How to get URL link on X (Twitter) App

Our preliminary analysis finds the tax provisions included in the May 12 text would increase long-run GDP by 0.6 percent and reduce federal tax revenue by $4 trillion from 2025 through 2034 on a conventional basis before added interest costs.

Our preliminary analysis finds the tax provisions included in the May 12 text would increase long-run GDP by 0.6 percent and reduce federal tax revenue by $4 trillion from 2025 through 2034 on a conventional basis before added interest costs.

1. The Math Doesn’t Work

1. The Math Doesn’t Work

Estate taxes are paid by the decedent’s estate before assets are distributed to heirs and are thus imposed on the overall value of the estate.

Estate taxes are paid by the decedent’s estate before assets are distributed to heirs and are thus imposed on the overall value of the estate.

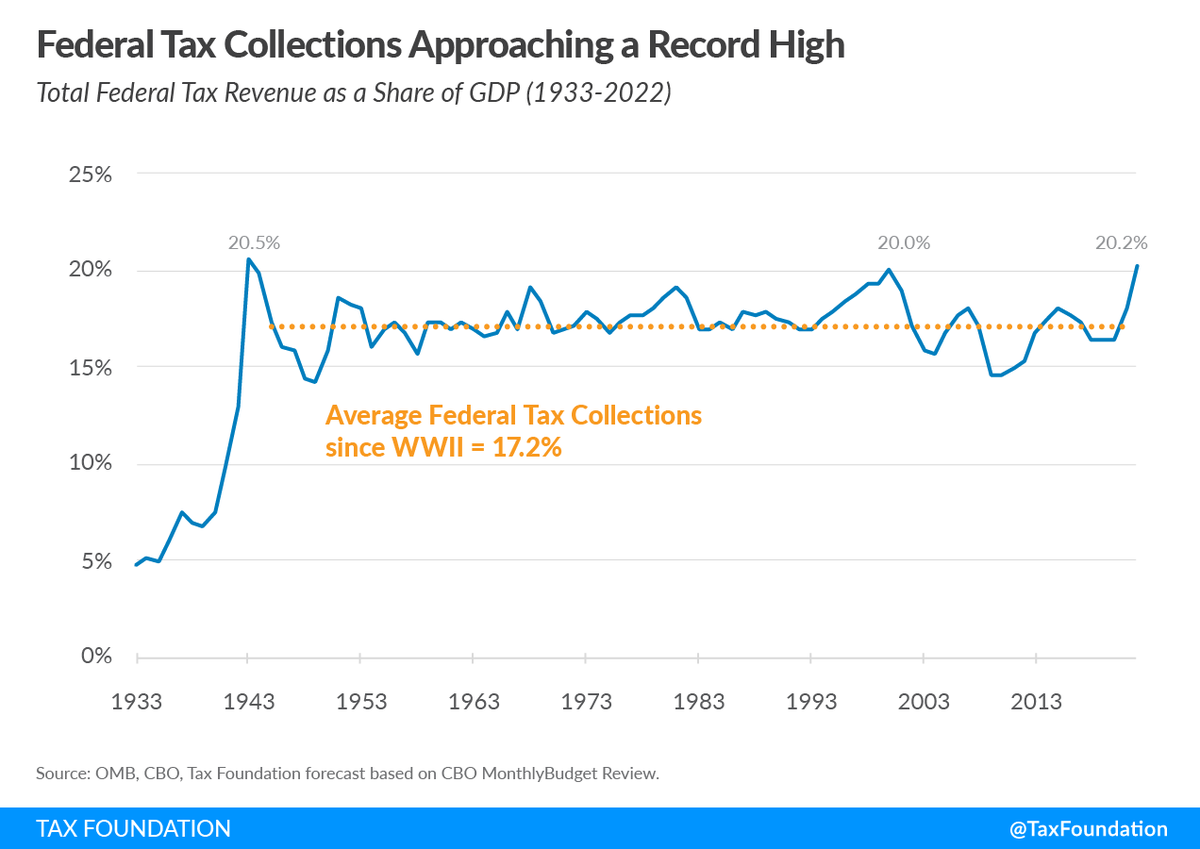

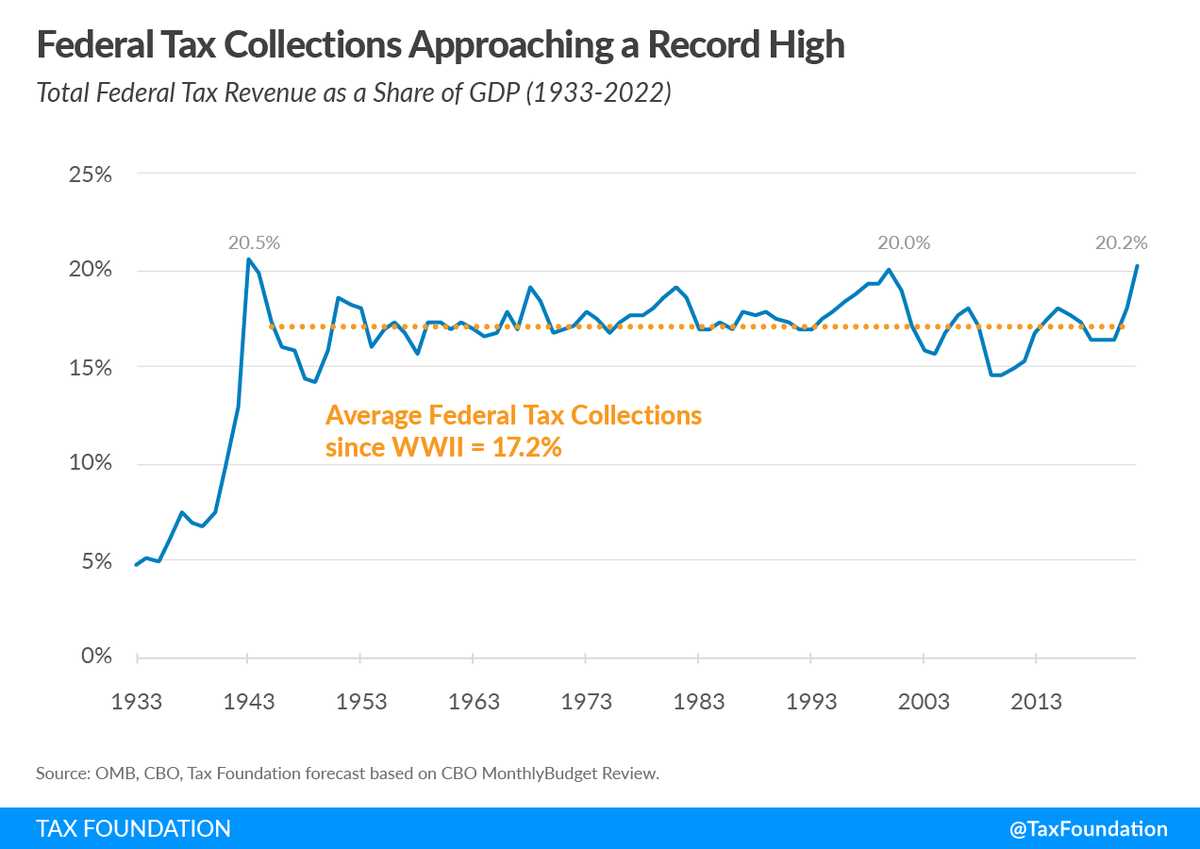

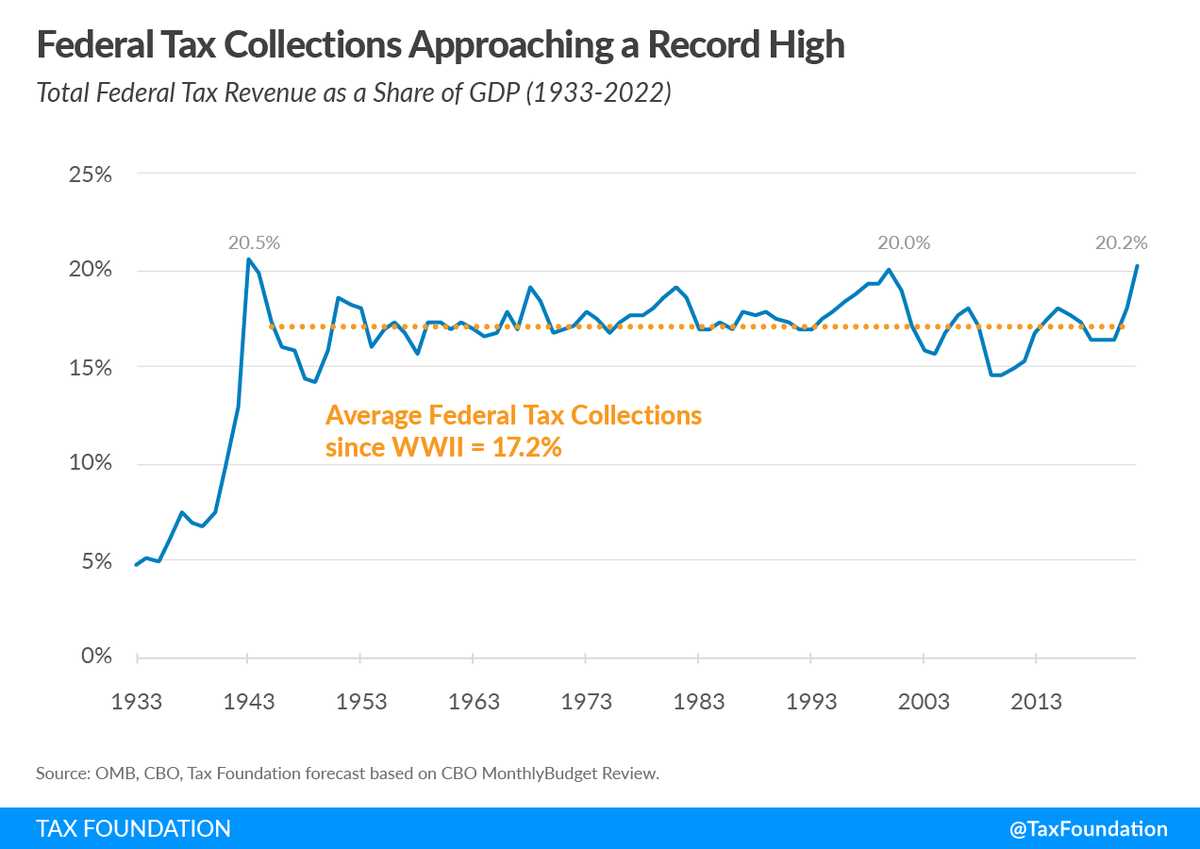

The latest inflation report confirms that prices for just about everything continue to rise, with the Consumer Price Index (CPI) up 8.3 percent over the last year and many categories up even higher, including food (11.4 percent) and energy (23.8 percent).

The latest inflation report confirms that prices for just about everything continue to rise, with the Consumer Price Index (CPI) up 8.3 percent over the last year and many categories up even higher, including food (11.4 percent) and energy (23.8 percent).

The on-again-off-again negotiations over the proposed #BuildBackBetter tax increases on corporations and high-income earners appears to be… on again.

The on-again-off-again negotiations over the proposed #BuildBackBetter tax increases on corporations and high-income earners appears to be… on again.

The most competitive tax systems in the OECD:

The most competitive tax systems in the OECD:

While President Biden’s #AmericanJobsPlan emphasizes making goods in America, the tax increases will raise the cost of production in the U.S, erode American competitiveness, and slow our economic recovery.

While President Biden’s #AmericanJobsPlan emphasizes making goods in America, the tax increases will raise the cost of production in the U.S, erode American competitiveness, and slow our economic recovery.

