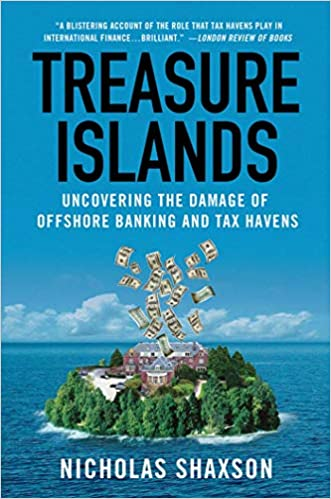

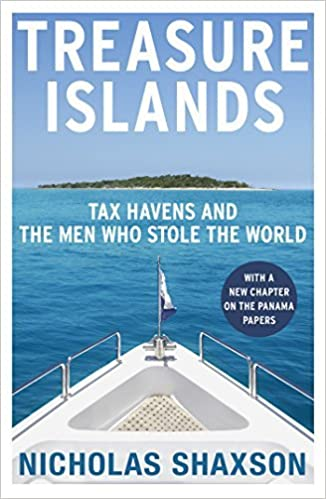

recently, I read this book, Treasure Islands, by Nicholas Shaxson, about tax havens, and it really broadened my understanding of the financial system in ways that are hard to articulate. but I'll try to highlight a few of the cooler parts

I love the different covers to this book. this topic is wonkier than what I normally cover, so it might be more dry. but one thing that this book stresses is that the offshore system is fundamentally not really a problem of individual mobsters or celebrity tax exiles...

mobsters and celebrity tax exiles and the superrich do use offshore tax havens, but the book stresses that the real problem, in terms of in scope and scale, are banks and financial service industries using this system

most people have a decent understanding of how tax evasion works on an individual level, and they're usually right about how it can work on the basic level. the book says that offshoring is fundamentally about artificially manipulating paper trails of money across borders

the book uses the banana to teach this point. to reach someone in the US, there's 2 paths: the physical route of the banana, and the artificial offshore paper trail. the physical route is what you'd expect, picked by a Honduran, shipped by a shipping company, sold in a store

but the accountant's paper trail is different. where are the profits generated? Honduras? en route? the grocery store? in the multinational's headquarters? which countries get to tax how much?

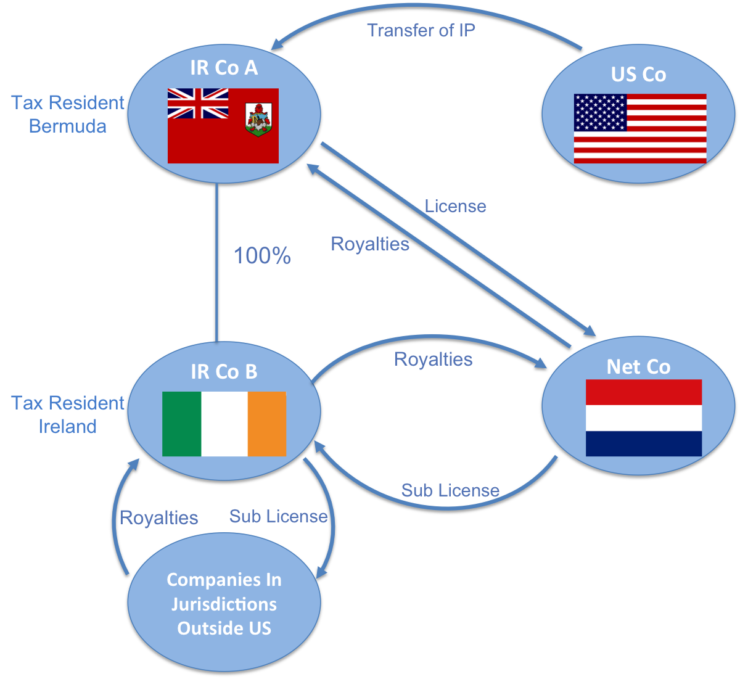

Chiquita will run its purchasing network from the Cayman Islands, put a financial services subsidiary in Luxembourg, park the brand in Ireland, its shipping subsidiary in the Isle of Man, put "executive management" in Jersey, and its insurance arm in Bermuda: all are tax havens

"each part of this multinational charges the other parts for the services they provide. So Chiquita’s Luxembourg finance subsidiary might lend money to Chiquita Honduras, then charge that Latin American subsidiary $10 million per year in interest payments for that loan..."

