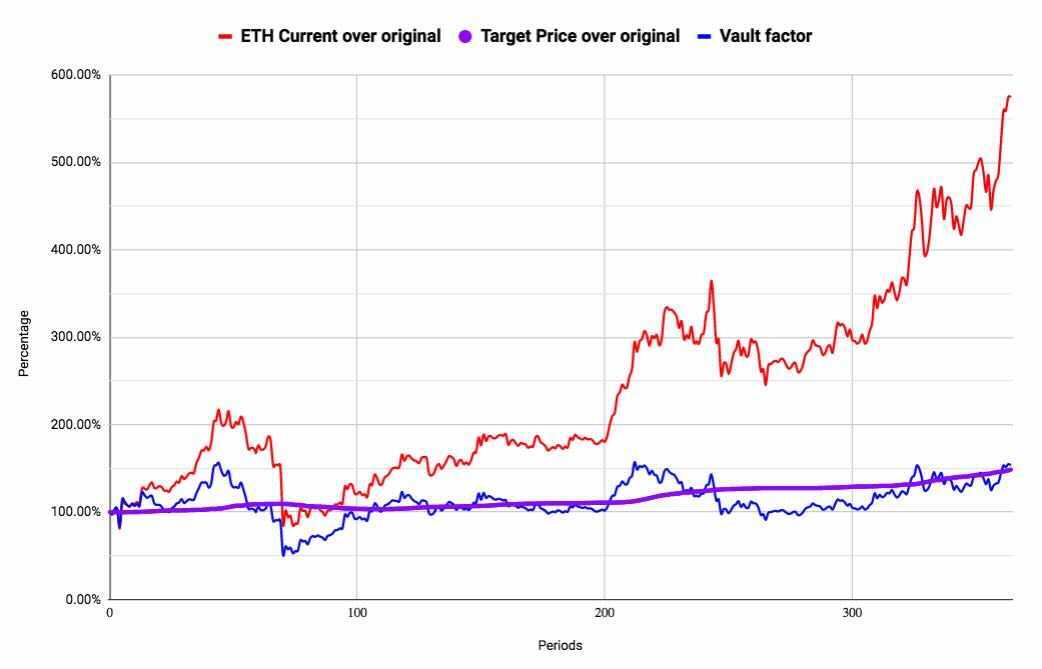

It starts out with an arbitrary target price (called the redemption price) that it adjusts to influence the market price of RAI.

First and foremost, RAI is not pegged to the dollar and instead pegged to itself.

It starts out with an arbitrary target price (called the redemption price) that it adjusts to influence the market price of RAI.

The way this works is that as RAI moves away from its redemption price, the protocol automatically adjusts its redemption price to proportionally oppose the price move in order to stabilize RAI.

Essentially the system devalues or revalues RAI according to a redemption rate (rate at which RAI is being devalued or revalued) to incentivize people to borrow or pay back their debt.

“It works kind of like a spring: the further the market price of RAI moves from the target price, the more powerful the interest rate, and the greater the incentive to return RAI to equilibrium.” - @ameensol

Although data points are limited at this time, RAI has been remarkably stable following its volatile start as market participants get more familiar with RAI’s mechanics and arbitrage RAI around its redemption price.

For more on $RAI check out our latest report on non pegged stablecoins. messari.io/article/the-ar…

• • •

Missing some Tweet in this thread? You can try to

force a refresh