OK, OK, I’ve live tweet Brenner’s talk on “From Capitalism to Feudalism?” 👇

~Two trends — decline and corporate welfare — have reached their peak during the pandemic.~ 2/

~ Billionaires’ wealth has increased $1 trillion — contrast that to the fight over $1.9 trillion package.~ 3/

He’s going to discuss long term decline and the ELITE response to that. @adam_tooze, you’re watching this right? 4/

Well understood that b/w 1865-1950, with the 2nd ind revo, US experienced a process of increasing DOMINATION of world political economy. Postwar moment was peak US lead — how to take advantage of that leading position? not least bc capacity expansion meant demand shortfalls. 5/

The problem faced by US postwar elites was how to organize the world market to make it safe for US capitalism. But the attempt succeeded too well — became hard for allies to compete in the world system, raising the possibility of defection. 6/

Says see Andrew Glenn et al. on postwar world economy: the contradictions of expanding US power led US to move from domination to hegemony. This contained the roots of US decline. 7/

Key partners turned out to be the defeated axis powers: Germany and Japan. To set them off on export-led growth, sharp switch in 1950: US gave access to the American market and guaranteed other markets. US yielded greater share of the growing world market to them. 8/

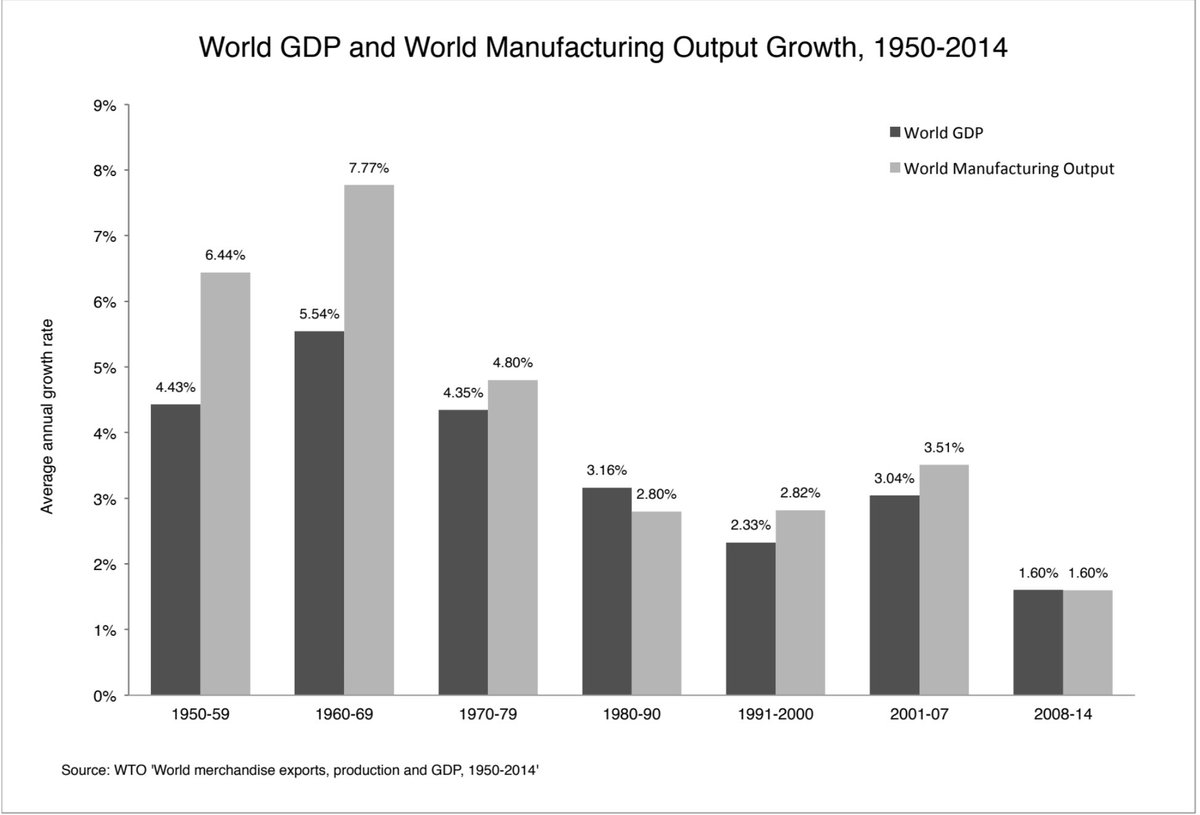

How could the US manage this transition of yielding share of world export trade that guaranteed relative decline? See graph. How could the US pay the price in industrial production? 9/

The KEY was “globalization”: instead of internal industrial growth, US FDI would harness cheap labor abroad. One region after another, esp in Asia, became recipients of US multinational investment. Massive shift: profits of MNCs grows rapidly through internationalization. 10/

OK, so one after another producers are producing the same goods at ever lower cost — Germany, Japan, Tigers, SE Asia, China — same process, deepened by US internationalization. 12/

This process cannot but lead to the problem of OVERCAPACITY that is BAKED INTO the FORM of postwar process of internationalization. This leads to a decline in profit rates in manufacturing — the epicenter of the loss of dynamism. 13/

This endogenous problem of overcapacity affects advanced manufacturers worldwide. A generalized downward pressure on profitability. US attempts to shift the weight to allies/competitors. But by ‘70s end, this attempt fails. 14/

Shift in world political economy to ‘bastard Keynesianism’ beginning with JFK: every greater deficits, ever looser money. Big picture: Keynesianism was a phenomenon of decline & confined to the US/UK (early developers). That collapsed with stagflation in the 70s. 15/

The catastrophe of stagflation threatened the principal commitment of the US to internationalism. This unexpected failure of the Keynesian intervention sets the stage for neoliberalism. 16/

US elites doubled down on internationalization, with MNCs become ever more powerful. What is new is that US elites back off from any attempt at domestic structural change. 17/

My question for Brenner: How were financial profits restored without a restoration of the underlying rate of profit? /19

Did Brenner just blame the decline in yields for the restoration of financial profits despite the loss of dynamism? Not clear. /20

Still waiting for Brenner’s explanation of the restoration of financial profits despite the persistence of low underlying profit rates. Tax cuts & discount rate-driven valuation effect is not enough. /22

Finance capital was about the way in which u have a merger between banks and industry. Finance serves industrial development, like in the 50s and 60s US. [Isn’t this the opposite of finance capitalism? Isn’t our period the period of financial capitalism?] /23

Think Brenner wants to say that finance profits are restored through predation — the Dumenil and Levy story in Capital Resurgent. The new political economy of upward redistribution works through finance. US state institutions support speculation (M2M) instead of production. /24

Fed-Treasury drove financial booms from the 1980s. [That’s true.] Ultimately, what you get is financial profits out of thin out — only possible through political intervention. [Is this plausible? Don’t think so.] /25

Financial profits are simply predation. [I don’t agree. That’s not the only source. The key he is missing is oligopolization that restored corp profits without restoring dynamism. See my policytensor.com/2019/05/16/bre…] /26

This is how we get Piketty’s graphs. [That’s true. But is it the whole story? Financial services account for only 14% of the top 1 percent of earners — same as doctors. Again, vertical polarization is a much bigger story than Brenner gives.] /24

Q & A time! I’ll tweet more if there’s an interesting question (especially mine). /25

The fall of profit rates was arrested by the extreme rise in the share of capital at the expense of labor. Working class’s incomes had to decline/stay down to induce capital investment. The question is whether, after the pandemic, there’ll be investment & growth.

/26

/26

Brenner takes my question: How were financial profits restored without a restoration of the underlying rate of profit? /27

Brenner: investor incomes have been restored through political means starting with bailouts — 2008 was extraordinary — together with a refusal to help US HHs in the same way as the financiers … /28

Fed-Treasury technocrats made sure investors made money through QE and so on. Fed tried to move support away. U immediately got another intervention. [He’s talking about the taper tantrum.] /29

After the GFC and the bailouts, NFCs went on a massive borrowing spree in order to fund dividends and buybacks. Record corp debt with very little investment to show for it. Financial shenanigans. [Extraordinary convergence between Goldman and Brenner! policytensor.com/2020/03/29/it-…] /30

~end of thread~ @UnrollHelper unroll plz?

• • •

Missing some Tweet in this thread? You can try to

force a refresh