Constellation Software is an anomaly.

- Valued at $40 billion

- Manages +500 software businesses

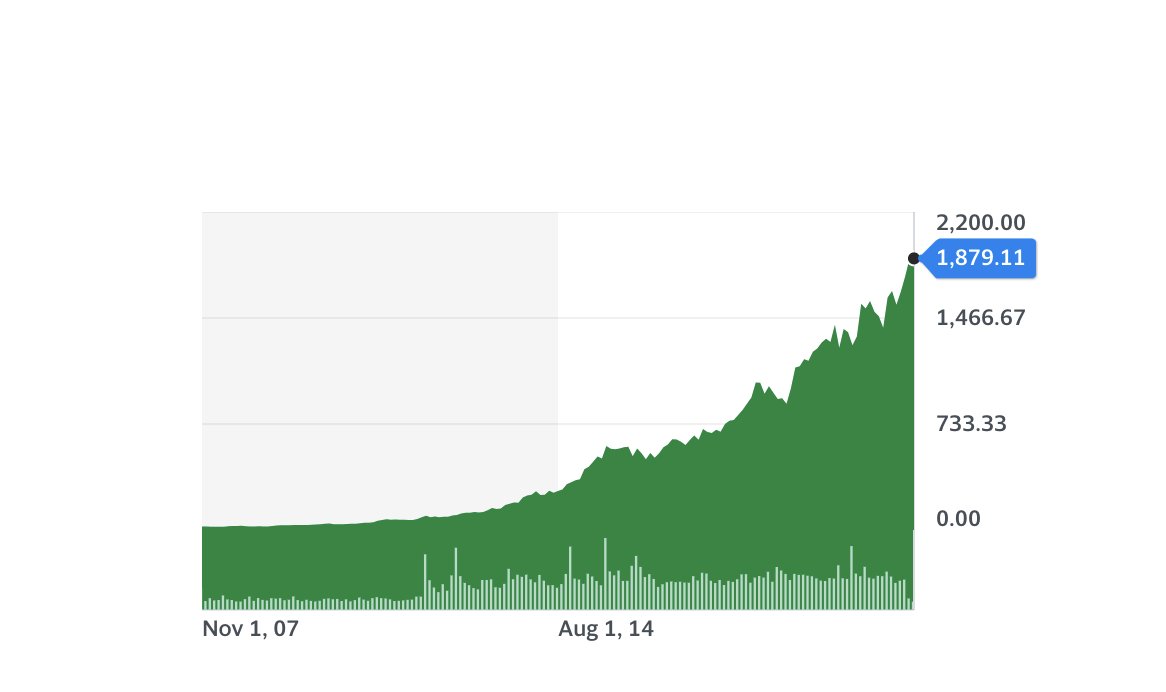

- Stock up 7,000% since IPO

...and yet still feels undervalued?

A few thoughts 👇

readthegeneralist.com/briefing/const…

- Valued at $40 billion

- Manages +500 software businesses

- Stock up 7,000% since IPO

...and yet still feels undervalued?

A few thoughts 👇

readthegeneralist.com/briefing/const…

1/

The Constellation story begins with Mark Leonard.

He's a mysterious, private figure.

A colleague called him: "Probably the most intensely private individual in IT."

The Constellation story begins with Mark Leonard.

He's a mysterious, private figure.

A colleague called him: "Probably the most intensely private individual in IT."

2/

Here's what we know:

- From England (or South Africa?)

- Emigrated to Canada and got a BSc and MBA

- Worked as a *grave-digger*

- Pivoted into VC ?!

Quite the move.

Here's what we know:

- From England (or South Africa?)

- Emigrated to Canada and got a BSc and MBA

- Worked as a *grave-digger*

- Pivoted into VC ?!

Quite the move.

3/

Leonard worked in VC for 11 years.

But it annoyed him.

In particular, he found it frustrating that he had to ignore good companies with small TAMs.

He also disliked the pressure to exit positions.

Leonard worked in VC for 11 years.

But it annoyed him.

In particular, he found it frustrating that he had to ignore good companies with small TAMs.

He also disliked the pressure to exit positions.

4/

The more he thought about it, the more Leonard thought there was an opportunity focusing on *small* companies.

In particular, he liked Vertical Market Software (VMS).

