Before he lost it all - all $20 billion - Bill Hwang was the greatest trader you’d never heard of.

Don't be like Bill Hwang, learn from his mistakes:

//thread//

Don't be like Bill Hwang, learn from his mistakes:

//thread//

1]

Never - ever (!) - put more money into more speculative trades than you could afford to lose - ever!

Mr. Hwang seems to have forgotten this golen rule.

Never - ever (!) - put more money into more speculative trades than you could afford to lose - ever!

Mr. Hwang seems to have forgotten this golen rule.

2]

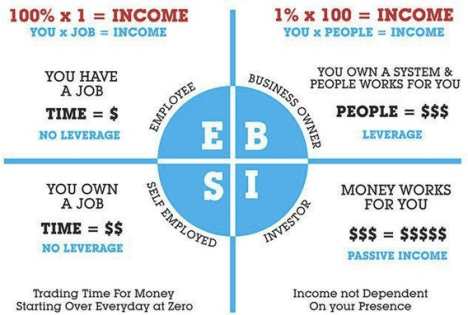

Borrowing to invest is a widely used tool. It works wonders if used right. Leverage magnifies returns if done right but can kill you if done wrong.

If you use it, know your downside, know your limitations and avoid getting "margin called" by all means.

Or don't use it...

Borrowing to invest is a widely used tool. It works wonders if used right. Leverage magnifies returns if done right but can kill you if done wrong.

If you use it, know your downside, know your limitations and avoid getting "margin called" by all means.

Or don't use it...

3]

Understand fear and greed.

Not just the fear and greed on the street, but your own emotions! Manage your inside first before attempting to manage more stuff.

Get rich quick stuff can make you poor damn fast!

financial-imagineer.com/fear-and-greed/

Understand fear and greed.

Not just the fear and greed on the street, but your own emotions! Manage your inside first before attempting to manage more stuff.

Get rich quick stuff can make you poor damn fast!

financial-imagineer.com/fear-and-greed/

4]

Chasing your losses.

People have a common trait when investing, they are happy to earn 10% on one position and sell: "See, I'm smart, I realized a 10% profit!" - however, they keep holding the losers "until they turn around".

Keep winners, let go of losers!

Not vice versa.

Chasing your losses.

People have a common trait when investing, they are happy to earn 10% on one position and sell: "See, I'm smart, I realized a 10% profit!" - however, they keep holding the losers "until they turn around".

Keep winners, let go of losers!

Not vice versa.

5]

Overconfidence bias.

You get it right once, great.

You get it right twice, awesome!

You get it right a third time? Genius!

All in!

Know your abilities AND your limitations.

Turn that knowledge about your own abilities into YOUR advantage!

Stick with your guns!

Overconfidence bias.

You get it right once, great.

You get it right twice, awesome!

You get it right a third time? Genius!

All in!

Know your abilities AND your limitations.

Turn that knowledge about your own abilities into YOUR advantage!

Stick with your guns!

6]

Catching the wave too late.

At one point even the last person on earth heard about the red-hot-stock outperforming the pack. If you heard about this investment opportunity from the random guy on the street, stay vigilant!

The @momentumdb might have move onwards by now.

Catching the wave too late.

At one point even the last person on earth heard about the red-hot-stock outperforming the pack. If you heard about this investment opportunity from the random guy on the street, stay vigilant!

The @momentumdb might have move onwards by now.

7]

Failing to diversify.

This doesn't mean you go buy 10 small cap stocks your besties chat about over beer - that's called de-worse-ify!

It means having a broadly diversified asset allocation tailored to your goals and risk appetite and rebalance it once shit happens.

Failing to diversify.

This doesn't mean you go buy 10 small cap stocks your besties chat about over beer - that's called de-worse-ify!

It means having a broadly diversified asset allocation tailored to your goals and risk appetite and rebalance it once shit happens.

8]

Yes, I just wrote it above, shit happens.

It happened before - and guess what - it will happen again. Have a plan for when ship will happen again!

Be mentally prepared to "hold through", "stay the course", "re-balance" or actually use stop-losses if you're afraid of this.

Yes, I just wrote it above, shit happens.

It happened before - and guess what - it will happen again. Have a plan for when ship will happen again!

Be mentally prepared to "hold through", "stay the course", "re-balance" or actually use stop-losses if you're afraid of this.

9]

Failing to plan is planning to fail!

I'm sure if Mr. Hwang would have had a plan for when shit hits the fan, we would still not know who he is.

But now we know.

Don't be like Mr. Hwang, learn from this!

If you enjoyed this consider to like and RT:

Failing to plan is planning to fail!

I'm sure if Mr. Hwang would have had a plan for when shit hits the fan, we would still not know who he is.

But now we know.

Don't be like Mr. Hwang, learn from this!

If you enjoyed this consider to like and RT:

https://twitter.com/FI_imagineer/status/1380241835830996996

• • •

Missing some Tweet in this thread? You can try to

force a refresh