Our new study outlines how several OECD countries allowed businesses to more quickly expense investments during the pandemic: buff.ly/39xKzto @ElkeAsen

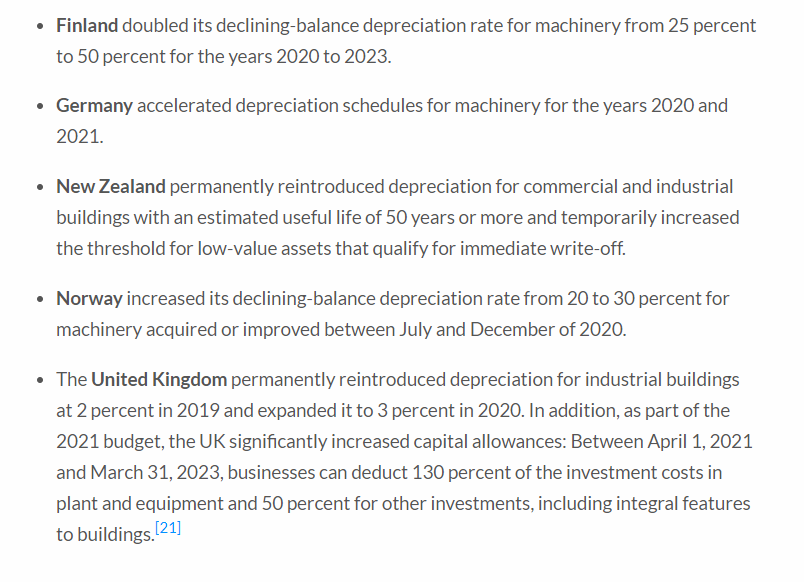

While the temporary nature of most of these expensing and accelerated depreciation provisions reduces their tax revenue impact in the long run, it also limits their long-run economic benefits.

Temporary provisions may encourage businesses to shift future investments forward to take advantage of the larger deductions but would not raise the level of investment permanently.

Thus, permanent full expensing across all asset types—rather than targeted temporary measures—would yield the highest economic benefits.

#Estonia and #Latvia have taken the lead in permanently ensuring their corporate tax codes do not pose a barrier to investment and growth, setting an example for other countries to follow.

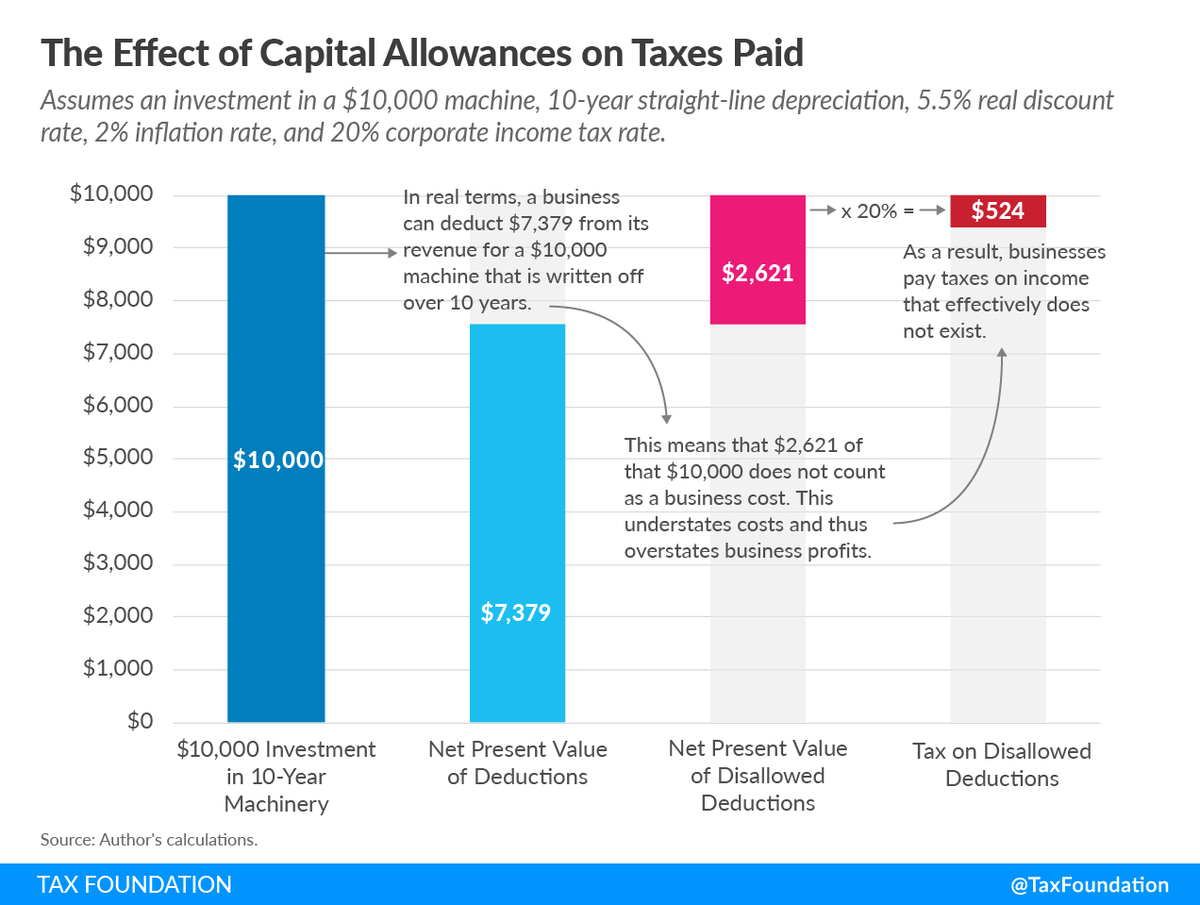

Although it has been important to reduce the distortionary effects of corporate income taxes by lowering statutory rates around the world, doing so without also considering capital allowances misses an important point of sound tax policy.

Low capital allowances reduce incentives to invest, leading to lower wages and slower economic growth.

Besides pursuing policies of full expensing for capital investments, it's also important to make capital allowance provisions permanent. Permanency implies certainty, which is an essential factor especially for long-term investment decisions.

For instance, the new temporary Canadian and U.S. expensing and accelerated depreciation provisions are likely to spur economic growth in the short term. Their long-term effects, however, would be much higher if the changes were made permanent.

• • •

Missing some Tweet in this thread? You can try to

force a refresh