I’m in the process of refi'ing some of my assets as well as acquiring some new ones and wanted to share some insights on mutlifam loans.

If you are thinking of buying a MF property in Canada and want to learn how CMHC insured multi-res loans work this thread is for you 👇👇👇

If you are thinking of buying a MF property in Canada and want to learn how CMHC insured multi-res loans work this thread is for you 👇👇👇

CMHC insured loans multi-res mortgages tend to have the lowest rates on the market as they are priced based on Canadian bond yields. Bond yields on the 5-year are around 1% today and CMHC insured loan rates would be ~1% higher.

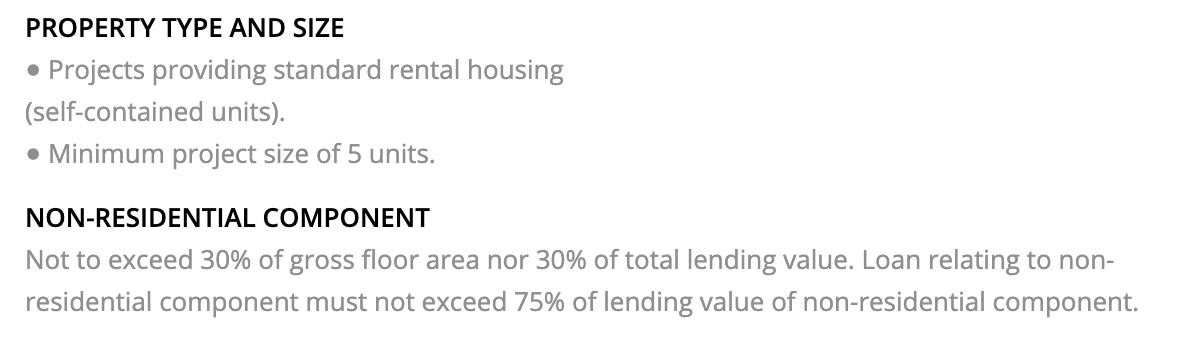

Now what qualifies for a CMHC insured mortgage? The property needs to 5+ LEGAL units and the property cannot have more than 30% of the Gross Floor Area (sq.ft) be non-residential i.e ground floor retail on a 2-strorey building.

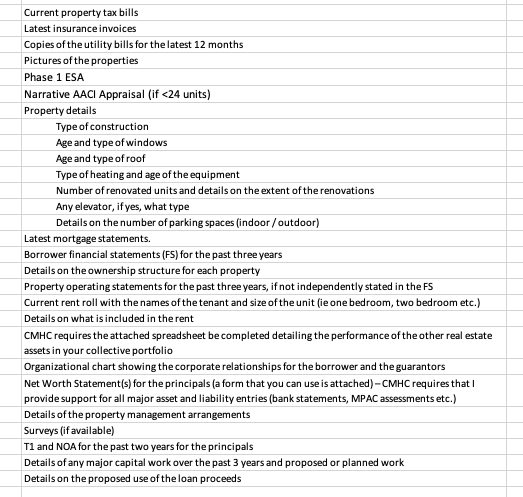

Here’s a list of info that is required to submit an application for CMHC financing. It is quite exhaustive, and you should be prepared to spend a few grand and possibly much more in DD depending on size of the building

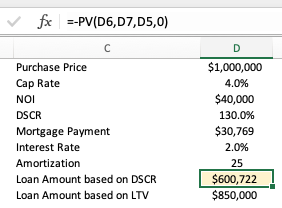

Now we’ve found a building that qualifies and we have all our documents ready to submit. So how much can I borrow?

Underwriting I feel is a key item that people miss the mark on when determining 1) investment decisions 2) how much of a loan they will actually qualify for.

Underwriting I feel is a key item that people miss the mark on when determining 1) investment decisions 2) how much of a loan they will actually qualify for.

Keeping things simple CMHC will insure a loan that is the LOWER of 1.3x DSCR or 85% Loan-To-Value*.

The asterisk is intentional and we’ll get to that later but below is a quick example of building only qualifies for a ~60% loan

The asterisk is intentional and we’ll get to that later but below is a quick example of building only qualifies for a ~60% loan

Now why the asterisk? CMHC's LTV does NOT equal Loan to Purchase Price

This is where most people get stuck by underwriting a deal with substantially less R&M and wages than the standardized u/w the lender will use

This is where most people get stuck by underwriting a deal with substantially less R&M and wages than the standardized u/w the lender will use

Typically the lender/cmhc will mark up your utilities, property taxes, insurance bills by 2-3% plus property management. They tend to use a slightly higher vacancy rate than market as well as the below standardized expenses;

R&M: $850-$1,000/unit

Wages: 400-500/unit

R&M: $850-$1,000/unit

Wages: 400-500/unit

In the above example we see that the listing/buyer represents this property as a 5.8% cap rate whereas the lender would view this as 4.8%.

Below is the difference in the lenders max loan amounts based on LTV* and DSCR of 1.3

This property would qualify for a 67% loan

Below is the difference in the lenders max loan amounts based on LTV* and DSCR of 1.3

This property would qualify for a 67% loan

So as we can see a buyer may be going into this purchase thinking they will be getting 85% loan but the reality is not the case.

But CMHC considers that they loaned you 85% of THEIR valuation. So what does that mean?

You pay the FULL insurance premium of ~4.5% of loan amount

But CMHC considers that they loaned you 85% of THEIR valuation. So what does that mean?

You pay the FULL insurance premium of ~4.5% of loan amount

Now that 2% interest rate we originally spoke about sounds good.. but the true cost of that loan is

2% + (4.5%/5) = 2.9%

This is also something people often over look by not considering the total cost of the loan.

2% + (4.5%/5) = 2.9%

This is also something people often over look by not considering the total cost of the loan.

This total cost of CMHC financing is still lower than conventional in most cases however the penalties for breaking the mortgages are extremely punitive so be prepared to hold for the 5year term.

Couple other items, if working with a broker make sure they are experienced in these loans and are ACTIVE.

You should not pay a broker fee more than 0.50% and the right broker will also get any lender fee's waived which helps lower your overall cost.

You should not pay a broker fee more than 0.50% and the right broker will also get any lender fee's waived which helps lower your overall cost.

The application/approval process for these loans are also quite long (6-8 weeks) so remember to set your conditional period accordingly!

That's about all I can think of right now on this topic.. any specific Q's my DM's are open!

That's about all I can think of right now on this topic.. any specific Q's my DM's are open!

I've been lucky to acquire some assets off market & by "educating" the seller of the realities of financing it has really helped in getting them to a price that makes sense.

It is tough to do this in most cases. Takes great relationship with a broker that the seller also trusts

It is tough to do this in most cases. Takes great relationship with a broker that the seller also trusts

How interest rates and cap rates can impact your ability to borrow.

https://twitter.com/Liam_Dougherty/status/1357708666451992578?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh