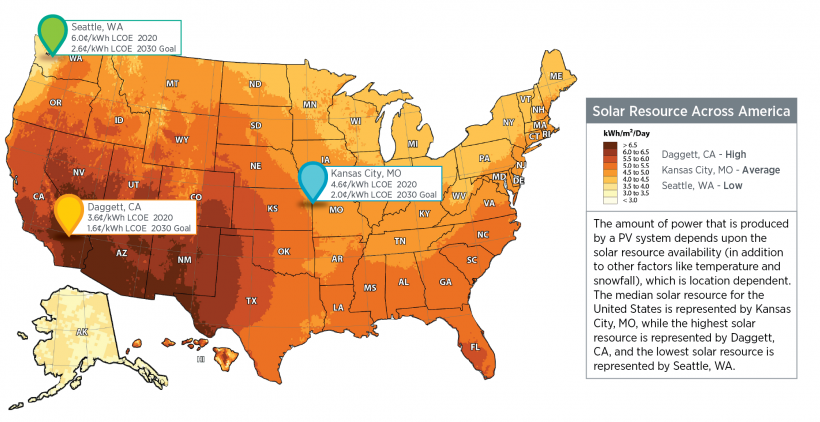

The US Department of Energy has new solar cost targets: 2 cents / kwh in average locations (Kansas City, MO) by 2030. This is a phenomenal goal, welcome additional investment in advanced solar R&D, and also very plausible. A short thread. 1/n

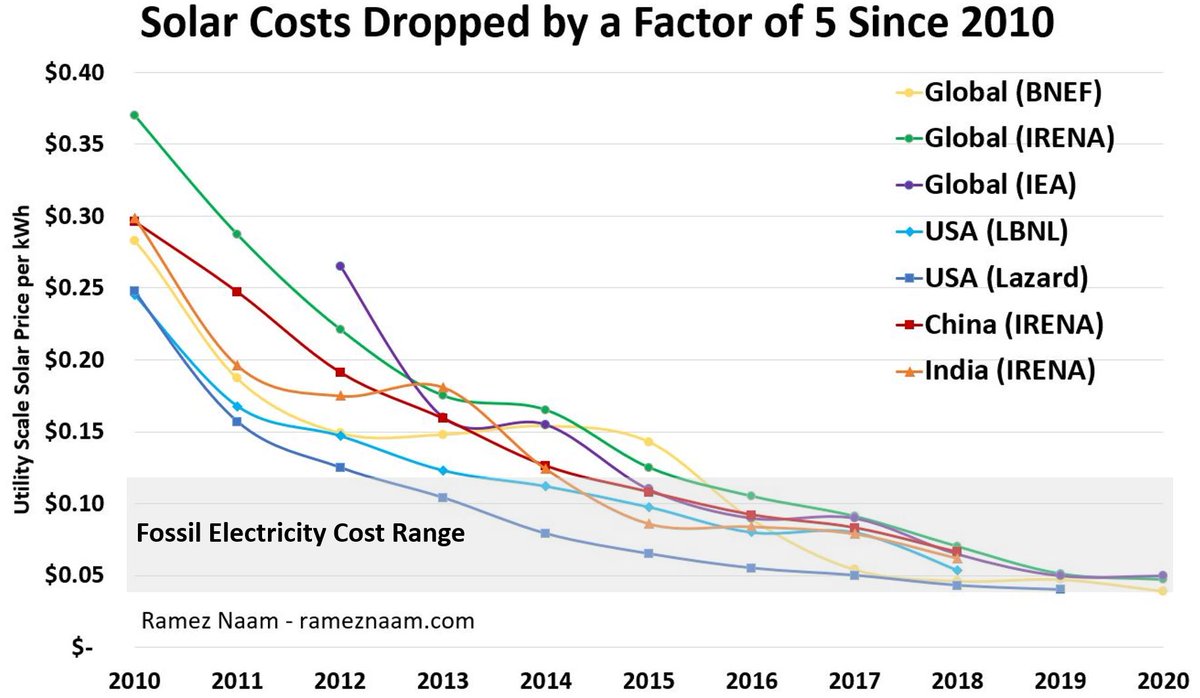

Achieving DOE's target of 60% cost reduction of solar by 2030 would make solar the cheapest source of electricity over most of the US. 2/n