Essentially, software for *niche* markets like libraries or marinas.

The more he thought about it, the more Leonard thought there was an opportunity focusing on *small* companies.

In particular, he liked Vertical Market Software (VMS).

Essentially, software for *niche* markets like libraries or marinas.

5/

Why did Leonard like these businesses?

VMS companies tended to have some favorable traits:

- Few competitors

- Weak competitors

- Sticky (low churn)

- High margins

Sure they were small. But what if you bought a bunch of them?

Why did Leonard like these businesses?

VMS companies tended to have some favorable traits:

- Few competitors

- Weak competitors

- Sticky (low churn)

- High margins

Sure they were small. But what if you bought a bunch of them?

6/

In 1995, Leonard started Constellation Software with $25 million from OMERS and some of his old VC colleagues.

The goal?

Be the best buyer of VMS companies in the world.

In 1995, Leonard started Constellation Software with $25 million from OMERS and some of his old VC colleagues.

The goal?

Be the best buyer of VMS companies in the world.

7/

It's worked.

Today, Constellation owns +500 VMS companies and has had one of the most remarkable runs of all time.

Since IPO in 2006, $CSU has gone from a $70 million → $40 *billion* valuation.

EBITDA, EPS and more have compounded 30% a year.

It's worked.

Today, Constellation owns +500 VMS companies and has had one of the most remarkable runs of all time.

Since IPO in 2006, $CSU has gone from a $70 million → $40 *billion* valuation.

EBITDA, EPS and more have compounded 30% a year.

8/

How does Constellation do that?

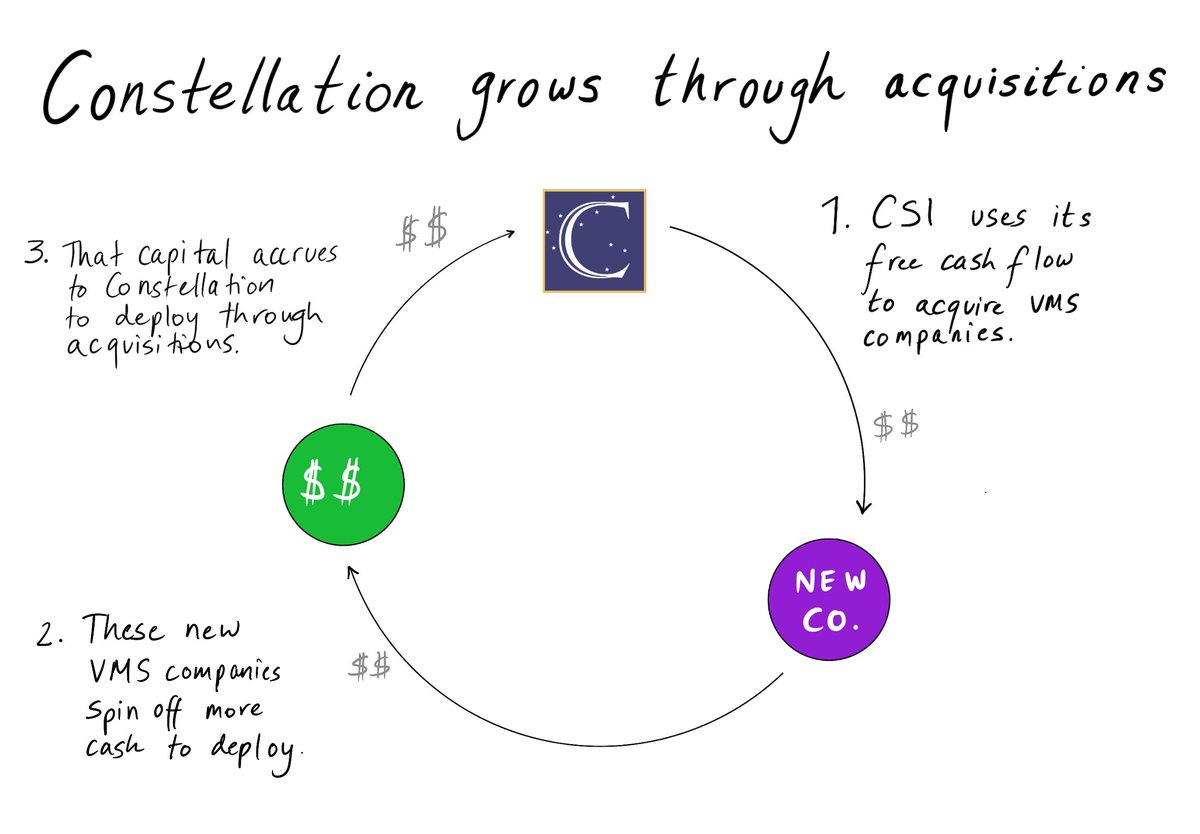

By buying growth.

