when @elonmusk found out Bezos had to pay a “Twitter army” to clap back at people on Twitter

Full story theintercept.com/2021/03/30/ama…

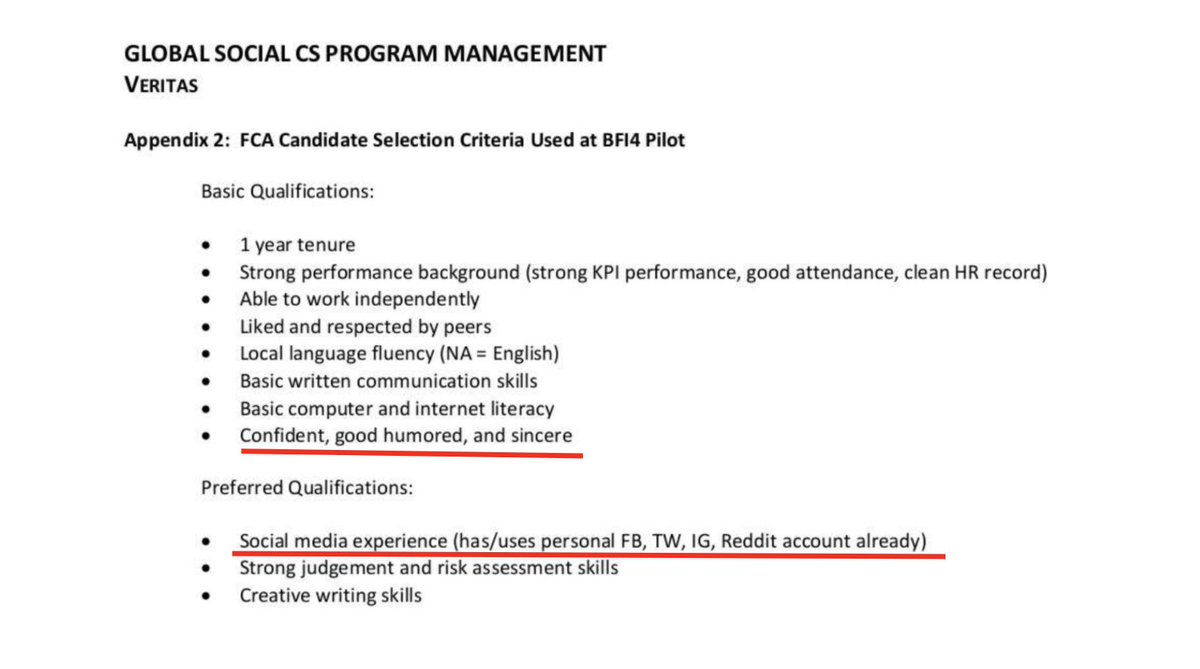

Here's the job description for Amazon's Twitter clapback army:

• great sense of humor

• confident, sincere

• excited about speaking their mind & rebutting critics

• Have personal FB, TW, IG, Reddit accounts

• great sense of humor

• confident, sincere

• excited about speaking their mind & rebutting critics

• Have personal FB, TW, IG, Reddit accounts

• • •

Missing some Tweet in this thread? You can try to

force a refresh