Hitting DOE's 2030 solar cost target would also mean that new solar electricity would cheaper than the operating cost of *existing* coal and natural gas plants (at least during daylight hours). I talked about this as the 3rd Phase of Clean Energy: rameznaam.com/2019/04/02/the… 3/n

In publishing this solar cost target, DOE is committing to working to make this cost reduction happen, with tens of millions of dollars in new R&D funding, especially for perovskite solar cells. Read more here: content.govdelivery.com/accounts/USEER… 4/n

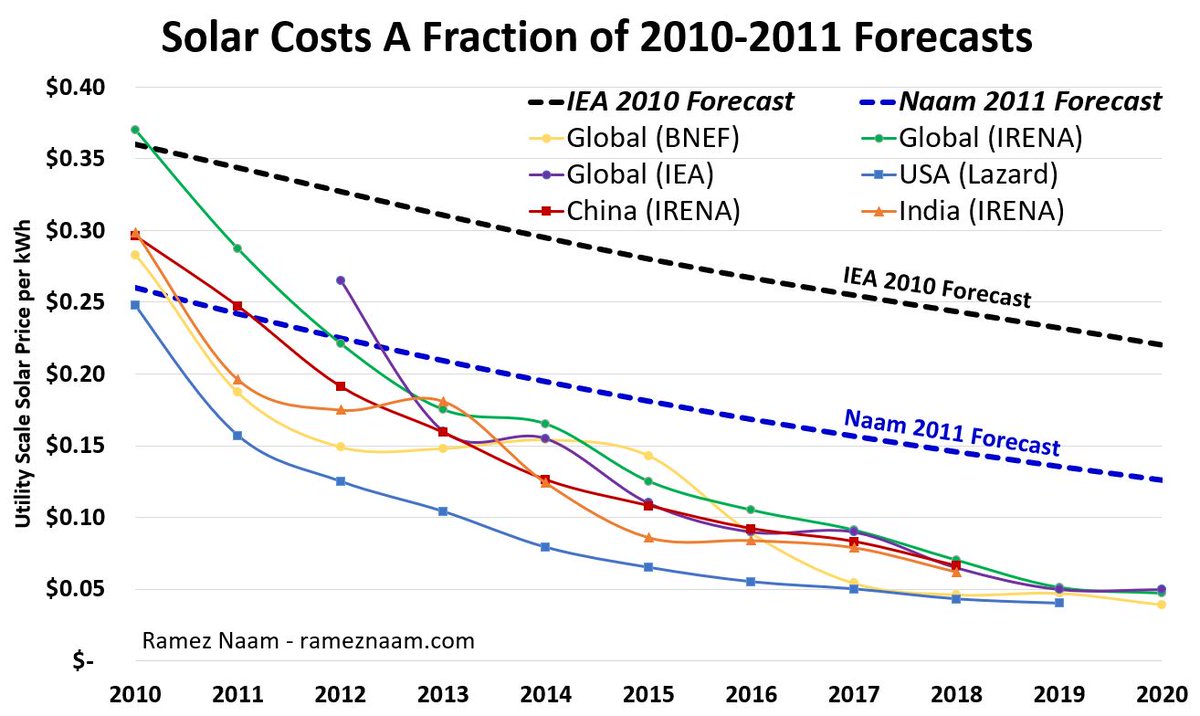

This solar cost *target* is actually fairly similar to the solar cost *forecast* I made last year based on the rate at which solar costs have historically come down: rameznaam.com/2020/05/14/sol… 5/n

Historically, solar costs have beaten DOE's most aggressive cost targets. For example, solar costs hit DOE's SunShot targets 3 years earlier than DOE's goal. utilitydive.com/news/doe-expan…

This target may be similar. We may well hit these costs before DOE's target date. 6/n

This target may be similar. We may well hit these costs before DOE's target date. 6/n

Forecasts of future solar cost declines can't be taken for granted, though. Too much rides on this. DOE's new funding for advanced solar technologies is thus extremely welcome. And indeed, we should invest far more in clean energy R&D, as @vsiv and others have argued.. 7/n

For more on the case for added clean energy innovation, and how to do it, see this great summary from @drvolts vox.com/energy-and-env…

Or the Columbia University report "Energizing America" energypolicy.columbia.edu/energizingamer… /fin

Or the Columbia University report "Energizing America" energypolicy.columbia.edu/energizingamer… /fin

• • •

Missing some Tweet in this thread? You can try to

force a refresh