Because VMS companies spit off cash, CSU has an amazing amount of free cash flow to buy *more* VMS businesses!

This creates a virtuous cycle, where each new acquisition gives CSU *more* money to make the next one.

How does Constellation do that?

By buying growth.

Because VMS companies spit off cash, CSU has an amazing amount of free cash flow to buy *more* VMS businesses!

This creates a virtuous cycle, where each new acquisition gives CSU *more* money to make the next one.

9/

This comes with its fair share of complexity though.

How does CSU manage more than 500 businesses?

It splits them up into six "mini-Constellations."

1. Volaris

2. Harris

3. Jonas

4. Vela

5. Perseus

6. Topicus

This comes with its fair share of complexity though.

How does CSU manage more than 500 businesses?

It splits them up into six "mini-Constellations."

1. Volaris

2. Harris

3. Jonas

4. Vela

5. Perseus

6. Topicus

10/

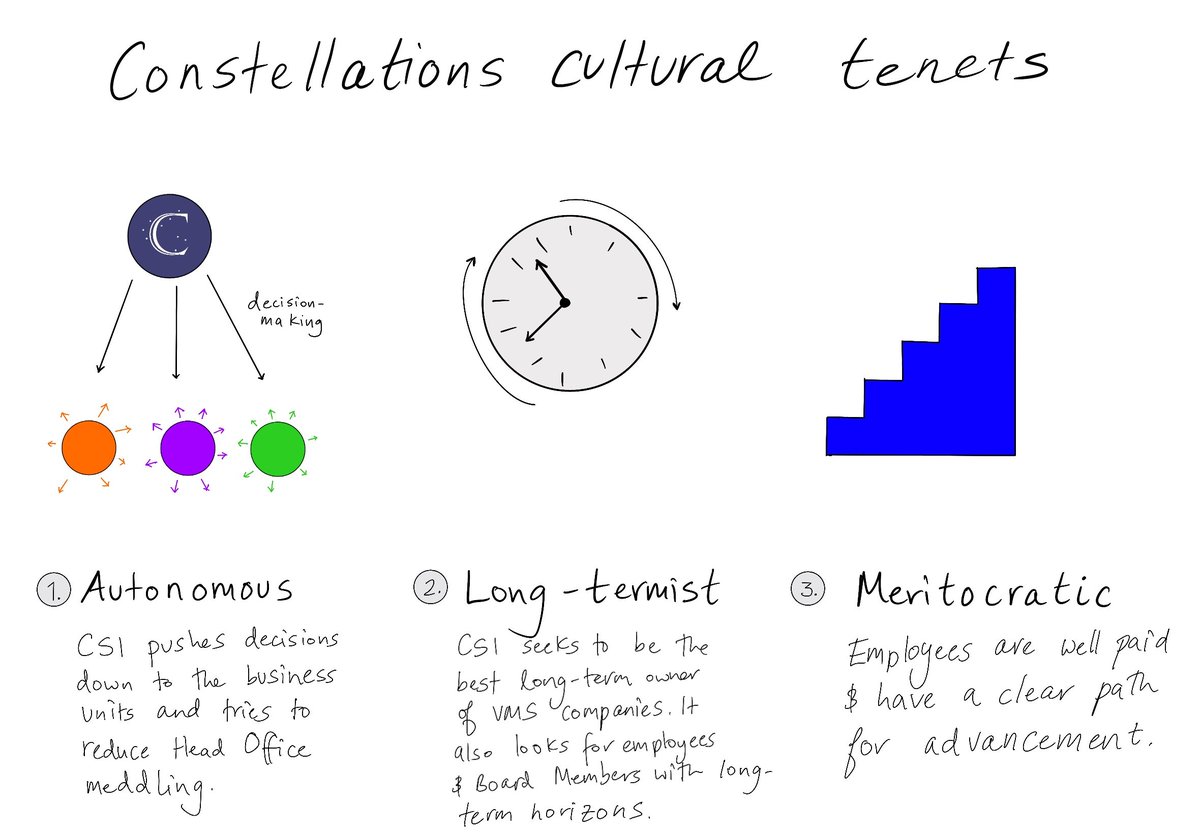

These 6 groups operate effectively independently.

Unlike other conglomerates, CSU doesn't try and harness a bunch of synergies between companies.

Instead, it sits back and lets great managers get to work.

These 6 groups operate effectively independently.

Unlike other conglomerates, CSU doesn't try and harness a bunch of synergies between companies.

Instead, it sits back and lets great managers get to work.

11/

That's part of what makes CSU so special: its culture.

(This is somewhat ironic as Leonard is very skeptical of "corporate culture").

1. Lots of autonomy

2. Focused on long-term results

3. Highly meritocratic

That's part of what makes CSU so special: its culture.

(This is somewhat ironic as Leonard is very skeptical of "corporate culture").

1. Lots of autonomy

2. Focused on long-term results

3. Highly meritocratic

12/

That is a key strength as CSU tries to evolve.

While its current strategy has worked incredibly well, it's hit a wall in terms of the amount of cash it can deploy.

It's a true "champagne problem" — CSU has more money than it can effectively invest.

That is a key strength as CSU tries to evolve.

While its current strategy has worked incredibly well, it's hit a wall in terms of the amount of cash it can deploy.

It's a true "champagne problem" — CSU has more money than it can effectively invest.

13/

To try and address that issue, CSU is trying three new things:

1. Lower its hurdle rate

2. Make bigger investments

3. Move beyond VMS (!)

What does that mean?

To try and address that issue, CSU is trying three new things:

1. Lower its hurdle rate

2. Make bigger investments

3. Move beyond VMS (!)

What does that mean?

14/

Basically, CSU is loosening its investment parameters. Now, it'll consider companies that don't meet its traditional criteria either in terms of return profile, size, or sector.

That's a pretty big change.

Basically, CSU is loosening its investment parameters. Now, it'll consider companies that don't meet its traditional criteria either in terms of return profile, size, or sector.

That's a pretty big change.

15/

Everyone should do their own investing research.

But a few things make me bullish about CSU's future despite this uncertainty.

1. Best in class management

2. Proven investing record

3. Still lots of VMS companies to buy

4. VMS space growing rapidly

Everyone should do their own investing research.

But a few things make me bullish about CSU's future despite this uncertainty.

1. Best in class management

2. Proven investing record

3. Still lots of VMS companies to buy

4. VMS space growing rapidly

16/

What does that mean?

Ultimately, I think CSU can continue to grow within the VMS space. And given the impressiveness of management, I think there's every chance they could develop a new sectoral competence.

That could unlock an entirely new wave of growth.

What does that mean?

Ultimately, I think CSU can continue to grow within the VMS space. And given the impressiveness of management, I think there's every chance they could develop a new sectoral competence.

That could unlock an entirely new wave of growth.

17/

There were some much brighter folks I spoke to as part of this research. (Or read their work).

H/t @shomikghosh21 @kylerhasson @NeckarValue @PythiaR @ErnestWongBWM @LockStockBarrl @CJOppel @the10thman1

the10thmanbb.com/investment-ide…

baskinwealth.com/an-ernest-opin…

There were some much brighter folks I spoke to as part of this research. (Or read their work).

H/t @shomikghosh21 @kylerhasson @NeckarValue @PythiaR @ErnestWongBWM @LockStockBarrl @CJOppel @the10thman1

the10thmanbb.com/investment-ide…

baskinwealth.com/an-ernest-opin…

18/

If you're interested in companies like Constellation, I'd love for you join me at The Generalist.

+32,000 readers rely on it to gain an edge.

readthegeneralist.com/briefing/const…

If you're interested in companies like Constellation, I'd love for you join me at The Generalist.

+32,000 readers rely on it to gain an edge.

readthegeneralist.com/briefing/const…

• • •

Missing some Tweet in this thread? You can try to

force a refresh