"The Honduran subsidiary will deduct this $10 million from its local profits, cutting or wiping out its local profits (and consequently its tax bill) there."

"The Luxembourg finance subsidiary, however, will record this $10 million as income—but because Luxembourg is a tax haven, it pays no taxes on this. with a wave of an accountant's wand, a hefty tax bill has disappeared"

the cool part is that these transactions don't have to be tied to any "going rate". "A kilo of toilet paper from China has been sold for $4,121.81, a liter of apple juice has been sold out of Israel at $2,052, and a ballpoint pen has been recorded at $8,500"

under SEC and GAAP, this doesn't fly, but not in the world of offshore accounting, babyyy

the whole banana thing is called "transfer pricing", and it's the corporate equivalent of individual offshore tax dodges. there are specific types, like the "Double Irish" and the "Dutch Sandwich" that are extremely common; companies almost have a fiduciary duty to do them

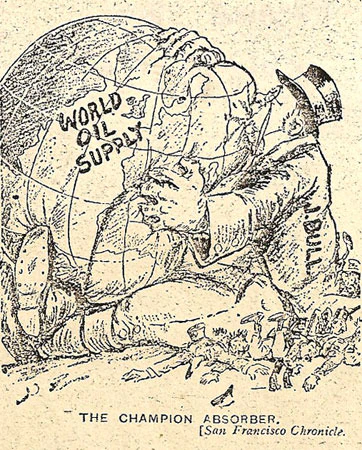

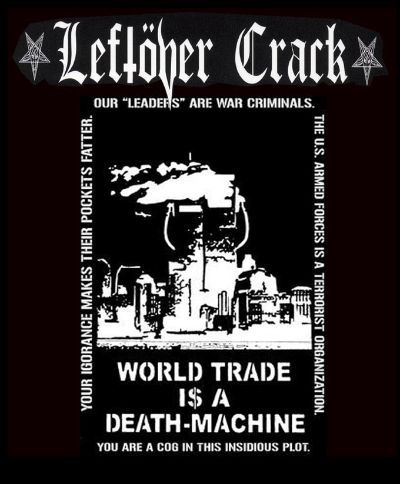

paying less taxes is cool and all, but all it does is really fuck the small and midsized businesses even more. which, again, who cares about them, right? but this is one of the main mechanisms by which monopoly capital slowly gobbles everything up

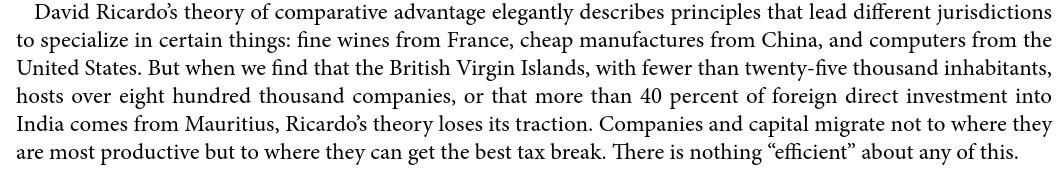

don't @ me about crony capitalism, but there is something to how this isn't even good capitalism. the offshore tax system is actually severely inefficient

