Book Start with this 𝗯𝗲𝗮𝘂𝘁𝗶𝗳𝘂𝗹 𝗟𝗶𝗻𝗲

Managing your finance is not a luxury for the rich, it is hygiene for everyone

If you are an investor, young or old there is no better time for you to pick up this book than right now

@HarperBusiness

Managing your finance is not a luxury for the rich, it is hygiene for everyone

If you are an investor, young or old there is no better time for you to pick up this book than right now

@HarperBusiness

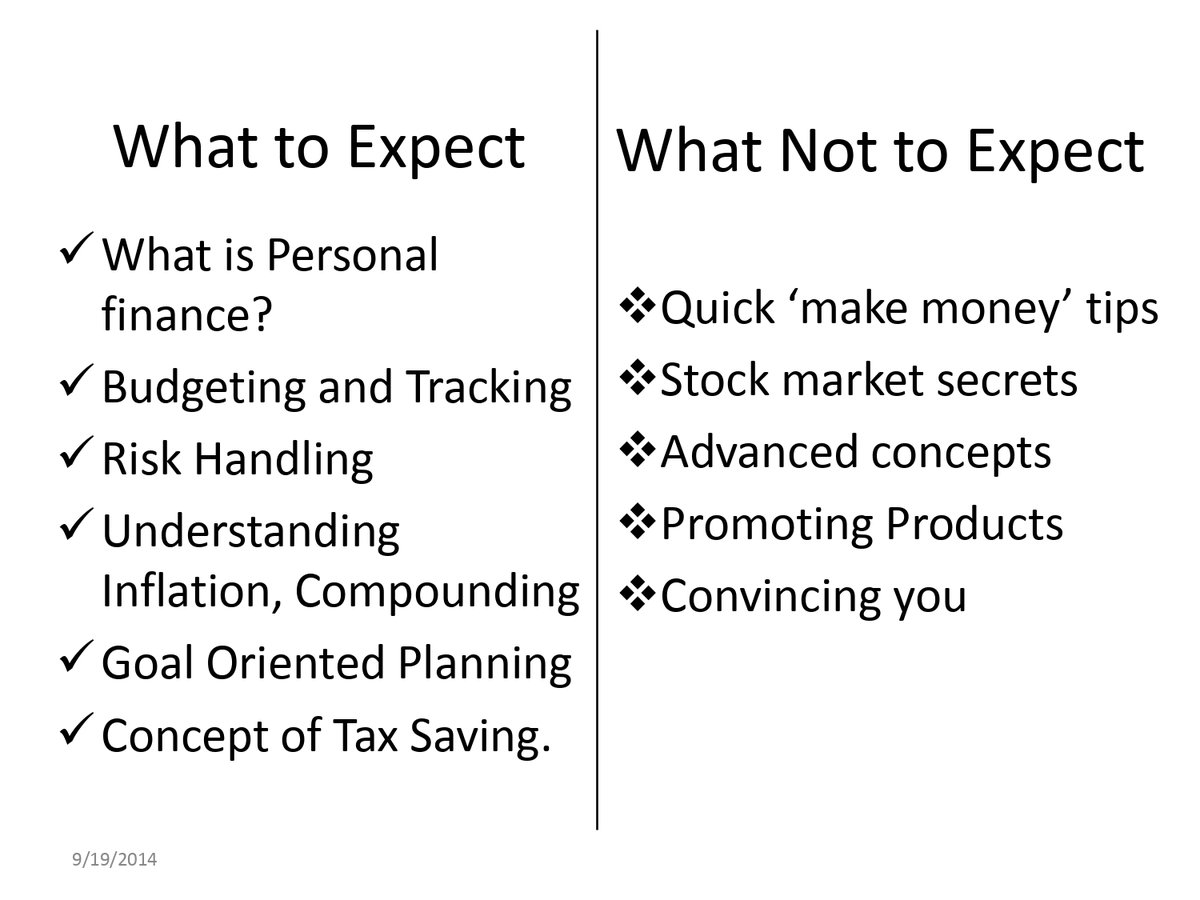

Our money worries usually center around finding the best return on investment. But there is a lot more to financial fitness than just investments. We need a system and not a single-shot solution.

Monika Halan share one wonderful idea which everyone should Try

You Should have 3 different Bank account

1. Income Account

2. Spending Account

3. Investing Account

You Should have 3 different Bank account

1. Income Account

2. Spending Account

3. Investing Account

Follow This 3 Rules

1. Your spending on living costs is no more than

45-50 percent of your take-home income;

2. Your EMI payouts are no more than 25-30 per

cent of your take-home income;

3. your savings are at least 15-20 percent of your take-home income.

1. Your spending on living costs is no more than

45-50 percent of your take-home income;

2. Your EMI payouts are no more than 25-30 per

cent of your take-home income;

3. your savings are at least 15-20 percent of your take-home income.

You should have six months to two years of living cost as an emergency fund Upto your comfortable period

Why you need an emergency fund 👇👇

Why you need an emergency fund 👇👇

There is a beautiful chapter on why you should avoid ULIP at any cost and Buy only Pure term Insurance

Also included a chapter on Why you need term and health insurance and its benefits and awareness

Also included a chapter on Why you need term and health insurance and its benefits and awareness

Book teaches us why you should invest and How to Start investing as a beginner, what you should do and don't

One Golden Quote I love

Equity is a slow cook, not instant noodles

Equity is a slow cook, not instant noodles

In Mutual fund section explained about

→Debt fund and types of debt fund

→Gold funds

→Equity fund

→Active and passive funds

→ELSS

→Index fund and ETF

→Debt fund and types of debt fund

→Gold funds

→Equity fund

→Active and passive funds

→ELSS

→Index fund and ETF

The last chapter is an absolute beauty, written Fabolousally

A Must read if u want to understand all about the above-mentioned things in the Lehman language

The Best beginner book for Personal Finance

Book is available in English & Hindi.

English: amzn.to/31IDUs1

Hindi: amzn.to/2QWypUx

Invest Now in this wonderful book

The Best beginner book for Personal Finance

Book is available in English & Hindi.

English: amzn.to/31IDUs1

Hindi: amzn.to/2QWypUx

Invest Now in this wonderful book

If you find this book summaries useful then please retweet the 1st Tweet of Thread for better reach

🙏🙏

🙏🙏

https://twitter.com/InvestmentBook1/status/1377967187072217089?s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh