DISCUSSION THREAD

Topic: $SRNGU/ $SRNG and potential Ginkgo Bioworks SPAC deal. Specifically, $20B valuation mentioned by Bloomberg

Will walk through some mkt data on chart below

Comments encouraged

#SynBio

$ZY

$AMRS $CDXS $ABCL $SYBX $PGEN

$BLI $TWST $TXG

$WUXAY $CRL $PPD

Topic: $SRNGU/ $SRNG and potential Ginkgo Bioworks SPAC deal. Specifically, $20B valuation mentioned by Bloomberg

Will walk through some mkt data on chart below

Comments encouraged

#SynBio

$ZY

$AMRS $CDXS $ABCL $SYBX $PGEN

$BLI $TWST $TXG

$WUXAY $CRL $PPD

^Will preface this w list of most interesting things in $SRNGU/ $SRNG S-1

1). HUGE cash trust: $1.5B

2). Mostly entertainment experts (they SPAC'd DraftKings), but sector agnostic

3). Criteria: "High growth +FCF potential"

2). One bio link: $ALLO $KRON @Vida_Ventures @bt_prop

1). HUGE cash trust: $1.5B

2). Mostly entertainment experts (they SPAC'd DraftKings), but sector agnostic

3). Criteria: "High growth +FCF potential"

2). One bio link: $ALLO $KRON @Vida_Ventures @bt_prop

Let's also establish

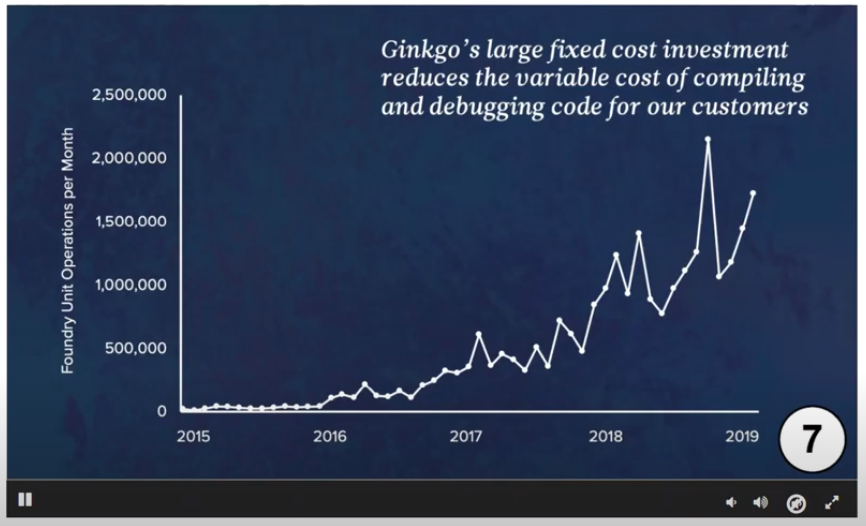

i). Ginkgo is IP creation biz (a #synbio $TXN/ $INTC/ $AMD) housed in automated CRO (see $PPD $WUXAY $CRL) "on steroids." That gets paid in cash+ stock/royalties

ii). Biology inherently hard to scale, but part of revenue magic of Ginkgo is code reuseability

i). Ginkgo is IP creation biz (a #synbio $TXN/ $INTC/ $AMD) housed in automated CRO (see $PPD $WUXAY $CRL) "on steroids." That gets paid in cash+ stock/royalties

ii). Biology inherently hard to scale, but part of revenue magic of Ginkgo is code reuseability

^There's a type of Biotwitter poster (or pro investor) that specializes in clin trial analysis & turns nose at co's that break old bio financial mold. Struggle to understand software too

Ginkgo's reuseable code base could enable:

10 deals per yr x $100M = $1B rev

$SRNGU/ $SRNG

Ginkgo's reuseable code base could enable:

10 deals per yr x $100M = $1B rev

$SRNGU/ $SRNG

^ Ginkgo has a dedicated "Deal Team" and seems to always running out of physical lab space, so it is now building an annex across the street from the already massive Drydock building

Big difference from 2013, when Ginkgo was proving its tech with SBIR and Scottish govt grants

Big difference from 2013, when Ginkgo was proving its tech with SBIR and Scottish govt grants

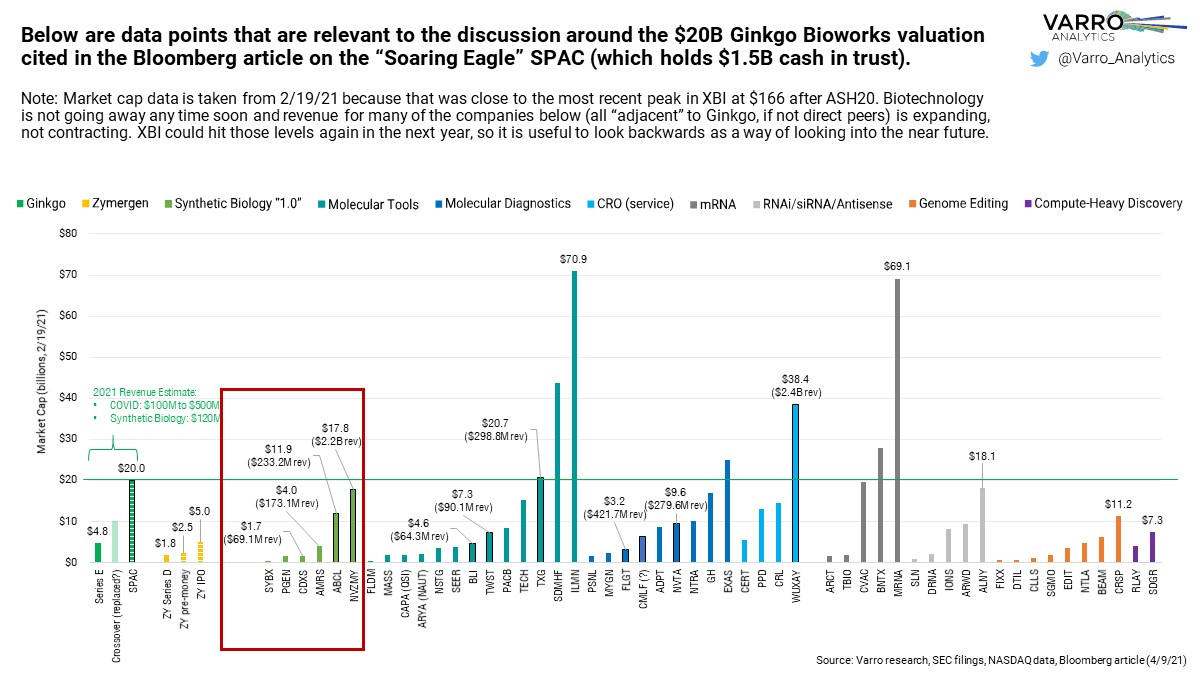

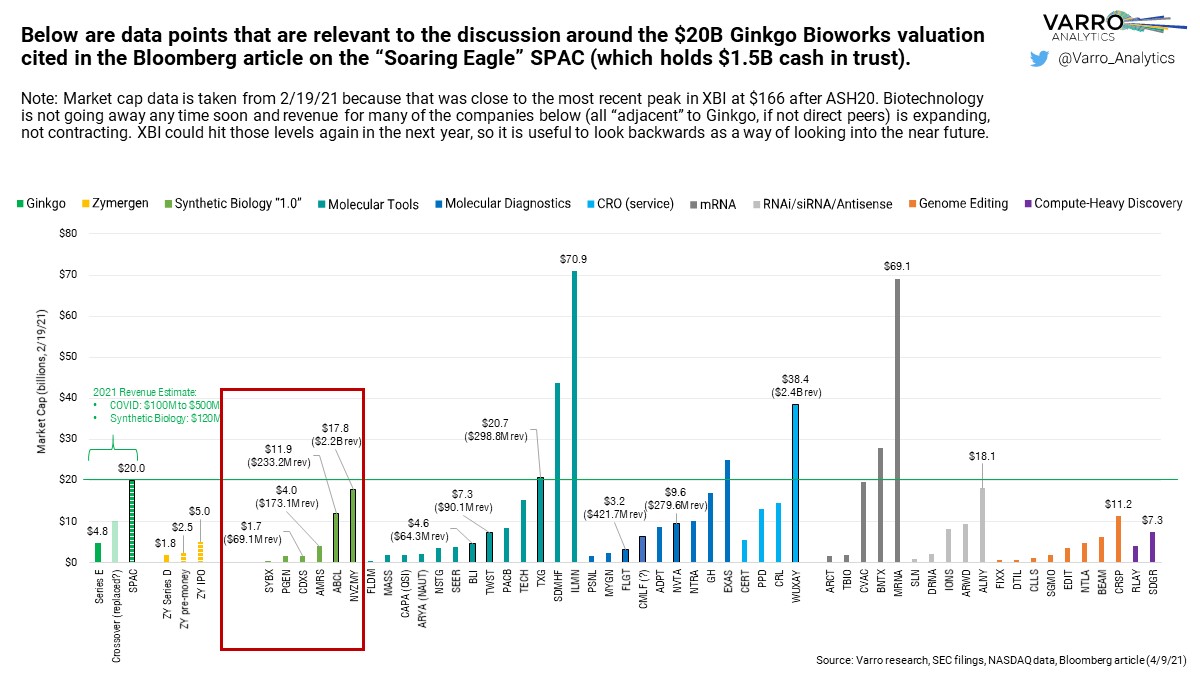

Turning back to chart from OP

Ginkgo core #synbio rev

•2018: $40M (Forbes)

•2019: $80M (Forbes)

•2020: unknown (COVID shutdown; focus on Concentric test dev, but did include $MRNA vax capping enzyme project)

•2021: $120M+ ( @buysidebio)

$SRNGU/ $SRNG

forbes.com/sites/amyfeldm…

Ginkgo core #synbio rev

•2018: $40M (Forbes)

•2019: $80M (Forbes)

•2020: unknown (COVID shutdown; focus on Concentric test dev, but did include $MRNA vax capping enzyme project)

•2021: $120M+ ( @buysidebio)

$SRNGU/ $SRNG

forbes.com/sites/amyfeldm…

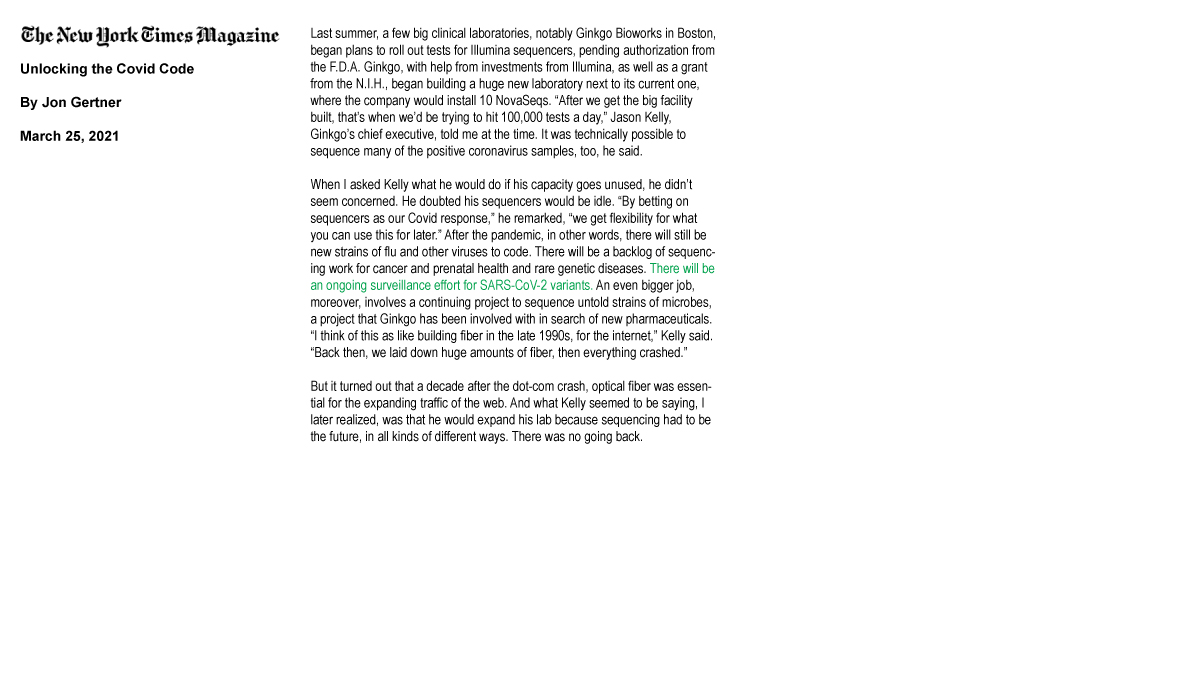

^Before $MRNA/ $BNTX vaccines found effective vs most current COVID variants (and on path to FDA pediatric approval), Ginkgo was planning to #NGS pool test every U.S. school for huge cost savings

Capacity remains, but may be used less

$SRNGU/ $SRNG

$ILMN

Capacity remains, but may be used less

$SRNGU/ $SRNG

$ILMN

https://twitter.com/Varro_Analytics/status/1257485346155245574

^ @GillianTan @crystaltse @kristenvbrown: found it interesting to compare size of cash trust for $SRNGU/ $SRNG to other healthcare/biotech/medtech SPACs.

Like nothing seen yet

$1.5B is huge

Stopped tracking them in December, but closest one was $500M

Like nothing seen yet

$1.5B is huge

Stopped tracking them in December, but closest one was $500M

https://twitter.com/Varro_Analytics/status/1333802346682277889

^Before #mRNA vax developments, had sized Concentric revenue like so:

($6 test) x (56M K12 students) x (25 weeks) x (5% penetration) = $420M

Now probably less. Maybe $100M still (variant surveill)?