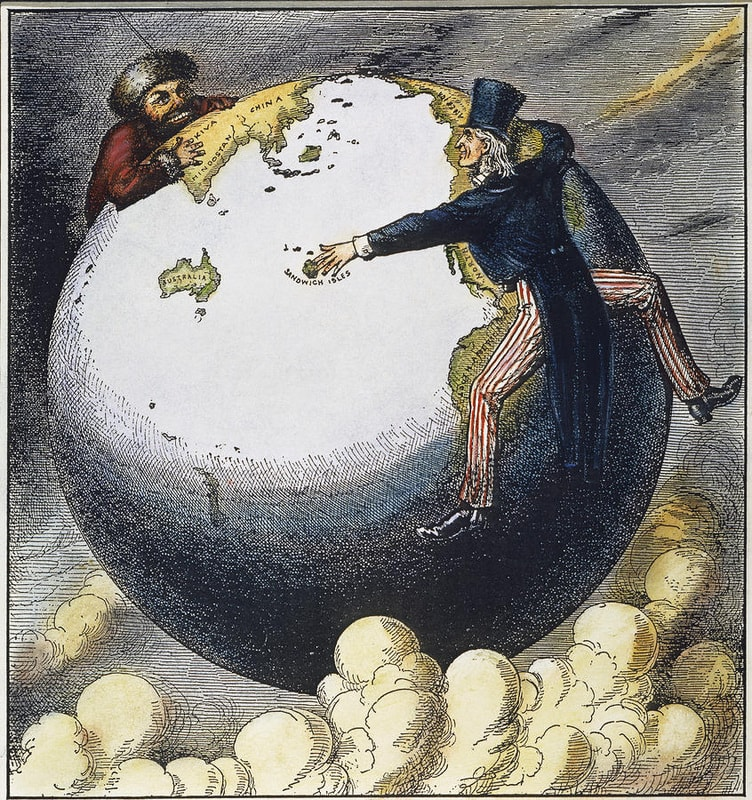

4 groupings of tax havens: continental european's tax havens, ones based around British colonial holdings and London, a US-run collection, and the oddities/outliers

the amounts literally boggle the mind. we're talking

$2.5 trillion on deposit in Luxembourg

1 trillion in Jersey/Guernsey/Isle of Man

1.9 trillion in Cayman Islands

the list goes on and on, and we're not even talking about borrowings

$2.5 trillion on deposit in Luxembourg

1 trillion in Jersey/Guernsey/Isle of Man

1.9 trillion in Cayman Islands

the list goes on and on, and we're not even talking about borrowings

"Offshore financial structures typically involve a trick sometimes known as laddering—a practice also expressed by the French word saucissonage, meaning to slice something into pieces like a sausage"

"When you slice a structure among several jurisdictions, each provides a new legal or accounting “wrapper” around the assets that can deepen the secrecy and the complexity protecting the assets."

the offshore world holds half of all banking, a third of foreign investment, possibly upwards of $11.5 trillion or more on deposit, which would be a quarter of all the world's wealth

what's worse, though, is that while this type of tax evasion is bad for developed/colonizer countries, its much more harmful for developing/colonized countries, because the former has the resources to police and curb -some- of the outflows, but the latter does not

"As the sociologist Pierre Bordieu once remarked, “The most successful ideological effects are those which have no need for words, and ask no more than complicitous silence.”"

offshore tax havens - secrecy jurisdictions - were in place before the great neoliberal reforms of Reagan and Thatcher, like deregulation, freer flows of capital, and lower taxes. "The secrecy jurisdictions have been the heart of the globalization project from the beginning"

"Serial tax avoiders are made knights of the realm in Britain and promoted to the top of high society in the United States". if you haven't noticed yet, this book is basically on some LaRouche shit, except it's all well-documented and real, lol

what I covered so far was basically the intro and chapter 1, but I won't be so thorough going forward, and I'll just point out some nuggets

a couple years ago, back when I was more into anarchism, I was obsessed with Osvaldo Bayer, an old Argentine anarchist who wrote Patagonia Rebelde, about a huge rural workers strike in Argentina back in 1920-22

the book (which is extremely good, btw) talked about those workers' struggles and strikes, their subsequent massacre, and about the foreign capital that made up the ranching industry and shipping at the time.

