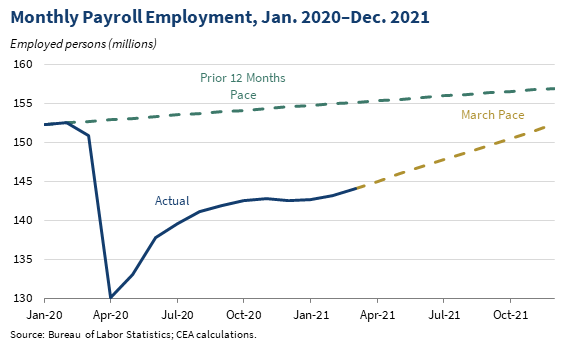

Today’s jobs report showed marked acceleration in March to the fastest pace since August of last year. The economy added 916,000 jobs in March, and job growth was revised up in both January and February.

Although there were 8.4 million fewer jobs in March than in February 2020, assuming the current pace of job growth holds, employment could be back to pre-pandemic levels around the end of this year.

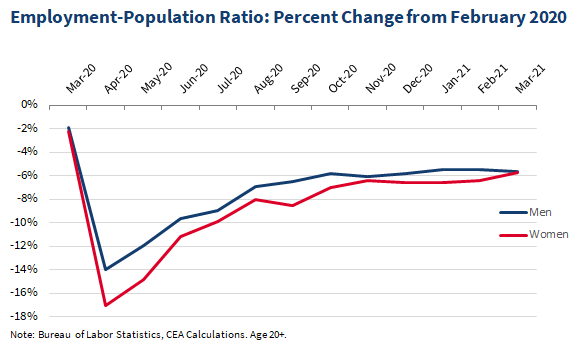

In March, women’s employment losses finally narrowed to about the same decline as men have experienced.

Since the beginning of this recession, women’s employment, as measured by the household survey, had fallen by more than men’s employment in percentage terms.

In March, women’s employment losses as a percent of employment finally neared the same point as men’s employment losses: employment for both men and women is now lower than it was in February 2020 by about 5 percent.

In numeric terms, women's employment losses are somewhat smaller (-3.7 million) than men's (-4.0 million), but because fewer women were employed back in February, these losses represent about the same percent fall in employment for women and men.

Appendix for twitter: often people look at the percentage point change in the employment-population ratio. Using that measure, men and women's drop in employment during the pandemic has looked somewhat similar.

But because women are less likely to be employed than men, a 2 percentage point drop for women is a much greater share of the employment rate than it is for men. The percent change in e-pop shows a similar story as looking at the levels.

Household survey data beginning January 2021 reflects updated population estimates from the U.S. Census Bureau. This update affected headcounts of men's and women's employment roughly equally and so did not materially affect the gap between men's and women's job losses.

Adjusting for labor force dropout and misclassification, the effective unemployment rate could be around 3 percentage points higher than the headline unemployment rate.

In March, the headline unemployment rate dropped to 6.0 percent, 2.5 percentage points above the rate in February 2020, before the pandemic sent many workers home and shuttered businesses and schools.

Given the way the Bureau of Labor Statistics identifies and defines unemployed workers, the headline unemployment rate likely understates unemployment in a pandemic relative to a typical downturn. Since February 2020, almost 4 million workers have dropped out of the labor force.

Accounting for labor force dropouts and misclassification issues related to BLS’s survey questions implies an unemployment rate around 9 percent.

Unemployment rates also vary substantially across groups, based on either the official unemployment rate or an adjusted rate. Again, Black and Latino workers have been particularly hard hit, with the adjusted rates for both remaining in double digits.

On the payroll side, there were 8.4 million fewer jobs in March than in February 2020. Job growth has accelerated the past few months, which has helped narrow the jobs gap and is putting our economy on track to regain the jobs lost in the pandemic.

The vast majority of industries added jobs in March, with notable gains in leisure &hospitality, construction, education & health services, and government. State and local education employment added 125,600 jobs in March, accounting for 92 percent of the jobs added in government.

Despite the gains in March, many industries are still working their way back from their pandemic losses. At the sector level, by far the worst hit industry is leisure and hospitality, with 19 percent fewer jobs than in February 2020.

However, not all industries have suffered in the pandemic. For instance, employment in couriers and messengers is up around 23 percent, and employment in building material and garden supply stores is up around 7 percent.

Other industries, particularly in leisure and hospitality, have struggled to find a way forward in the pandemic. Employment in motion picture and sound recording is down over 40 percent while performing arts and spectator sports is down around 34 percent since before the pandemic

Many of the industries whose employment has fallen the most relative to February 2020 will continue to struggle until the pandemic is fully under control.

As the Administration stresses every month, the monthly employment and unemployment figures can be volatile, and payroll employment estimates can be subject to substantial revision.

Therefore, it is important not to read too much into any one monthly report, and it is informative to consider each report in the context of other data as they become available.

• • •

Missing some Tweet in this thread? You can try to

force a refresh