Note: $FLGT had *HUGE* yr with #NGS COVID tests in 2020 ($250M+)

$SRNGU/ $SRNG

($6 test) x (56M K12 students) x (25 weeks) x (5% penetration) = $420M

Now probably less. Maybe $100M still (variant surveill)?

Note: $FLGT had *HUGE* yr with #NGS COVID tests in 2020 ($250M+)

$SRNGU/ $SRNG

Lastly in this box, at $13M in 2020, $ZY has fraction of Ginkgo rev

And it has locked itself into biz model where it sells end products (rather than creating IP for Fortune500 via JVs like Ginkgo)

Perceptive debt/ "going concern" issue too

$SRNGU/ $SRNG

And it has locked itself into biz model where it sells end products (rather than creating IP for Fortune500 via JVs like Ginkgo)

Perceptive debt/ "going concern" issue too

$SRNGU/ $SRNG

https://twitter.com/Varro_Analytics/status/1374738704426803202

^ cc @AnnaMarieWagner really enjoyed the podcast when it came out in February

Had to transcribe the part about reuseability for the BioTwitter crowd. Makes total sense!

Had to transcribe the part about reuseability for the BioTwitter crowd. Makes total sense!

CONTINUED FROM YESTERDAY

Here are "#SynBio 1.0" co's

Added Novozymes ( $NVZMY), which is a more mature biz (laundry enzymes) than Ginkgo, but would have a similar valuation ($17B) if Ginkgo got a $20B

$NVZMY has ~$2.2B in rev and ~$450M in net income

Here are "#SynBio 1.0" co's

Added Novozymes ( $NVZMY), which is a more mature biz (laundry enzymes) than Ginkgo, but would have a similar valuation ($17B) if Ginkgo got a $20B

$NVZMY has ~$2.2B in rev and ~$450M in net income

https://twitter.com/calvinsynbio/status/1381271327328321539

^ Ginkgo's human capital and extreme focus on #DNAsynthesis and Abstraction + Standards (concepts from computer science/electrical engineering imported by Knight/Collins/Endy) set it apart from $NVZMY

Ginkgo is more nimble and can jump into completely new projects in new markets

Ginkgo is more nimble and can jump into completely new projects in new markets

^A roughly equivalent $NVZMY vs Ginkgo valuation can be made if you assign a generous terminal value to Ginkgo in DCF. That's what it boils down to

Will be interesting to build a Ginkgo model & compare it to $AMRS/ $CDXS too (close direct comps) ( $AMRS is a Ginkgo partner too)

Will be interesting to build a Ginkgo model & compare it to $AMRS/ $CDXS too (close direct comps) ( $AMRS is a Ginkgo partner too)

^ $ABCL is a Canadian #synbio co that was able to IPO during pandemic due to its #COVID antibody partnership with $LLY (bamlanivimab)

Ginkgo has an antibody program with @TotientBio. Also runs multiple $BLI machines, and may see more antibody therapeutics programs in future?🧐

Ginkgo has an antibody program with @TotientBio. Also runs multiple $BLI machines, and may see more antibody therapeutics programs in future?🧐

^ $ABCL had a huge step up in valuation when it IPO'd. Specialist healthcare funds in early 2020 crossover round made something like 20x from late venture to IPO pricing (not sure the exact number, but it was big)

A $20B valuation assumes Ginkgo is worth more ~2x $ABCL's

A $20B valuation assumes Ginkgo is worth more ~2x $ABCL's

^84% of $ABCL's $233M in rev came from bamlanivimab royalties, which got FDA EUA for COVID. Unclear if those will continue now that vaxes are being rolled out. Might be a 1-yr bolus

Ginkgo has more avenues for growth, in both regulated areas (therapeutics) & less regulated areas

Ginkgo has more avenues for growth, in both regulated areas (therapeutics) & less regulated areas

Last few bits on Ginkgo. Then going to head off

$TXG is interesting "adjacent" comp also valued around $20B. Far ahead of competitors in tech, like Ginkgo (even though $TXG is a #singlecell tools/software provider). Ginkgo rev could move into parity with $TXG with quick growth

$TXG is interesting "adjacent" comp also valued around $20B. Far ahead of competitors in tech, like Ginkgo (even though $TXG is a #singlecell tools/software provider). Ginkgo rev could move into parity with $TXG with quick growth

^ Also, Contract Research Organizations (CRO's) in chart are service providers. Unlike Ginkgo, they don't take equity/royalties. And Ginkgo unlocks new value through IP creation, not just running experiments to spec

This gives Ginkgo profile skewed to upside

$PPD $CRL $WUXAY

This gives Ginkgo profile skewed to upside

$PPD $CRL $WUXAY

End of Ginkgo discussion

• • •

Missing some Tweet in this thread? You can try to

force a refresh