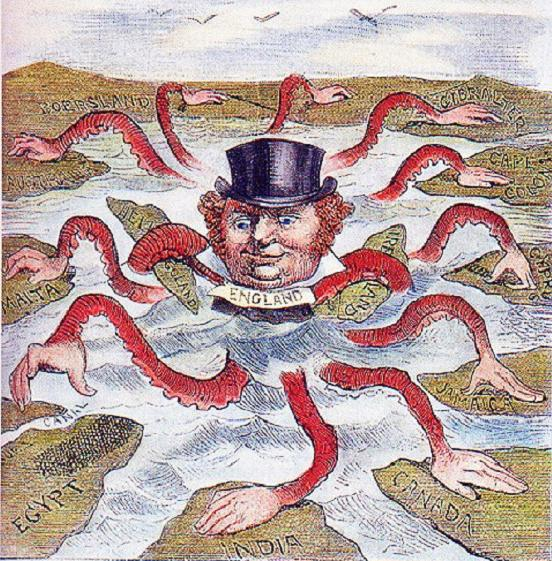

so imagine my surprise when I'm reading Treasures Islands, years later, and learning about how the same shitty British family running a meat-packing dynasty in Argentina, who helped murder all those workers, basically invented the multinational corporation

"in his book The Rise and Fall of the House of Vestey, the biographer Philip Knightley argues that the meat packers’ cartel had such a crippling effect on the Argentine labor movement and early economic development..."

"that “it led almost directly to the formation of militant labour organisations that pushed Peron into power, the subsequent dictatorship of the generals, the terrorism, the Falklands War and the country’s economic disasters.”"

"The Vesteys’ basic formula for gaining market power—squeeze them at the producer end, squeeze them at the consumer end, and push all the profits into the middle—was a philosophy that they also deployed, with astonishing success, in the area of tax."

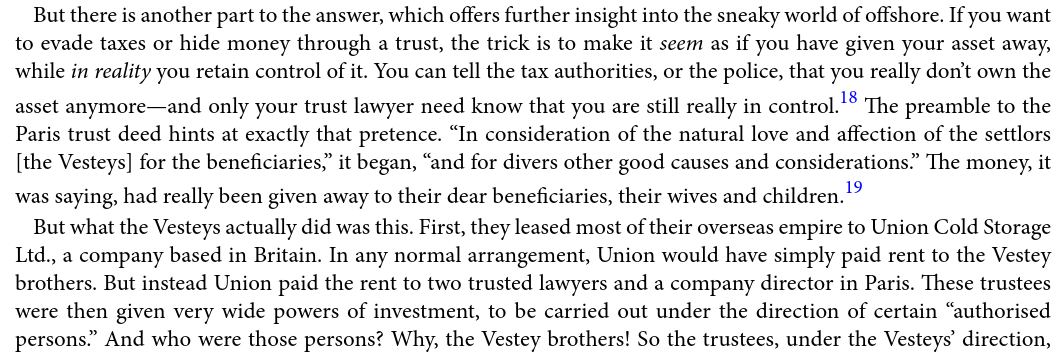

the Vesteys wanted to live in Britain without really paying British taxes, which is tricky but doable, as they owned multinational corporations. but the tax authorities wouldn't let them, so what'd they turn to (apart from offshoring)?

"Many people think that the best way to achieve secrecy in your financial affairs is to shift your money to a country like Switzerland, with strong bank secrecy laws. But trusts are, in a sense, the Anglo-Saxon equivalent."

"They create forms of secrecy that can be harder to penetrate than the straightforward reticence of the Swiss variety. Trusts are powerful mechanisms, usually with no evidence of their existence on public record anywhere. They are secrets between lawyers and their clients"

"Trusts emerged in the Middle Ages when knights leaving on the Crusades would leave their possessions in the hands of trusted stewards, who would look after them to provide benefits to the knights’ wives and children when they were away or if they never returned."

so William Vestey set up a trust which helped him avoid taxes for decades. he also bought himself a Baronship. he was such a funny asshole, saying “I am technically abroad at present . . . the present position of affairs suits me admirably. I am abroad. I pay nothing.”

so basically, trusts give the appearance that you've given away your assets, but you go on controlling them. keep that in mind when you think about that asshole, Bill Gates, lmao

