Here's my interview from yesterday with @JaredSKaplan, CEO of @OppLoans -- the parent company is OppFi.com

@OppLoans is coming public via reverse merger with $FGNA which is backed by @CoachJoeMoglia and @kcerminara

@OppLoans is coming public via reverse merger with $FGNA which is backed by @CoachJoeMoglia and @kcerminara

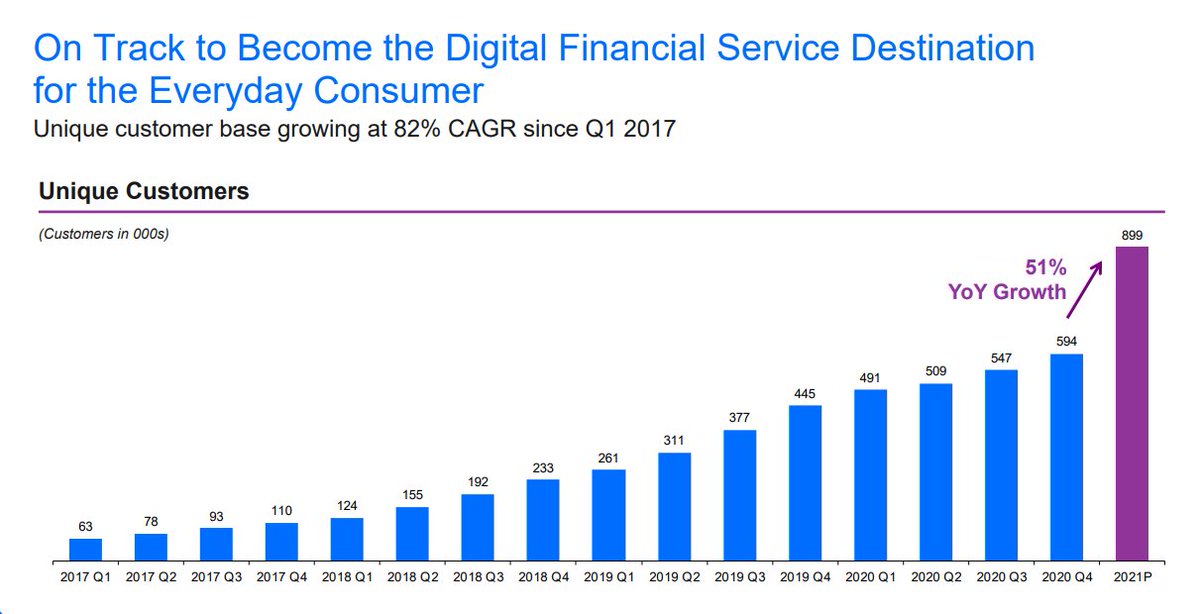

@OppLoans is building a digital-first banking/lending platform for the millions of unbanked and underbanked Americans

Customers love @OppLoans -- very few companies achieve an NPS score of 84 (one of the highest I've seen)

@OppLoans is launching new products to increase ARPU..

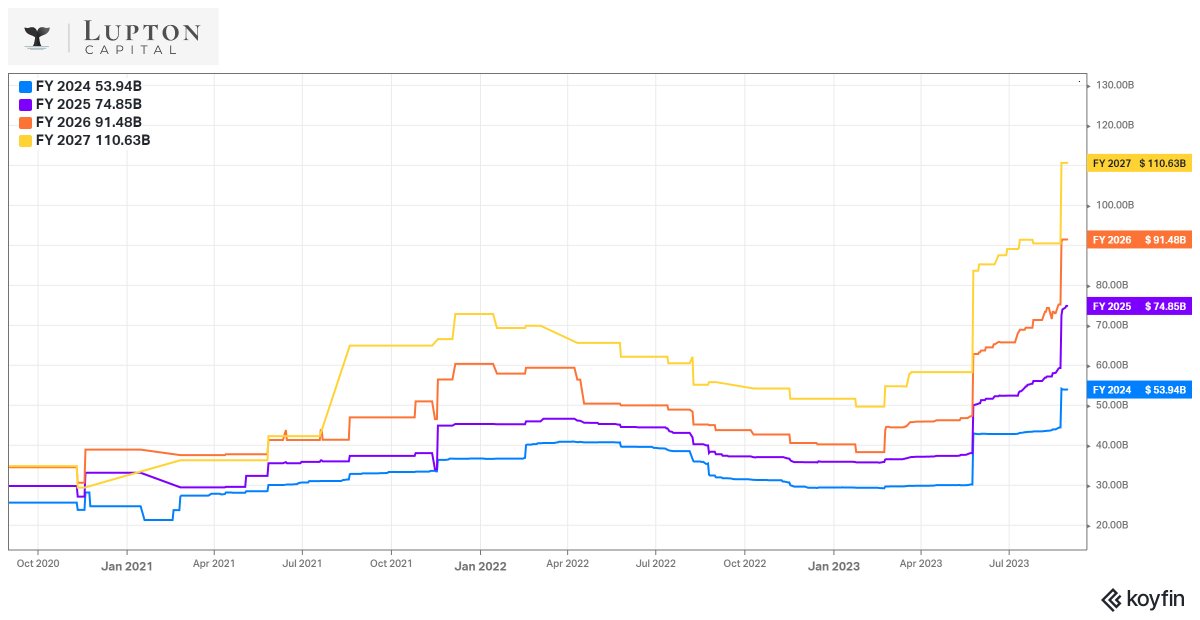

Perhaps the most compelling reason to consider @OppLoans aka $FGNA for your portfolio is the valuation.

$FGNA (OppFi) is currently trading at 7x EBITDA and 14x earnings

I can't think of any other SPACs growing at 40% with strong profit margins and free cash flow.

$FGNA (OppFi) is currently trading at 7x EBITDA and 14x earnings

I can't think of any other SPACs growing at 40% with strong profit margins and free cash flow.

I don't currently have a position in $FGNA but I'm considering it -- primarily based on the strong fundamentals and very reasonable valuation.

• • •

Missing some Tweet in this thread? You can try to

force a refresh