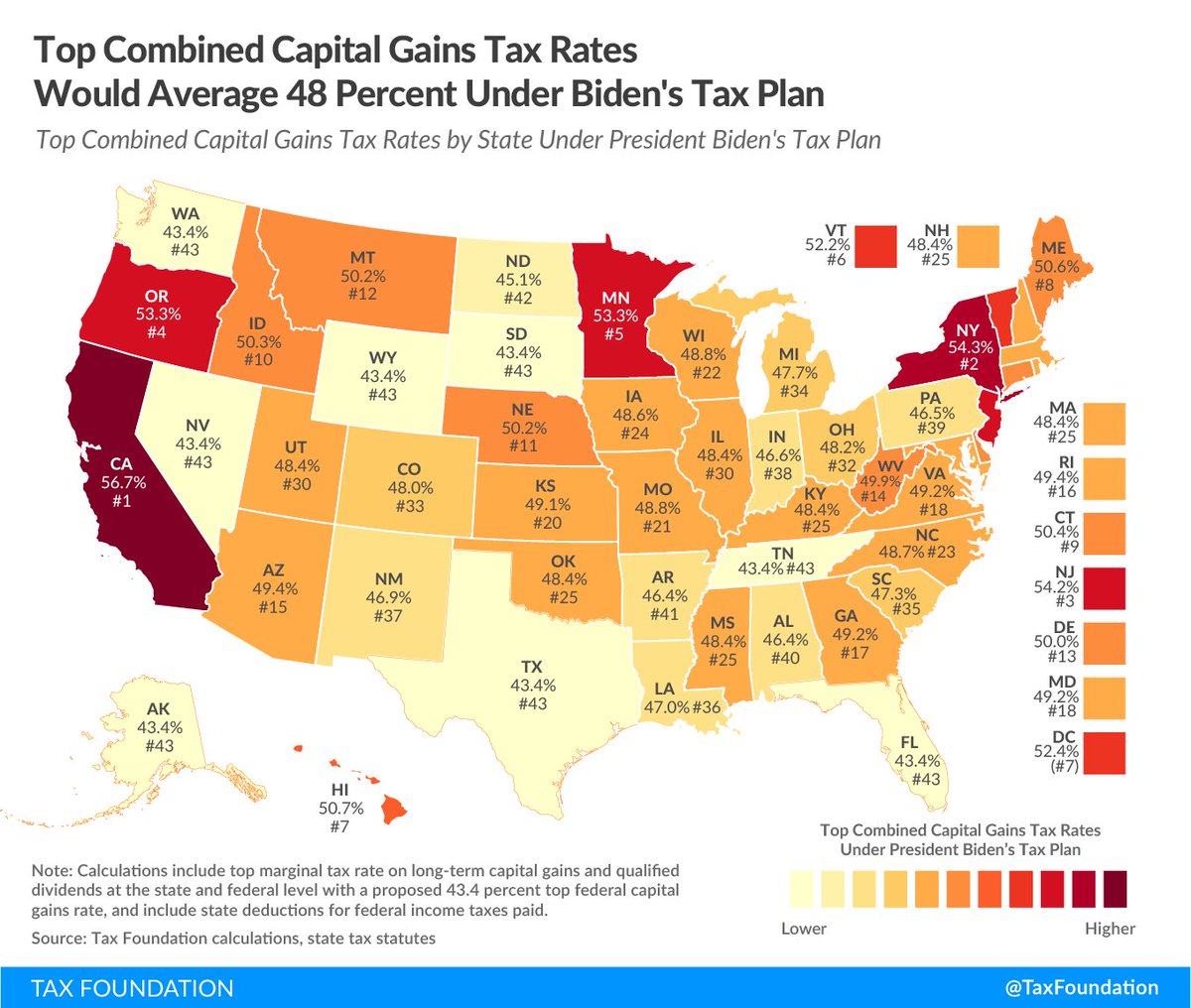

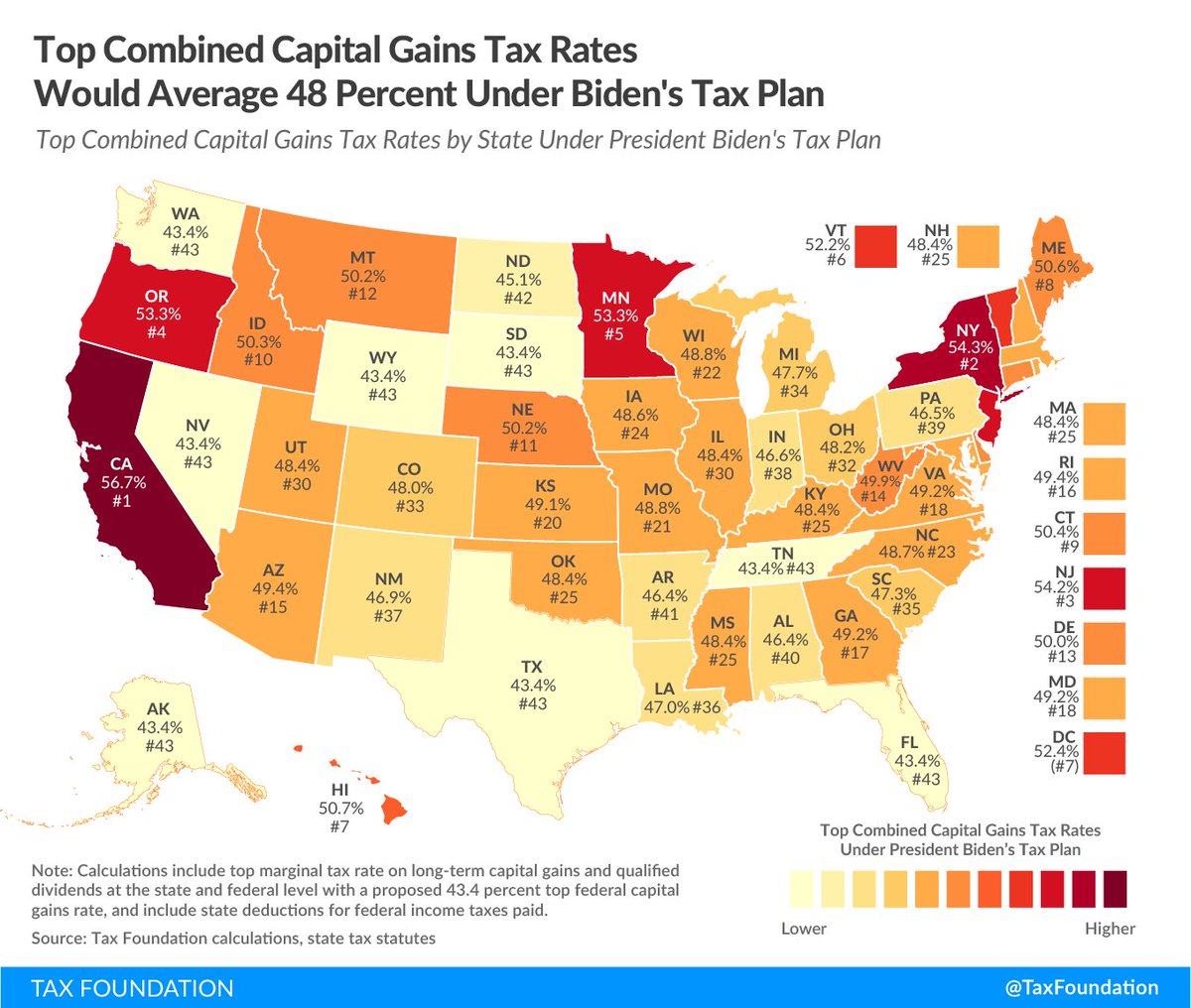

President Biden’s #AmericanFamilyPlan will likely include a large increase in the top federal tax rate on long-term capital gains and qualified dividends, from 23.8% today to 39.6% for higher earners.

President Biden’s #AmericanFamilyPlan will likely include a large increase in the top federal tax rate on long-term capital gains and qualified dividends, from 23.8% today to 39.6% for higher earners.

President Biden’s #AmericanFamilyPlan will likely include a large increase in the top federal tax rate on long-term capital gains and qualified dividends, from 23.8% today to 39.6% for higher earners.

President Biden’s #AmericanFamilyPlan will likely include a large increase in the top federal tax rate on long-term capital gains and qualified dividends, from 23.8% today to 39.6% for higher earners.

Capital gains taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment.

Capital gains taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment.

As state economies reopen and travelers consider options for their first travel experience since the pandemic started, states should ensure that their tax codes and revenue options don't stand in the way of a robust recovery.

As state economies reopen and travelers consider options for their first travel experience since the pandemic started, states should ensure that their tax codes and revenue options don't stand in the way of a robust recovery.

In our new book, Options for Reforming America’s Tax Code 2.0, we illustrate the economic, distributional, and revenue trade-offs of 70 tax changes, including President Biden’s proposal to increase the corporate tax rate to 28 percent.

In our new book, Options for Reforming America’s Tax Code 2.0, we illustrate the economic, distributional, and revenue trade-offs of 70 tax changes, including President Biden’s proposal to increase the corporate tax rate to 28 percent.

Both the federal government and the states raise revenue for infrastructure spending through taxes on motor fuel and vehicles. States also collect fees from toll roads and other road charges.

Both the federal government and the states raise revenue for infrastructure spending through taxes on motor fuel and vehicles. States also collect fees from toll roads and other road charges.

Alaska, Arizona, California, Colorado, D.C., Illinois, Maine, Massachusetts, Michigan, Montana, Nevada, New Jersey, New York, Oregon, South Dakota, Vermont, Washington have passed bills or approved ballot measures that allow for the sale of recreational marijuana.

Alaska, Arizona, California, Colorado, D.C., Illinois, Maine, Massachusetts, Michigan, Montana, Nevada, New Jersey, New York, Oregon, South Dakota, Vermont, Washington have passed bills or approved ballot measures that allow for the sale of recreational marijuana.