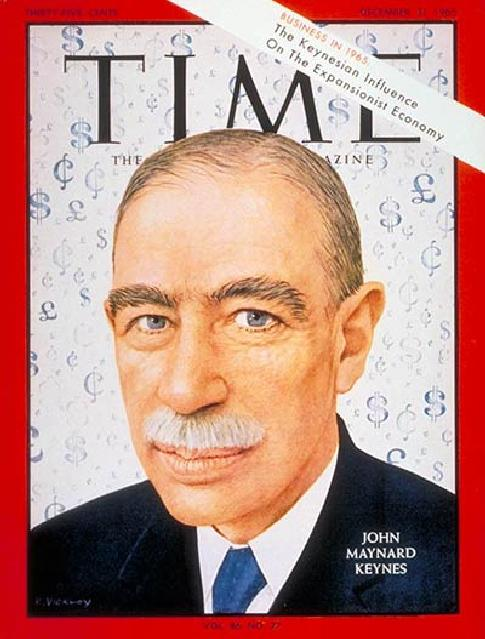

as far as I can tell, as an author, Shaxson seems to be sympathetic to standard Keynesianism, and has a whole chapter on Keynes' views about finance and offshore banking

“Experience is accumulating,” Keynes said, “that remoteness between ownership and operation is an evil in the relations among men, likely or certain in the long run to set up strains and enmities which will bring to nought the financial calculation.”

“The decadent international but individualistic capitalism,” Keynes wrote, “is not a success. It is not intelligent, it is not beautiful, it is not just, it is not virtuous—and it doesn’t deliver the goods. In short, we dislike it, and we are beginning to despise it.”

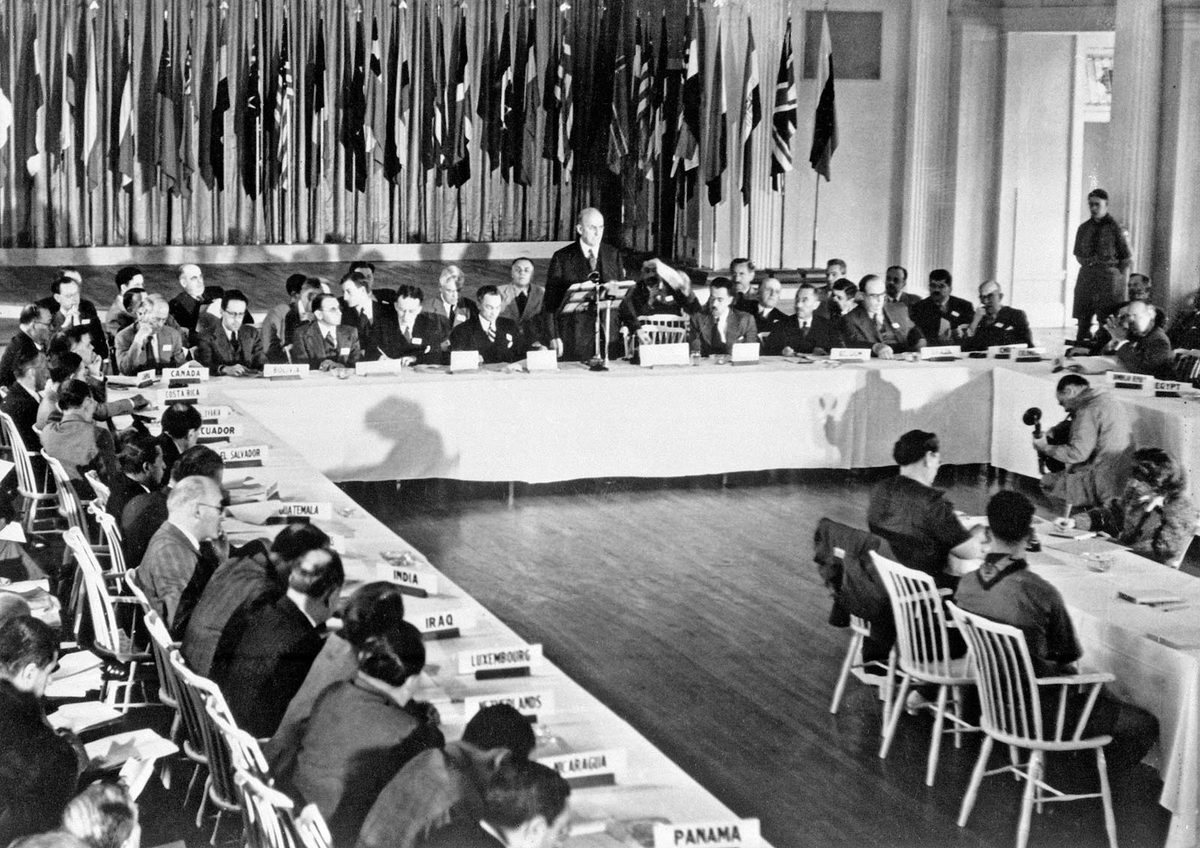

"Many people today see the IMF and World Bank—the children of the Bretton Woods Conference—as the handmaidens of globalization, of unfettered trade and capital flows, and the instruments of Wall Street bankers. This was not the original idea."

"Keynes did want open trade, but finance was to remain tightly regulated: otherwise, surges of flighty capital would generate recurrent crises that would hamper growth, disrupt and discredit trade, and possibly drive fragile European economies into the arms of the communists."

"“Above all, let finance be primarily national.” The Bretton Woods plan, for all its faults, was designed to tame the forces of international finance."

whoops, this is the one thing we DIDN'T want to happen

whoops, this is the one thing we DIDN'T want to happen

"Dismantling capital controls is one thing. But we have a world where capital is not only free to flow across borders but is encouraged to flow, lured by the offshore attractions of secrecy, evasion of banking regulations, tax evasion and avoidance. Keynes would be horrified."

even worse, the book points out that the Marshall Plan functioned as one big capital flight scheme: "American postwar aid was smaller than the money flowing in the other direction"

Henry Cabot Lodge said: There is a small, bloated, selfish class of people whose assets have been spread all over the place. People of moderate means in this country are being taxed to support a foreign aid program which the well-to-do people abroad are not helping to support.”

"The Marshall Plan set the precedent: taxpayers foot the bill for policies that delighted Wall Street. What was presented as enlightened self-interest was substantially a racket, in the precise sense of a fraud, facilitated by public ignorance."

"The countries that have grown most rapidly, top-ranking economists explained in 2008, “have been those that rely least on capital inflows . . . financial globalisation has not generated increased investment or higher growth in emerging markets.”"

“Financial liberalisation and financial crises go together like a horse and carriage.”

idk man, its weird how the experts are constantly wrong...unless...maybe they're right about how to make money off debt, lol

idk man, its weird how the experts are constantly wrong...unless...maybe they're right about how to make money off debt, lol

"China carefully and systematically restricts inward and outward investments and other flows of capital, and at the time of writing it is growing fast. Clearly these kinds of controls, unfashionable for so many years, ought to be a policy option"

I'm gonna have to do another thread later for some other major plotlines in this book; there's some WILD twists and turns later. this book's so good because you don't need to be a marxist or, like, a LaRouchian to see how the British financial system is literally evil, lol

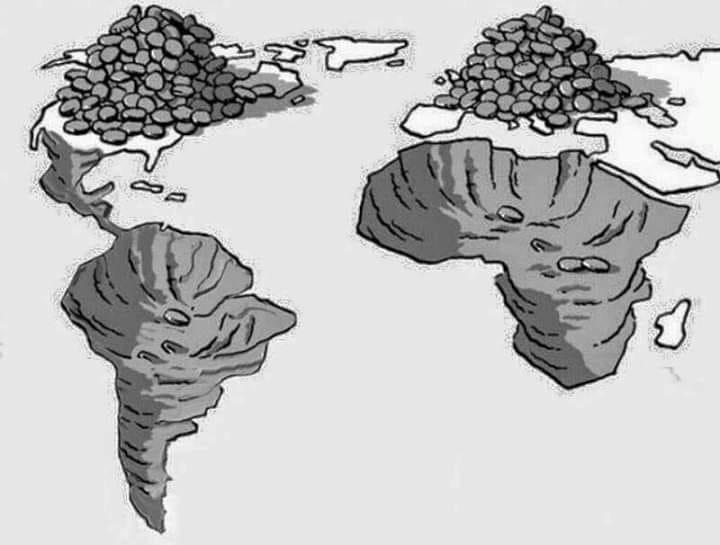

and yeah, I recommend this book very hard. I mean, look at the author: his head's literally inflated with knowledge

god bless

god bless

• • •

Missing some Tweet in this thread? You can try to

force a refresh